Why cash flow statements are king by Adnan Akhand, VP of accounting and compliance, BX3

When Hollywood tries to give its take on Wall Street, generally cash flow statements aren’t front and center of the plot lines. Coming from my perspective as a certified public accountant, the film and television industry is really missing an opportunity here. No matter how tight the script, there are few better methods to tell the actual story of a business than cash flow statements.

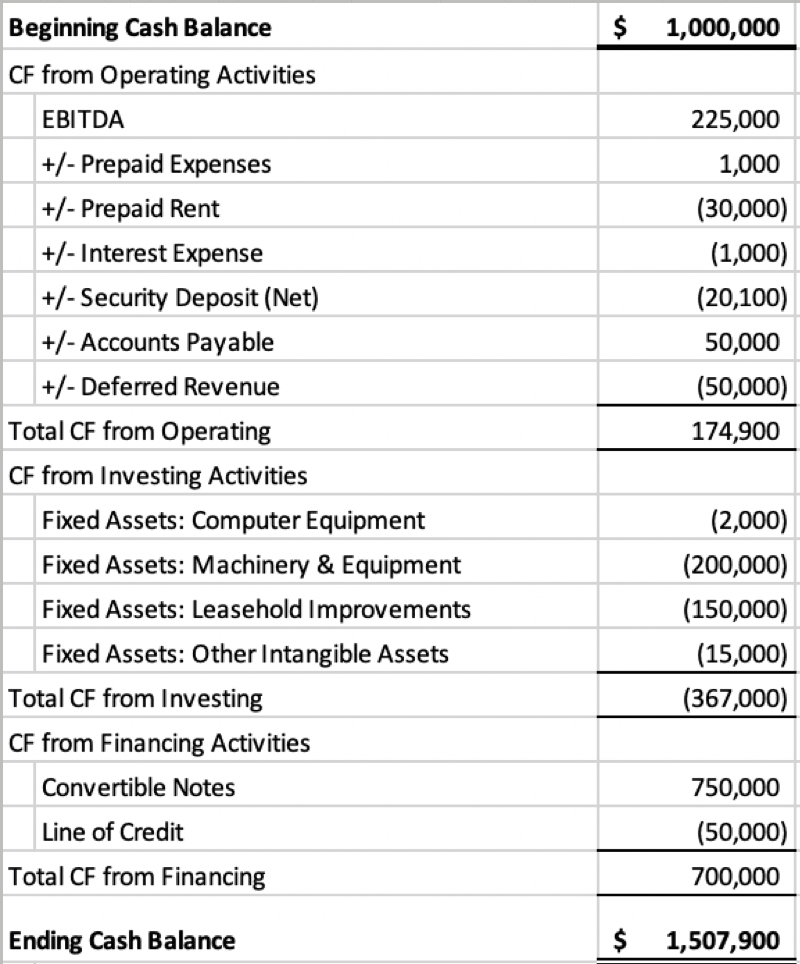

As their name would suggest, cash flow statements help businesses understand where money is going in and where it’s going out. While balance sheets and income statements might get better name recognition among the non-accountants among us—that includes some of you on venture capital boards out there—they don’t provide a holistic picture of how cash is being used within an organization. Whether you’re an entrepreneur who wants to put your best foot forward or an investor wanting to get the real lowdown on runway burn, here’s why cash flow statements are a real way to get your finger on the pulse of what’s happening in a business.

Getting into the [cash] flow

At its core, a cash flow statement is a summary of all the cash activities of a business. It provides invaluable insight into a company’s operations and allows management to make strategic planning decisions early.

As you can see in the above image, the monthly cash flow statement derives its data from both the income statement and balance sheet. Whether you’re a startup or a company that’s been in business for more than a century, this document allows management teams to peer into operations, income, and various other goings-on to glean a clear picture of the status quo and map out a chart for a sound future.

Accounting issues

Say there is an anticipated cash surplus, for example. Management could set metrics internally that would lead to a bonus payout. This could be a great way to motivate a team without hurting the business’ cash flow. A cash surplus could also mean the opportunity to pay down expensive debt. Conversely, a cash deficit could mean that a business’ operations are inefficient. The last thing any business wants to realize is that it has burned its runway after it’s too late to take action. Realizing your business needs external funding early in the process is crucial if you want to negotiate from a favorable position.

Investors and lenders can look to cash flow statements to get a sense of whether or not a company may be investable or has the means to repay debt.

Investors aren’t charities. If they see you only have a few months of runway left, they will make you pay for it —usually by taking large portions of equity. Of course, external funding is based on the understanding that a cash infusion will lead the business to running cash flow positive. Whatever the case may be, the days of investor capital funding going toward incompetently run businesses seem to be coming to an end.

The three sides of cash flows

There are two ways to present the cash flow statement: the direct method and indirect method. The direct method presents the cash inflows and outflows based on cash-related categories—think income statement style. The indirect method, the more widely used of the two, begins with net income, and works its way back to cash. Both methods have their merits. The indirect method, however, is more popular for one main reason: It is typically faster, and easier, to prepare an indirect cash flow statement.

The indirect method takes net income and adjusts for non-cash items, while the direct method requires separating cash and non-cash transactions prior to preparation. There are three main facets of cash flow statements: money from operating activities; investing activities; and financing activities.

On the operational side, the goal is to zero in on the main revenue generators of a business. Beyond the obvious factors such as income, this section of a cash-flow sheet also includes, well, non-cash items such as adding back depreciation and changes in working capital such as prepaid expenses, and accounts receivable/payable. Investing activities can include buying and selling property and changes to capital such as plants and equipment, as well as any other non-current assets.

Cash flow statements: Conclusion

It also includes the purchase or disposition of marketable securities. The third and final part is cash flow from financing activities. These include proceeds from and repayments of loans, issuing and buybacks of stocks, and the payment of dividends. Financing activities are often among the primary areas that are affected by the net cash flow projections, as “playing with the numbers” here will help determine how much funding the company may need or how much it can distribute in dividends or bonuses without impacting their ability to operate efficiently.

For investors and management alike, getting a handle on cash flow statements is a good option to get a top-down perspective on a business’ relative health. A quick glance can reveal runway burn, places to economize, and room for some extra rewards. Granted, they might not have that name recognition often accorded to balance sheets or revenue statements—but maybe they should.

After all, cash flow statements tell the whole, true story, no holds barred. Perfect for that Hollywood documentary coming out one day about your founders or portfolio firms.