Hayden Capital Management commentary for the first quarter ended March 2021.

Q1 2021 hedge fund letters, conferences and more

Dear Partners and Friends,

Hayden Capital Management Performance

If anything, last quarter proved that 2021 might be almost as crazy as 2020. We saw everything from a continuation of technology stocks outperforming initially, to a rotation towards “re-opening” stocks as vaccines gave investors confidence that Covid may soon be behind us, to interest rates rising and thus sparking a sell-off for long-duration assets, to the collapse of a large family office that was highly levered and resulting in aggregate billions of dollars in losses for its prime brokers.

All of this is just noise to us – it’s not going impact the 5 – 10 years earnings trajectory of our companies (which is really what matters). But it does reiterate that one of the keys to successful investing, is resilience.

For example, from mid-February to late March, we were down -29% during this period as a result of the above factors. As I often tell our partners, volatility is just the price we pay for our concentrated, predominately long-only strategy. This is one of our key “edges” – since I’d estimate that at fewer than 10% of funds in this industry are structurally set up to withstand this type of volatility.

Resilience is core to our portfolio, in the types & emotional temperament of partners we allow to join the Hayden family, in Hayden’s culture, and even in Hayden’s structure & business operations itself. All of this is crucial to not just increasing the odds of us providing our partners a high return on their capital per year, but also to provide these returns for as many years as possible ahead3.

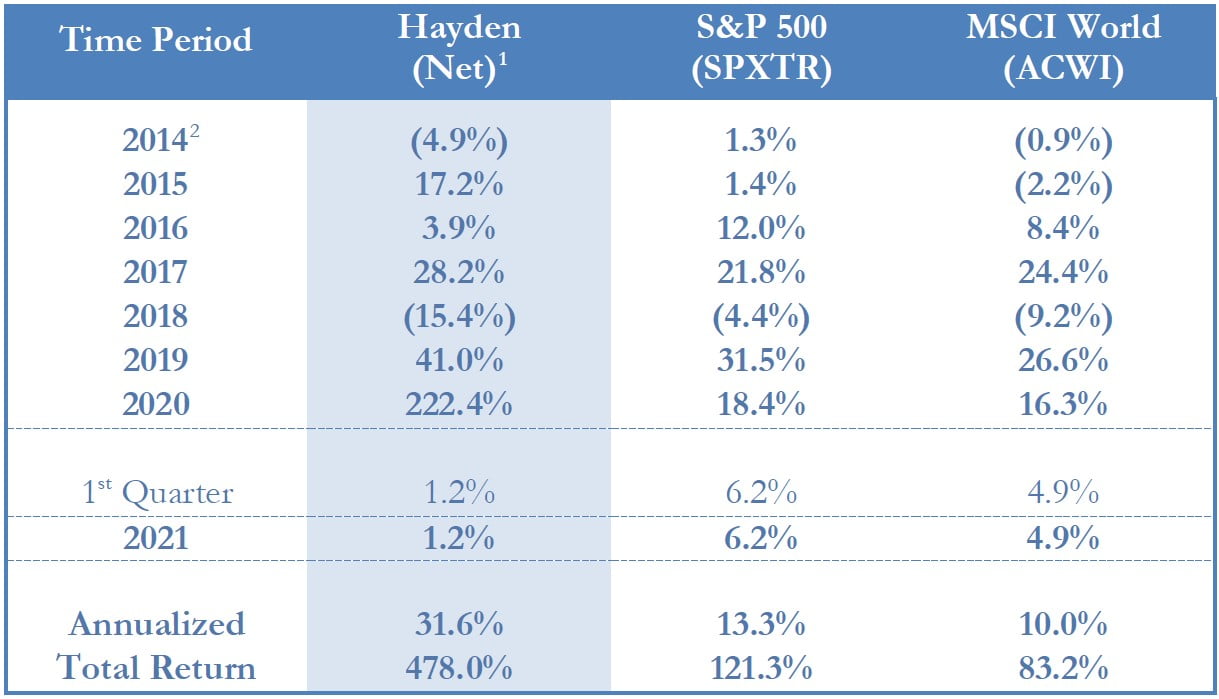

Our portfolio returned +1.2% during the first quarter, compared to +6.2% for the S&P 500 and +4.9% for the MSCI World indices. This brings our annualized return to +31.6%, or a +478.0% cumulative return since inception.

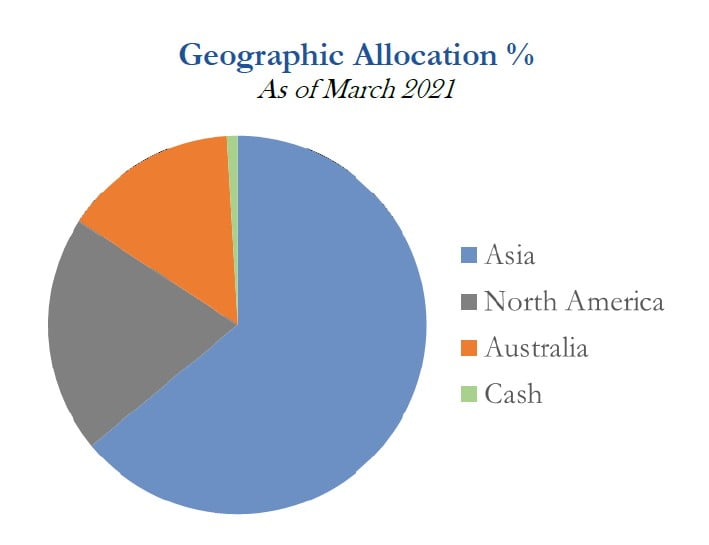

On the geographic allocation front, we remain predominately invested in companies operating in Asia, where we’re finding the most interesting opportunities, at ~64% of the portfolio. Another ~15% is in Australia, while ~20% is in North America, with a minimal residual cash balance.

