If 2020 taught us anything, it’s that you never really know what the year will bring. The notion of “break in case of emergency” savings took on an entirely different meaning in the midst of the COVID-19 pandemic, and for some people, personal finance concerns took center stage.

Q1 2021 hedge fund letters, conferences and more

Spending too much money is usually one of the finance mistakes people regret the most, but clipping coupons and pinching pennies isn’t considered glamorous either. Still, establishing a routine around how you spend money smartly and put money into savings in the process, can set you up for the future (and all of the unexpected shifts in the economy you may not be anticipating).

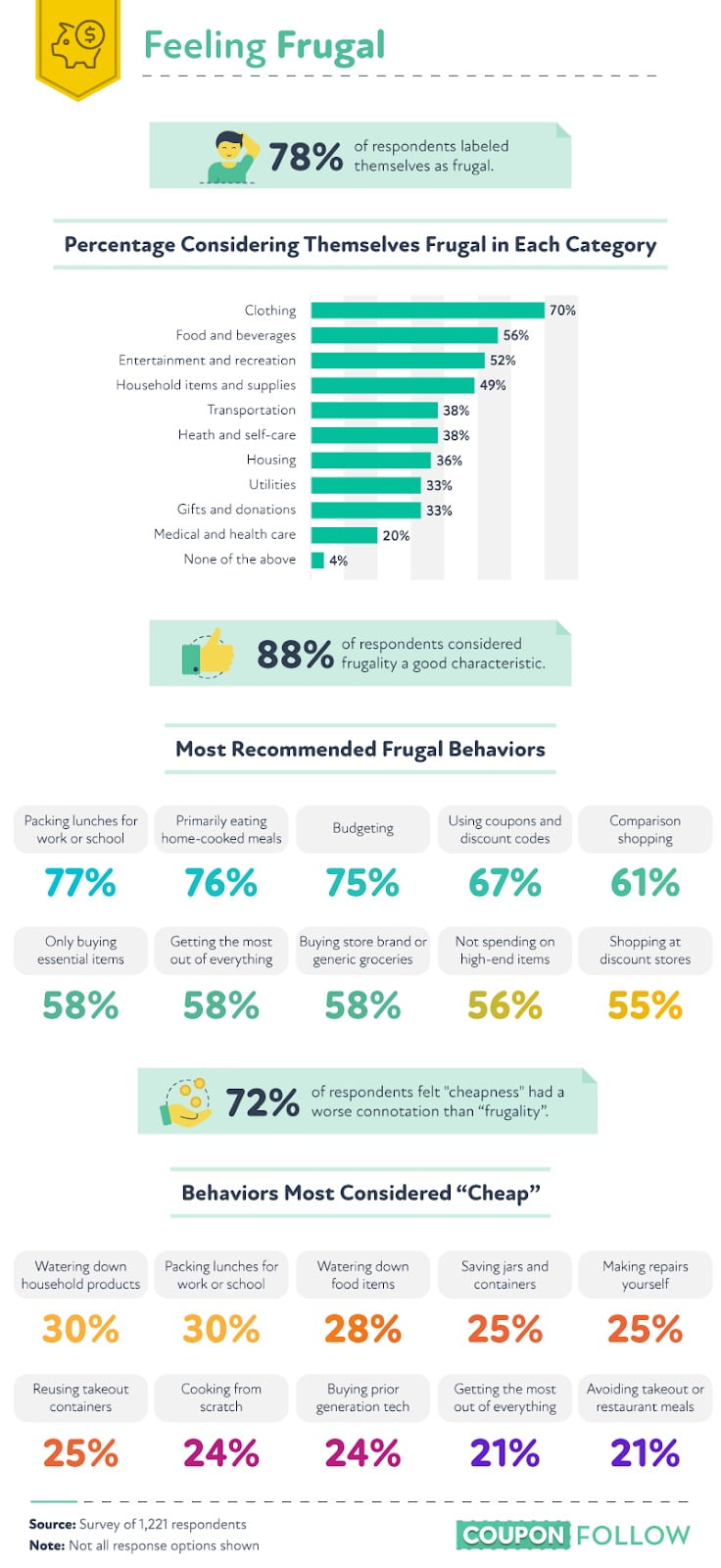

For a closer look at the fine art of frugality, budgeting, and building a savings account, CouponFollow surveyed over 1,200 people about the behaviors that work for them to save every possible penny. They found clothing purchases, food and beverages, and entertainment purchases were the thriftiest, on average, but that’s not all their survey revealed.

