Whitney Tilson’s email to investors discussing Elon Musk‘s forecast of “tough” 1H in 2020; Why You Must Dump Tesla Inc (NASDAQ:TSLA) Stock Here; various comments; Analysts on Tesla’s temporary exceptions to positive cash flow generation.

1) The weirdest part of the call was this:

Q2 hedge fund letters, conference, scoops etc

Toni Sacconaghi

Yes, thank you. I was wondering if you can comment about whether you felt that Q2 benefited from consumers in the U.S. sort of rushing out to buy Model 3 in advance of the declining federal tax credit, a phenomenon that you sort of saw in Q4. And part of the reason I ask is, at least by my analysis it looks like maybe 70% of the Model 3 sold in the quarter were in the U.S., which is sort of higher than your normalized percentage of U. S. sales. And so, do you feel that that phenomena may have occurred in Q2? And are you still confident that Q3 deliveries can improve sequentially? And beyond the data point that you provided on the call that the orders quarter data are better than last quarter, is there anything else you can point to that provides that confidence?

Elon Musk

Yeah, I think we'll -- demand in Q3 will exceed Q2. It has thus far, and I think we'll see some acceleration of that. So -- and then, I think Q4 will be, I think very strong. So, we expect that quarter-over-quarter improvements. I think Q1 next year will be tough. I think Q3 or Q4 will be good, Q1 will be tough. Q2 will be not as bad, but still tough. And then I see like Q3 and Q4 next year will be incredible.

Note that Toni didn’t ask about 2020, but Musk nevertheless VOLUNTEERED that “Q1 next year will be tough…Q2 will be not as bad, but still tough. And then I see like Q3 and Q4 next year will be incredible.”

Here’s Anton Wahlman’s take on the implications: Why You Must Dump Tesla Stock Here. Excerpt:

If you're a sell-side analyst, a fund manager or a growth investor and Tesla's CEO just told you that 2020's first half will be very weak, what should you do? You can't possibly own this stock now. You must get out.

2) Two friends had a discussion about this. First one:

My theory is that Musk has lied about Q4 2019 anyway -- it won't show a profit. Then, he was somehow hit by a stream of consciousness, thinking it would sound better if he said that 2020 too would be back-end loaded ("Hey, almost every year is, isn't it -- remember 2018?). Whether this had any anchor in truth or not, I don't know. I am assuming everything will be worse than he says, for all quarters going forward.

The thing about a liar such as Musk is that he often forgets what he lied about before. He had forgotten what he had said about Q4 2019, and why or whether anything he said about first half of 2020 would fit, or at least be in need of an explanation. You could tell he was just winging it with his thoughts there. They weren't part of any notes. Sometimes he just says things that makes no sense. This was one of those times.

2nd one:

There is no reason I know of why q3 or q4 should improve. They basically said they got labor out of the system and scrap is down to nothing.

First one:

They wouldn't have guided to Q3 breakeven if they didn't have some sort of a card up their sleeve. They may not get to breakeven (I don't think they will), but I do think the loss will narrow from the $400 million just reported. I think the loss will be cut in half -- or even more.

The Street won't forgive him if he's guided to breakeven in Q3 and the loss isn't at least meaningfully smaller than it was in Q2. The stock would go to $150 if Q3 losses exceed Q2’s. They will pull out all the stops, apply any accounting gimmick, to show a loss that's smaller than $300 million.

I think Q4 will be worse than Q3. Why? Because time is not on Tesla's side, at least not right now:

-

- Porsche Taycan starts shipping in December.

- Mercedes EQC should be Europe-wide by October.

- VW ID3 will start production in Nov-Dec and will hold up many people in Europe from buying anything else.

- People will start to wait for BMW iX3 and Volvo/Polestar 2, even if they are 6-12 months away from delivery at that point (to Europe).

- Ford should unveil the "Mustang-inspired" crossover-SUV perhaps on November 19 or 20, for delivery around August 2020.

Once people see these things, it will be harder to hawk a Tesla -- especially if not attached to even larger discounts.

And then we have numerous other surprises you will see from Mercedes, GM, Nissan, Hyundai, Kia, Jaguar Land Rover and others. Hey, the Frankfurt Auto Show is September 9!

I am looking at a $200 million loss for Q3 but more like $600 million for Q4. I think there is a 75% probability you will win your bet.

