Apis Capital Flagship Fund commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Partners,

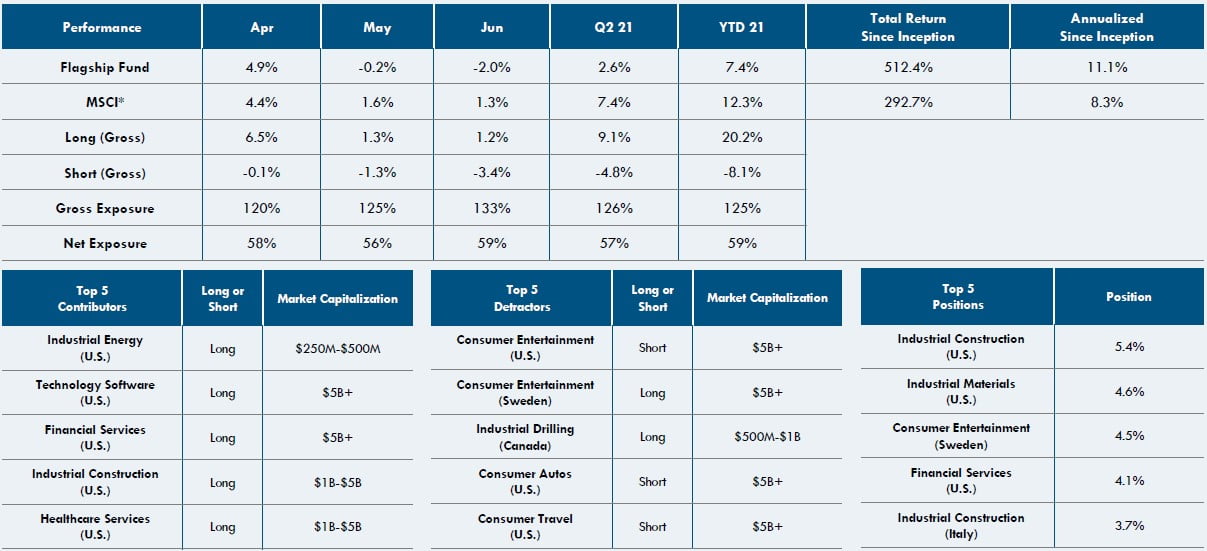

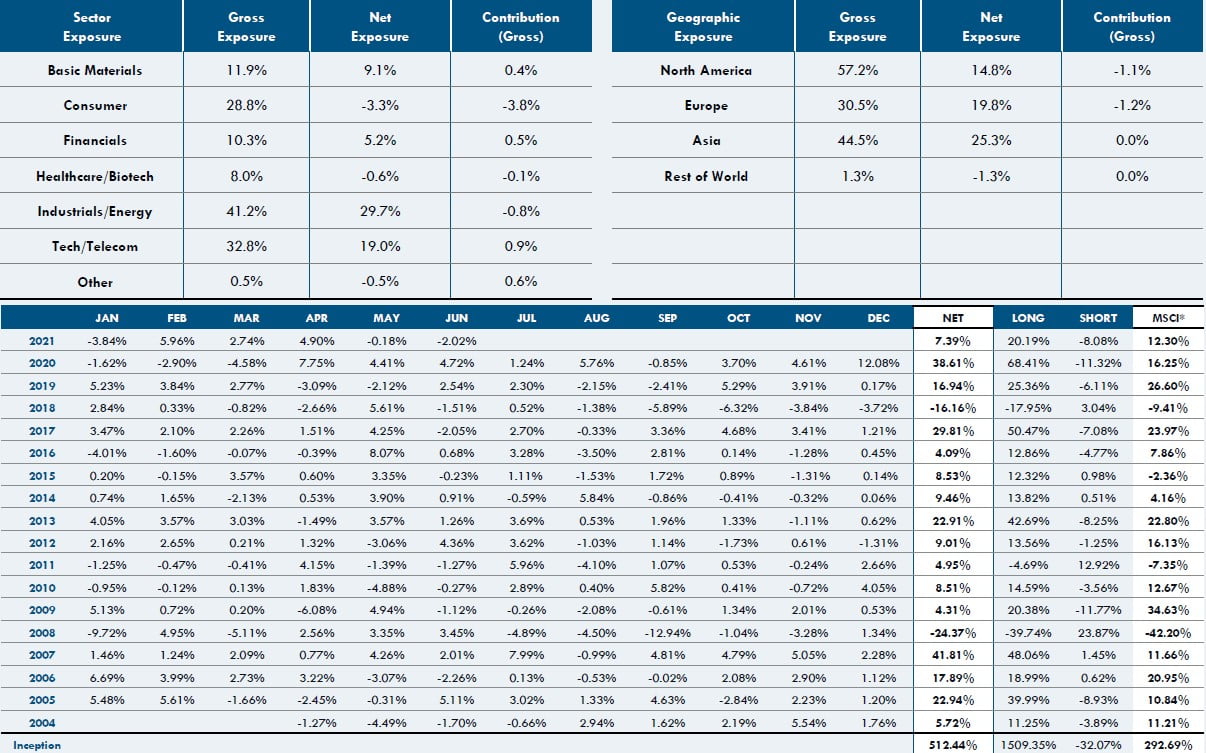

Our Flagship Fund was up 2.6% net in Q2 2021. During the past quarter, our longs contributed 9.1% (gross), while our shorts detracted 4.8% (gross). At the end of June, the Fund was approximately 59% net long with the portfolio 96% long and 37% short.

Apis Capital Flagship Fund Performance Overview (Gross Returns)

The second quarter was characterized by several feuds playing out in the market. The retail embrace of SPACs and meme stocks continued in earnest. While we were somewhat impacted on the short side, we maintain a handful of small positions. The long side was characterized by strong performances from commodity-related names offset by a pullback from other companies in our portfolio that performed strongly last year. In general, the market is working out whether to favor growth or value stocks. As we have discussed in previous letters, our framework allows for both growth and value; moreover, we often find both elements in the same stock.

Regionally, Europe and Asia both contributed more than 2.0% gross and North America was slightly negative due to the short side. By sector, Cyclicals added nearly 5.0% and Financials contributed nearly 2.0%. Consumer was a detractor (again, driven by the short side), down about 3.1% during the quarter.

Notable winners on the long side included Penn Virginia, a shale oil name we have owned during past cycles. It is a conservative, hedged operator, which participated solidly in the oil rally, contributing about 1.7%. Also contributing more than 1.0% were flatexDEGIRO (an online broker in Europe), Cornerstone Building (building supplies in the U.S.) and HEG Ltd (Indian manufacturer of graphite electrodes). Long detractors were all below 1.0% each and included previously discussed names, such as Intelligent Systems which we expect to have a strong catalyst in Q4 as well as Darling Ingredients. On the short side of the book, we had one retail-driven detractor, costing us about 2.7%, along with a handful of others detracting between 0.3% and 0.6%. These continue to be some of the most compelling shorts we have ever seen, but we acknowledge the need to manage risk and have intentionally kept them small, generally between 0.2% to 1.0% in size. Contributors on the short side included names like Chugoku Electric Power, which managed to defy the market as Japan continues to turn away from coal, falling 26% in the quarter.

While net exposure has remained relatively flat at just under 60%, our gross has risen from 118% to 133% over the quarter, which is more typical of our historical average and driven mostly by increased exposure to the Industrials sector.

Investment Highlights

Chroma ATE, Inc. (Taiwan – $3bn market cap)