The Purchases You Could Be Saving On

There’s no doubt about it: A vast majority of people (88%) consider frugality a positive characteristic. When people consider themselves frugal, what are the purchases they find themselves saving on? For most, it was clothing (70%), food and beverages (56%), and entertainment and recreation (52%).

So how do they do it? The easiest answers may not be completely surprising concepts:

- Packing lunches for work or school

- Eating home-cooked meals over going out

- Creating a budget

- Using coupons and discount codes

- Comparing products before making a purchase

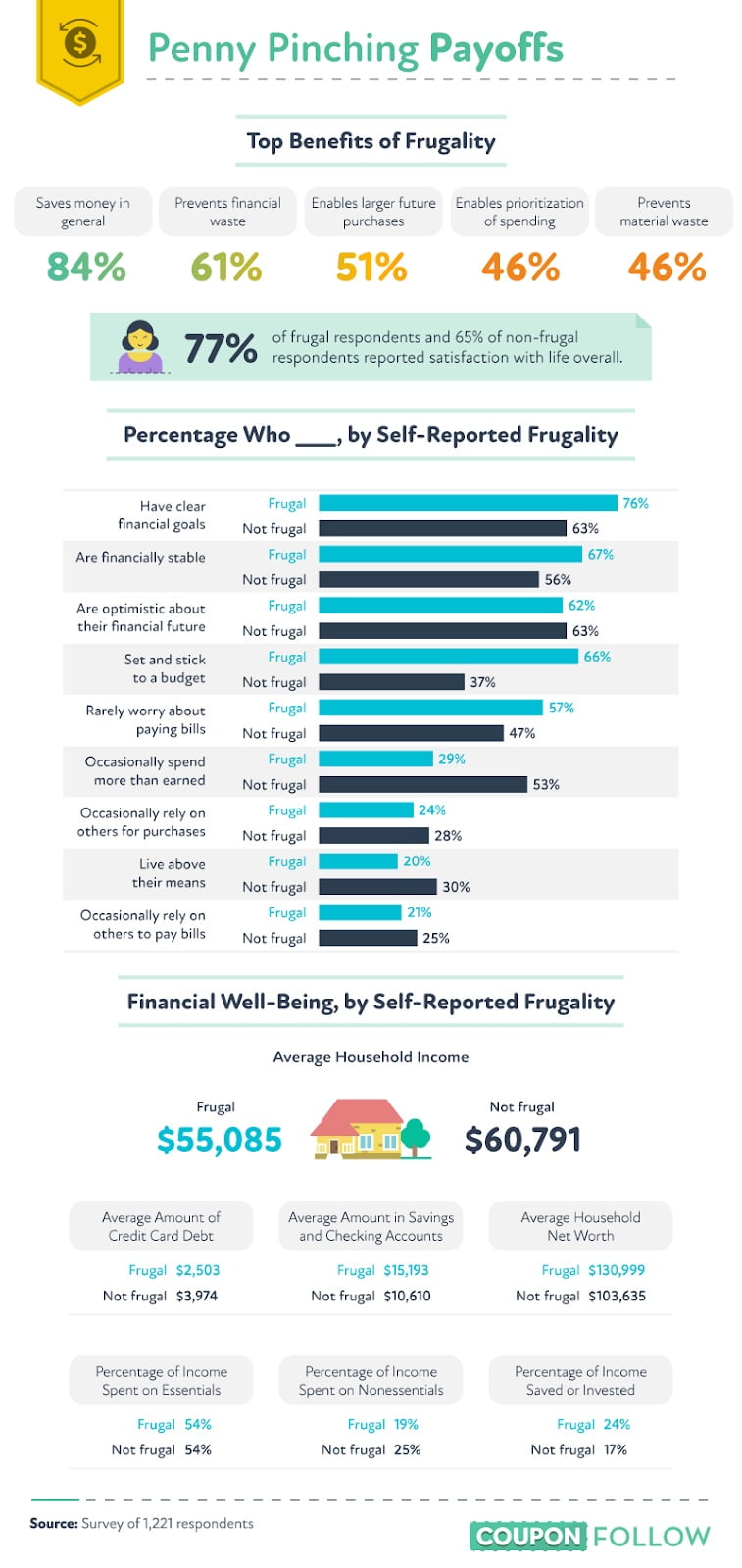

Creating a “frugal” mindset takes a certain amount of work, but like your money, none of that effort will go to waste. The biggest benefits of pinching pennies include saving money (84%), preventing financial waste (61%), being able to make bigger purchases in the future (51%), and being able to prioritize spending (46%).

