Artificial intelligence is one of the most profound changes to stock trading since the advent of online brokers. With AI, anyone can find patterns in stock prices and use enormous datasets to predict which stocks will soar.

The most important thing for traders is to decide which is the best AI stock picking software for their trading approach.

In this guide, we’ll review 7 of the best AI stock picker services available today. We’ll also explain how artificial intelligence can play a role in your investing strategy, and how to use an AI stock app effectively.

Our picks of the top AI stock picker services

Here’s a quick look at the best AI stock picker services:

- AltIndex – Daily AI stock picks based on fundamental, technical, and alternative data. Provides deep insights into companies based on web traffic, employment data, and more.

- TrendSpider – AI-powered technical analysis helping traders identify day and swing trading opportunities. Identifies candlestick patterns, trendlines, Fibonacci retracements, and more.

- Danelfin – Straightforward artificial intelligence stock picks with fundamental analysis and 3-month price targets. Offers a free list of top AI picks.

- Trade Ideas – Artificial intelligence stock scanner built for day traders. Has a steep learning curve, but offers actionable entry and exits for every trade recommendation.

- Tickeron – Mix and match AI trading robots based on fundamental and technical signals. Offers both signals and automated trading services.

- BlackBoxStocks – Day trading service helping traders find volatile opportunities. Ideal for options traders since it includes an options order flow feed.

- Kavout – Artificial intelligence investing platform for building and diagnosing long-term stock portfolios. Offers built-in AI screens for finding new investment ideas.

- Candlestick.ai – Mobile app with 3 weekly AI picks tailored to different investment styles. Soon to introduce a conversational AI advisor.

A closer look at the best AI stock picking app

Want to know which of these AI stock tools is best? We’ll cover each in detail below and highlight the types of stock trading they’re best suited for.

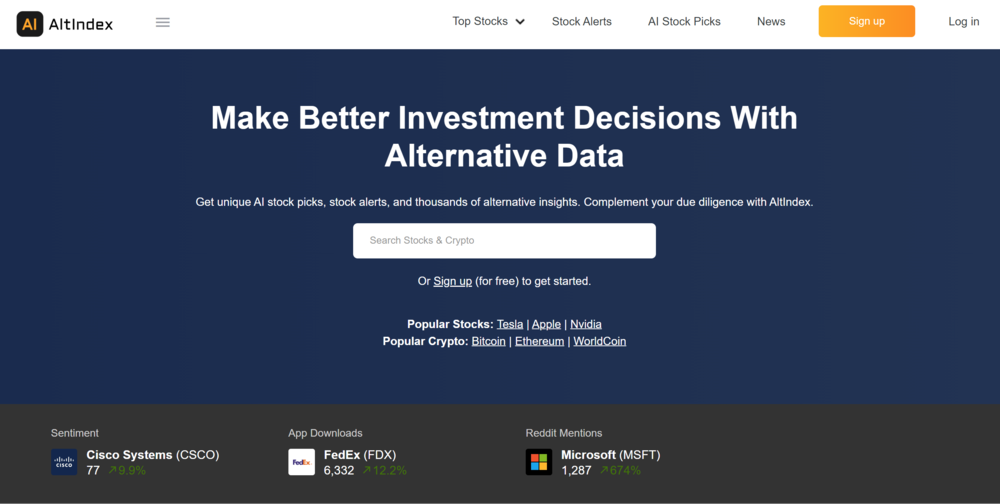

1. AltIndex – Daily, artificial intelligence-powered stock picks based on alternative data

AltIndex is a powerful AI stock app that takes a holistic look at companies, going beyond traditional stock performance data to help traders decide which stocks could rise and fall.

The platform uses a combination of fundamental, technical, and alternative data analysis that’s relatively unique and helps AltIndex provide personalized investment advice. Some of the unique metrics that AltIndex monitors include social media sentiment, Google Ads spending, employee ratings, ESG efforts, mobile app downloads, and more.

These alternative data points are incredibly helpful in going beyond just a company’s earnings to find out how healthy it actually is. Factors like ESG and employee ratings also point to whether a company will remain popular in the future. Alternative data has long been used by hedge funds because of the insights it provides.

AltIndex combines this alternative data analysis with traditional fundamental and technical metrics to assign AI scores to each stock. This is further broken down into sub-scores like brand score, employment score, user growth score, and fundamental score giving its users the best stock tips on the market.