Ecosystems Need Role-Models

One of my cornerstone theories, is that in order for countries to develop a diverse, vibrant technology ecosystem centered around innovation, they first need a handful of early pioneers to pave the way. These early pioneers act to prove to others that it’s indeed possible to build a large and successful company within the home country, while also showing other entrepreneurs and investors that they don’t need to embark for Silicon Valley, to create enormous wealth.

In the process, these early role-models sow the seeds and “fertilize the soil” in numerous ways – by inspiring future entrepreneurs to build for the local market, cultivating a deep talent pool of technology-oriented employees who have been well-trained at these early pioneers (the more successful the pioneers, the more employees / alumni they’ll train), and signaling to global investors that the market is ripe for investment and thus increasing the interest / availability of funding in the ecosystem.

This thesis seems especially relevant for countries whose domestic industries have historically been driven by “traditional” industries (manufacturing, agriculture / commodities, service businesses, SOEs, etc.). These industries tend to be slower moving and are passed down within families from generation-to-generation, historically leaving little hope for ambitious outsider entrepreneurs to make their own mark. As a result, often these early entrepreneurs would seek to take their talents elsewhere (often to the US).

However, as an economy develops, there will always be a few brave entrepreneurs who decide to go against the grain and launch businesses within their home markets. During the very early phases of ecosystem development, these entrepreneurs often face an uphill battle – whether it’s:

- Talent Constraints (Attracting great software developers): Parents may discourage their kids from studying computer science, since historically there’s been few opportunities for employment in the country. Or alternatively, for those that do, all the good ones who had the ability to leave, already left for Silicon Valley, thus leaving very few exceptional developers for local startups to hire.

- Funding Constraints (Attracting funding for their businesses): Why would global Venture Capitalists invest, when there’s no historical precedents for successful “exits” in the market. Or perhaps there isn’t a local venture community at all, so funding needs to come from traditional bank loans, local families, or investments from SOE-type conglomerates.

- Regulatory Constraints (Facing adverse regulation): The “traditional” companies have long entrenched government ties, that they may use to squash disruptive competition. Or perhaps it’s a simple case of regulation frameworks being outdated for the new business models.

- Lack of Demand (Due to low disposable income): When a country’s GDP per capita is below USD ~$2,000 - 4,000, households tend to lack disposable income to purchase discretionary items. This creates a lack of demand for non-staples, consumer facing companies and makes it tough to build a viable business.

What’s also interesting, is that most commonly the most successful early pioneers (what I call first generation, or “Gen-1” companies), are companies that build around tried and tested business models that they then tailor for the local market (think ecommerce, online travel agencies, food delivery, ride-hailing, etc.). We saw this phase of development in China during the early 2000’s and Southeast Asia in the early 2010’s.

Perhaps it’s because it’s easier to get funding from VC’s, since these investors can look at global peers to gain confidence in the opportunity. Or maybe it stems from a lack of self-confidence / access to innovative talent, so it’s easier to have an existing “blueprint” from global competitors, and to learn from the mistakes or challenges they’ve already faced and found a solution for. Or maybe it’s because the economy isn’t developed enough, to create the large enough latent consumer base that’s necessary for the exponential growth that investors and startups rely upon.

Whatever the case, it’s often a tough road for their early pioneers. If they’re able to make it past these headwinds and to grow alongside the country’s development though, what they often find is a lack of competition once they break-through – since there were fewer people brave enough to start similar businesses in the first place, and those that do likely got weeded out quickly due to the adversity mentioned above.

The successful pioneers become valued in the tens of billions, and their rise attracts the attention of global media coverage and investors. As this first crop of Gen-1 companies graduate into globally known firms, they act as role models for the rest of the ecosystem.

On the talent front, they prove to parents & students that yes, it is possible to build world-leading firms right in their home countries (in addition, these Gen-1 companies offer opportunities for these new talents to “train and nurture” earlier on in their careers). Additionally, they give inspiration to fellow entrepreneurs, since they prove that it’s possible for someone who “looks like me, someone who has a similar background as me” to go out and build a world-leading company. At this stage, top talent who originally moved to Silicon Valley are also now increasingly coming back home (i.e. “returnees”, as they see greater career opportunities by taking their talents back home to a less competitive environment).