Perhaps the most important distinction among people who self-identify as frugal: 77% consider themselves satisfied with life in general, an increase over the 65% of not-so-frugal spenders.

So what helps make them happier? Self-identified frugal spenders were more likely to have clear financial goals, be financially stable, be optimistic about their financial futures, and say that they rarely worry about paying their bills. Compared to people who don’t consider themselves frugal, penny pinchers were nearly twice as likely to be able to set a budget and stick to it.

You don’t have to make money to be able to spend it, either. Non-frugal spenders, who were generally less happy and less financially stable, also reported earning $5,500 more, on average. Despite having higher incomes, non-frugal spenders also had more credit card debt, less money in savings, less expensive homes, and less money invested or saved.

Valuing Frugal Tendencies

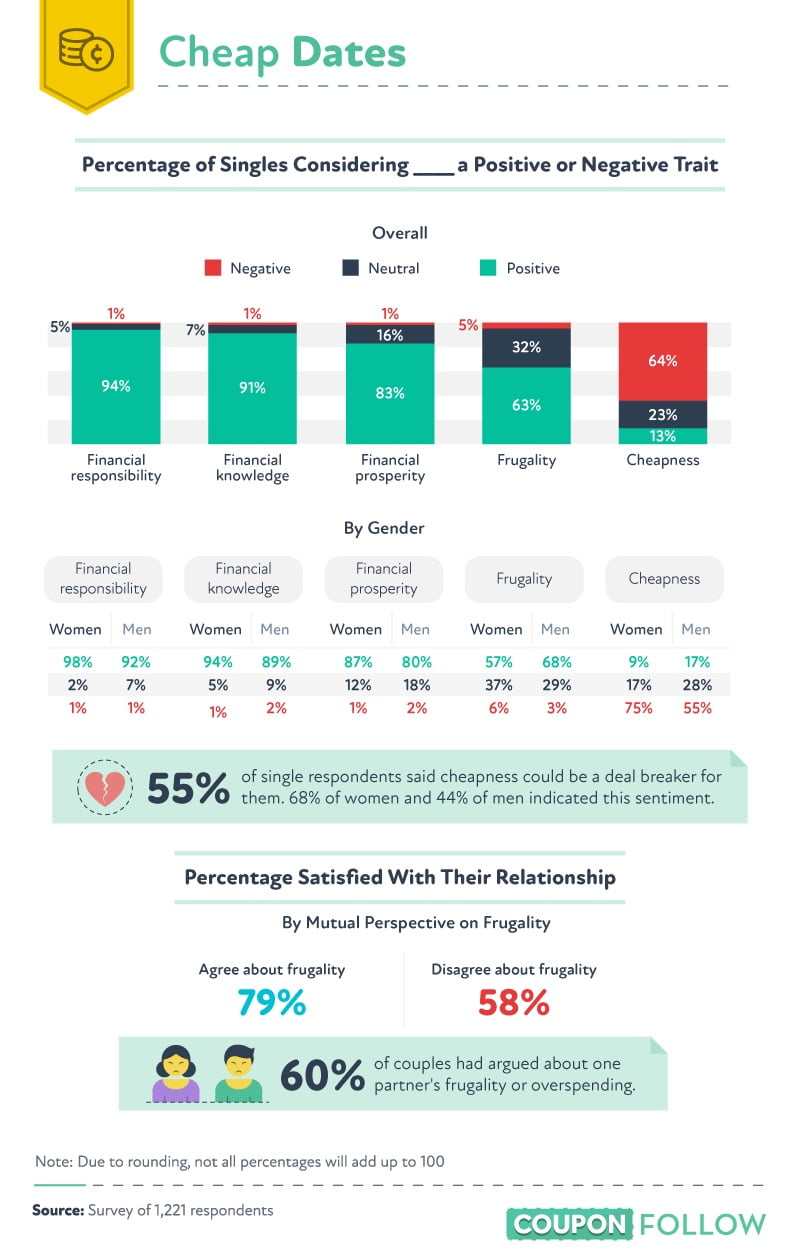

A relationship where one person considers themselves frugal and the other doesn’t might be unfortunately imbalanced. In general, financial responsibility (94%) and financial knowledge (91%) were extremely valuable traits, followed closely by financial prosperity (83%). Frugality (63%) and cheapness (13%) were far less likely to be viewed as favorable characteristics, though.