AltIndex also delivers a 6-month price prediction for each stock in its database. Traders and investors can use this to make decisions based on their risk tolerance. AltIndex also provides a list of top-rated stocks based on price predictions, which makes it easy for traders to find actionable ideas quickly.

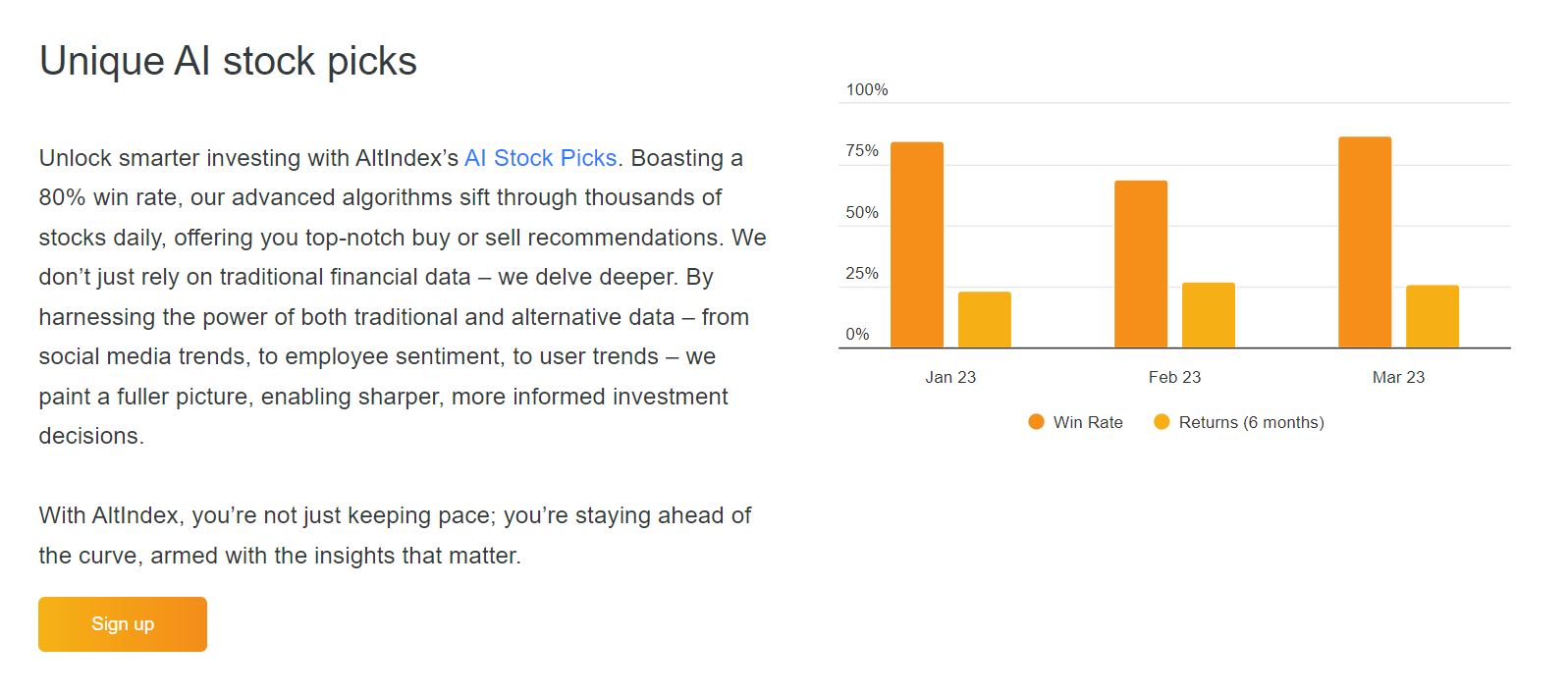

AltIndex claims an 80% win rate on its AI picks, which is really impressive. Over the first 3 months of 2023, the picks delivered a 6-month return of 23-26% each month.

An AI stock screener lets traders dig in deeper, filtering stocks by AI scores, predicted upside, and dozens of fundamental, technical, and alternative metrics. The AltIndex screener is really powerful for traders who already have an investment strategy, but want to narrow down their ideas further using AI.