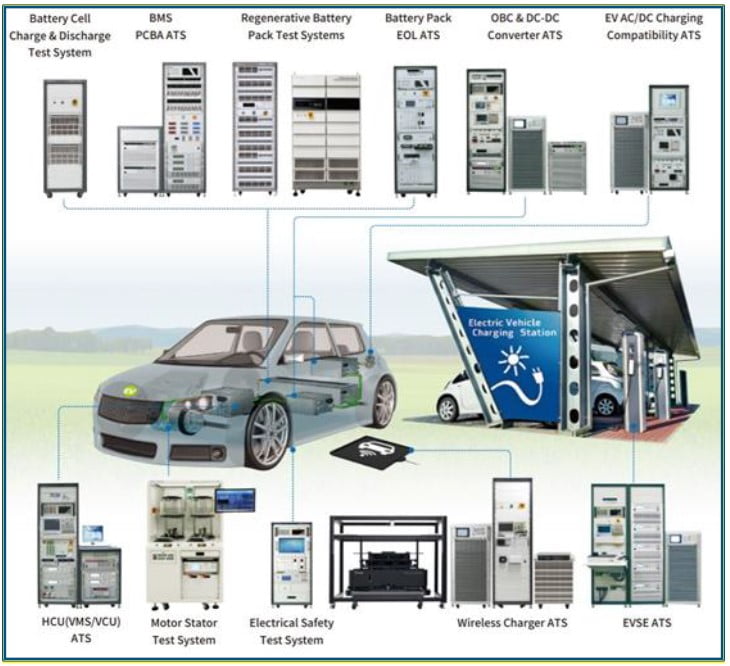

There are a lot of markets that grow fast but do so without any sustainable profits. The common thread is generally too much competition. Electric vehicles are a perfect case in point. Electric vehicle manufacturers and their suppliers have been largely loss making as they are in a death match to establish market share. Investors will point to Amazon and its years of losses combined with growth to justify the strategy. While we are skeptical that the auto industry is analogous to Amazon, we have been able to find a way to participate in the growth of the electric vehicle industry while also generating cash flow and profits at a reasonable valuation.

Chroma Ate Inc. (TPE:2360) is a provider of highly technical testing equipment for a variety of electronics with over a third of its sales coming directly from electric vehicles and over half indirectly. It operates in an oligopoly with companies like Teradyne, where their market share is difficult to pin down but is reportedly as high as 90% within Taiwan. The company produces small batches of equipment for a variety of components in the vehicle ranging from the battery to the on-board charger and DC converter. It has a long history of producing this type of equipment going back to the 1980’s and financial performance has ebbed & flowed with product cycles such as flat screen televisions and mobile phones. Recently, however, the specifications have ramped up as complexity across all electronics has increased exponentially. In addition to electric vehicles, the company has developed niche testing equipment for power semiconductors used in 5G base stations among other applications. Testing these types of semiconductors requires a different “system level” approach now that extreme levels of power are being used. As a result, the time to test is much longer, necessitating more equipment to maintain testing throughput. Chroma has seen this in year-to-date results with nearly 20% growth. With a mid-to-high teens price-to-earnings multiple, Chroma trades at a discount to its peers despite an excellent outlook and market position. We think the company has the potential to be a solid compounder with tremendous upside for years to come and we do not have worry about whether Tesla, Nikola or VW wins the electric vehicle wars; Chroma should be a long-term winner regardless.

HSD Engine (Korea – $350mm market cap)

Shipping is a notoriously rotten industry; few things are more commoditized and cyclical. This also presents opportunity, with some of the most epic swings a cyclical investor can find. Ship builders like Samsung Heavy in Korea have historically seen 10x gains followed by 90% plunges or, more recently, Evergreen Marine in Taiwan which recently rose 2,200% on the back of surging shipping rates. The reason for these moves is that capacity takes a long time to add, it stays in place for a long time once it is built, and customers do not really care about the cost of shipping when the products they need are in short supply.

The current environment is a perfect storm:

1) On the supply side, ship orders are at some of the lowest levels historically seen as most operators have been struggling ever since the end of the financial crisis. The ships in operation today are aged and, until just recently, many were being scrapped as they were no longer economic to operate.

2) On the demand side, large segments of the shipping industry that had been idling for the past decade suddenly saw an explosion of demand, particularly in the bulk carrier segment for raw materials like copper and the container segment used to transport goods.

This cycle has an unusual wrinkle as there is an environmental component – pending decarbonization regulations – that will add significant uncertainty to what fuels will be permissible over the next decade and beyond. Since ships are typically purchased based on 20+ year lives, owners & operators care a great deal about this issue.

One key beneficiary of both this cycle and the fuel uncertainty is HSD Engine Co Ltd (KRX:082740) who holds 40% market share in Korea for ship engines and is one of just two producers of dual fuel engines. These engines can burn both marine fuel (essentially diesel) and LNG (liquid natural gas) which has lower carbon emissions. As ship owners place new orders, they are beginning to take this dual fuel option as they anticipate needing this to meet future regulations. In the first quarter, 37% of orders were for dual fuel engines, up from just 4% in 2020. Overall orders are up over 60% and we think this can continue for an extended period as it could take many years to balance the shipping market. With the added tailwind of decarbonization, HSD only trades at a single digit price-to-earnings multiple. We think this cycle has the ingredients be very long and very strong. HSD offers a great way to participate with a lot of upside.

P.S. - These engines are very, very big….

As always, we encourage your questions and comments, so please do not hesitate to call our team here at Apis or Will Dombrowski at +1.203.409.6301.

Sincerely,

Daniel Barker

Portfolio Manager & Managing Member

Eric Almeraz

Director of Research & Managing Member