Some institutional analysts believe that Bitcoin could surpass $100,000 in 2024. This means the broader cryptocurrency market will likely enter a prolonged upward trajectory.

But which will be the best crypto to buy now and produce the biggest gains when the next bull cycle begins?

This guide reveals the 10 cryptos with the most potential in 2024. We cover new and established projects with various market capitalizations. Read on to discover the next 100x cryptocurrencies.

This month, we expanded our listings by including Dogeverse and 99Bitcoins. In addition, we removed a few older ones as part of our adjustments.

- Multi-chain utility across 6 chains including Ethereum, Solana and Base

- Staking rewards on Ethereum for presale buyers

- Advanced bridging technology with Wormhole and Portal integration

USDT

USDT ETH

ETH MATIC

MATIC- +1 more

- Potential to skyrocket amid Solana meme coin hype

- Rumored to be from the developers $SLERF, which saw huge growth earlier this year

- Similar to Slothana, which recently saw a hugely successful presale and launch

SOL

SOL

- An AI and dog-themed memecoin on Ethereum

- Presale tokens are staked an provide rewards during the presale

ETH

ETH USDT

USDT

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

SOL

SOL ETH

ETH BNB

BNB- +1 more

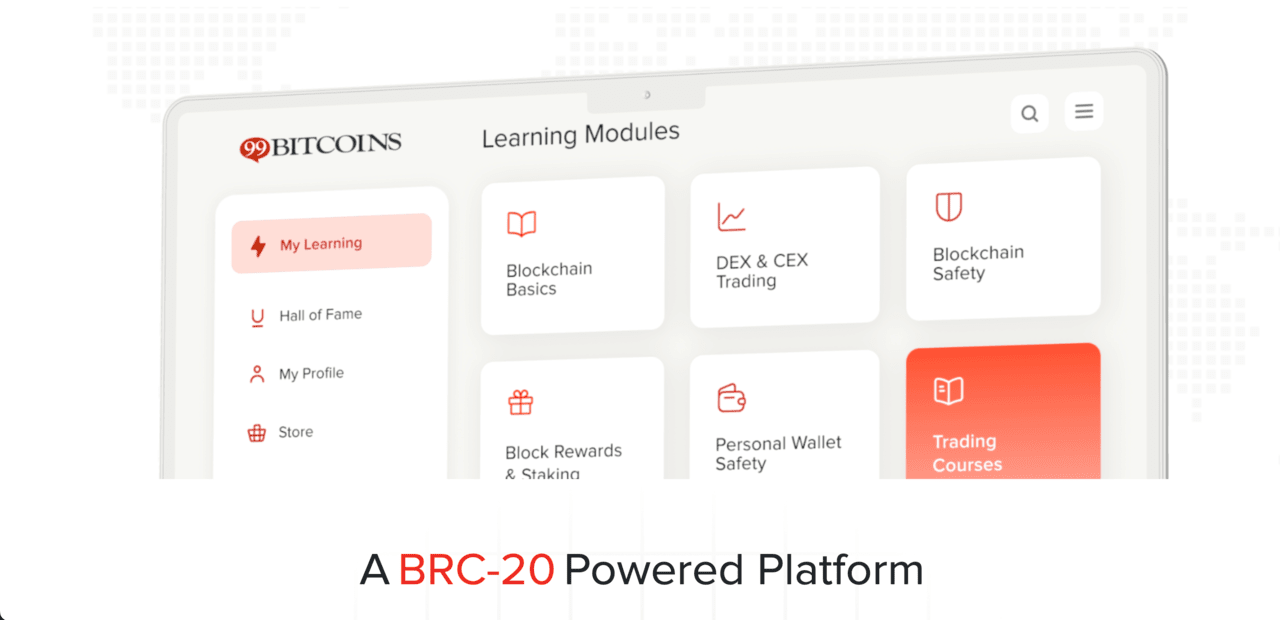

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

ETH

ETH USDT

USDT BNB

BNB- +1 more

- The 5SCAPE tokens unlock special in-game features

- Brings VR capabilities into Web3 gaming

- An ERC20 token that's compatible with existing Ethereum DeFi platforms and smart contracts