Traders can start using AltIndex for free and get one AI stock pick plus research into 20 stocks. Paid plans start at just $29 per month for unlimited stock research, full access to the AI stock screener, and 10 monthly AI stock picks.

| Free Plan | Starting Price | Pick Style | Pick Format |

| Yes | $29/month | Fundamental, technical, and alternative data | Daily picks |

Pros

- 80% win rate for AI picks

- Free plan to try out the picks

Cons

- Minimal detail about what fundamental and technical data is used

2. TrendSpider – AI-powered technical analysis and charting platform

TrendSpider is a powerful platform for stock charting and technical analysis that includes unparalleled automation features. With this platform, artificial intelligence can help traders automatically identify trendlines, candlestick patterns, Fibonacci retracements, and more.

The software is surprisingly easy to use, making it a good option even for beginner chartists. Traders can simply select the auto-annotate feature and specify what level of sensitivity they want for the analysis. TrendSpider will find all of the relevant trendlines and patterns within a few seconds.

TrendSpider takes this approach one step further, providing traders with a scanner that can search for popular candlestick patterns or stocks setting up for a breakout. This is an incredibly handy tool for swing traders, who can quickly find opportunities before it’s too late.

Notably, the scanner is completely code-free. Traders can essentially describe the conditions they want to search for in plain English, and TrendSpider’s machine learning tools will take care of the rest. This is just another way that the platform makes itself as user-friendly as possible.

The platform also enables traders to backtest strategies and run profitable strategies as bots. These bots can be integrated with IFTTT, Zapier, or other automation software to execute trades without manual intervention.

TrendSpider offers a 7-day free trial and paid plans start at $22.40 per month. All plans include real-time financial data and all of TrendSpider’s pattern recognition tools.

| Free Plan | Starting Price | Pick Style | Pick Format |

| 7-day free trial | $22.40/month | Technical analysis | Customizable stock screener |

Pros

- Highly customizable technical screener

- Set up bots for automated trading

- User-friendly design with no coding required

Cons

- Doesn’t offer a pre-made list of top opportunities

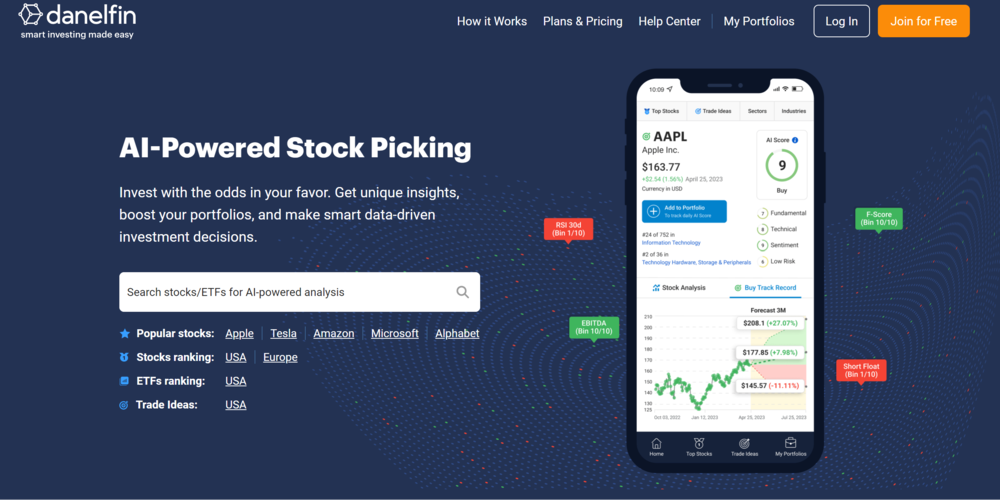

3. Danelfin – Straightforward AI trading bot with 3-month price targets to follow

Danelfin is an easy-to-use stock picking service powered by AI. It offers straightforward top stocks lists, 3-month price targets for thousands of stocks, and understandable stock scores.

The user-friendliness of this platform makes it a great option for new swing traders and active investors who are just getting into AI stock picking for the first time.

Danelfin assigns each stock in its database—which covers both US and European stocks—an AI score on a scale from 1-10. The higher the score, the greater the likelihood that the stock will outperform the broader market over the next 3 months.

The overall score is broken down into sub-scores for fundamental, technical, and sentiment analysis, plus another score for risk. So, traders can get some insight into why the AI tools are recommending a particular stock.

Danelfin offers a list of top stocks that traders can explore as well as a list of actionable long and short trade suggestions. One nice thing is that the artificial intelligence calculates a low, medium, and high price target for each stock, giving traders an idea of the confidence interval in each prediction. The software also displays the results of past predictions for each stock, letting traders know just how well Danelfin has worked for that particular company in the past.

