The US GDP has already recovered from the pandemic recession. What’s next for the economy and the gold market?

Q1 2021 hedge fund letters, conferences and more

The Economic Crisis Is Over

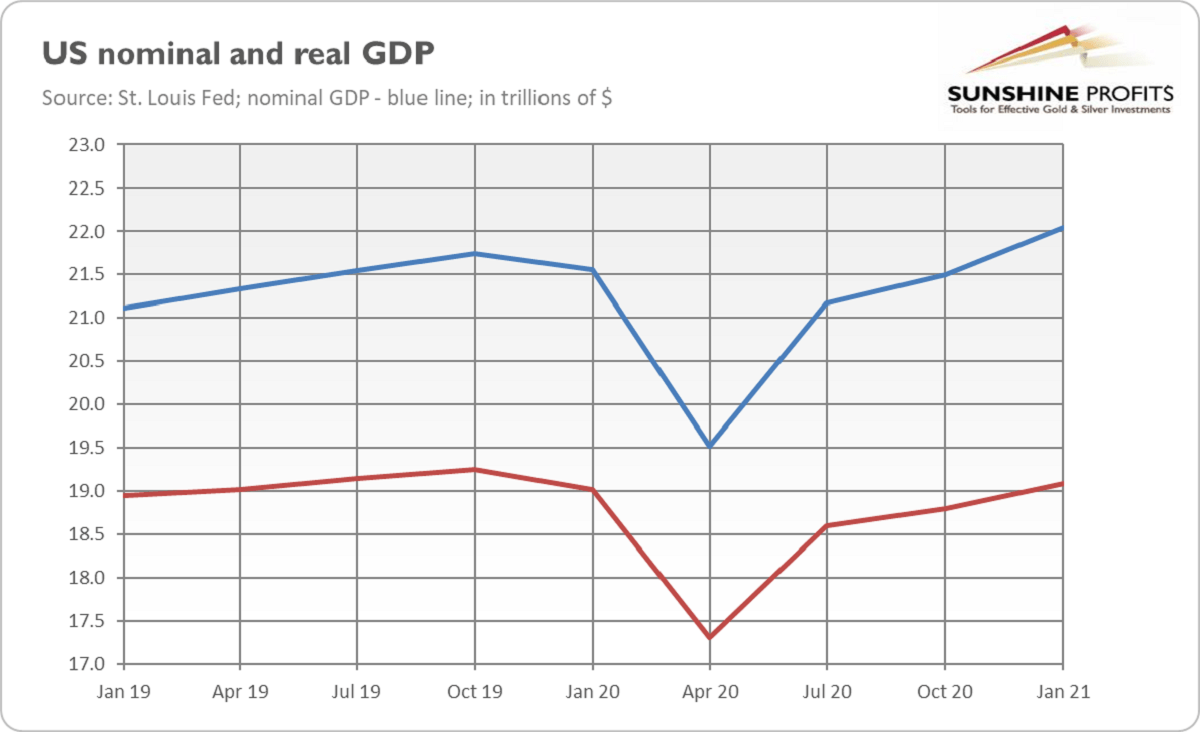

Ladies and Gentlemen, the economic crisis has ended. Actually, not only is the recession over but so is the recovery! This is at least what the recent GDP readings are indicating. As the chart below shows, the US nominal GDP has already jumped above the pre-pandemic level . The real GDP, which takes inflation into account, remained in the first quarter of 2021 below the size of the economy seen at the end of 2019, but it will likely surpass this level in the second quarter of the year.

