Forge First Funds commentary for the month ended May 31, 2018.

The Sui Generis Canada Partners LP fund was down 1.35% for the Class A Lead Series during May 2018, resulting in a year-to-date net return of 1.33% and since inception (March 1, 2015) cumulative net return of 10.86% (3.22% annualized).

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Capital markets regained their footing during the month of May with the first part of the month being dominated by the various narratives around strengthening oil prices while earnings season played out in Canada. Our funds posted a slightly negative month, our first of 2018, as a couple of long positions reported earnings that proved underwhelming to the street. More broadly speaking, the return of low volatility and strength in momentum names characterized the back half of the month, with the VIX (volatility) index continuing its downtrend and the large and mega-cap technology names regaining a bid, rendering the tumult of the first quarter a distant memory. We continue to believe that our acute focus on free cash generation is the single most important factor upon which to focus when investing in equities, and as a result we should continue to outperform throughout both the market and business cycles.

A theme that will begin to grow in importance over the coming months is what we believe is the inevitable rise of inflation throughout the developed world. The combination of rising natural resource prices yielding increasing input costs, the strongest employment numbers in decades, and still remarkably accommodative monetary policy looks like it may finally bring inflation back into the discussion. Raw material costs, as reflected by the Commodity Research Bureau (CRB) Price Index, bottomed almost exactly one year ago and have risen 24% since (Figure 1).

In spite of this impressive increase, we believe there is a lot of room to run given the index currently sits 60% below the highs we witnessed in 2008 while economic growth continues to surprise to the upside.

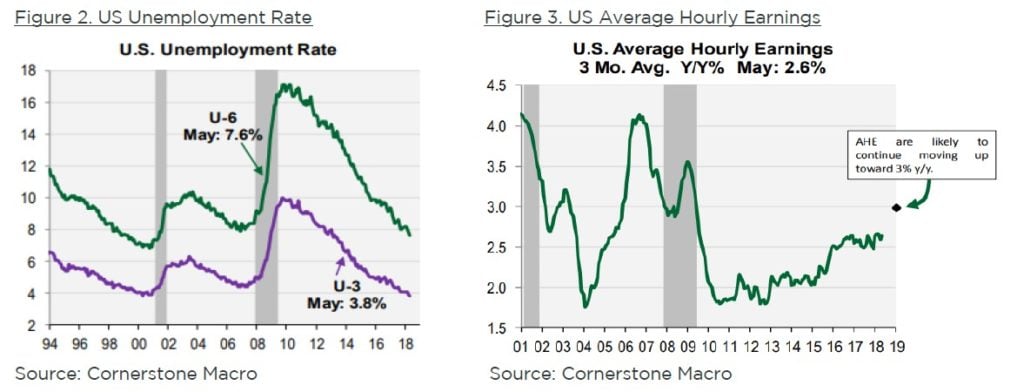

So while we believe the raw material rally will inevitably contribute to rising costs, it’s actually the employment picture that makes us believe the higher inflation recipe is just about complete. The combination of an obscenely low US unemployment rate of 3.8% (Figure 2) and continuously increasing hourly wages (Figure 3) should create yet another input cost pressure on businesses that we believe will eventually work its way to the consumer.