On the funding side, due to their success, these Gen-1 companies also create a lot of wealth for not just the founders, but also their early employees. These handful of billionaires and hundreds of millionaires, often then take their newfound wealth, and reinvest them back into what they know – early-stage startups, operating within their home ecosystems. In addition, these role models prove to outside international investors, that this is an ecosystem they should be paying attention to and proves that there’s a viable opportunity to create wealth in the region. These factors are the initial “seeds” that get re-planted from the “mother plant”, back into the ecosystem in the form of Seed and Series A investments.

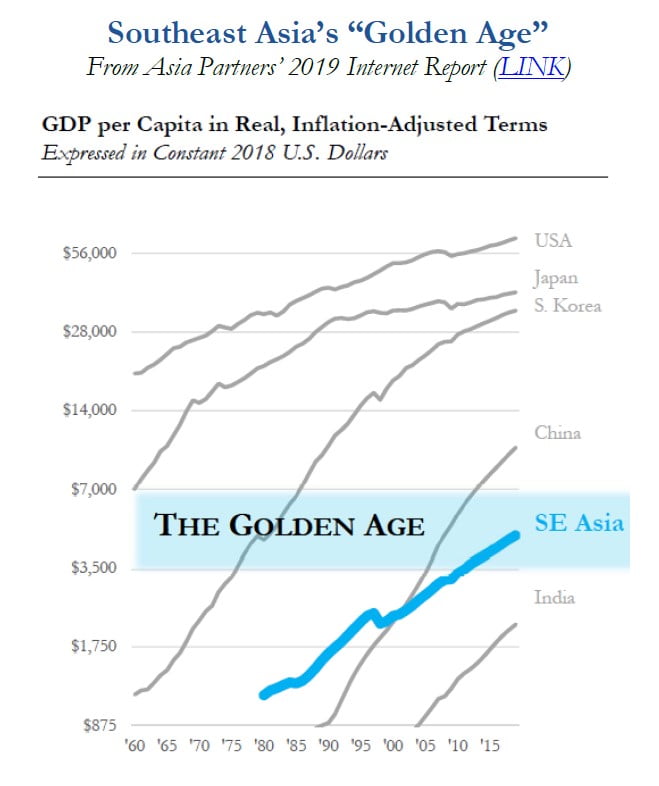

On the demand side, due to the rapid growth of their home countries (often ~5 - 10% annual GDP growth), GDP per capita quickly reaches the $2,000 – 4,000 threshold. At this level, disposable income grows quicker than overall income, as basic needs are met and excess income is used to improve household lifestyles (higher quality products, vacations, entertainment, etc.).

The businesses that make it to this point, start finding a rapidly growing base of customers who can afford and find value in these products, while at the same time having very little competition in serving this demand. Gen-2 companies are able to launch into this fertile environment (thus increasing their odds of viability) without having to “slog” through many years of waiting for the market to be ready, that the Gen-1 companies had to endure.

Taking these factors combined, the road tends to be much easier for this second crop of entrepreneurs, building these “Gen-2” companies. Because of easier access to top talent, high expectations customers, and also ample funding, these companies tend to be more innovative in nature too. It’s at this stage in an ecosystem’s development, that you see the truly innovative ideas. No longer are these companies copying well-trodden blueprints, but they have the confidence and resources to innovate at the leading-edge, on a global level.

**

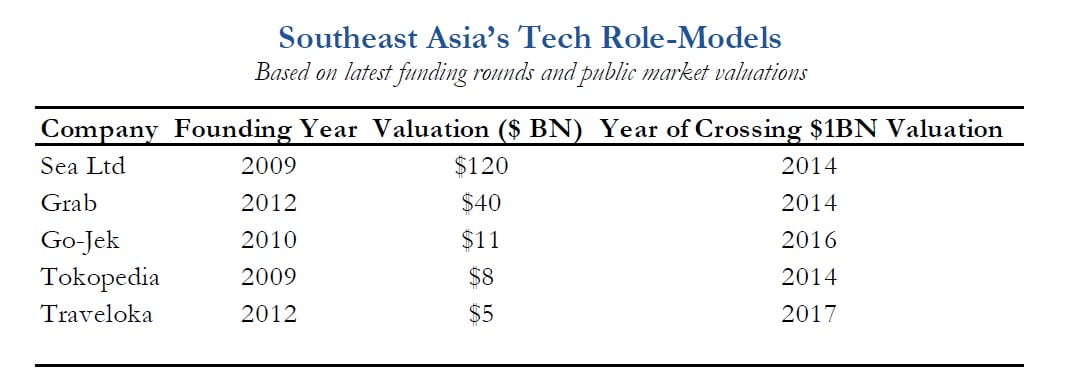

The reason I outline this thesis, is because I believe Southeast Asia is about to go through this exact transition over the next five years. Sea Ltd is now the largest public company in Southeast Asia. Grab, Go-Jek, Tokopedia, Traveloka are all about to go public, and are attracting international attention. These Gen-1 companies were all founded a decade ago, at a time when the talent pool was shallow and access to funding was tough.