3) Another friend’s comments:

I want to add to the comment on the importance of JB leaving because the main technology in Tesla cars is the battery, which was JB's focus. The future depends on the relationship with Panasonic, who seems to have had enough of Elon.

JB stepping down should not have been a surprise as the interplay at the shareholder meeting indicated Drew Baglino was going to take over, and JB has been selling shares as fast as he could with his 10b5-1 sales of several million dollars every period. Now he can probably sell what else he has, once he claims not to possess Meaningful Non-Public Information. Doug Field waited 3 months or so. I was watching the after-hours session when it was announced, and shares moved from down $20 to down $27, so the market did make that specific part of the dump on the announcement and so it was not all priced in. He has been out of sight for quite a while except for these events. He started Redwood, a materials recycling business, that doesn't sound so high tech as new battery chemistry. He may have been a calming influence with Panasonic, and that relationship is both crucial and not as smooth as it should be. He was the only well-known figure from the early days. Now it’s all Elon.

4) Another friend:

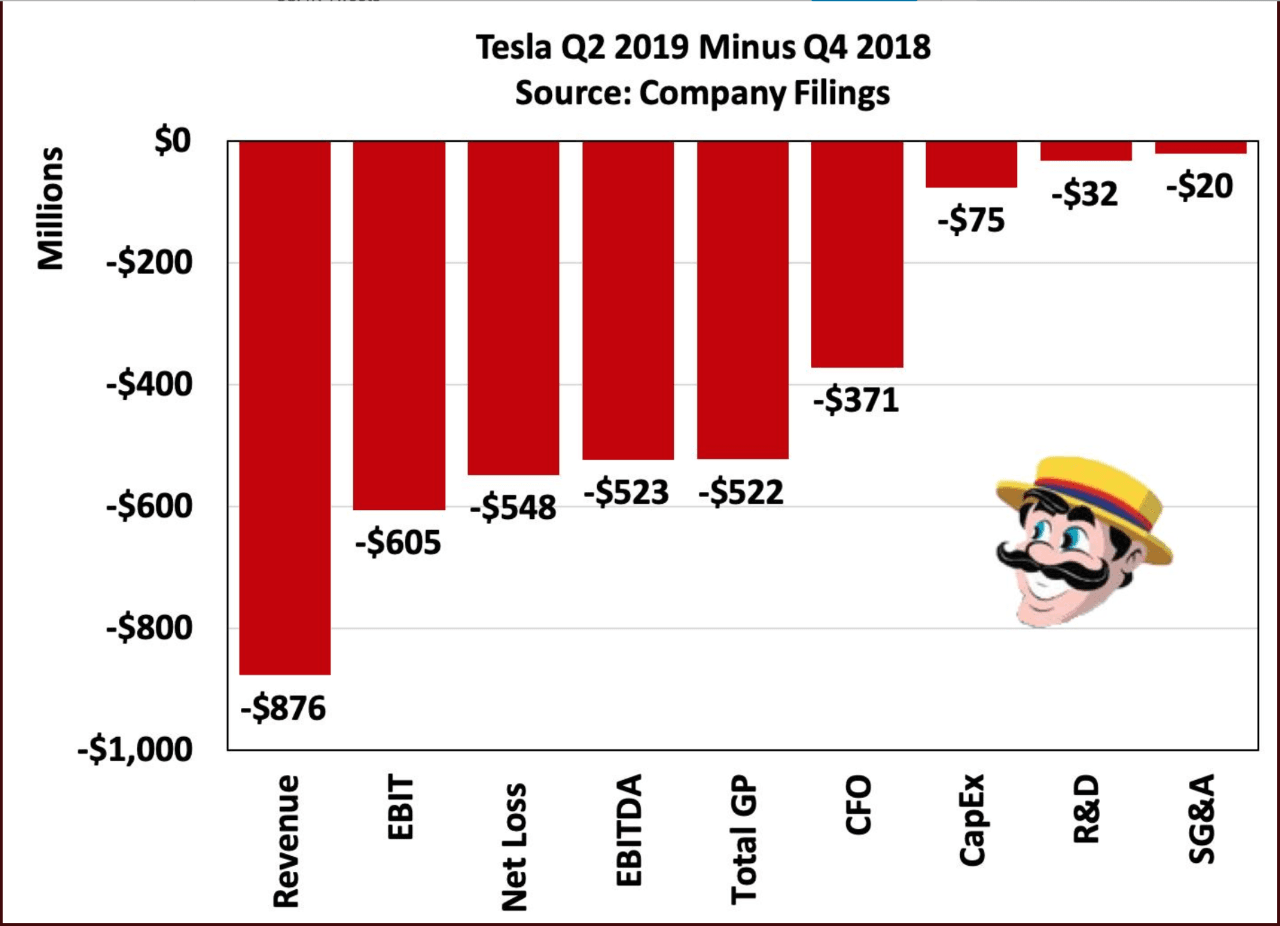

Attaching two screenshots that to me sum things up.

Free cash flow was impressive, but not when you realize that to achieve it, Tesla sold down inventory (not sustainable, obviously) and slashed Cap Ex to below its D&A. (We'll need to see the Q to know more.)

5) Factset’s summary of analysts:

Street Takeaways - Tesla Q2 Earnings

Thursday, July 25, 2019 03:35:58 PM (GMT)

- Overview:

- The stock is trading (13.9%) following last night's second quarter release that included EPS ($1.12) ex-items vs FactSet ($0.35) on revenue $6.35B vs FactSet $6.47B. Management also noted the company continues to expect 360,000 to 400,000 vehicle deliveries this year and continues to aim for positive GAAP net income in Q3 and the following quarters, although continuous volume growth, capacity expansion and cash generation will remain the main focus.

- ................

- Sentiment around the stock remains relatively tepid, as a quick look at sell-side sentiment shows 35% of firms keeping Buy-equivalent ratings compared to a 49% average for the S&P 500; average price target of $267.19 represents a 17% premium to current levels

- Analyst Commentary:

- Evercore ISI analyst Arndt Ellinghorst -

- ..............

