Blue Tower Asset Management commentary for the third quarter ended September 2021, providing an investment theses on Nihon Falcom Corporation (TYO:3723).

Q3 2021 hedge fund letters, conferences and more

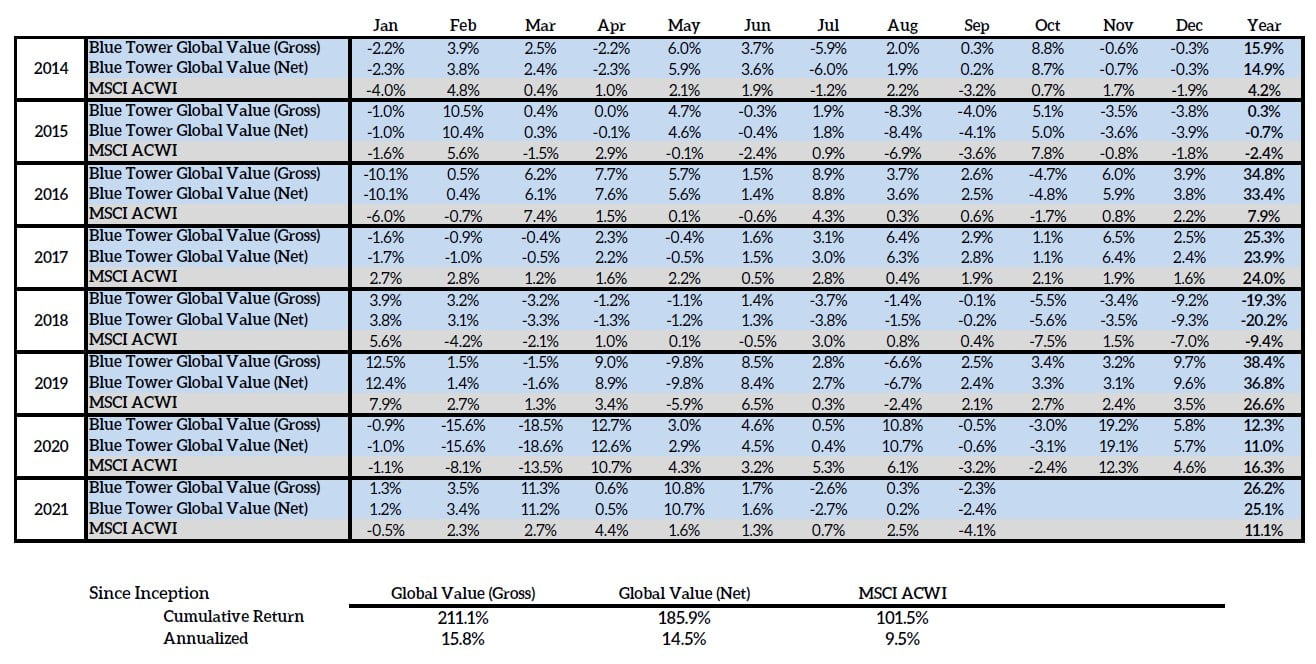

The Blue Tower Global Value strategy registered a decline in Q3 of -4.89% net of fees (-4.61% gross). Fears over Covid variants, including the Delta variant, were negatively affecting consumer and investor sentiment. Additional factors were persistent supply chain issues, energy price increases in Europe and Asia, and inflation pressures and labor shortages in the US.

One type of company that is able to deal with inflation pressures better than most are entertainment media businesses such as video game developers. The value of their intellectual property assets is unaffected by inflation and as long as they have captured the interest of their target customer base, they don’t have to worry as much about price competition as companies in more commoditized industries. One video gaming company recently added to our portfolio is the Nihon Falcom Corporation.

Executive Summary

Nihon Falcom is a Japanese video game developer focused on producing roleplaying games (RPGs). Founded in Tokyo in March 1981 by Masayuki Kato, Nihon Falcom is one of the oldest continuously active video game companies in the world. The company played a seminal role in the development of the action RPG genre and the Japanese video game industry in general1. While previously video game software was a fickle industry with boom-and-bust cycles, the industry has been evolving to become more predictable and high quality due to the increasing importance of online distribution and cross-platform licensing. Companies are also able to monetize their IP through sales of branded product merchandise and licensing the soundtracks of games. Today, Falcom’s most valuable gaming intellectual property are two game franchise series, the Trails series (a subset of their larger Legend of Heroes franchise) and the Ys series. Falcom, perhaps due to its small size, has flown under the radar of many investors and trades at a deep discount to peers despite the high quality of their intellectual property.