ETH

ETH BNB

BNB USDT

USDT- +2 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

ETH

ETH USDT

USDT Debit

Debit

- Gain exclusive airdrop points by buying and holding $SMOG

- Conquer foes and reap rewards on the Solana blockchain

- Secure your stake on Solana through a direct $SMOG purchase on Jupiter DEX

SOL

SOL ETH

ETH USDT

USDT

- Innovative blockchain-based electric vehicles project

- The eTukTuk prototype is scheduled to be revealed in the first phase

- opBNB will be used in tandem with BNB for scalability and reduce costs

ETH

ETH BNB

BNB USDT

USDT- +1 more

List of 11 cryptocurrencies with big potential

- Dogeverse (DOGEVERSE): As the first truly multi-chain Doge token, $DOGEVERSE breaks down barriers between the Ethereum, BNB Chain, Polygon, Solana, Avalanche, or Base Blockchains.

- 99Bitcoins (99BTC): The upcoming Bitcoin halving is a pivotal event, and 99Bitcoins is your guide. Their platform offers dedicated modules with historical data, expert analysis, and interactive tools to help you understand its potential impact on the market.

- 5th Scape ($5SCAPE): Evolving the VR landscape with ultra-real immersive gaming, movies, animations, interactive learning & digital experiences. Over $1.7M raised.

- Sponge V2 ($SPONGEV2): A new version of the Sponge token, Sponge V2 offers play-to-earn gaming opportunities. Get 185% staking APYs.

- Smog ($SMOG): This trending meme coin is listed straight on the Jupiter DEX. Smog offers huge airdrop rewards and 42% staking yields.

- eTukTuk ($TUK): Innovative Web3 project that builds EV charging stations for TukTuk drivers. eTukTuk has raised more than $2.4 million on presale.