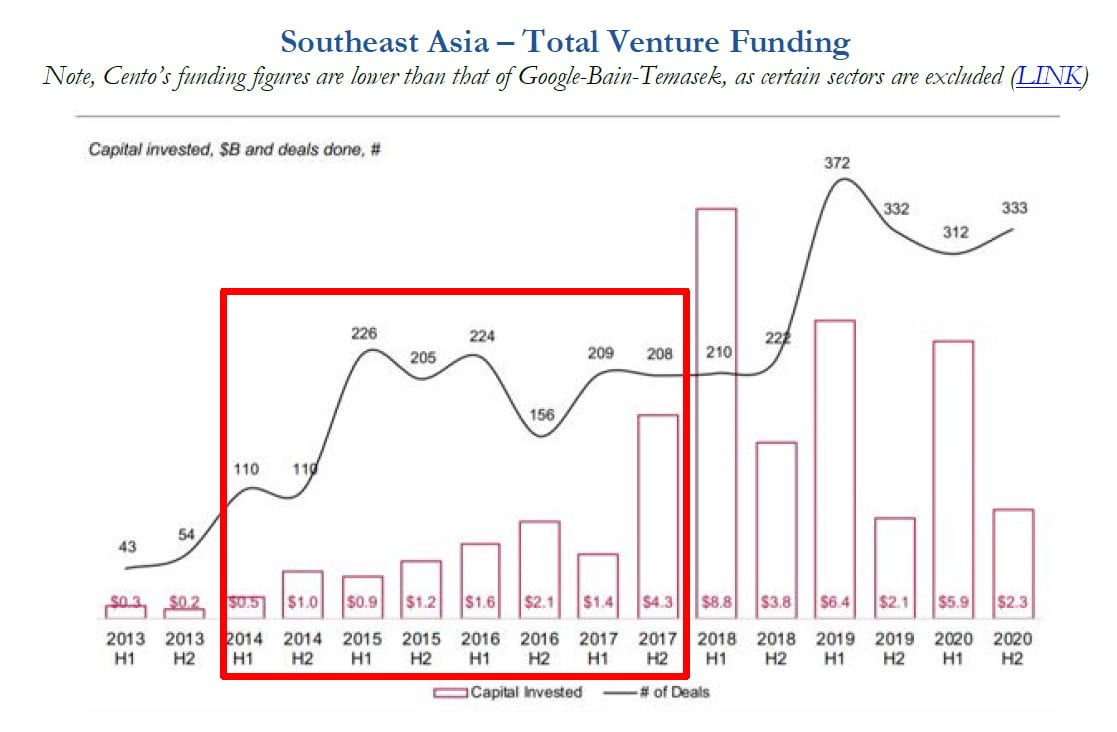

However, the ecosystem started to change in 2014 - 2017, as these pioneering firms began to cross the $1 Billion valuation threshold (i.e. unicorn-status).

As they did so, capital from international investors started entering the ecosystem in a big way. Prior to 2013, there was <$1 Billion in venture capital flowing into the Southeast Asia ecosystem annually. After these Gen-1 companies started proving out the market in 2014, we saw these amount increase dramatically to $5 Billion, $10 Billion and beyond per year. The increased publicity drew international investors to the region, and also increased the number of entrepreneurs brave enough to launch new businesses. By 2019, ~$12 Billion was being invested into the Southeast Asia ecosystem annually (LINK).

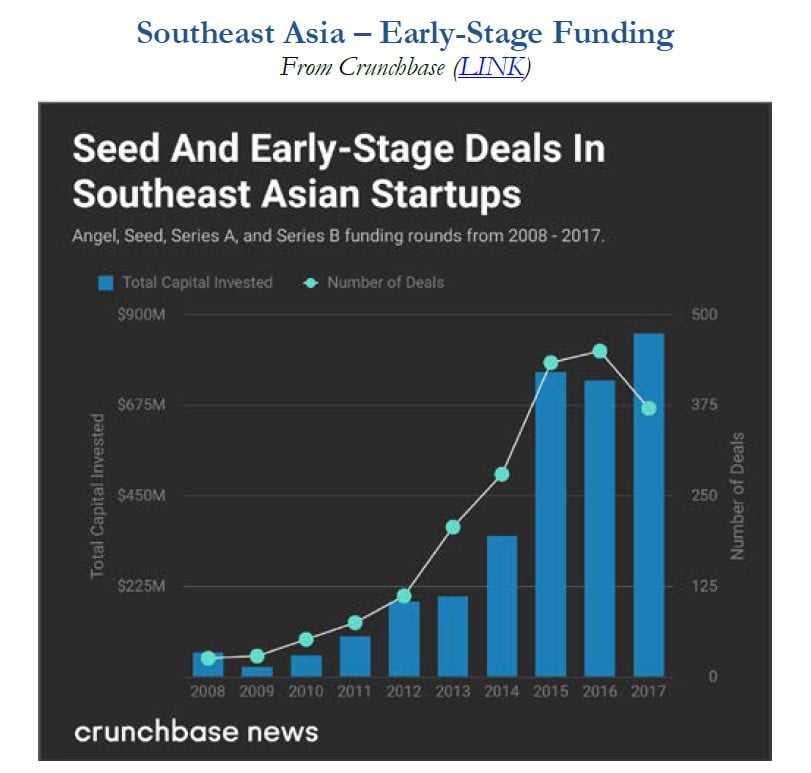

Some of the spike in activity was attributable to the larger rounds raised by these unicorn companies. However, much of the funding also went into Seed to Series B stage companies. In fact, according to Google-Bain-Temasek’s e-Conomy report, mid-stage funding (Series C & D) has actually plateaued in recent years, while 95% of deal activity takes place in the earlier Seed to Series B stages (LINK). According to Crunchbase, funding in this segment has increased from just $61M in 2008 to $853M by 2017 (a ~14x increase).

