Crude oil futures fell after the bulls took over. What are the determinants of supply and demand that are driving crude oil prices this week?

WTI crude oil futures bounced just below the $90 mark yesterday on the NYMEX. It was before being taken over by bulls in a climate of economic uncertainty over the possibility of a global recession, which would stifle demand.

Q2 2022 hedge fund letters, conferences and more

Macroeconomics, Inflation and Recession Fears

After the CPI figures that I commented on last week, inflation accelerated further in Canada and the United Kingdom, reaching a new peak in 40 years as well. Indeed, the UK consumer price index hit a 40-year high in June (9.4% year on year), with the Bank of England's (BoE) Bailey predicting a 50-bp hike. On the other hand, I noticed that the UK unemployment rate remained at 3.8% in the three months ending in May.

On the Geopolitical Scene

In Libya, the Libyan National Oil Company (NOC) announced on Wednesday the resumption of production in several oil fields, helping to calm the market. Since mid-April, six major oil fields and terminals have been closed by groups close to the eastern camp, which wanted a "fairer distribution" of crude oil revenues.

Fundamental Analysis

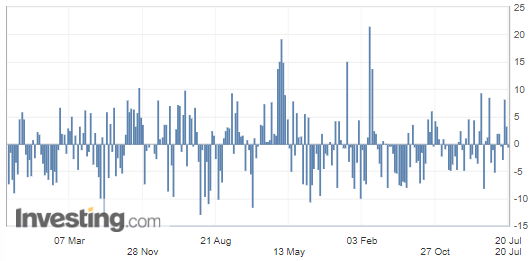

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

U.S. Crude Oil Inventories

This time, we could see the commercial crude oil reserves in the United States slightly dropping to -0.446M barrels while expectations were showing an earlier rise of 1.357M barrels.

US crude inventories have thus decreased by not even half a million barrel in volume, which is not a very significant deviation to mention a greater demand and is not really a strong bullish factor for crude oil prices, since the drop can be explained, in part, by the increase in oil exports.

(Source: Investing.com)

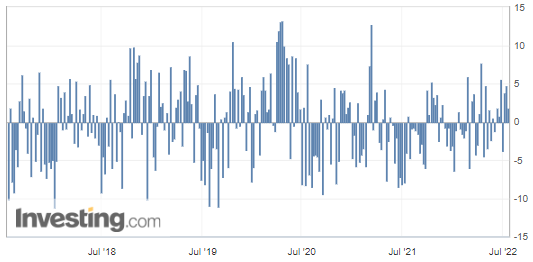

Those figures were in contradiction with those reported a day earlier by the American Petroleum Institute (API):

U.S. API Weekly Crude Oil Stock

(Source: Investing.com)

As you can see, no clear directional signal could be extracted from any of those figures for now.

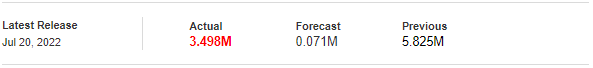

However, the number that showed the largest deviation from the forecast was the gasoline inventories:

U.S. Gasoline Inventories

Here we have a clearer picture regarding the slowdown in demand for gasoline in the United States, with almost three and a half million barrels of commercial gasoline held as per below:

This is precisely where we could eventually see a drop in demand marked by an unexpected increase in gasoline reserves, because the report can be seen more as a bearish signal, as it signals further evidence of waning gasoline demand at the peak of the summer driving season – the latter being usually considered a higher demand period for fuel with rising holiday trips.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