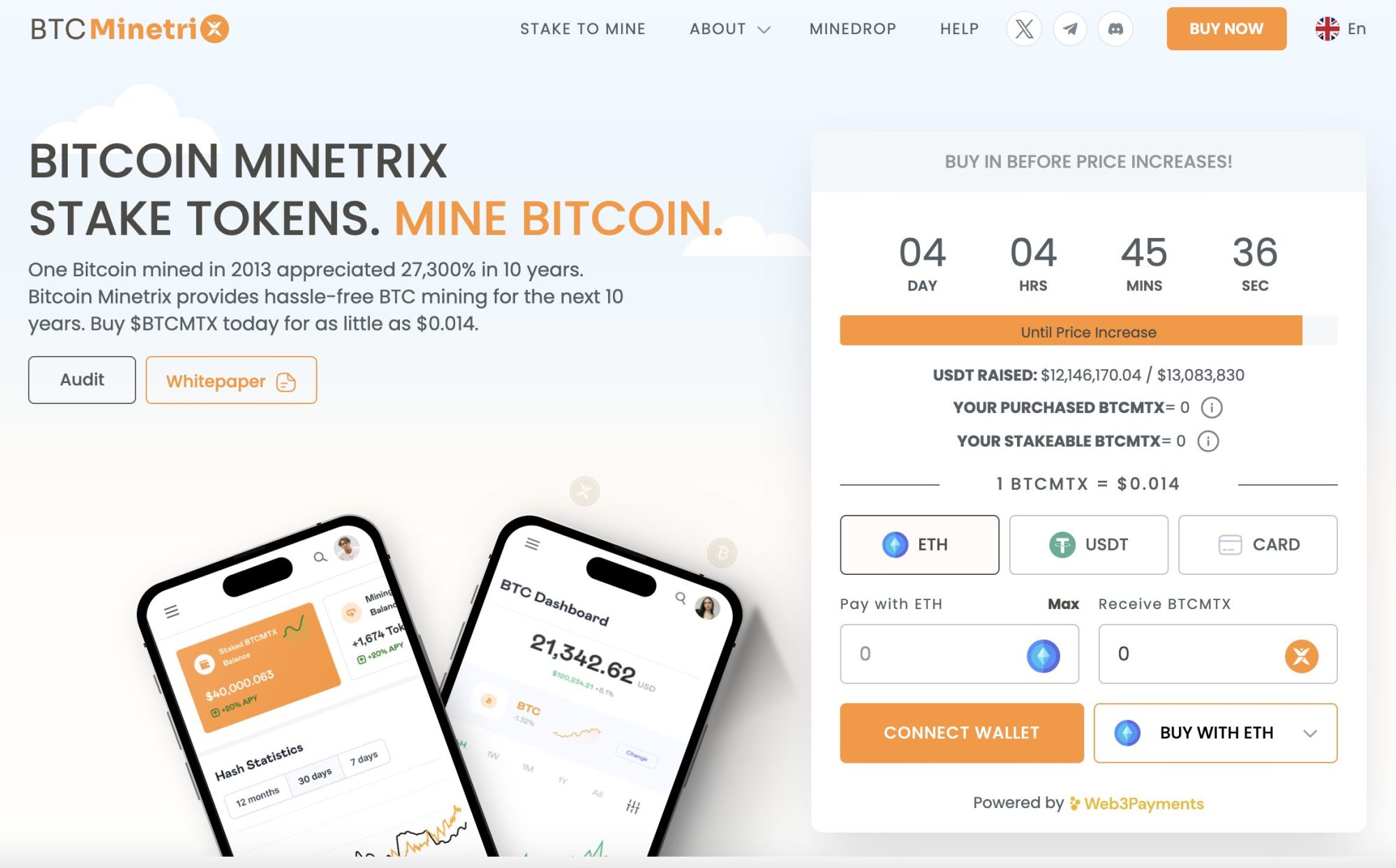

- Bitcoin Minetrix ($BTCMTX): Innovative cryptocurrency decentralizes cloud mining by offering tokenized cloud mining credits. Over $12M raised.

