The first four weeks of October 2018 have seen big drops in stock prices across the globe, and as in any market correction, the question that you face as an investor is what, if anything, you should be doing in response. I feel the urge to react, but I know that if I do so, I can put my portfolio at risk. I go through a four step process, starting with a hitting of the pause button, following up with using the data to assess the damage and a check of the fundamentals, before acting. The bottom line is that none of the offered explanations for the stock rout hold.

See the slides here.

Aswath Damodaran: An October Surprise – Time To Hit The Pause Button

Q3 hedge fund letters, conference, scoops etc

Transcript

Welcome back. I'm sorry if I look little blurred or dark but I'm sitting in a hotel room in Santiago Chile and the lights not that crane in this room but I'm going to shoot it anyway. I mean what's to lose. So it's been four weeks in October and it's been a very interesting month and I'm using the word interesting the way China the Chinese use it as a curse. It's been a tough four weeks for stocks not just in the U.S. but around the world. So I don't see a good time to take a look at where we are in the market and give you a clue where I feel I am in my investment put forward.

Let's face it any time you have a market selloff like you have in the last four weeks it makes you sit up and think about what to do. Maybe you should be reacting maybe this is the correction that people have been warning you about for the last six years. Maybe it's time to get out of stocks. Maybe you need to reassess what you do and those thoughts crossed my mind just like they cross anybody else's mind in a period like this. Right. And as I've been wrestling with what to do I find myself going back to a four step process that I've used over and over again the last few years and I posted about this before. The first step in this process is in a sense to hit the pause button. What does that mean. There are two things that I realized happened in a crisis and these are things that are embedded in us as human beings. The first is you panic and when you panic you react. Muireann do do stupid things. In fact what I often think is instinctive is often really stupid. So the first thing I've learned to do when there's a market crisis is to take a deep breath and step back from the action that's easier for me to do than somebody works as an investment portfolio manager or as a hedge fund manager. I can take a step back and I find it's very useful not to be caught up in the mood at the moment. The second is I turn off the noise. Let me explain what I mean by this.

Thirty years ago you were an investor and investor not in the sense of somebody whose job it was to be a professional investor but a doctor a lawyer a factory worker with all of your money invested in stocks and you went off to work in the modern art world that you didn't even know what the market was doing during the course of the day you were too busy doing your job and then you got back home and perhaps saw the news in the evening the 630 news the 7 o'clock news you'd see a couple of minutes about stocks usually talking about the Dow and then maybe a minute or two of Expert Expert analysis and then he went down you went back to watching your favorite said Kamini stop thinking about the stocks in your portfolio. You say how primitive. You're right. Today we can constantly track what's in our portfolios. We can trade in the middle of the day during a lunch break.

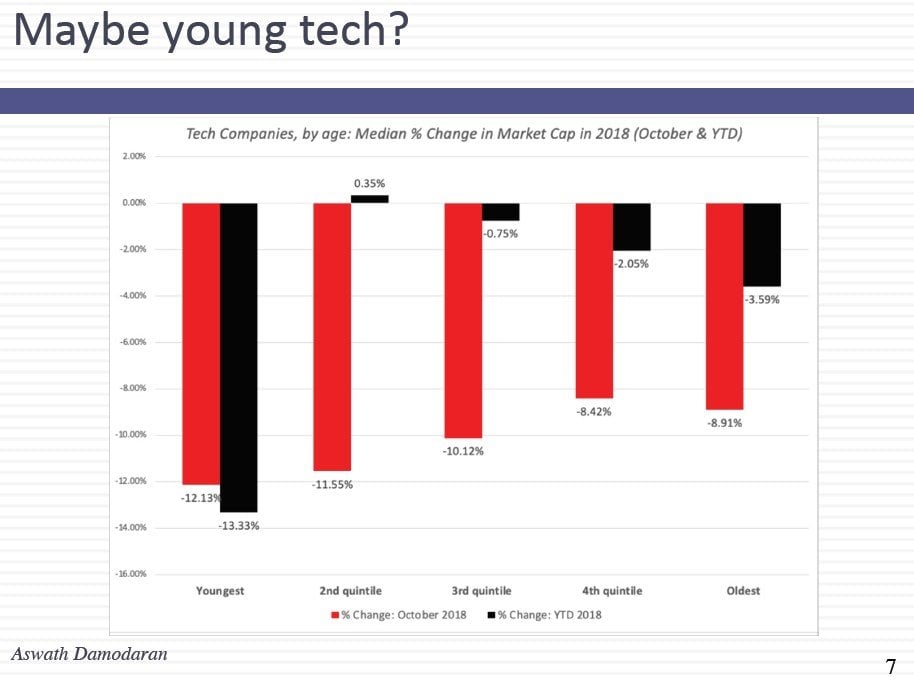

We can trade while we're sitting at a desk we can ever take a day running across it and try any of this is good because studies have shown that when you get feedback constantly you tend tend to exaggerate all those irrational impulses we have as investors. So the second thing I tried to do is turn off the noise. What does that mean. I don't watch CNBC and I don't sleep. I love the people on CNBC. I'm not. This is not about them. This is about the collective feedback you get from watching the market. It's all the time. I don't read the market news incessantly I don't have an app on the on my phone that tracks the stock prices. I try to step away from that constant information flow doesn't mean I'm not tracking what's happening at the end of each day. But it's not incessant it's not continuous. So that's a first let's take a deep breath. The second step is to take a look at the numbers yourself because when you have a market crisis like this when there are so many experts and each one claims a different reason for the sell off one say at least the sell off I've heard reasons ranging from this is that this is due to tech stocks swooning and coming back down. I've heard that this is because of the Fed we're not planning to raise rates it's because Saudi Arabia.