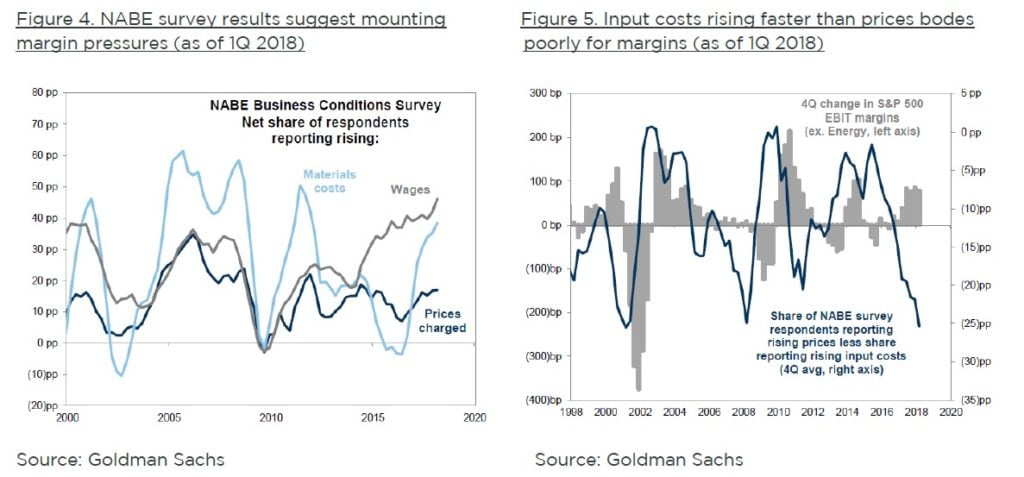

Increasing producer price inflation should soon bring about one of two things; margin compression (Figure 4) or upward biases in consumer price inflation (Figure 5), and neither is ideal.

Should we be right about this, investing in an inflationary environment will likely yield opportunities that are unique from those we have witnessed over the previous months and years. The first and most obvious opportunity is to own those companies that are benefiting from said inflationary forces (think miners), energy companies or perhaps even pairing long consumer staples (those who can pass along cost inflation) against short consumer discretionary (who may struggle to pass along inflationary pressure and thus may not maintain their margins). Where possible we believe investors will be well served to focus on those companies with large market share thus affording them additional pricing power.

Having said all that, you should not be surprised that last month we added a position that we believe possesses many of these qualities all in one convenient package. The company is Finning International (FTT.CA), the world’s largest dealer of Caterpillar equipment, with the exclusive distributorship and service rights in Western Canada, Latin America and the UK. Caterpillar equipment is synonymous with mines and construction sites all over the world, and given the geographic focus of Finning’s dealerships, we believe they stand to benefit from very strong end user demand growth over the coming years as copper, oil, natural gas, and other commodities exhibit the additional strength we believe they will in the current up-cycle. Counter cyclical investments over the last three years should allow Finning to realize return on invested capital (ROIC) expansion toward 17%, something we simply can’t get from a miner or an oil company. So Finning became a compelling and convenient long exposure for us given our beliefs stated above as they relate to inflation and commodities. Not only do we get a company whose sales are strongly correlated to the areas benefiting from the inflation we believe is becoming apparent (commodities), but we’re also getting a well-run, high return on capital, strong market share, price setter with a ubiquitous brand whose products and services are anything but discretionary to their customers.