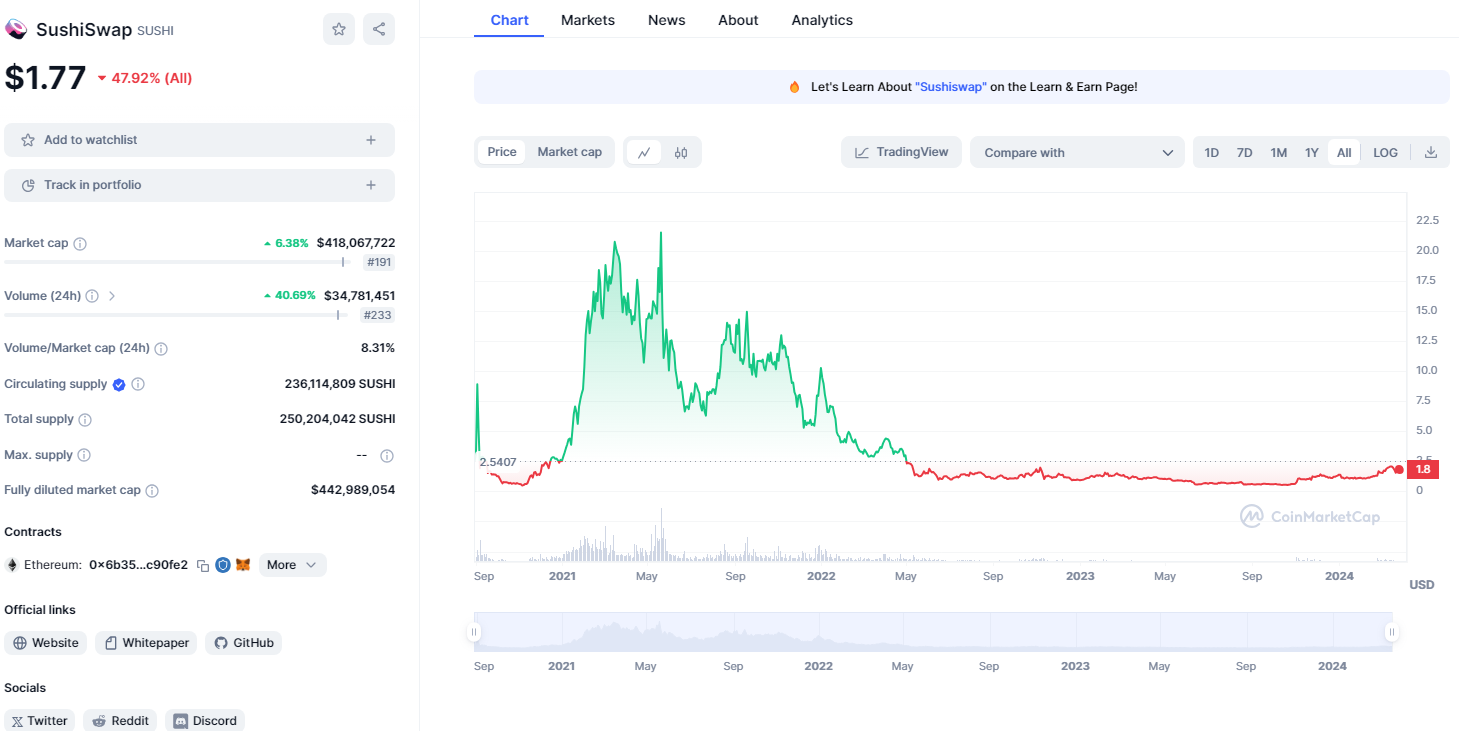

- SushiSwap ($SUSHI): This decentralized cryptocurrency exchange is undervalued, with a market capitalization of just $335 million.

- Ripple ($XRP): XRP provides cross-border payment technology for banks, and supports cross-currency transfers. Top #10 crypto token by market cap.

- Solana ($SOL): Solana facilitates fast, cheap, scalable, and energy-efficient transactions. This crypto can handle up to 65,000 TPS.

- Cronos ($CRO): Backing the Crypto.com exchange, Cronos is trading 90% below its all-time high. Its live market cap stands at $3.6 billion.

Cryptocurrencies with the most potential in 2024

In-depth research is needed to discover the best cryptocurrency with the highest potential. Read on for our full analysis of the 11 projects listed above.

1. Dogeverse (DOGEVERSE): A chain-hopping Doge on a quest to unite the cryptoverse

Dogeverse is the first truly multi-chain Doge token, inspired by Cosmo, the intergalactic Doge explorer. $DOGEVERSE bridges the gap between Ethereum, BNB Chain, Polygon, Solana, Avalanche, and Base, uniting crypto communities through a shared love for Doge memes.

The Dogeverse multichain ecosystem

Tired of expensive gas fees and limited chain options? Dogeverse solves this in one leap! Buy and claim $DOGEVERSE on any major blockchain for a smooth, affordable experience.

Dogeverse breaks down barriers between crypto communities. With advanced bridge technology, $DOGEVERSE holders can seamlessly navigate different chains, boosting the ecosystem’s liquidity and utility.

Mirroring Cosmo’s vision of a unified crypto-verse, Dogeverse allows buying and claiming on six blockchains, bringing together meme enthusiasts and crypto adventurers from DEXs to CEXs.

Multichain deployment

Dogeverse launches on Ethereum for security and wide adoption. Then, it bridges to other chains using secure portal bridge technology. This ensures a user-friendly experience, allowing presale buyers to claim directly on their chosen blockchain.

- Effortlessly switch between chains for optimal trading.

- Choose chains with lower fees and faster processing times.

- Start your journey on your preferred blockchain for ultimate flexibility.

- Foster a diverse community with inclusive accessibility.

Dogeverse’s multichain launch creates a user-centric platform, aligning with the project’s vision of a unified crypto-verse.

Pros

- Learn from industry leaders and gain valuable perspectives within the dynamic cryptocurrency landscape

- Connect with over 2 million crypto enthusiasts, share knowledge, and foster collaboration

- Benefit from 99Bitcoins’ experience and trust as a leading crypto education platform

Cons:

- The BTC airdrop’s fixed amount of rewards is dependent on chance

- Understanding complex crypto concepts takes time and effort, even with an interactive platform

2. 99Bitcoins (99BTC): A trusted authority in crypto education

The Bitcoin halving, a pre-programmed event that cuts the number of new bitcoins mined in half roughly every four years, is a pivotal moment for the cryptocurrency market. This scarcity mechanism can significantly impact Bitcoin’s price and overall market sentiment.

Your guide through the halving

99Bitcoins, a leading cryptocurrency education platform, is here to equip you with the knowledge to navigate the Bitcoin halving. Their comprehensive Learn-to-Earn platform offers a wealth of features specifically designed to help you understand this critical event:

- Dedicated halving modules: Dive deep into the history of Bitcoin halvings, analyzing past trends and their impact on the market.

- Expert insights and predictions: Gain valuable perspectives from industry professionals as they unpack the potential consequences of the upcoming halving.