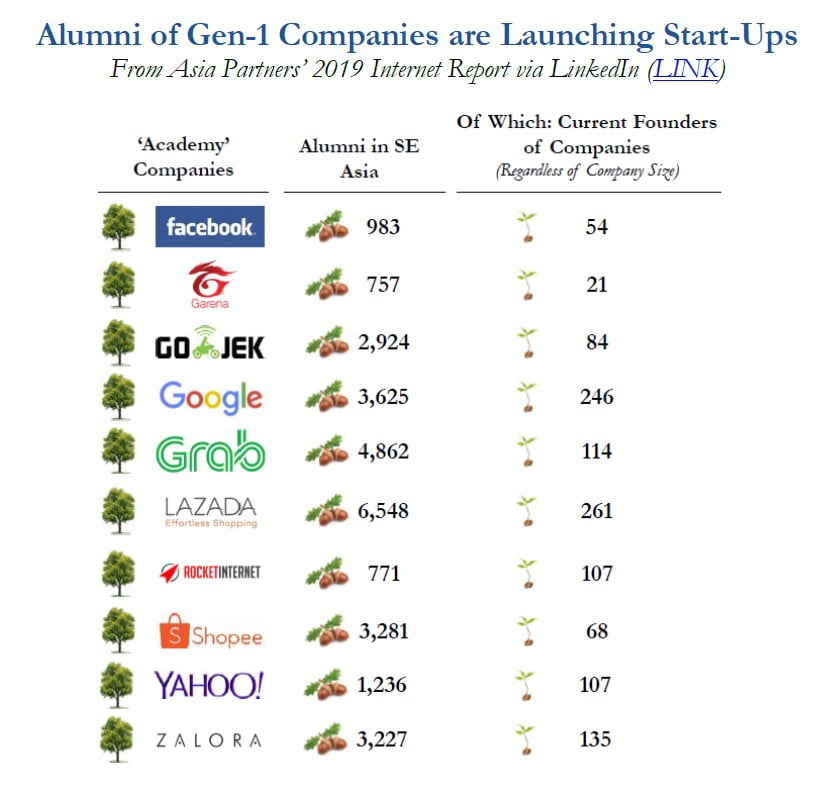

But all of this funding is useless, if these new companies can’t find sharp technical talent to help run these businesses day-to-day. Luckily, these Gen-1 companies are training an entire cohort of battle-tested employees, who are starting to go out on their own to create Gen-2 companies.

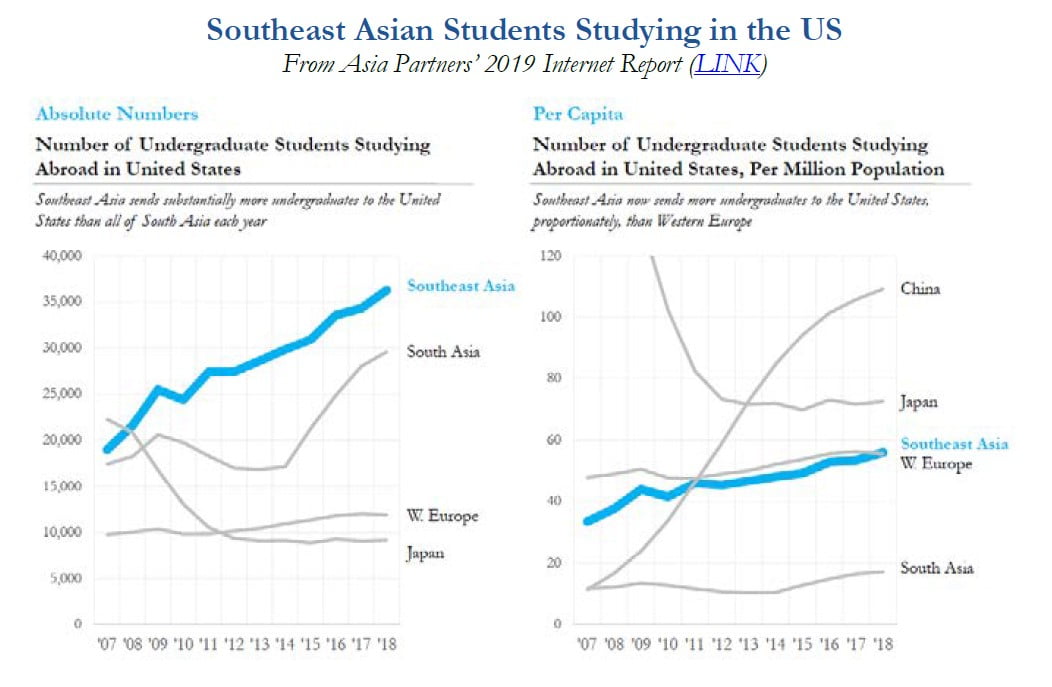

According to Asia Partners’ 2019 Internet Report, there are ~1,200 alumni of global and regional Gen-1 technology companies, that have launched their own businesses (~4% of the total ~28,000 alumni). In addition, Southeast Asia is now sending more students to study abroad in the US than all of South Asia (India, Pakistan, Bangladesh, and Sri Lanka).

