Gold continues to show strength alongside silver which hit a two year high earlier this week. The white metals are poised for big movements as we review platinum, palladium, and rhodium’s price movements. We will also review the price changes of the US Dollar Index, equities markets, and more.

Gold Strong As Silver Hits 2 Year High – Golden Rule Radio

Transcript

Welcome back to Golden Rule radio. And this week, Robert and I are here to dive right into the markets sitting on the heels of one of the biggest updates I think I’ve ever seen in the Platinum price moving up almost 5% in a single day today. So we will definitely get into the Platinum pricing the other white metals, but let’s kick it off with the yellow one first gold. What’s gold doing, Robert?

Q2 hedge fund letters, conference, scoops etc

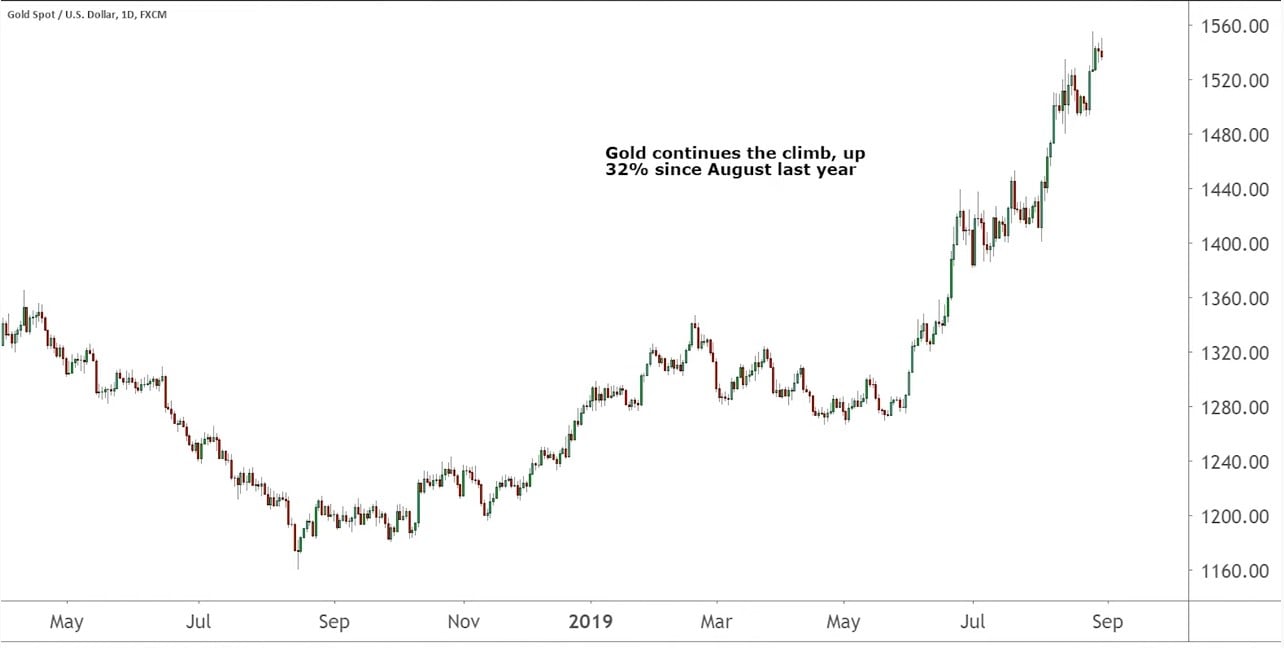

Well, Gold's been strong. It's still holding above 1500 1540. Today just below it. And something's clearly changed in the global markets. In the last couple of months. Yeah, you think clearly changed? What kind of buying does it take to drive gold? From 1272? where we are now at 1500? And only two months? What What does it take it takes institutional buying. And I think that's what's happened. As well as obviously, what has driven that, I think is the negative yields in the bond markets around the world. Money's looking for somewhere safe to be. And so gold has really caught the bid in the last couple of months. Obviously, our listeners know that. But it's not wanting to show weakness here. It's strong, it's above 1500, we had a little bit of a pullback down to 1490 on the last move, but I mean, it is clearly changed and turned a corner here.

Sure we pointed out this kind of stair stepping up we seem to be doing where I hinted we may be seeing the second of maybe like a three waves Elliot pattern building. But the the big argument had to be that we talked about last week is we had to push above that like 1535 high we had been stuck in that range. When that happened this week, we did get up into the 1550s. So I'm looking back in the charts back to like 2011 to 2013, where we're at this low point in that trading range. And there's a little shoulder there right before things fell off the table in April of 2013. Teen and that's right around 1600, you know, low, low 1605 ish, maybe 16 and a quarter. So there's there's a little bump there where we could see a little bit of pullback. But that's that's begging the question of are there standing orders? You know, have people had to standing sell orders at those prices? Are they going to look at those prices in place some standing sell orders? Or is the general public or the trader even involved in the market at this point, like you brought up? Are we just seeing the opening shots fired by the institutional traders, because when the general public gets involved in this market goes manic, which I don't think it has yet. But when that happens, we're not talking two or 300 bucks over the course of the few months, like we've already seen. We're talking $1,000 over the course of six or 12 months.

Yeah. And there's different phases to a bull market. I think we've just begun and seen the first phase of this new cyclical gold bull market.

Would you agree with that? Yeah, I completely agree. This is 2006. all over again. Sure.

You know, and it's taken a while to get here, you know, bottoming in late 2015. Nobody knew that that was the actual bottom, you know, you could speculate on it. And then we haven't really even been able to determine that that was the bottom. I don't think until we've had this last couple months move pushing it up into the 1500s. I mean, that's clearly turned a corner, gold has definitely been leading the charge, which I think adds even more strength to your argument that this is almost purely institutional investing at this point. Yep. So we've seen the first phase, this next phase would be a larger volume of investors coming into it. And so I think what's happened this first phase, now, Gold's on the radar, Gold's become attractive, people are now asking about it and wondering about it and wanting to be into it. And probably, if you're sitting on the sidelines, you're saying, I want to be into it. But I'd like to buy it cheaper, I don't know that you're going to get it

much cheaper, or even if you can buy it cheaper. We're not talking substantial numbers here. I mean, in the long run, if Gold's going to 3500 on this move what's 50 bucks up or down at this point? So on the other hand, with gold leading the charge, I think it's fair to say, you know, we've we've been arguing for a long time, that when some of these other metals start to play catch up, you want to make sure you'd already been in those markets. So if we can transition over to the white metals, which I hinted at a moment ago, platinum up 5%, or almost 5%. Just today, silver pushing to the highest price in two years, you know, silver in a few days is taken out years worth of up and down noise. So seeing these white metals start to make pretty aggressive leaps and bounds single day leaps and bounds. It's it's encouraging for me to see some of these more investment minded or even industrial minded assets.