Traders can start using Danelfin for free and get the top 10 stocks recommended by the AI at no cost. Paid plans start at $17 per month and unlock daily trade ideas and more access to the stock research that goes into Danelfin’s AI models.

| Free Plan | Starting Price | Pick Style | Pick Format |

| Yes | $17/month | Technical and fundamental analysis | Daily list of top 10 picks |

Pros

- Get top 10 daily recommendations for free

- Covers US and European stocks

- See past signal results for each stock

Cons

- Very limited charting and analysis tools for further research

4. Trade Ideas – AI stock scanner built for day traders

Trade Ideas is arguably the most powerful and comprehensive stock screener on the market today. It’s also one of only a handful of screeners that’s harnessed artificial intelligence’s power for finding stock trading opportunities.

The platform’s AI, nicknamed Holly, scans the market each night and runs millions of scenarios to identify potential trades for the following day. When traders log into Trade Ideas in the morning, they’ll see a list of Holly’s best ideas complete with entry and exit points.

Traders can essentially use Trade Ideas like a signals service, simply following along with Holly’s recommendations. The platform even integrates with brokers like Interactive Brokers and TradeZero to let traders execute signals from Holly automatically.

Traders can also use the platform to build their own stock scans, although the platform has a very steep learning curve. There are basically no limits to how complex scans can be or what custom technical and fundamental metrics a trader can include. This is a platform designed around highly experienced day traders, so beginners should beware that it can be overwhelming.

Another thing to keep in mind about Trade Ideas is that it’s expensive. The stock scanning features start at $84 per month, and traders will have to shell out $167 per month for access to the AI tools.

The lofty price can be worthwhile for day traders with a lot of capital to deploy, but pricing is definitely a consideration when deciding whether to use Trade Ideas over another AI stock picker app.

| Free Plan | Starting Price | Pick Style | Pick Format |

| Yes | Free | Fundamental analysis | Stock scores |

Pros

- Extremely powerful AI trading signals daily

- Highly customizable stock screens

- Integrated charting tools

Cons

- Very steep learning curve

- Expensive

5. Tickeron – Mix and match AI trading robots from a vibrant marketplace

Tickeron is a market analysis platform that’s leaned heavily into AI. The service offers a marketplace where traders can find and purchase AI trading bots to deliver signals or even trade automatically on their behalf.

There’s a wide range of AI bots available on Tickeron. Some are based on fundamental analysis, some on technical analysis, and some on a combination of both. All of the bots are backtested and evaluated by Tickeron’s team to ensure they’re profitable.

Notably, Tickeron’s bots aren’t just for stocks. The platform also has bots for forex trading and crypto trading, making this a versatile platform for multi-asset traders.

Tickeron also incorporates artificial intelligence into its market research tools. Traders can take advantage of a trend prediction engine to find hot stocks and market sectors. There’s also a pattern detection tool that can identify common candlestick patterns like double tops, head and shoulders, and ascending triangle patterns.

A stock screener lets traders mix their own custom strategies with Tickeron’s AI analysis to find opportunities in the market right now. It’s not the most user-friendly screener we’ve tested, but it does offer a ton of filter parameters.

Tickeron’s pricing is confusing. Traders can use the platform for free, but a free plan offers only limited access to stock research and no access to artificial intelligence tools. Daily AI-generated signals start at $5 per month, while pricing for bots in the marketplace starts at $90 per month for a single bot. There are different plans for day traders, swing traders, and investors, too.

| Free Plan | Starting Price | Pick Style | Pick Format |

| Yes | $5/month | Technical and fundamental analysis | Daily trade signals |

Pros

- Candlestick pattern identification

- Supports stock, forex, and crypto trading

- Daily AI-powered trading signals

Cons

- Pricing options are confusing

6. BlackBoxStocks – Options trading platform using AI tools to identify high volatility opportunities

BlackBoxStocks is an AI-powered trading system with a devoted community of traders around it. The platform delivers a combination of daily signals and deep research to help traders spot and act on highly volatile trading opportunities.

With BlackBoxStocks, traders receive a list of potential stocks to watch at the start of each day. They can follow these stocks using a myriad of research tools including an options order flow feed, a dark pool feed, a volatility indicator, technical price charts, and more.

Traders can find even more ideas in BlackBoxStocks using a built-in screener and a community chat. The chat is very active, enabling traders to share their ideas and get feedback from more experienced peers.