On a per capita level, it’s now reaching ~58 students per million people, or the same percentage as China in 2011. This doesn’t include students studying in Australia or the UK either, which are both popular destinations as well. Anecdotally, I’m also hearing of more and more cases of students returning home after a few years of working in the US, back to their home countries due to the better opportunities there.

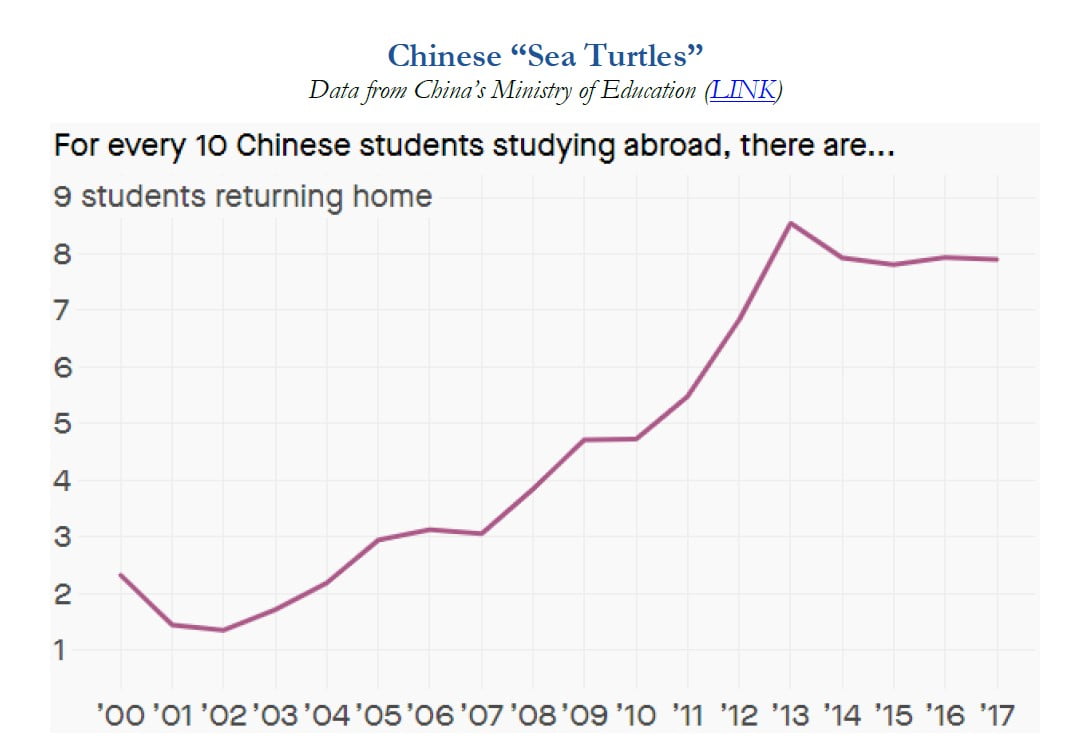

Perhaps over the next decade, we’ll see a similar to trend as China followed, whereby increased employment and advancement opportunities result in more of these students returning back home immediately after graduation, and fueling the ecosystem even further.

For example, 20 years ago 90% of Chinese students who came to the US for college decided to stay afterwards. But nowadays due to a combination of racism, increased difficulty in securing a visa, more exciting job opportunities back home, and potentially better living standards in China, 80% of students are choosing to return to China instead (these students are known as “Sea Turtles” in China)4.

On the demand side, we’re also seeing countries in Southeast Asia reach an average GDP per capita level of ~$4,000, or the level where we expect to see disposable incomes start to increase exponentially5.

If we use China as a case study, this is the same level of GDP per capita as China experienced around 2010. And also similar to Southeast Asia, the Chinese Gen-1 companies launched approximately 10 years before the region reached this level. For example, Baidu was founded in 2000, Alibaba in 1999, and Tencent in 1998. Meanwhile the Gen-2 companies launched a decade later, with Meituan in 2010, Pinduoduo in 2015 (although it was actually an evolution of Colin Huang’s prior start-ups Leqi & Xunmeng, founded in 2010), and Bytedance in 2012. It took approximately a decade between the founding of the Gen-1 companies and those of the Gen-2 companies.

Chinese Gen-2 companies were no longer copying well-trodden business models, but rather leading their fields in new innovation. Meituan launched within food delivery in 2013, and through their business model innovation became the first major food delivery company to achieve profitability globally. Pinduoduo is a pioneer in Social Commerce. And Bytedance invented an addictive new algorithm that learns what each user likes and personalizes the content feed for them. The more developed ecosystems in which these Gen-2 companies launched in, gave them the freedom to pioneer and follow their own paths in their local markets.