- Interactive learning tools: Test your knowledge and solidify your understanding with engaging quizzes and simulations, allowing you to explore various market scenarios.

- Investment strategies for halving: Learn practical strategies to capitalize on price fluctuations surrounding the halving event potentially.

By leveraging 99Bitcoins’ Learn-to-Earn platform, you can transform the Bitcoin halving from a source of uncertainty to an opportunity. A thorough understanding of this event and its potential ramifications empowers you to make informed investment decisions and navigate the ever-changing cryptocurrency landscape more confidently.

Pros

- Learn from industry leaders and gain valuable perspectives within the dynamic cryptocurrency landscape

- Thriving Community: Connect with over 2 million crypto enthusiasts, share knowledge, and foster collaboration

- Established Reputation: Benefit from 99Bitcoins’ experience and trust as a leading crypto education platform

Cons:

- The fixed amount in the airdrop relies on chance for rewards

- Understanding complex crypto concepts takes time and effort, even with an interactive platform

3. 5th Scape (5SCAPE): All-in-one immersive suite of games, interactive learning, movies, and more

5th Scape is launching an all-in-one, immersive suite of digital interactive products and experiences pushing virtual reality’s boundaries.

With both the virtual reality and gaming sectors set for consistent growth, the project will bring a metaverse-style virtual ecosystem, complete with a proprietary VR headset and gaming chair.

The platform will launch with an initial set of gaming products, such as MMA, cricket, soccer, archery, and ultra-real racing, which will transport players into a hyper-realistic virtual reality world.

5th Scape is in its initial phases of the presale, offering tokens at an early contributor price of $0.00187, and users can obtain tokens by swapping ETH, MATIC, USDT, BNB or via card payment. As with all crypto projects, it’s always key to get in early and secure tokens at the cheapest price to maximize potential rewards.

The native $5SCAPE token can be used, transacted with and earned as rewards within the 5th Scape ecosystem. Players can use tokens to purchase premium content or products, access exclusive features, obtain in-game items and perks, and for character customization.

Players can also be awarded tokens for completing missions or achieving milestones. Staking features are due to be launched soon and will allow players to earn extra tokens for helping to power the 5th Scape ecosystem.

Pros

- Unique cross-over between blockchain and VR technology

- Proprietary hardware

Cons:

- VR projects are relatively unproven in the crypto space

4. Sponge V2 (SPONGEV2) – New version of Sponge token boasts the highest growth potential

In 2023, Sponge ($SPONGE) launched and instantly became one of the best performing meme coins. Now, the platform is launching its V2 token, Sponge V2, which brings added utility and earning opportunities.

Using the stake-to-bridge mechanism, your existing V1 tokens can be staked into the new V2 smart contract. As a reward, the platform will offer an equal amount of V2 tokens.

Once the staking event ends, investors can claim their Sponge V2 tokens. You can opt to continue staking your holdings, and earn APYs (annual percentage yields) of more than 1,500%. So far, more than 1 billion tokens have been locked on the V2 smart contract.

The high APYs will promote long-term holding among community members. Of the total supply of 150 billion tokens, over 43% will be offered as staking rewards. Investors can also be rewarded through the upcoming play-to-earn ecosystem.

The Sponge V2 whitepaper states that the play-to-earn environment will be a racing game with a free and paid version. In the paid form, you will compete against other players, climb up a leaderboard, and earn $SPONGEV2 tokens. A further 8% supply has been set aside for P2E rewards.

This new version of Sponge looks to revive the token – hoping to offer similar highs as the original token. At its peak, $SPONGE reached a market cap of nearly $100 million. The added use cases can help Sponge V2 surpass this performance.

Pros

- Meme coin market is hot right now

- Potential to replicate the 100x success of Sponge V2

Cons:

- Unknown whether success of Sponge V1 will be replicated

5. Smog (SMOG): New meme coin challenger with rapidly growing community and plans for huge airdrop

Branded as the “one meme coin to rule them all”, new Solana project $SMOG is posing a fierce challenge to the likes of Bonk and Myro, with a rapidly growing community and huge upside potential.

The coin launched fairly through a Jupiter liquidity pool on February 7, generating major interest in the early stages as gains topped 1,400% within the first hour. This number hit 3,000% in the first three days, and 4,700% inside a week.