- Cautions that sequential pressure on profits + cash flow is likely to increase given: 1) demand pull forward (US incentives) 2) deteriorating mix / price across all models 3) WC unwind / sequential capex increases - while loss of JB Straubel is the largest executive departure yet for a company that has, unfortunately, heard this song before.

- Target is $200

- Maintains an Underperform rating

- JMP analyst Joseph Osha - lowers target

- Notes even leaving aside the impact of lower regulatory credits, gross margin disappointed, with the GAAP outcome of 14.5% well below firm's forecast and Street expectations

- ..................

- Maintains a Market Outperform rating

- Morgan Stanley analyst Adam Jonas -

- Notes the simplified approach to guidance, which included less specificity on opex,and no range for 3Q unit volume outlook - and while Tesla targets positive GAAP profitability in 3Q and 4Q, it allowed for 'expected fluctuations' and 'temporary exceptions' around free cash flow generation - firm understands why the stock is giving up some of its recent gains on added uncertainty.

- ................

- Target is $230

- Maintains an Equal-weight rating

- Needham analyst Rajvindra S. Gill -

- Notes that while gross margins grew slightly q/q from 12.8% in Q1, they remain at depressed levels as significant ASP reductions across all vehicles hurt margins - the impact of which only partially offset by cost improvements.

- ..........

- Maintains an Underperform rating

- Nomura/Instinet analyst Christopher Eberle - lowers target

- Notes profitability metrics underwhelmed - as Automotive gross margin declined sequentially and non-GAAP loss-per-share missed revised Street estimates by over ($0.75).

- ................

- Target to $270 from $300

- Maintains a Neutral rating

- Piper Jaffray analyst Alexander E. Potter - lowers target

- Highlights forward-looking metrics related to revenue (orders, deliveries, etc.) are all trending in the right direction - suggests these are the most important components of the story - the post-market selloff was driven initially by mix-related concerns (and the resulting pressure on gross margin) - and Tesla's CTO subsequently resigned on the earnings call, and the selling pressure intensified.

- Believes it will take time for Tesla to prove that JB Straubel's departure does not portend ominous developments down the road - but ultimately, firm thinks management turnover will only matter if Tesla's financial metrics never improve.

- Target to $386 from $396; 18x FY22E EV/EBITDA, after capex, discounted at 15%

- Maintains an Overweight rating

- Evercore ISI analyst Arndt Ellinghorst -