Argosy Investors commentary for the third quarter ended September 2021, disucssing the decline in stock price of Dream Finders Homes, Grocery Outlet Holdings and Roadrunner Transportation Systems.

Q3 2021 hedge fund letters, conferences and more

Dear Investors,

Year-to-date 2021 performance was 17.1% in select accounts. The S&P 500 by comparison returned 15.9%.

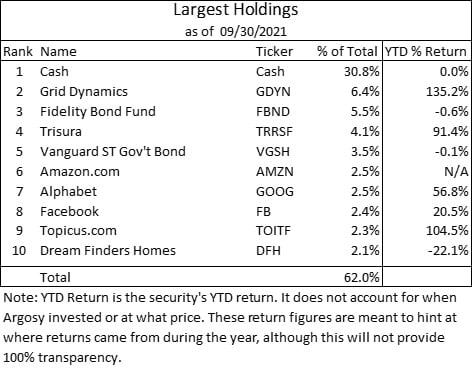

This quarter our holdings experienced mixed performance. Some of the portfolio companies I have invested in most recently have done the worst of late (more on that later). We are sharpening our pencils on depressed names in and out of our portfolio, trimming more richly valued names, and slowly consolidating the portfolio into our best ideas. We feel a portfolio of ~30 businesses, with the top 10-15 representing a significant majority of our equity exposure is a prudent way to grow our wealth without being too concentrated.

This chart shows that as a portfolio increasingly diversifies beyond 20 stocks (they must not be significantly correlated to one another), the benefits of additional diversification diminish substantially. We think that this is the correct way to think about long-term investment. As Omaha’s most famous investor, Warren Buffett, would remind us, if we owned 5 or 6 well-positioned businesses in the town or city in which we live, no one would accuse us of being too concentrated.

The above passage is a bit aspirational, if I’m being honest. I greatly respect the trust put in me by the people whose money I manage, and if I were to put 25% of their money into an investment that went horribly, I would feel terribly. Having a bit more diversified portfolio than the above chart would suggest is optimal is a bit of insurance against my own ignorance.

Existing Portfolio Activity: ESI, TAP, EPAM, DAVA, GDYN, WFC, GXO, JD

This section will sound repetitive to last quarter’s section on existing positions. I trimmed or eliminated our stakes in Element Solutions Inc (NYSE:ESI), Molson Coors Beverage Co (NYSE:TAP), EPAM Systems Inc (NYSE:EPAM), Endava PLC (NYSE:DAVA), Grid Dynamics Holdings Inc (NASDAQ:GDYN), GXO Logistics Inc (NYSE:GXO), JD.Com Inc (NASDAQ:JD), and Wells Fargo & Co (NYSE:WFC) during the quarter. Each of these had appreciated significantly since purchasing and I considered none of them except DAVA, GDYN, and EPAM a core position at this time. DAVA, GDYN, and EPAM continue to discount multiple years of 20%+ growth and even still would be valued at >30x 2024 earnings. We are slowly trimming here despite the strong growth of the businesses.

GXO was a spin-off of XPO, and we elected to keep the XPO business because we do not perceive GXO's contract logistics business as inherently attractive. We sold JD as a result of the furor over Chinese stocks during the quarter. We had been concerned about China’s lack of respect for investor rights for some time, and Beijing has become significantly more aggressive in asserting itself of late. In addition, the legal structure Chinese companies use to come public in the U.S., a Cayman Islands shell corporation leaves American investors with an unsure path to recovering value should these companies cease to trade on U.S. exchanges. Because of the uncertainty, we exited our position in JD completely. We still love JD's long-term prospects, but we cannot estimate the legal/regulatory risk associated with these companies anymore. More broadly, we are freeing up cash for some other positions we already own which have declined in this market, and after additional review, remain attractive.

Dream Finders Homes

Dream Finders Homes Inc (NASDAQ:DFH), like Grocery Outlet below, was down over 30% since our first purchases during the first quarter of this year. Their stock price declined significantly due to a large shareholder, Boston Omaha, offloading almost 10% of the publicly-traded shares of DFH in a short period of time. This was unexpected because Boston Omaha presents itself to public markets as a patient long-term investor, like Warren Buffett. In fact, one of the two principals of Boston Omaha is directly related to the Oracle of Omaha.

The timing was curious as well because DFH announced a fairly large acquisition around the time that Boston Omaha’s share sales began. Some could interpret this pattern as a lack of confidence in the acquisition, but it is equally plausible that Boston Omaha sold DFH shares to generate cash to fund its other investments, particularly funding their recently-announced SPAC deal, leaving us an opportunity to acquire shares at an attractive price. Importantly, so far the founder and CEO of DFH has elected not to sell any of his shares, even though he is now allowed to.