In the case of Southeast Asia, it feels like we are right at that tipping point today. It’s been a decade since the Gen-1 companies were formed and started fertilizing the Southeast Asian tech ecosystem. And as illustrated above, I believe the factors are all leading in the same direction, with conditions ripe for the next generation of entrepreneurs.

We’re excited to watch this transformational event over the next 5 - 10 years, and will be closely monitoring for this next cohort of Gen-2 entrepreneurs. As these new seedlings / Gen-2 founders scale their businesses, they’ll find a much easier environment to build their companies than the previous generation did, which will provide the freedom necessary to think globally and lead innovation on a world-stage.

I’m excited about the potential of the Southeast Asian region over the next decade. And by getting to know these companies during their formative stages, hopefully we’ll have the ability to identify and partner with some of these exceptional founders early on their journey.

Portfolio Review

Amazon (AMZN): We sold our last remaining stake in Amazon this quarter. Amazon was our longest-running investment holding, after having originally purchasing it at the inception of Hayden in 2014, at a price of ~$317.

I gave some details of how Amazon has progressed over these past 6.5 years in last year’s Q2 2020 letter, which partners can find here (LINK). The company has executed amazingly well over this tenure, with revenues up ~3.3x and since our initial purchase, and reported operating income up ~30x over that period.

Generally, I believe there are three reasons to sell an investment: 1) we recognize our initial thesis is wrong (sell out as quick as possible), 2) we have a significantly higher returning opportunity to redeploy the capital into (sell-down to fund the new investment), or 3) the company is maturing and hitting the top part of it’s S-curve / business lifecycle, so the business has fewer places to reinvest its capital internally. As such, the future returns will likely be lower than the past. This investment thus becomes a “source of capital” in the future, as we fund earlier-stage investment opportunities.

In the case of Amazon, we decided to sell due to the third scenario. I’m sure Amazon will continue to generate value for shareholders and continue to keep pace with the broader technology sector. However, I’m just not confident it’s as attractive an investment as when we first invested.

With ~51% of US households having an Amazon Prime account (and with very low churn), each of these households continuing to increase their annual spend with Amazon, and few / no real competitors in sight, Amazon is a dominant force that will only continue to accrue value as consumers continue to move from offline to online purchases for their everyday needs. Likewise, the “cash-flow machine” of Amazon Web Services is in a similar position of strength, with AWS now having ~32% market share and continuing to grow at +30% y/y. Because of this, I think Amazon is probably one of the safest investments in the technology sector today.

So why did we decide to sell the investment then? Simply put, Amazon is in a much different place than when we initially invested. Back in 2014, investors were starting to question whether Amazon’s promise of future earnings potential would actually come to fruition.

Operating income had declined from ~$1.4BN in 2010, to ~$676M in 2012, to just ~$178M by the end of 2014. Expenses were outpacing revenue growth, and investors were questioning whether Amazon’s expenses were truly “investments” as they claimed, or whether it was a structural necessity of the business and thus would never flow to investor’s bottom line.

The critical question was “what portion of expenses are truly growth investments vs. structural expenses, and as a result, will Amazon ever be capable of generating significant profits?”

Our analysis indicated that these expenditures truly were the former, and led to the belief that the business’ structural margins would inevitably increase over time. This was our differentiated insight / investment edge.

Fast-forward to today, and our thesis proved correct with operating margins having increased from ~0.2% to ~6%. However due to this success and proving this facet out to investors, Amazon investors have much higher confidence and a better understanding of the company today. I’m not sure we have the same level of differentiated insights, as we did back then.

In addition, I believe the departure of Jeff Bezos and his long-time lieutenants signal a regime change. Perhaps it’s now “Day 1.5” instead of the Day 1 mentality that made Amazon so successful (LINK)… The departures within the past couple years include:

- Jeff Bezos – Founder, CEO, Visionary. Started Amazon in 1994.

- Jeff Blackburn – Joined Amazon in 1998. Oversaw Amazon Marketplace, Advertising, Amazon Studios, Prime Video, Prime Music, M&A.

- Jeff Wilke – Joined Amazon in 1999. Oversaw Amazon Consumer (ecommerce) business.

- Steve Kessel – Joined Amazon in 1999. Oversaw Physical Stores, Kindle, and Whole Foods.

Blackburn, Wilke, and Kessel have each arguably created hundreds of billions of shareholder value. On top of this, Bezos is the visionary and culture-setter behind Amazon. When he and his long-time lieutenants take their hands off the wheel, it is probably time for us to as well.

We sold our remaining shares at an average price of ~$3,240. Based on our initial investment, we made a ~10x return in a little over six years, for a ~45% IRR7. We reinvested the proceeds into our existing portfolio, taking advantage of the prices offered by this latest market draw-down.

Conclusion

As mentioned earlier this year, while I believe our first five years were about providing “proof of concept” for our strategy and differentiated firm structure, our next five years are going to be about continuing to hone what we’ve already built, and to make it more robust.

In-line with this Hayden 2.0, we have a couple new developments. The most important announcement is that we welcomed Philip Kor to the team.

Philip is joining us as a research analyst consultant, based in Singapore. Philip and I have worked together on and off for several years, most notably in late 2018 while we were conducting our research on Sea Ltd and Carvana (partners will notice Philip’s name from the materials back then), and also more recently last year.

