Whitney Tilson’s email to investors discussing Joel Litman webinar; Enrique Abeyta on Slack; MoviePass shutting down.

1) I recently had the pleasure of meeting Professor Joel Litman.

Joel Litman is a forensic accountant who has developed a methodology for analyzing companies’ financial statements, making dozens of adjustments to uncover their true earnings and financial health.

Q2 hedge fund letters, conference, scoops etc

Nine of the top 10 global investment houses and 180 of the top 300 money managers pay up to $100,000 a month for his service, which he's making available for the first time to individual investors at an affordable price.

He'll be describing it – and revealing the ugly truth about a popular tech stock – in his free webinar on September 25. You can sign up for it here.

2) My colleague Enrique Abeyta recently took a look at office-productivity software company Slack (WORK) and wrote up the following:

As the IPO (or not) of the We Company approaches, I wanted to analyze the performance of another unicorn that recently went public, Slack Technologies.

I've used its corporate messaging software for several years, and am very happy with it. But a good – or even great – product does not necessarily make a great company.

Last week, the company reported earnings for the first time since its June 19 IPO, which triggered a big sell-off, as the stock has fallen from $31 to under $25.

The company actually beat analyst estimates... there was just some noise around one-time costs regarding customer outages. As a result, the analyst community – which is still supporting the stock, with nine "buys" versus seven "neutrals" – is arguing that the sell-off is unwarranted.

Enrique argues they're completely missing the point. More from his e-mail...

Remember, Slack didn't go public via a traditional underwritten offering, but rather with a "direct listing," similar to what Spotify (SPOT) did last year. Slack argued this would result in "less volatility," but mechanically it means that all of Slack's roughly 575 million shares in the float were available to trade immediately.

So here is a company that went public at 22 times current year REVENUES and quickly traded up to 32 times that revenue estimate. It also loses money and burns cash (though not a lot).

It's a credit to the company and its underwriters for being able to get this kind of absurd valuation, but it set the stock up for failure. This chart shows how the stock has performed since the IPO...

Even before the "miss" on the quarter, the stock had already fallen 18% from the post-IPO close and is now 36% below its IPO price.

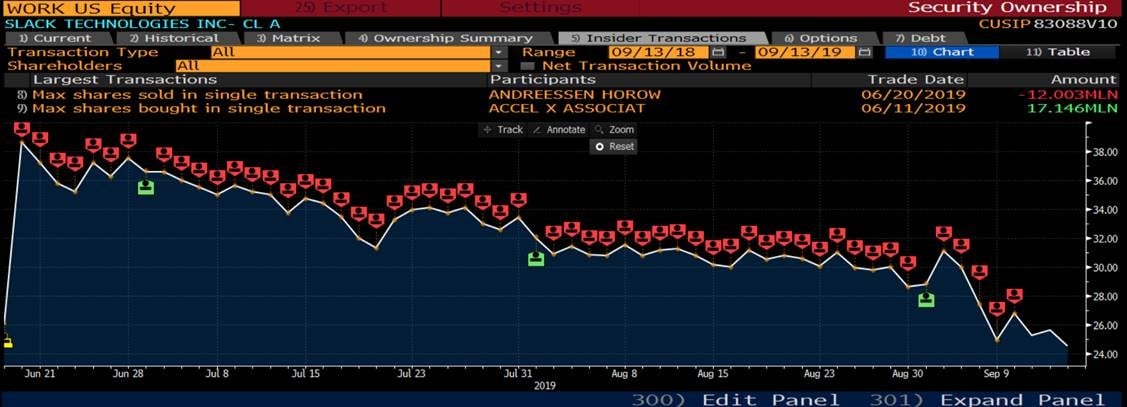

Not surprisingly, insiders and pre-IPO investors have been sellers at a valuation of 25-plus times revenues. Look at this chart, which shows insider selling...

Slack has a great product, but I see no limit to the downside in its shares in the near term. The stock already was down about 20% before the volatility and uncertainty around earnings, so there is absolutely no valuation support here.

As of last Monday, when the stock traded down 9%, approximately 585 million shares have traded since the IPO. The float is still around 575 million shares. Until the stock trades roughly twice that amount, giving existing shareholders a chance to exit, I think this stock continues to trade down.

Based on recent trading volumes, that's six or seven months away. Between now and then, I think the stock gets cut in half.

The slaughter of the unicorns (and their imaginary valuations) continues...

3) MoviePass announced on Friday that it's shutting down: MoviePass Ending Its Run, 2 Years After Millions Signed Up. Excerpt:

The company, which became a cultural phenomenon for its all-you-can-eat movie buffet but struggled with investors to find a functioning business model, said in a letter to subscribers that it would close down Saturday morning because efforts to recapitalize the business "have not been successful to date."

In many ways, MoviePass was a victim of its own success.

Shame on me for never publicly flagging MoviePass's parent company, Helios & Matheson, as the most obvious zero in history.

The idea of charging $10 a month for a movie credit card that users could spend up to $270 a month on was so ludicrous (though my wife and I enjoyed it for a year!), and the resulting financials were so horrific that it boggles my mind...

Kudos to Business Insider for this insightful article, which reveals that, behind the scenes at the company, things were even crazier than I would have imagined... The definitive story of how a controversial Florida businessman blew up MoviePass and burned hundreds of millions. Excerpt:

A four-month investigation by Business Insider chronicles the rise and fall of the movie-ticket-subscription startup MoviePass.

The only dumber idea I've ever heard of – which also ended in disaster – was this one: The worst sales promotion in history. Excerpt:

In late 1992, the UK branch of the vacuum manufacturer, Hoover, offered an impossibly sweet promotion: If a customer bought any product worth £100, he'd get two free round-trip flights to the United States.

For the 84-year-old electronics brand, it was meant to be an eye-catching way to boost dwindling sales, escape the gloom of a recession, and shrug off increased competition.

Instead, it led to the destruction of the company – a precipitous downfall that saw multimillion-dollar losses and customer revolts.

Best regards,

Whitney