Some people think building up their savings is enough to safeguard against inflation. But when it comes down to figuring out how to build a hedge against inflation, saving money is not going to help in the long run. This is because you are not able to accrue much from interest on your savings. If the prices for everything from groceries to houses rise, then that same amount of money that has not increased from saving will not offer as much buying power. This is especially true considering federal interest rates are pretty much at zero, so you aren’t even making money from your savings.

Q1 2021 hedge fund letters, conferences and more

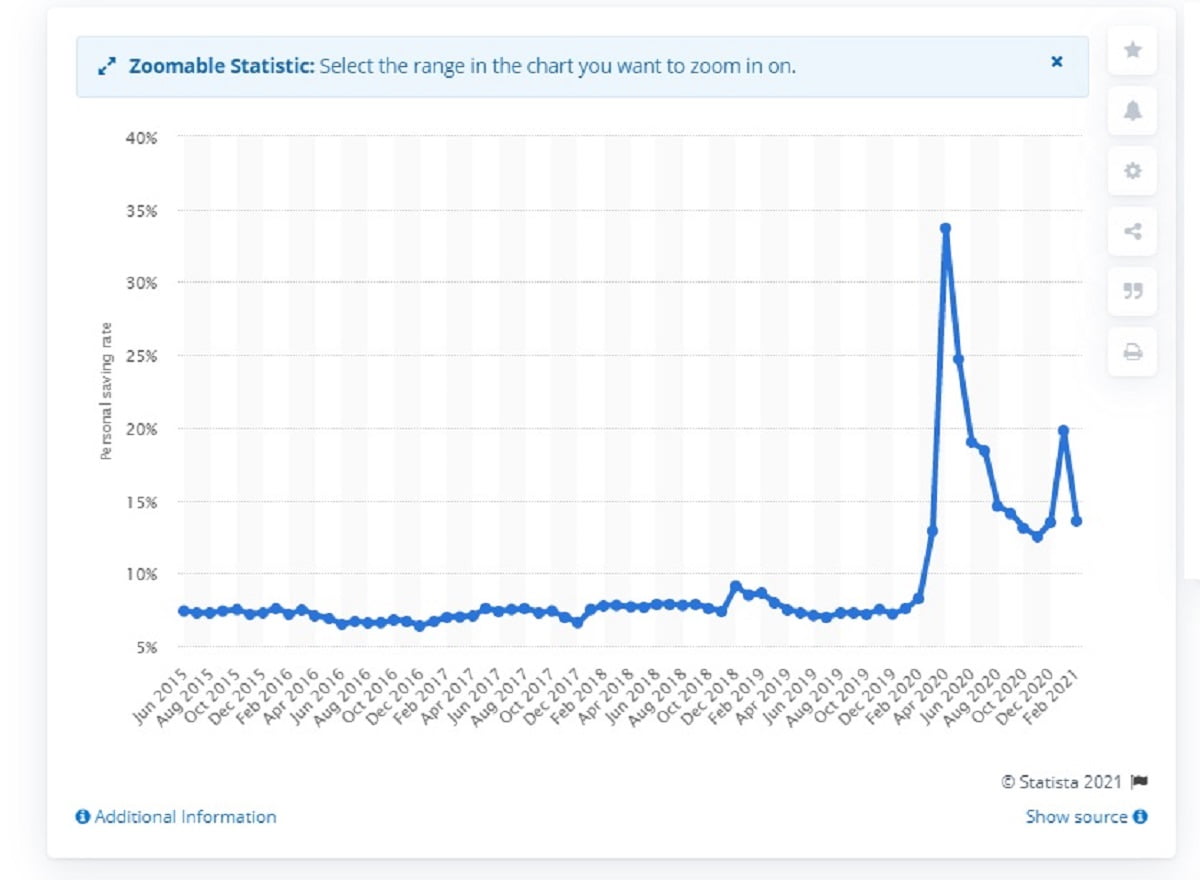

Here’s a chart of the US savings rate from June 2015 through February of this year. Notice how these align with when the stimulus checks were sent out to Americans.

What the average consumer does not realize is that although there is talk about inflation, there are ways to guard against it. Saving money can only go so far, so what can you really do to hedge against inflation?

How the Fed Handles Inflation

Normally, central banks work to maintain the inflation rate within a certain boundary. This boundary has been 2.3%. With the pandemic, the Federal Reserve has stated it will instead maintain an average inflation of 2% instead of below 2%. This is a subtle difference, but it actually means a lot for the US economy.