Smog’s ascension is showing no signs of slowing. The project is quickly gathering community momentum, with over 22,000 X followers and 13,000 members in its Telegram channel.

Community engagement has been hastened by the project’s Zealy campaign, in which more than 3,000 people are currently participating in various tasks in return for XP, which can be redeemed for extra tokens in the project’s forthcoming airdrop.

The airdrop in question is being called the “greatest” in Solana history by the project’s creators. Of the token’s 1.4 billion supply, 35% (490 million) is being allocated to the airdrop, which is due to take place during Phase 3 of the project.

With the value increase we’ve already seen, in addition to the huge forthcoming airdrop, $SMOG is clearly among the cryptos with the most potential this year.

Pros

- Aiming to follow in the footsteps of hugely successful meme coin launches

- Huge airdrop on the horizon

Cons:

- Meme coins tend to be highly volatile

6. eTukTuk (TUK) – Web 3.0 transportation project in Sri Lanka

eTukTuk is set on revolutionizing urban transportation in the developing world. Starting in Sri Lanka, the project will bring a fleet of all-electric tuk-tuks and accompanying charging infrastructure.

In an attempt to reduce carbon emissions in impoverished, Eastern nations, the vehicles will provide a sustainable alternative to the 1.2 million tuk-tuks in Sri Lanka with gasoline or diesel engines.

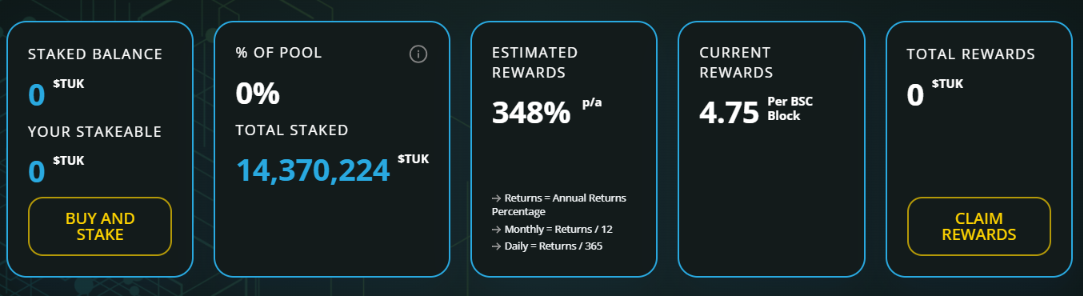

eTukTuk is offering up to 348% APY with 4.75 per BSC block. The presale stage is ongoing at the time of this writing with a price increase at the end of every round.

Investors and traders can participate in the presale via BNB, USDT (BSC), or credit card. Buying via ETH is also available, however, in doing so the eligibility got the 348% APY will be lost.

Besides staking pools, $TUK holders will also enjoy a share of the charging fees along with power supplies when the vehicles are launched and adopted in Sri Lanka according to the whitepaper.

Pros

- Environmental ethos

- Utilizes advanced technology

Cons:

- Crypto-led physical infrastructure projects are relatively unproven as yet

7. Bitcoin Minetrix (BTCMTX): Stake-to-mine crypto offers cloud mining credits

The next cryptocurrency on our list is $BTCMTX, the native token of Bitcoin Minetrix. This revolutionary cryptocurrency helps solve a growing problem in cloud mining.

Cloud mining allows everyday individuals to rent mining power from third-party corporations, allowing them to easily earn a portion of mining revenues. However, many third-party corporations engage in fraud and deceit. Therefore, Bitcoin Minetrix is aiming to solve the problem by decentralizing cloud mining.

With Bitcoin Minetrix, investors can buy $BTCMTX tokens and earn cloud mining credits. The credits are stored on the blockchain and cannot be duplicated or stolen.

To earn the cloud mining credits, stake $BTCMTX on the Ethereum-powered smart contract. Over time, your staked tokens will get converted into cloud-mining ERC-20 credits.

While you cannot directly use these credits, you can burn them on the blockchain to generate allocated mining times. Thus, users can take part in BTC mining operations and a share of mining revenues.

From a total supply of 4 billion tokens, 2.8 billion are being distributed through the ongoing presale. Investors can also earn high staking yields by locking-in $BTCMTX on the smart contract.