In fact, more than half of people (55%) said cheapness was a deal breaker for them in a romantic relationship. While agreeing how to spend – and save – money isn’t guaranteed in any relationship, people who have the same perspective on frugality were far more likely to be happy with their partners (79%) than those who disagreed about how to be “frugal” with their money (58%).

While women were generally more likely to report valuing financial responsibility or knowledge, men more often indicated having a positive attitude toward frugality and cheapness.

Changes in Savings Patterns Between Generations

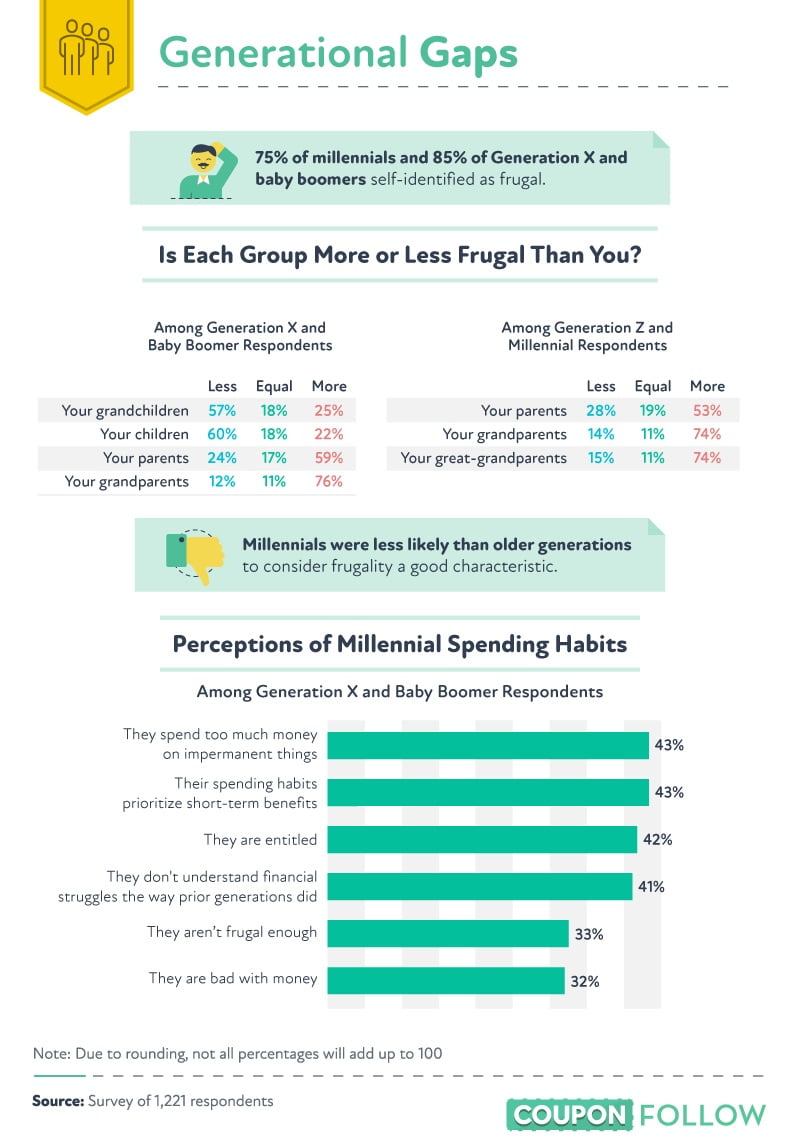

In general, millennials were less likely than other generations to consider frugality a positive characteristic. When baby boomers and Generation X Americans were asked to rate how frugal they felt other generations were, both indicated that their children and grandchildren were less frugal, while their parents and grandparents were significantly more frugal.

In looking at the spending habits of millennials, Gen Xers and baby boomers agreed younger generations spend too much money on unimportant things (43%), their spending habits prioritize short-term benefits (43%), they’re entitled (42%), and they don’t understand the struggles of older generations (41%).

Pinching Pennies for the Greater Good

For most people, being “cheap” isn’t an attractive quality. Still, people who consider themselves frugal are better at saving money where they can and maximizing spending in other ways.

Better yet, people who consider their spending and saving habits “frugal” are more likely to be happy with their life and their relationships. With more money in savings, more opportunity to invest, and money to spend on bigger and better homes, being frugal means you can make less money and stretch every dollar as far as it will go.