Strubel Investment Management’s commentary for the month of September 2021, discussing the financial trouble of Evergrande Property Services Group Ltd (HKG:6666).

Q2 2021 hedge fund letters, conferences and more

Dear Investors,

I like to write newsletters when there is actually something worthwhile to discuss. Over the past few months, there have been few to no new developments in the stock market worth discussion. But lately we finally have some news worthy events.

We are still seeing the same slow re-opening as the world deals with the delta variant of COVID and vaccinations increase. The global supply chain issues are all still present. Inflation readings are still high, driven by both supply chain disruptions and the lingering effect of stimulus-driven demand.

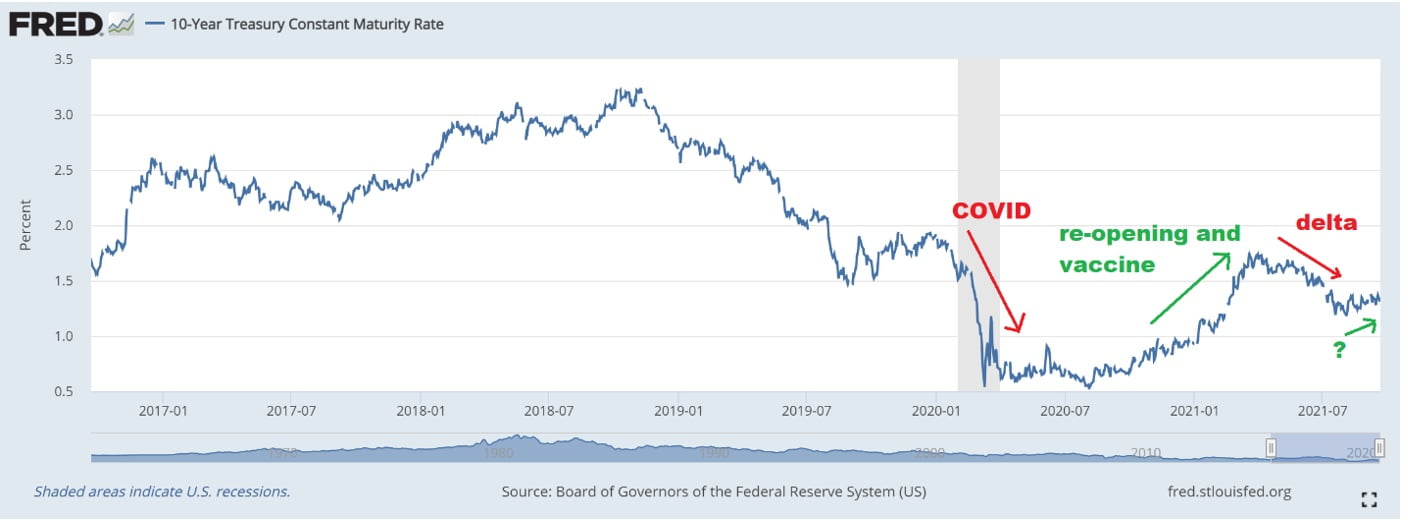

Interest Rates Are Creeping Up

One thing that has changed is we are now starting to see interest rates creep up. The chart below shows the interest rate of the 10-year treasury note. Prior to COVID, rates were around 2-3%. When COVID hit, rates dropped to .5%. As optimism built about a vaccine and re-openings began, rates climbed back to near their pre-COVID levels. Then pessimism over the new delta variant brought them back down.

For clients who were buying bonds, I’ve advised and continue to advise them to stay with shorter term bonds as we wait for rates get back to pre-COVID levels. (Short-term bonds are not as sensitive to interest rate increases.) Every pandemic in history has ended, so I think it’s prudent to believe the COVID pandemic will end as well. (COVID might be with us in some form, but the global commerce-altering effects will end.)

Evergrande's Financial Trouble

The only other new development in the markets right now is the financial trouble of a large Chinese real estate developer, Evergrande. To give you an idea of the size of the company, it is reported to employ over 120,000 people, has real estate projects in over 170 Chinese cities, and may rank as 122 in the Fortune Global 500 list, if its financials are accurate.

We have always tried to maintain as little exposure to China as possible for many reasons. First, the Chinese economy is run for the benefit of the Chinese. There is no reason to think that you (or me) as an outside Western investor will be treated on par with Communist party insiders. Many of the Chinese companies listed in the US stock markets have turned out to be frauds. The scale of the fraud ranged from simply inflating various financial metrics to completely fabricated and fake companies. Additionally, for most Chinese companies listed in the US, investors are not actually owning any of the company itself. You are actually part owner of a legal entity (called a VIE) that has a contractual agreement with the actual operating company. How likely is it that Chinese courts will enforce the agreement if something happens? Finally, the investment landscape can change on a dime if the Communist party or the Premier decides on a new policy. Changes to things like tutoring and ESL services and videogaming have led to some Chinese stocks dropping by 50%, 60%, 70%, or even 80% or more because of a sudden policy change by party leaders.

I don’t live in China. I don’t have any inside sources in China. I’m not a high ranking member (or member at all) of the Chinese Communist Party. I can’t read Chinese. I don’t know Chinese accounting standards, so I don’t have knowledge to add about the Evergrande situation. The only thing I will say is that it’s been obvious for a long time that the Chinese property market has problems. (There are some completely empty cities in China.) We know the Chinese financial system is not tightly integrated into global financial systems. Given that and our continued emphasis on minimizing exposure to China, there is no reason for clients to worry about any major spillover effects from Evergrande.