We consider inflation to be mild when it is between 2.3% and 3.3%. But it starts to run high above 3.3%, and it is very high when it is above 4.9%. Mark Williams, a master lecturer at Boston University, posed a simple comparison to show what this actually means. Basically, an annual inflation rate of 5% indicates that a single dollar is actually worth $0.95 the year after.

Additionally, he mentioned that those who are putting their savings into low-interest bank accounts are really the ones losing money on inflation. This is because the accrued interest is so low that it actually is eaten up by inflation. You are not building a hedge against inflation, and you make nothing or lose money by saving only. The latter is probably more so the case because of low-interest rates today.

Is Inflation Always Bad? How Do You Measure Inflation?

There are two measures of inflation used in the US. These are the Consumer Price Index (CPI) and Producer Price Index (PPI). CPI measures the price of a set of finished goods, which is reported each month by the Bureau of Labor Statistics. On the other hand, the BLS also reports the PPI monthly. This is a weighted average of the prices for producers on American soil at any stage of the production and post-production line. These statistics reveal growth or stagnation in an economy.

It may surprise you to know that inflation is not always bad. Normally, inflation is helpful because it measures economic growth. This means that companies are producing, people are spending, and wages are increasing. See, inflation is slightly necessary as it encourages people to make purchases, and this helps national economic growth. On top of that, there are plenty of markets that do well despite inflation, all of which help contribute to a hedge against inflation. Traditionally, this includes real estate, TIPS bonds, and commodities like gold and silver. Now, there’s another market: cryptocurrency.

How Do People Hedge Against Inflation?

Investing may not always be the first instinct for those who are trying to stave off inflation. But, the point of investing before and during inflation is to preserve your buying power for more investing later. This also can help continuously build wealth through investing. The key is to diversify as you hedge against inflation because you can dilute risk with a varied basket. This helps fight inflation if your investment depreciates in one sector. However, investing unwisely can only increase your risk of exposure and detract from your long-term goals. Therefore, investing against inflation can be a risky game, but not always.

In the past, there were five main methods for creating a safe haven hedge against inflation. This included:

- Reallocating money into the stock market,

- Diversifying your stock portfolio with international stocks

- Investing in Real Estate Investment Trusts (REITs)

- Buying Treasury inflation-protected securities (TIPS), which are bonds linked to inflation and the Consumer Price Index.

- Buying commodities like gold, oil, grain, corn, etc.

Aside from investing in stocks and TIPs, real estate and commodities remain some of the most trusted inflation safeguards. So, inflation deflates nominal assets from CDs and traditional bonds, right? Well, tangible assets actually have their own value, which makes their worth float up with inflation. Today, people actually have even more options than this. This is exactly what helps boost the price of gold, silver, and cryptocurrencies today.

COVID and Commodities: Investing Against Inflation

The meteoric rise in cryptocurrency investments, as well as the current silver raid, is widely reflective of the current market outlook. Most people, especially Michael Saylor and Elon Musk, are worried about their assets depreciating with the US dollar. That is why major companies jumped right into cryptocurrencies, especially Bitcoin, as a hedge against inflation. As for individual investors, some people are buying as a means to tip the financial scales against hedge funds and major corporations.

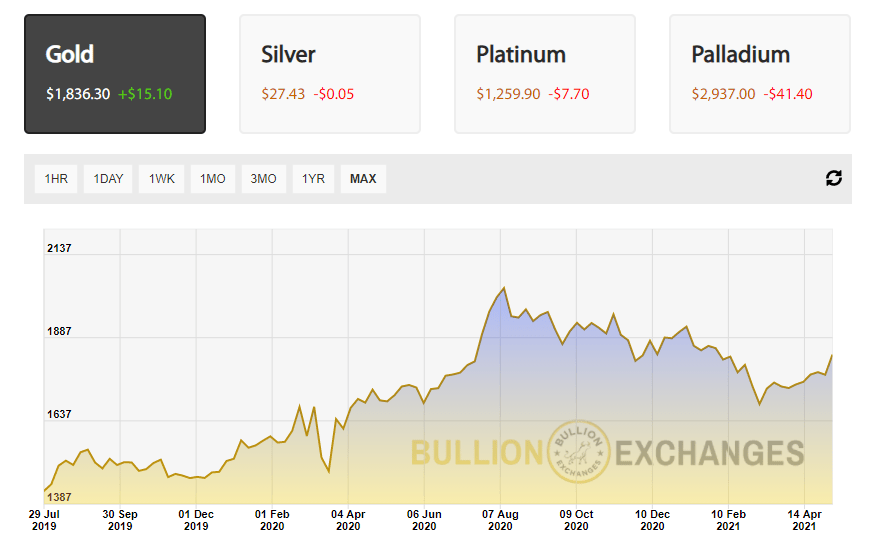

So far, gold boomed early during the pandemic: it rose over $2,000 per oz in August of 2020 for the first time in history. Then, it steadily fell throughout the past eight months and began to rise again in April. Today, the price of gold is around $1,840 per oz, which is continuing to steadily increase.

