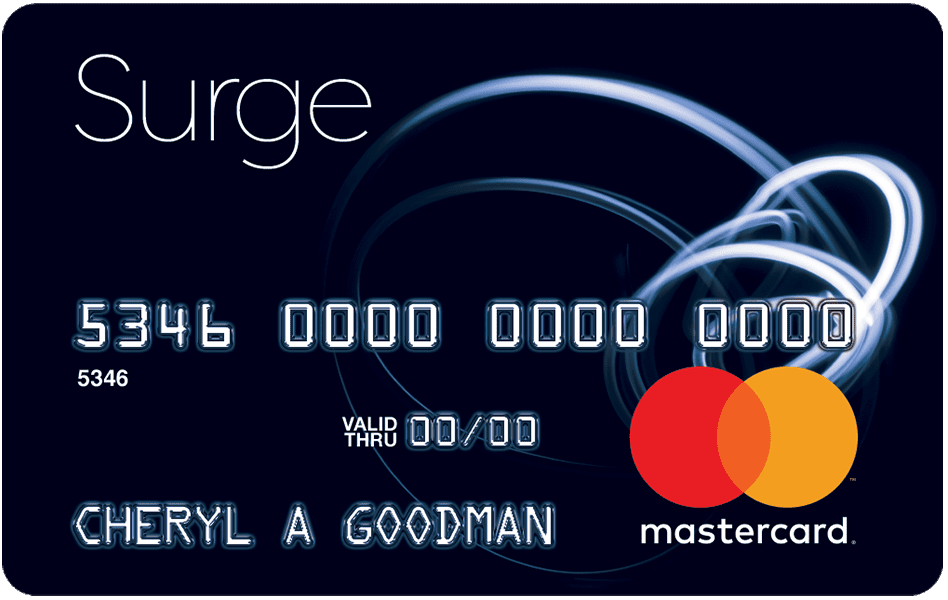

The Surge credit card is designed for people with less-than-perfect credit, so anyone with any level of credit score is welcome to apply. The Surge Mastercard is issued by Celtic Bank and serviced by Continental Finance. It comes with financial products and services aimed at helping consumers get their credit back on track.

The Surge Mastercard through Continental Finance is also linked to Celtic Bank. Celtic Bank describes itself as a “leading nationwide small business lender and residential construction lender.”

Continental Finance touts itself as specializing in “providing credit products and services to customers who are largely overlooked by traditional credit card issuers and local banks.”

Introduction to the Surge credit card

The Surge credit card reports to all three major credit bureaus every month so that customers can start repairing their credit history right away. People who haven’t had a credit card before can also start building credit with the Surge credit card. Customers can view their credit scores monthly on their electronic statements via their online account for their Surge credit card.

According to the credit card issuer’s website the initial credit limit ranges from $300 to $1,000, and customers may be eligible for a credit limit increase after only six months. You can apply for the Surge Mastercard online, whether or not you have received an offer via the mail.

The application process is fast and easy, and the approval or decline is usually provided online instantly. However, sometimes Continental Finance will spend more time reviewing an applicant’s credit history before they will be approved. To make payments, you will need the correct website for the Surge credit card login. Customers can make a payment online via the Continental Finance website.

Beware the Annual Fee and APR on the Surge credit card

One thing consumers should note before they apply for this credit card is the fact that it comes with extremely high fees. Celtic Bank and Continental Finance are not upfront about these fees before you apply either. To find out what the annual fee and other fees are, you must pull up the latest cardholder agreement. You can also read a review to find out these details.

As of the time of this writing, the Surge Mastercard has an annual fee of $75 for the first year and $99 for all following years. In addition, there is a monthly maintenance fee of $10. However, the monthly maintenance fee isn’t billed until after your account has been open for 12 months. The Surge Mastercard also charges another $30 if you want a second card for your account, such as in the case of joint account holders.

Continental Finance also states that some of the set-up and maintenance fees will be charged before you start using your card, reducing the amount of credit available at first. However, if you reject all the fees and haven’t used the card or paid any of the fees yet, you aren’t responsible for any of the fees.