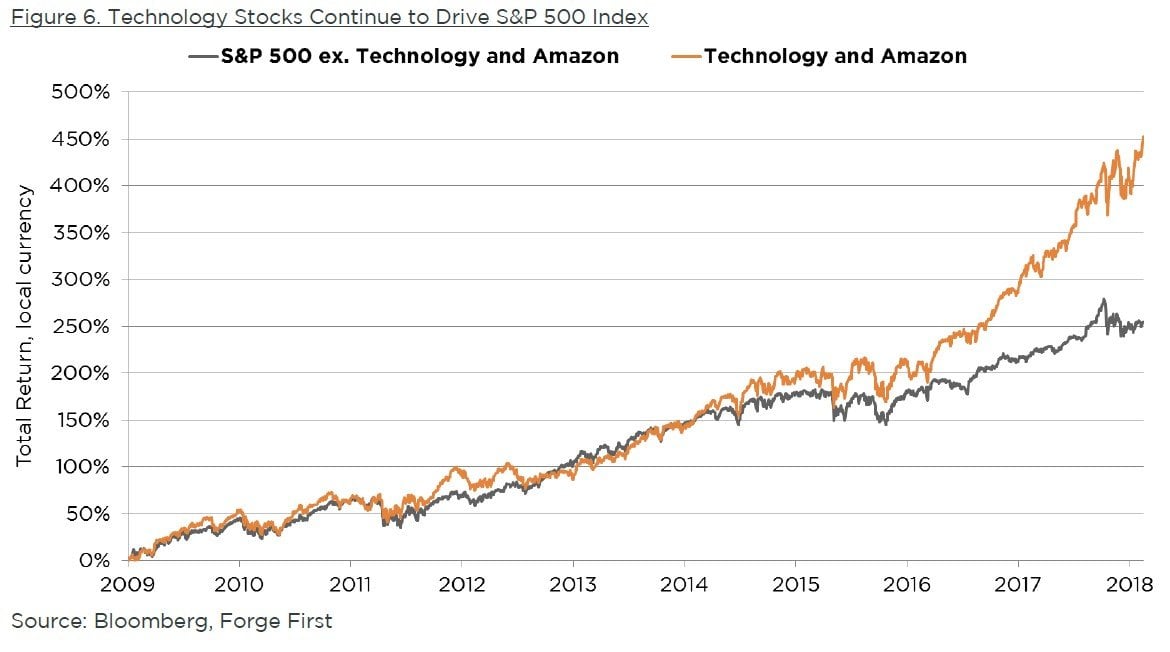

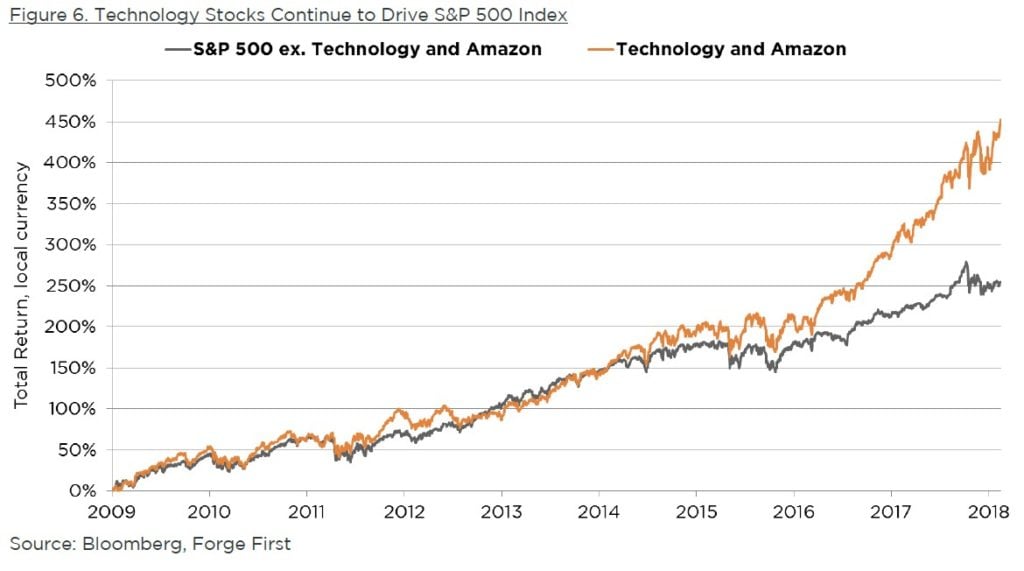

Lastly, there is no denying that large cap, US tech equities have been a generous place to be positioned over the last 10 years, as can be seen from Figure 6 below which shows the performance of the S&P 500 ex- technology and Amazon (AMZN.US) vs the S&P 500 technology index and Amazon.

Earlier this month we increased our net long exposure to a basket of US large cap equities (including some technology names) and combined this positioning with a protective options hedging strategy. Our rationale for this decision is that should US markets continue to grind higher from here, we think this basket of securities will benefit more from the upward move in the overall market, however should markets pull back the options that we have employed will offer downside protection, hence in our view this positioning offers a favourable risk/reward scenario for the portfolios going forward.

Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower volatility in your investment portfolio. As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd

Portfolio Manager

D: 416-597-7934

Andrew McCreath, CFA

President and CEO

D: 416-687-6771