Unlike other AI-powered trading platforms, BlackBoxStocks is a self-contained trading system. Everything traders need to make smarter investment decisions can be found within the software, and there are detailed guides to how to use it effectively. This makes BlackBoxStocks suitable for traders of all experience levels.

BlackBoxStocks costs $99.97 per month or $959 per year. Traders can try out the platform before committing with a 7-day free trial.

| Free Plan | Starting Price | Pick Style | Pick Format |

| 7-day free trial | $99.97/month | Technical analysis | Daily trade signals |

Pros

- Community chat with other traders

- Research tools including stock screener and charts

- Includes options order flow feed

Cons

- Requires monitoring the market throughout the day

7. Kavout – AI investing platform helping investors build the perfect portfolio

Kavout is an AI-powered service targeted at active and long-term investors rather than traders. Its goal is to help investors build and maintain the best possible portfolio for their financial goals.

With Kavout’s portfolio builder tool, investors can assemble a portfolio of top-rated stocks from multiple sectors. The tool helps investors avoid common pitfalls like buying highly correlated stocks or stocks that are likely to underperform the broader market.

An AI algorithm rates every stock in Kavout’s database on its quality, value, momentum, growth, and volatility. Investors can quickly screen stocks based on these ratings, making it easier to decide which stocks to include in their portfolio.

Once investors have assembled their portfolio, they can use Kavout to monitor how diversified it is and weed out underperforming stocks. A dashboard breaks down AI scores for each stock and highlights positive and negative financial metrics that investors should pay attention to.

Kavout can also help investors find additional stocks to add to their portfolio over time using a multi-factor screener. This incorporates all of Kavout’s scores, financial ratings, and other fundamental analysis metrics.

Kavout is currently free to use, making it a great option for new investors who want to get their portfolio started on the right foot.

| Free Plan | Starting Price | Pick Style | Pick Format |

| Yes | Free | Fundamental analysis | Stock scores |

Pros

- Designed for long-term investors

- Help achieve truly diversified portfolios

- Free to use

Cons

- Limited tools for portfolio rebalancing

Comparison table of the best AI stock picker in 2024

| Platform | Free plan? | Starting price (premium) | Pick style | Pick format |

| Altindex | Yes | $199/yr | Fundamental, technical, and alternative data | Daily picks |

| TrendSpider | 7-day trial | $58/yr | Technical analysis | Customizable stock screener |

| Danelfin | Yes | $228/yr | Technical and fundamental analysis | Daily list of top 10 picks |

| Trade Ideas | Yes | $1068/yr | Technical analysis | Daily picks |

| Tickeron | Yes | $90/mo | Technical and fundamental analysis | Daily trade signals |

| BlackBoxStocks | 7-day trial | $959/yr | Technical analysis | Daily trade signals |

| Kavout | Yes | Not publicized | Fundamental analysis | Stock scores |

Methodology

Our expert panel spends around five hours researching each project, exploring the platform, its active community, and the range of features it offers.

In the interest of objectivity, our panel contains a range of different background and experience levels, with some possessing very little understanding of finance. This way, we are able to assess the product from a range of perspectives.

References

- https://www2.deloitte.com/us/en/pages/financial-services/articles/infocus-adopting-alternative-data-investing.html

- https://www.cnbc.com/2022/12/29/stock-market-futures-open-to-close-news.html

- https://www.cnbc.com/2023/04/12/chatgpt-may-be-able-to-predict-stock-movements-finance-professor-says.html

- https://www.benzinga.com/general/topics/23/06/32861724/what-percentage-of-stock-trades-are-made-by-bots-and-algorithms

- https://finance.yahoo.com/news/investors-know-automatic-trading-systems-130031035.html

FAQs

Is there an AI service that can pick stocks?

There are several AI stock picking services including Danelfin, Trade Ideas, and Candlestick.ai. These services use AI to analyze a wide range of technical and fundamental parameters and recommend stocks to trade.

Is AI legal for stock trading?

It’s completely legal to use AI tools to trade stocks. Traders can use AI to analyze stock trades or even place trades automatically on their behalf.

What is the best AI service to use for stock prediction?

AltIndex is the best AI stock picking service to use today. AltIndex uses machine learning to analyze technical, fundamental, and alternative data parameters for thousands of stocks. It delivers an easy-to-understand stock score and a 6-month price prediction that traders can use to make investment decisions.