Introduction – Hedging Your Portfolio

Q2 2021 hedge fund letters, conferences and more

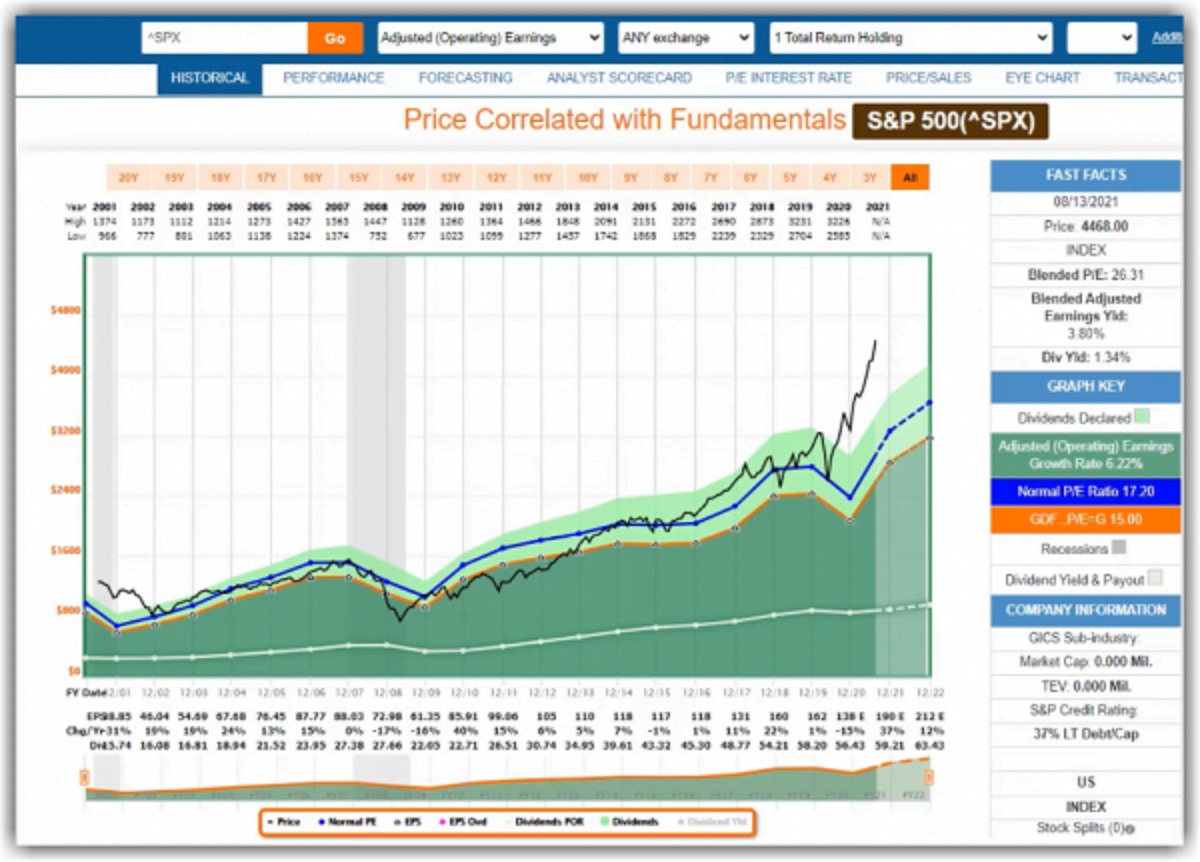

Hedging your portfolio from the pending market crash. The overall stock market is currently significantly overvalued. However, not all stocks are overvalued. Therefore, there are good companies at attractive valuations to be found. But most importantly, all bull markets eventually end with a bear market, and the market’s current long-running bull market is no exception. Of course, the opposite is always true, all bear markets end with a bull market. But the good news is that bear markets tend to be short in duration, while bull markets last for considerably longer periods of time. But the one we are in is one of the longest on record, but like all bull markets will inevitably come to an end.

Since investors know this either by knowledge or intuition, there is a strong desire for people to want to hedge their portfolio against the market collapse. From my long experience, the problem with hedges are that they rarely work as expected. Short-term price volatility is simply too unpredictable. Nevertheless, there are ways that prudent and intelligent investors can protect themselves from market crashes. In this video I will cover 6 that I consider to be the best and most important.

Portfolio

6 Ways to Hedge Your Portfolio:

- Number 1: always exercise the discipline to only invest in a stock when it offers a margin of safety.

- Number 2: invest in the business and not the stock.

- Number 3: invest for the long-term and avoid knee-jerk reactions to short-term price volatility.

- Number 4: if retired or risk-averse, invest in dividend paying stocks.

- Number 5: engage in constant due diligence and monitoring of the fundamentals.

- Number 6: diversify properly but not too much or too little.

In this video I will review PepsiCo (NASDAQ:PEP), Oracle (NYSE:ORCL), Genworth Financial (NYSE:GNW), 3M Co (NYSE:MMM), Omnicom Group (NYSE:OMC), Boston Beer Co (NYSE:SAM), Metlife (NYSE:MET), Walgreens Boots Alliance (NASDAQ:WBA), Carmax (NYSE:KMX), Brunswick Corp (NYSE:BC), Viacombs Inc (NASDAQ:VIAC), Stanley Black & Decker (NYSE:SWK)

FAST Graphs Analyze Out Loud Video

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long ORCL, MMM, OMC, WBZ, SWK at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Article by F.A.S.T. Graphs