The third bitcoin halving event occurred on Monday, and now, the stage is set for another dramatic increase in the bitcoin price. The bitcoin halving event also coincides with unprecedented quantitative easing from the world’s central banks, and bitcoin’s correlation with equities spiked this week.

Q1 2020 hedge fund letters, conferences and more

When the bitcoin price is cut in half

A bitcoin halving event occurs when the reward miners get for verifying a new block of bitcoin via number crunching on their powerful computers is cut in half. Such events occur about every four years or 210,000 blocks. This time around, the reward fell from 12.5 bitcoins to 6.25 bitcoins.

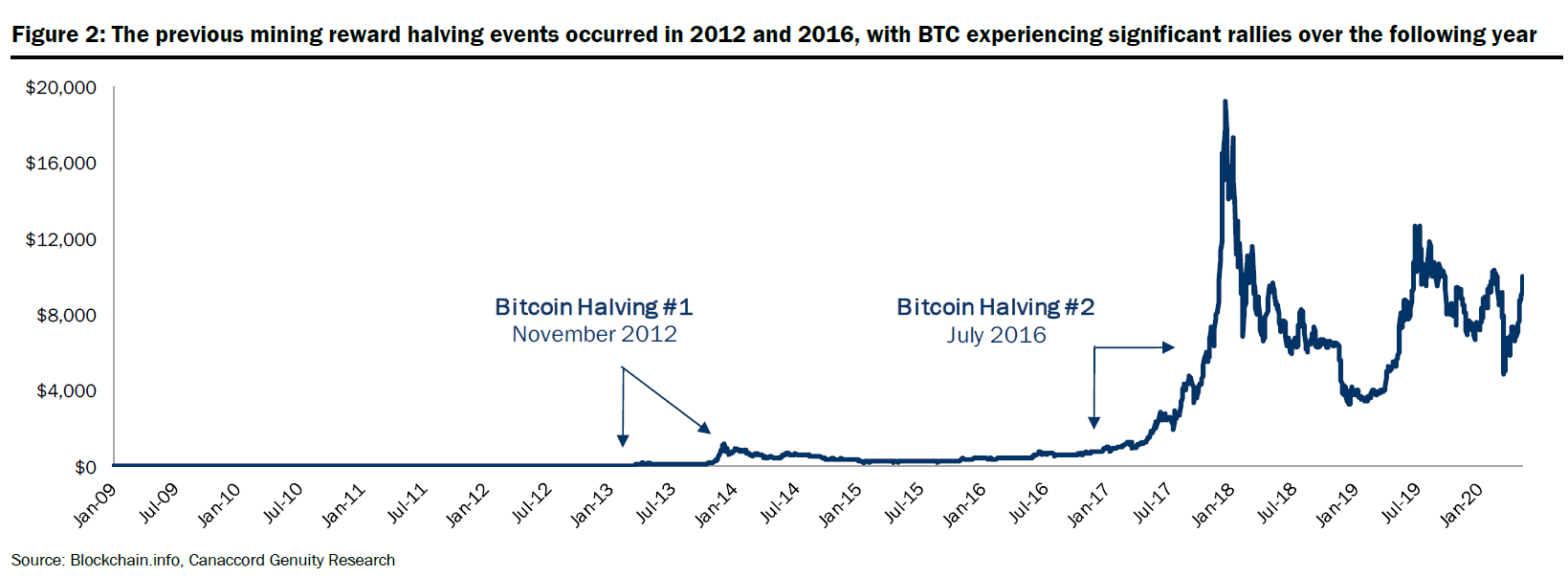

Canaccord Genuity analyst Michael Graham said in a note this week that each of the last bitcoin halving events preceded historic rallies by about a year. The bitcoin price climbed by about 10,000% in 2014 and 3,000% in 2017.

Graham explained some of the theories surrounding bitcoin halving events. He said one theory suggests the bitcoin price should adjust to mining costs, which basically double when the reward is cut in half. Another theory suggests that cutting the mining reward in half tightens supply, thus increasing the bitcoin price. Although that was true years ago when mining rewards were very large compared to the amount of outstanding bitcoin, Graham feels it is less of a valid theory today because the annual mining reward amounts to about 4% of the outstanding bitcoin.

Bitcoin halving event occurs with QE

This year's bitcoin halving event is unique because the tightening of the bitcoin supply comes alongside massive amounts of monetary easing around the globe. The world's central banks are printing trillions of dollars in money to deal with the economic impact of the coronavirus.

Uncertainty peaked in early March, and the spread between spot gold prices and futures prices widened because of problems with delivery of physical gold caused by the pandemic. Graham said that highlighted the problems of having a physical safe-haven asset and increases bitcoin's value proposition as a sort of digital gold.

While spot gold prices struggled, bitcoin rallied, climbing by about 40% over the month before this latest halving event.

Bitcoin correlation with equities spikes

Bitcoin prices rallied 43% to start the year, rising above $10,000. It was the second time the cryptocurrency breached that mark since the bull market in late 2017. The bitcoin price retreated to about $9,000 in late February, and then the coronavirus started spreading around the world in early March.

At that time, the selloff in global equities accelerated, and the bitcoin price plunged 50% in a week before bottom around $4,000 in mid-March. At that time, bitcoin's correlation with the S&P 500 jumped to the highest level in years. The bitcoin price rallied 150% from the March lows back to about $10,000. However, it continues to struggle to break out above that psychological level. This past weekend, the bitcoin price tumbled 15% back to $8,500. Today it's trading at around $9,100.