Customers should also note the APR, which is extremely high at 29.99%, and there is no minimum interest charge. While it’s true that the Surge card allows some people with a poor credit score to get a credit card, you will certainly pay a steep price for it, whether you have made a purchase or have a balance or not.

Other fees include a cash advance fee of $5 or 5% of the amount of the cash advance, whichever is greater. The issuer of the Surge card also charges a 3% fee on every foreign transaction in U.S. dollars. The late payment fee and returned payment fee are up to $40.

A person who decides to sign up for the Surge card also doesn’t earn any rewards in exchange for all those charges. The good news about the Surge Mastercard is that it isn’t a secured card, so customers do not have to put down a security deposit. Celtic Bank also offers $0 fraud liability, which means you are only responsible for the purchases you made on your Surge Mastercard.

Surge Credit Card Login for Online Account Access

The Surge credit card login allows you to view all the transactions you have made on your Surge credit card, make a payment, view your account online, and access other online services. You can also view your monthly statements and update your contact information.

Surge Credit Card Login

The Surge credit card login page to get into your online account is here. You can also reach your online account access for your Surge credit card here.

Surge Credit Card Customer Service

The phone number for the customer service for the Surge credit card from Continental Finance at Celtic Bank is on the back of your credit card. If you do not have your credit card handy, you can reach customer service for the Surge credit card at this phone number: 1-866-449-4514. You can get automated account information and reach live customer service at this phone number.

To report a lost of stolen Surge credit card, you can call this phone number: 1-800-556-5678.

Surge Mastercard Payments Phone Number

To make payments on your Surge card account by phone, you can call 1-800-518-6142.

Surge Credit Card Billing Address

To make payments on your Surge card via mail, you can send them to:

Surge Card

P.O. Box 6812

Carol Stream, IL 60197-6812

Although the Surge card is generally an unsecured credit card, Celtic Bank and Continental Finance may require a security deposit from some customers. Some customers may be more interested in a credit card with rewards, so they can check out the $300 Surge secured product.

The address to send your payment to fund your security deposit is:

Surge Card

P.O. Box 8099

Newark, DE 19714-8099

For general inquiries about the Surge credit card, Continental Finance or Celtic Bank, you can write to:

Surge Card

P.O. Box 3220

Buffalo, NY 14240-3220

Customer Service Hours

Customer service for the Surge credit card is available by phone between 7 a.m. and 10 p.m. Eastern Time Monday through Friday and from 9 a.m. until 4 p.m. on Saturday.

How to Apply for a Continental Finance Surge Credit Card Online or Over the Phone

To apply for a Surge credit card, you can do so online, over the phone or through the mail. To apply by phone, you can call the phone number for Continental Finance at 1-866-513-4598. To apply via the mail, you can return the acceptance form you received with the pre-selected offer that arrived in your mailbox.

To apply for a Surge credit card, you will need to provide your full name as it appears on government documents, your Social Security Number, birth date and physical address. A bank cannot use a P.O. box because federal law requires them to obtain, verify and record identifying information on all every customer. A bank also uses a the personal information of each customer to pull data on their financial and credit background and review it.

FAQs

How Do I Cancel My Surge Card?

You can cancel your Surge credit card by calling this phone number: 1-866-449-4514 or by sending written correspondence to the address on your monthly statement.

Does the Surge Credit Card Give Credit Increases?

Like most credit cards, the Surge Mastercard does give credit increases to eligible consumers. Customers start with a credit line of between $300 and $1,000 and are eligible for a credit increase after just six months.

Final Thoughts

A Surge credit card might be an option for a customer who needs a credit card with features aimed at helping them get their credit back on track so that they can get loans or other credit cards with better terms.

As with most credit cards, you can access your Surge card account online for a variety of customer services. You can pay your bill when you access your account online via the Celtic Bank site.

However, you should also note the significant expense and high APR for those who choose this credit card. There can be a benefit for a customer with a low credit score, making this card very accessible for those who can’t get other credit cards.