Pros

- Decentralizes cloud mining

- Offers high staking yields

Cons:

- Staking rewards decrease as more tokens are staked

8. SushiSwap (SUSHI): Undervalued decentralized exchange trading 95% below its all-time high

SushiSwap is an established decentralized exchange. It enables users to buy, sell, and swap cryptocurrency tokens anonymously. Most importantly, SushiSwap leverages liquidity pools, meaning that it doesn’t rely on traditional order books.

For instance, if you wanted to swap USDT for DAI, you wouldn’t need another market participant; simply connect a wallet to SushiSwap and complete the exchange.

Right now, SushiSwap has a market capitalization of just $275 million. In contrast, Uniswap – one of SushiSwap’s biggest competitors, is valued at several billion dollars.

With this in mind, SushiSwap offers a superb upside – especially as more people will be trading on decentralized exchanges during the next bull run.

In addition SushiSwap is currently trading 95% below its all-time price of $23.38, providing a great, low entry point for investors eyeing major upside potential.

Pros

- Self-contained crypto exchange

- Currently trading well below its potential

Cons:

- Arguably a risky bet given recent poor performance

9. Ripple (XRP): Cross-border payment technology for banks and a direct beneficiary of institutional interest in crypto

Ripple is already a large-cap cryptocurrency, but there is plenty of upside to target. Ripple is valued at $32 billion, although its native token, $XRP, still trades 84% below all-time highs.

We like Ripple for its cross-border payment technology, which helps banks transact intentionally with low fees and fast settlement speeds.

Hundreds of banks are already testing Ripple’s technology, providing the project with significant credibility. Moreover, Ripple recently won a court battle against the SEC, which accused it of selling unregistered securities. This encouraged Coinbase and other US-based exchanges to finally list $XRP.

In terms of utility, $XRP provides banks with liquidity when engaging in cross-currency transfers. For instance, if a bank in Vietnam wants to send funds to Argentina, $XRP would bridge the Vietnamese Dong and Argentine Peso, meaning there’s no requirement to use corresponding banks.

Crucially, as institutional interest in cryptocurrencies continues to increase, $XRP can be a direct beneficiary.

Pros

- Low fees

- Fast settlement speeds

- Pace-setting cross-border payment technology

Cons:

- XRP trading well below all-time highs

10. Solana (SOL): Exploring the future of smart contracts and dApps with 300%+ annual gains

Solana is another large-cap cryptocurrency with huge upside potential. Despite getting caught up in the FTX saga, the token has been on a prolonged bull run since 2023, up over 300% in the past 12 months.

By comparison, Ethereum’s value has increased by 70% over the same period. This is a considerable achievement, as Solana competes for a slice of Ethereum’s smart contract ecosystem.

Although the number of dApps on Solana is tiny compared to Ethereum, the former offers a better value proposition, not only in terms of increased scalability but also faster transactions, lower fees, and energy efficiency.

And of course, Solana is worth just a fraction of Ethereum’s $240 billion market capitalization.

While Solana has been a solid run as of late, it still trades 80% below its all-time high. There is every chance that Solana will record new peaks during the next bull run. Therefore, even with a valuation of $23 billion, Solana is one of the best cryptocurrencies to buy.

Pros

- Faster, cheaper and more efficient than Ethereum

- Potential considerably outweighs current value

Cons:

- Lacks the reputation or performance of Ethereum

11. Cronos (CRO): Trusted cryptocurrency exchange that could chip away at Binance’s market dominance

Cronos is the native cryptocurrency of Crypto.com, a popular exchange with over $500 million in daily trading volume. This is just a tiny fraction of Binance, which processed $10 billion over the same period.

That being said, Binance was recently fined over $4 billion by the Department of Justice for money laundering offenses.

Add this to the FTX collapse from last year, and Crypto.com can organically increase its market share. After all, Crypto.com offers some of the lowest trading commissions in the market. It supports hundreds of cryptocurrencies and offers competitive APYs on savings accounts. And most importantly, Crypto.com is in good shape with US regulators.

So, to speculate on the future growth of Crypto.com, consider Cronos. It has a market capitalization of just $2.2 billion. In contrast, BNB – the token backing Binance, is valued at over $34 billion.

In addition, Cronos is trading 90% below its prior all-time highs.