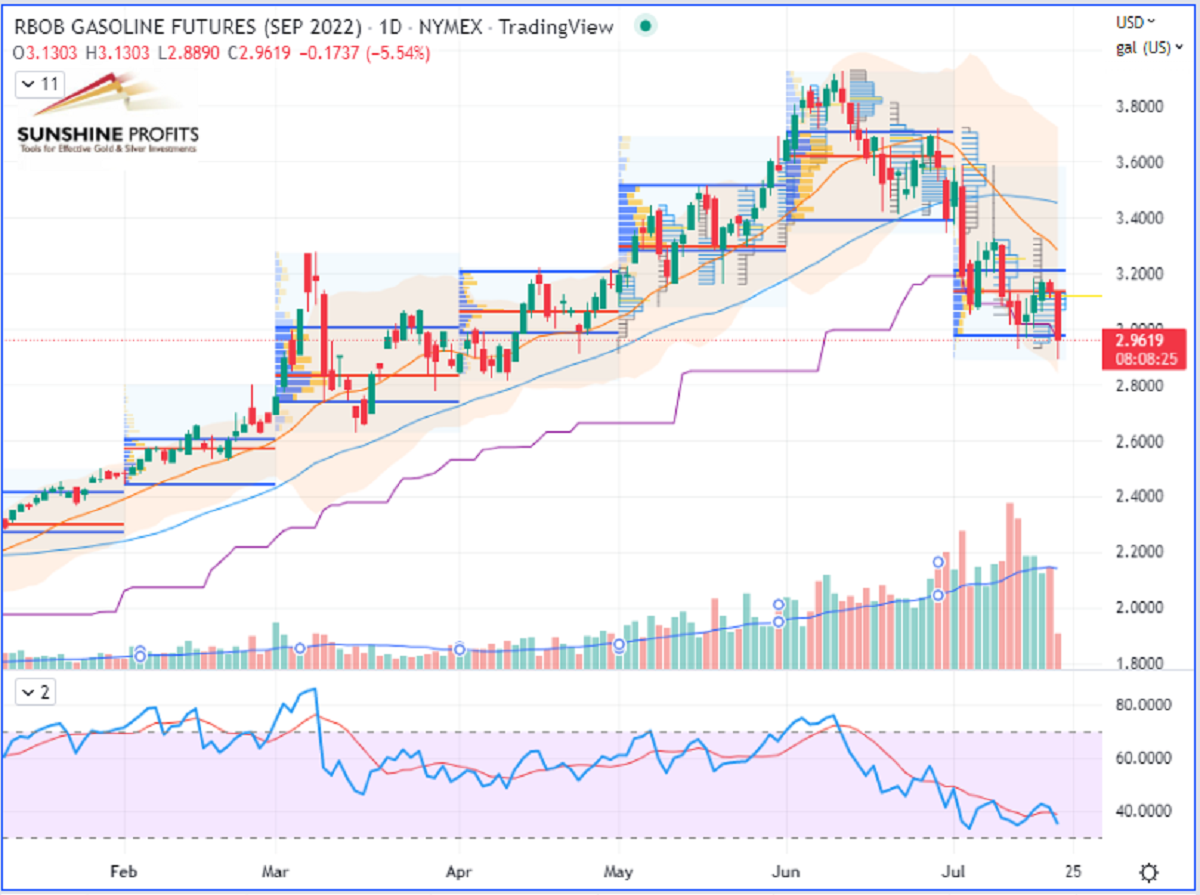

RBOB Gasoline (RBU22) Futures (September contract, daily chart)

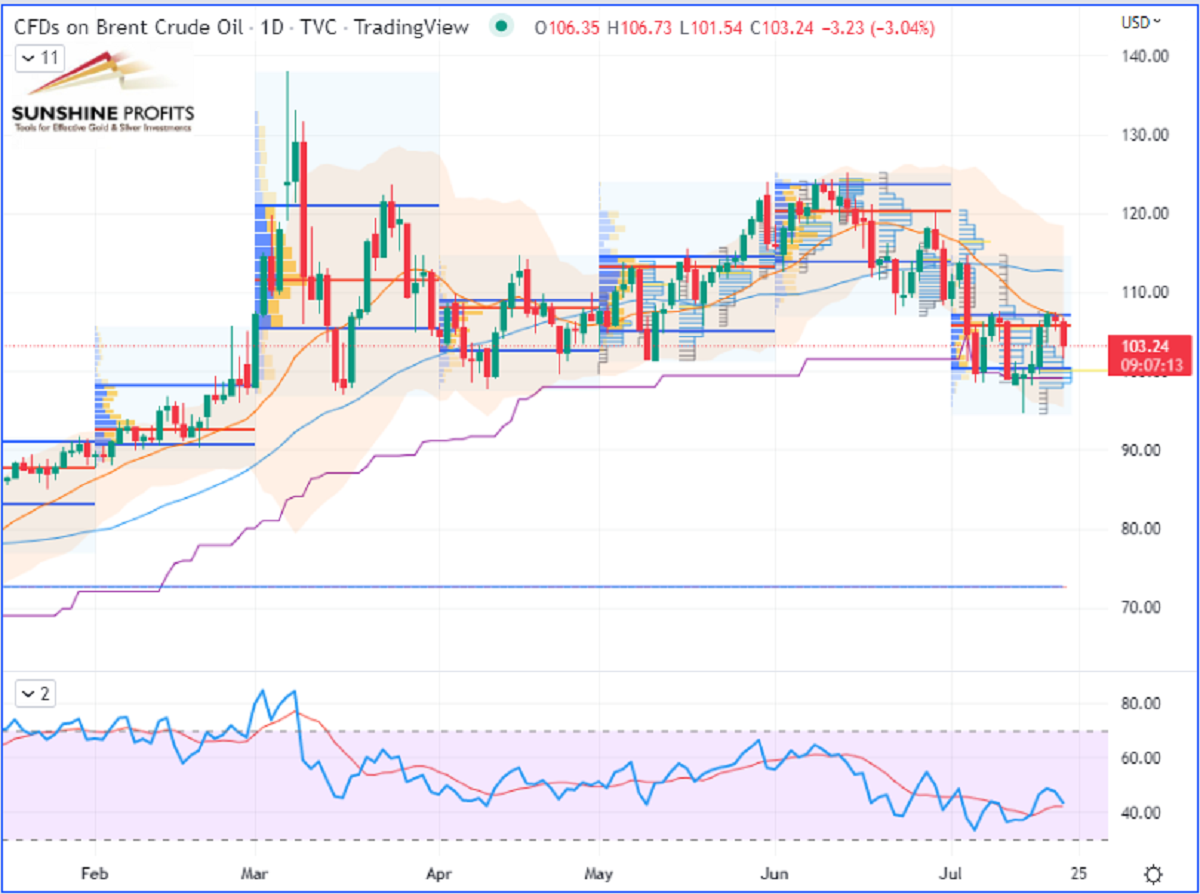

Brent Crude Oil (BRNU22) Futures (September contract, daily chart) – Represented by its Contract for Difference (CFD) UKOIL

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.