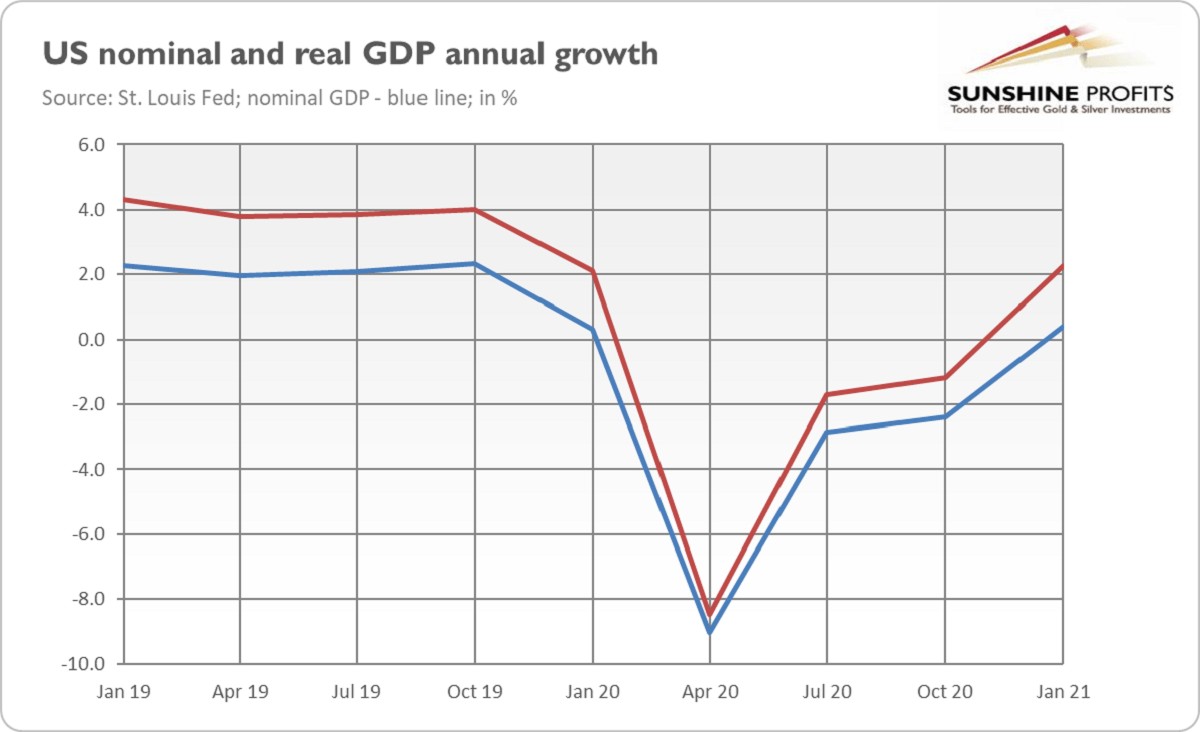

As one can see in the chart below, in terms of GDP growth, the situation is a bit worse, as the annual percentage changes are still below the pre-epidemic level . However, this should change in the second quarter of 2021 when the growth pace is likely to peak amid base effect and reopening of the economy.

So, the question is: what’s next? Will the economic boom become well-established or will we see a lot of volatility or even new slumps? Given the recent flux of disappointing high-frequency indicators that fell considerably short of expectations (just think about April’s nonfarm payrolls ), the question is very relevant.

Threats To Growth

Well, there are many threats to growth , that’s for sure. The first is, of course, the ever-evolving coronavirus and its new variants. However, judging by preliminary evidence, the vaccines should remain effective, allowing economies to function freely.

The second obvious danger is clearly the economy overheating and higher inflation . The Fed and the Congress injected a lot of liquidity into the economy although it would recover if it was left to its own devices thanks to the rollout of vaccinations and easing lockdowns. So, much of government funds arrived just when the economy practically recovered, which is a recipe for higher prices and inflation-related turbulences in the financial markets.

Third, the increase in debt – both private and public – makes the global economy more fragile. Given the level of indebtedness, even small increases in real interest rates would be dangerous. They would increase the costs of servicing debts for the governments and could hit the asset prices. The fact that the Fed will be under great pressure to remain very dovish is, of course, positive for gold prices . Even if we see some effort to normalize the monetary policy , interest rates and the Fed’s balance sheet will never return to the pre-recession levels.

Last but not least, there is a threat of financial crisis . Many people are worried that there is a bubble in the stock market (and in other markets as well, such as the cryptocurrency market). Indeed, the equities have been reaching new peaks and the valuations are elevated. The margin debt has also jumped. Not surprisingly, the relative frequency of Google searches for the “stock market bubble” has recently risen (just as for the word “inflation”).

Even the Fed in its latest Financial Stability Report expressed some concerns. This is what the Fed Governor Lael Brainard said in a statement linked to the report :

Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year. Equity indices are setting new highs, equity prices relative to forecasts of earnings are near the top of their historical distribution, and the appetite for risk has increased broadly, as the "meme stock" episode demonstrated. Corporate bond markets are also seeing elevated risk appetite, and the spreads of lower quality speculative-grade bonds relative to Treasury yields are among the tightest we have seen historically. The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.

Implications For Gold

To sum up, the US economy has already recovered from the coronavirus recession, which is bad for safe-haven assets such as gold , as the yellow metal doesn’t like economic expansions. However, there are important threats to sustainable economic growth, which should support the price of gold.

Actually, there is still room for gold to rally further . This is because we are in an inflationary phase of the economic expansion (this boom will be more inflationary than the post- Great Recession period), and all the money created during the pandemic has flowed into the asset markets, pushing their prices into elevated levels not necessarily justified by fundamentals (just think about Dogecoin). Gold could benefit from such a bubble, as well as from an inflationary and hot environment.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter . Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.