Pros

- Trading commissions among the market’s lowest

- Good reputation in the eyes of US regulators

Cons:

- Inactivity fees

Tips on discovering crypto with the most potential in 2024

We’ll now discuss how you can find your own high-potential cryptocurrencies. This will ensure you invest based on your personal goals and risk tolerance.

Look for upcoming presales to get a first-mover advantage

Presales are one of the most effective ways to find a cryptocurrency that can produce gains of 100x or even 1,000x.

The reason for this is simple; you’ll be investing when the cryptocurrency starts its journey. This means a very small market capitalization, giving you ample room for growth.

Furthermore, many crypto presales offer a discount. This means you’ll get a lower price when compared to the eventual exchange listing.

Discover trending cryptocurrencies that are generating hype

In general, the most valuable cryptocurrencies have achieved success because of their underlying technology. Whether it be Bitcoin, Ethereum, XRP, Solana, or Cardano, large-cap cryptocurrencies have an identifiable use case.

However, there will always be exceptions to the rule. For instance, some cryptocurrency projects succeed because of speculation, hype, and fear of missing out (FOMO). This sentiment can snowball, with other investors adopting the same idea and choosing to invest, leading to an increase in the token’s value.

To find these high-potential projects, a good place to start is with a decentralized exchange such as DEXTools. Being a platform that tends to list low cap gems, DEXtools is ideal for opportunistic crypto investors.

After exploring DexTools, head over to a price-tracking platform such as CoinMarketCap, and visit the ‘Trending’ page. Once again, this shows you which cryptocurrencies people are searching for.

Build a portfolio of quality cryptocurrencies trading at discounts

While it can be tempting to focus on new cryptocurrencies with small market capitalizations, it may also be a smart move to invest in some more established cryptocurrencies.

Although the returns will be smaller, you can still target an attractive upside. This is especially the case with cryptocurrencies that were hammered by the broader bear market.

For instance, SushiSwap, one of the projects in our list above, currently holds $1.18 billion in locked liquidity, and yet it is trading more than 90% below its all-time high. This is a prime example of an established project that still boasts the potential for high returns.

“““““

Research the token’s features and utility

Many cryptocurrencies have no utility, and were purely created to generate hype and value. Pepe, for example, has increased by several thousand percent since launching in April 2023, even though it has no utility.

However, in the long run, the most successful cryptocurrencies are those that offer token holders actual value. In particular, these projects are able to survive prolonged bear markets, whether that’s Bitcoin, XRP, or Chainlink.

This is the same as buying quality blue-chip stocks during a market recession – the likes of Coca-Cola, Johnson & Johnson, and Walmart have gone through many market crashes, but have always recovered.

The same concept should be applied when searching for cryptos with the most potential.

FAQs

Which crypto has the highest prediction?

The growth of new cryptocurrencies like Dogeverse, 5th Scape, and Sponge V2 is projected to be substantial, even though they currently have low valuations.

Which crypto will give 1000x?

To make crypto gains of 1000x you’ll need to invest in small-cap projects. Two high-potential coins that could do 1000x include Dogeverse and 5th Scape.

Which crypto is best to buy now?

Bitcoin and Ethereum are currently trading at discounted rates. For greater growth potential, consider investing in a presale cryptocurrency like Bitcoin Minetrix.

Where to find crypto with the highest potential?

To find a cryptocurrency with the most potential, check out trending coins on DexTools and CoinMarketCap. You can also explore quality presales like Dogeverse and 5th Scape.

References

- www.uktech.news/news/founder-interviews/br-dge-founder-brian-coburn-20231222

- https://www.reuters.com/markets/us/bitcoin-could-hit-100000-by-end-2024-standard-chartered-says-2023-04-24/

- https://www.bloomberg.com/news/articles/2023-10-30/novogratz-reiterates-that-he-expects-spot-bitcoin-btc-etf-approval-this-year

- https://www.reuters.com/markets/us/sec-dropping-claims-against-ripple-executives-court-filing-2023-10-19/

- https://seekingalpha.com/article/4556450-solana-its-worse-than-ftx-contagion

- https://www.justice.gov/opa/pr/binance-and-ceo-plead-guilty-federal-charges-4b-resolution

- https://www.morningstar.com/etfs/spot-bitcoin-etfs-inch-closer-their-debut

- https://markets.businessinsider.com/news/currencies/metaverse-property-decentraland-sale-price-mana-coin-cryptocurrency-2021-11