The video game industry is also an attractive market as the value of their IP is inherently protected from commoditization. Game developers have pricing power and should not be as susceptible to harm by an inflationary environment as other industries. Furthermore, games are relatively cheap per hour of entertainment compared to other forms of entertainment.

Investment Thesis: Nihon Falcom

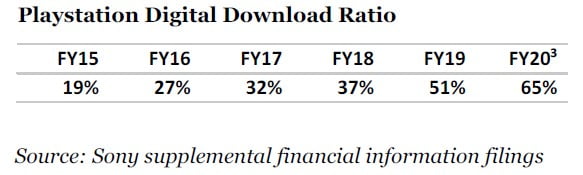

The video game industry is well into a transition towards digital distribution in lieu of distribution through physical media. This can be seen in the sales of Playstation software where Sony reported that 65% of their Playstation game sales in fiscal year 2020 were through online downloads as compared to 19% in 2015. Publishers generate far larger margins from the sales of digital software than they do from physical media. A game publisher can expect to collect 40%2 of the retail cost of a game sold in a brick-and-mortar store while online platforms such as Steam give them 70-80% of the gross revenue from their games. Additionally, game publishers can practice price discrimination among their users by offering optional downloadable content (DLC) that gives additional features or experiences within the game than enhance the base game. This allows a much greater amount of total profit to be generated from a game as they can more fully exploit each individual player’s propensity to spend. These DLC sales allow games to enjoy a continuous revenue trail even years after the initial sale of the game.

While Nihon Falcom was an early player in the Japanese video game industry, they are relatively obscure outside of Japan when compared to other Japanese video game developers such as Konami and Square-Enix. Their lack of international growth is partly due to a decision in the 1990s to continue developing their games for the Japanese PC market rather than developing them for consoles such as the Playstation and Xbox. Falcom has since corrected course and now produces console games as their main market for video game sales.

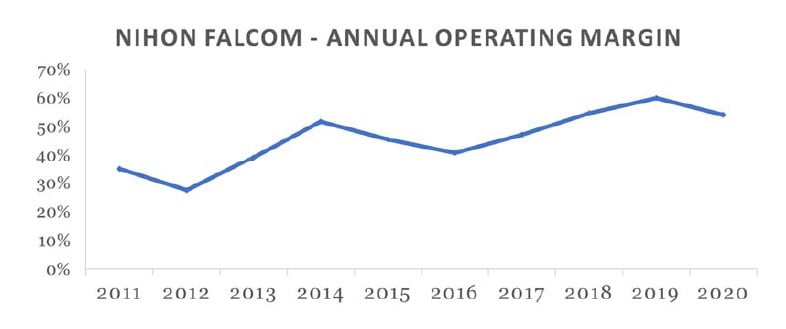

The digital downloads have improved the margins and decreased the cyclicality of sales for the video game development industry, greatly increasing the business quality of game developers. Falcom has managed to take full advantage of the changing industry dynamics as evidenced by the increase of their operating profit margin over the last 10 years.

The music of Falcom games is one of the selling points of the franchise to their userbase. They have been able to monetize this through the sale of soundtracks through digital downloads such as the iTunes store. They have also used their music as a promotional tool by offering free licensing of the music for noncommercial use and held online music concerts as part of their release announcements for new games. Digital sales of music are reported in their general licensing segment which also includes foreign language translations of games, ports of games to other consoles, and all other licensing of Falcom IP for merchandise not produced by Falcom. Therefore, it is difficult to determine if music sales or merchandise licensing are a material source of revenue for the overall company.

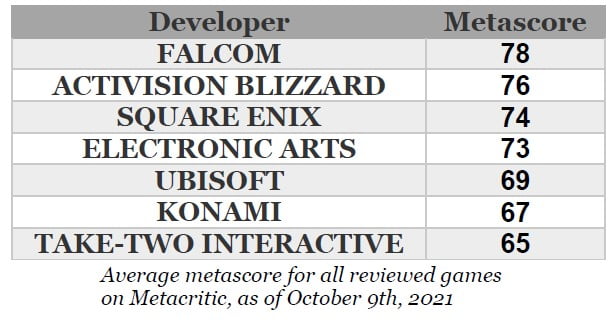

Falcom is unable to compete with larger developers on the visual effects, rendered cutscenes, or graphics of their games. However, they more than make up with it in their attention to the storylines, gameplay mechanics, and music in their products. The games in their series have cross-references to each other and characters from previous games make cameo appearances. These inside references and continuing story arcs keep fans locked into the franchise and waiting for future installments, allow for a more predictable future demand for games. Fans and critics alike have been impressed with the quality of Falcom’s games as their online reviews reveal. Metacritic is an aggregator of critical reviews for entertainment media (similar to Rotten Tomatoes). The average Metacritic metascore for Falcom’s games from 2005-2021 is a 78, an extremely high developer average for that site. On the Steam online store for their PC platform ports, the user reviews for their games are overwhelmingly positive.