The acquisition of McGuyer Homes, doing business as Coventry Homes in Texas, for $475 million is a big deal for DFH. It was funded with cash on hand and $150 million of preferred stock paying dividends at a 9% rate. DFH agreed to pay additional money to McGuyer if they achieve certain thresholds, which gives us insight into DFH’s expectations for the business, as well as earnings levels the sellers of McGuyer believe are reasonable to hit. For 2022, the earn-out threshold is $66 million. Below that amount, DFH owes the sellers nothing. If McGuyer is able to hit this threshold, then DFH is paying 7x pre-tax income for these assets in the fast-growing Austin, TX market.

The other important element to this deal is that DFH structured the transaction so that they remain an asset-light homebuilder. McGuyer’s sellers will retain $100 million in real estate inventory, and DFH has the option to purchase that inventory over the next 2 years. I have to believe that many homebuilders would be reticent to agree to such terms, so while some in the market may view this deal negatively, I believe DFH is being disciplined in pursuing this deal. We will just have to see as the future unfolds.

Given the additional earnings from the McGuyer assets, I believe that DFH is now capable of producing >$2 in earnings in 2022. Obviously, interest rates, raw material prices, labor availability, and other factors could impact their ability to deliver this result, but I think that DFH could be worth ~$30 based on 2022 earnings, nearly 100% higher than recent prices. Future growth could justify prices above $50 over the next several years.

Grocery Outlet Holdings

Grocery Outlet Holding Corp (NASDAQ:GO) stock has declined significantly, over 30%, since our initial purchase. I don’t especially enjoy sharing our failures, even short-term ones, with you. I hope by being transparent with you about both the good and the bad that I will earn your trust over time. GO’s decline was particularly surprising to me because they are a chain of grocery stores with a long runway for growth nationwide.

It seems like GO’s extremely predictable drop in sales from a pandemic-driven spike in 2020 has spooked some investors, temporarily. I am often surprised by how short-term Wall Street can be, and I believe GO’s decline represents an attractive opportunity to add to our position, which I did during the 3rd quarter. We believe the long-term returns in the mid-teens are still intact, and we think the recent decline could allow our returns to be closer to 20%+ in the short-term if our thesis for the business turns out to be correct.

Roadrunner Transportation Systems

Roadrunner Transportation Systems Inc (OTCMKTS:RRTS) stock “declined” almost 100% during the quarter. I write “declined” in quotation marks because I don’t actually believe the value of this position declined at all. There was an SEC rule change implemented during the quarter designed to protect small investors. The rule change required companies to prepare publicly available financial information in order for brokers to quote their prices. Since RRTS is owned 90% by Elliott, a prominent hedge fund, they made the decision months ago to save money by ceasing many financial reporting requirements during their turnaround. As a result, the brokers where your accounts reside will not quote a price for our shares.

We believe RRTS will emerge back onto the public markets in due course, but for now they are essentially a private company. We will have to wait an indefinite period of time to learn what happens to our investment. My initial thesis still remains valid that RRTS is turning around its LTL business to become a profitable competitor alongside XPO and ODFL. With that said, Elliot has a reputation for having “sharp elbows” and it is within the realm of possibility that our very small investment into RRTS could become worthless at some point. I will update you when there is progress on this company.

New Portfolio Activity

We didn’t add any new positions this quarter, as we have been researching a number of positions. We currently see many opportunities to increase concentration in our existing portfolio, but that is not to say that we won’t invest in new opportunities when it makes sense. We are, however, trying to consciously focus more of our portfolio on our best ideas.

Conclusion

Thank you for your confidence in me. It is humbling that some of the people I care most about in this world have trusted me to grow their hard-earned wealth. Investing entails risks, sometimes difficult to foresee before they occur, and I heavily weigh the many hours of work that went into creating the wealth in the first place against the risks I assume in making any given investment. While it can seem tempting to act when things are not going our way, and there will be times when things are really not going our way, patience and emotional stability are probably the two most important investment attributes.

Without these, the best analytical prowess is wasted on the next new shiny thing, and in the worst of times, the highly analytical investor without the emotional stability to withstand adversity will not see things through. In fairness, my own direct experiences in the investment world are limited to the years after the Great Financial Crisis. My only experiences with market adversity have been relatively brief, and the market has always climbed back relatively quickly.

Please prepare yourself now for those inevitable times in any person’s investing life when the unthinkable occurs and it has profound financial consequences on all of us. That time will happen at some point, and the more we prepare ourselves emotionally now, the better we will be able to endure the disappointment of losses in our portfolio and continue to invest. We face an opposite challenge today: the market is making a lot of us who invest look pretty smart. I try to continue pushing the portfolio forward during these times but with a deep (if vicarious) appreciation for the potential to sustain abrupt and significant losses. We will be tested, and I look forward to doing my best to help you navigate those times with patience and equanimity.

Until January,

Argosy Investors