Philip is a great analyst, but what sets him apart is his unique ability to “pull the thread” and utilize his relationships / wide network in Southeast Asia to get to the “on the ground” experiences of the companies we’re studying. This additional angle is invaluable, and the primary research provides qualitative context that simple desktop work can’t possibly match. We welcome Philip to the team and look forward to the additional insights he’ll bring over the coming years.

**

On the branding front, partners may notice a slightly different design to our letter this quarter. We hired a branding consultant to subtly freshen up the look of our letters and presentations. In addition, partners may see some changes to the look of our website later this year as well. Lastly, we also chose a new icon logo, that replaces our prior logo (which originally, I had scrappily created myself via a combination of Microsoft Paint & Adobe years ago).

I hope that this new refresh in the branding aligns more clearly with our values of transparency & simplicity. But more than anything, I’m just glad that our designs no longer look like they were self-designed with clipart (which admittedly some of it was!).

**

On the business side, we are raising our relationship minimum to $250,000 USD this quarter (there’s no change in terms for our existing partners).

I sincerely wish we didn’t need to have a minimum, and that we could serve more individual individuals where our returns could truly make a difference in their lives. We’ve always prioritized the quality of our partners, over the size of their checks after all.

But due to time constraints, our commitment to ensuring our existing partners continue to receive the client experience they deserve, and also regulatory hurdles, we’re not able to do so at this time. Perhaps somewhere down the line, we’ll be able to open a publicly traded closed-end fund, holding company, or some other vehicle that allows for this scalability without sacrificing the type of relationship we strive to have with our partners.

But in the meantime, we need to protect the interests of our existing Hayden “family”. As we get closer to our strategy’s capacity limits over the coming years, we will likely need to continue raising the minimum in the future.

In light of our business’ growth, we are also planning to undergo SEC registration over the next few months. We engaged Hardin Compliance Consulting to help with this effort, in addition to tailoring our compliance program and acting as our compliance manager going forward.

**

Also, I wanted to say a big thank you to the students and professors at the University of Chicago, NYU Stern, and Columbia’s CSIMA group for inviting me to speak over the past few months.

I sincerely enjoy speaking with young investors, since it wasn’t all that long ago that I was just starting out on my own investing journey and contemplating the different possibilities of my career path. I hope that I was able to show that it is possible to take a “different path” in this industry vs. the traditional route that most take.

So much of this industry is about relationships and serendipity, and sometimes taking the less traveled route can actually lead to higher exposure of both (on the flip side, how many deep, creative insights and meaningful new relationships can you really cultivate, when you’re working till 3am everyday as a banking analyst?). It’s not right for everyone – but for a select few who are passionate, have capacity to suffer or “吃苦” (literally translated as “eating bitter”), and already know the direction they want to take in their careers, choosing the non-traditional path might be the better bet.

**

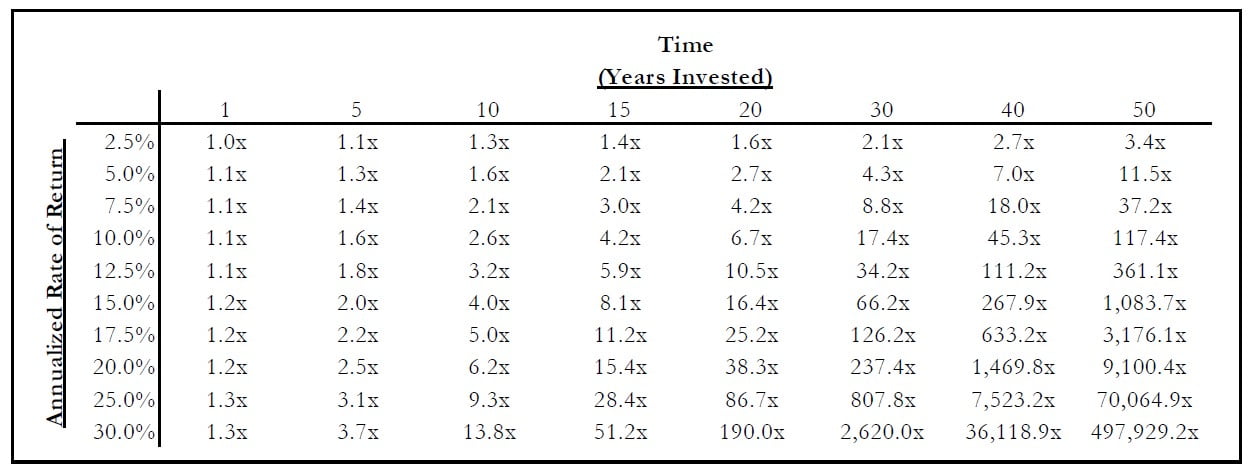

Lastly, it has been a few years since I last broke out the compounding table, so I thought it’s a good time for a refresher. This table is so important, because whether it’s knowledge, personal relationships, or physical health, compounding occurs in many other aspects of life outside of investing.

As such, I’ll just leave our partners with the below. As the saying goes, “time in the market, beats timing the market”.

Sincerely,

Fred Liu, CFA

Managing Partner