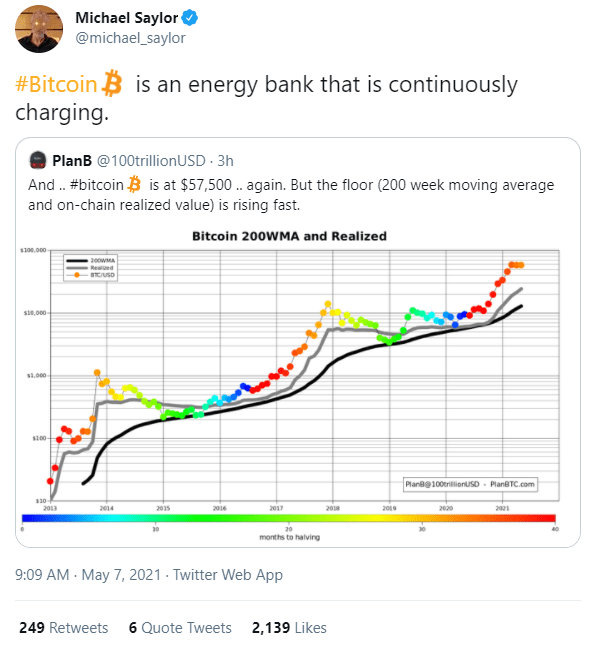

Comparatively, Bitcoin was a mere $9,000 last May, and is now almost $60,000 again. This incredible growth, especially with other cryptos like Dogecoin and Ether, is why many are loving the cryptocurrency market. Many even want to use crypto for regular purchases, from gold to Tesla.

Still, this rise can be offputting for some investors. Gold and silver moved slowly throughout the pandemic, but cryptocurrency has skyrocketed. The fast gains are tempting for anyone, but the steadiness of precious metals also leaves something to be desired. So when it comes to hedging against inflation, should you simply abandon the dollar if you can use cryptocurrency daily?

Is Crypto the Way to Hedge Against Inflation?

Cryptocurrency has helped many people win big this year so far. However, critics of the crypto market regularly point to taxes as the grim reaper. Kelly Evans from CNBC wrote in the CNBC afternoon newsletter on May 6th:

“If you pay your $40 restaurant bill in Bitcoin, the IRS treats that as a sale and taxes the capital gains accordingly. Congratulations, your $40 bill now costs $40 + your tax bill! This makes zero sense for anyone to do when they're sitting on gains in their holdings...”

Evans’ argument is that cryptocurrency is not a currency at all, but a taxable source of digital property. She also equates it to home equity lines: when the price rises, you sell and use the gains to repay the loans. Then you pocket the difference. Basically, all those who are excited by taking cash against their cryptocurrency will enjoy the benefits, until the price collapses.

This is why there is a huge debate about whether you should buy gold or cryptocurrency. The whole point of hedging against inflation is to try and prevent your assets from losing value. People buy tangible commodities, or stocks related to said commodities, to diversify their investments. This is often fueled by the hope to increase buying power for later, and thus, protect from inflation.

Is Crypto Better than Gold as a Hedge Against Inflation?

Cryptocurrency, although not a physical commodity, has a decentralized value as a digital coin that no government regulates. This is still a very new market that attracts everyone from major companies to the college student who is amused by Dogecoin.

Truthfully, people can benefit from holding both gold and crypto as an inflation hedge. Gold is traditionally a great investment during inflation, and cryptocurrency is being used in the same way now. Cryptocurrency is simply newer and only time will tell if its success will last. There is more push for cryptocurrency to win over USD as the currency of the future.

Source: Twitter

Until then, investors may want to balance their inflation hedges in line with their goals. One way is to invest in a healthy mix of gold, silver, cryptocurrency, and other stable assets. Keeping up with inflation can help you maintain the value of your dollar, and possibly help you cultivate more!