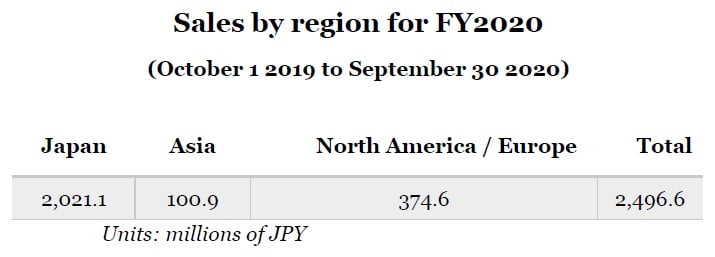

The positive word of mouth about Falcom may lead to increased demand for their games in North American and European markets. Currently, sales for Falcom games come almost entirely from the Japanese market. Their games are increasing in popularity on international markets which give them a very long runway of potential growth.

Risks

There are two main risks that Falcom faces in their game development:

The quality of their future games and franchise storylines could decrease leading to shrinking customer base.

In the 90s, Falcom suffered immensely from the departure of several important employees to other companies. As a small company, each lost employee has a bigger impact on the business than it would for a larger developer. Therefore, another mass departure of employees could imperil their development prospects.

Valuation

In considering the value one should place on the shares of Falcom, consideration must be given to their large net cash position of ¥7 billion, almost equal to half the market capitalization of the stock. The founder of Nihon Falcom is still the chairman of the company and a major shareholder. Owner-operators tend to be more cautious with deploying the business’ capital and Masayuki Kato has been no exception. Even though Toshihiro Kondo has taken over as the company’s president, frugality and conservative capital allocation is still in the DNA of the company.

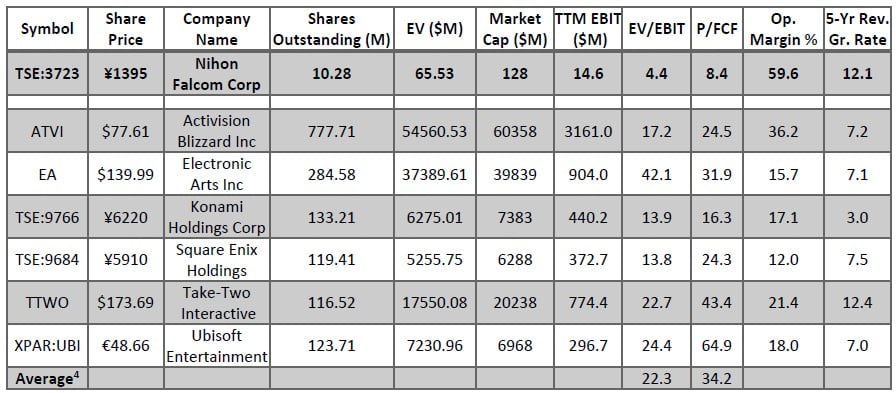

Therefore, we have elected to use the average enterprise-value-to-earnings-before-interest-andtaxes of a selection of major US and Japanese game developers as the target EV/EBIT of Falcom. EV/EBIT normalizes for leverage and capital structure between companies.

Holding EBIT and net cash constant, if Nihon Falcom was trading at the same EV/EBIT multiple of the selected peer group, their share price would be at ¥4234.

To demonstrate that this is not merely an effect of their large cash position, using a free cash flow multiple gives an even higher share price. At the same P/FCF as the peer group, their share price would be ¥5700.

Nihon Falcom may not converge with their peer group multiples in the near term. Microcap stocks in Japan have a demonstrated ability to trade at depressed multiples for many years. In the case of Nihon Falcom, the high free cash flow yield and significant organic growth should give investors an adequate rate of return even with no rerating of the stock to a higher multiple.

I enjoy whenever I receive questions from investors, so please feel free to reach out.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager

Blue Tower Asset Management