Saber Capital Management letter to investors for the first quarter ended March 31, 2019.

Dear Investment Partner:

As you know, Saber Capital Management is in the midst of a transition to managing money through a partnership structure instead of separate accounts. This is the first letter I’m sending to you as partners in our fund, and I wanted to use it to outline my reasoning for why I decided to make this important change. But first, I wanted to make some comments on last year’s performance, our recent results, and discuss our portfolio.

Q1 hedge fund letters, conference, scoops etc

Results and General Commentary

The fund’s performance was underwhelming in 2018, finishing the year down 8.09%, net of all expenses. This underperformed the S&P 500, which was down 4.38% for the year. There were no fees earned in 2018, since the General Partner only earns a fee if the fund earns more than 6% per year from the previous high water mark.

2018 was the first year of underperformance since 2014, and it was Saber’s first down year. I want to make it clear that unfortunately, this will not be our last underperforming year, nor will it be our last down year. This type of year should be expected from time to time, and in some ways a downturn should be a welcome opportunity for two reasons:

First, we own stock in high quality companies that are generating significant amounts of excess free cash flow, and most of them are using a portion of that cash to buy back their own shares. Buybacks, when done at attractive prices, are an excellent, tax-efficient way to increase per-share intrinsic value. And when stock prices are lower, these companies get to acquire those shares for less, meaning each dollar spent on buybacks creates more future value. Assuming that you are a long-term shareholder (which we all are here at Saber), lower stock prices are actually a boon for future intrinsic value at companies that consistently buy back stock.

Second, the companies that we own are durable, and recession proof. It is comforting to know that our investments, while subject to the whims of the market in the short-term, will not just survive during economic downturns, but in many cases these companies will thrive, taking share from weaker competitors and thereby increasing their earning power going forward.

So, while lower stock prices and lower portfolio values are never fun in the short-term, they should be viewed from the vantage point of a rational, long-term business owner. This viewpoint puts little to no emphasis on the current share price, and much more emphasis on the long-term prospects for the businesses. And this viewpoint, in the context of our current portfolio, is quite good.

All of this said, I want to be clear that I am not immune to feeling disappointed when our portfolio has a bad year. When it comes to my own capital, I am honestly indifferent to the ups and downs in the market. I intend to be in this game for many years. On most days, I conduct my day to day research without any idea what the stock market is doing (good or bad), and while I’m usually well aware of roughly where stock prices are just through reading the paper, I don’t purposely seek out the quotes of our holdings more than once or twice a week, except for during times when I’m looking to buy more stock (like during the December downturn). However, the reality of managing money for others means that I am fully aware that this indifference to short-term price swings doesn’t always extend to all of my investors. I think my investor base is world-class, and I mean this with 100% sincerity. But I also know that regardless of how long-term oriented you are as an investor, it’s never fun to have a subpar year. And 2018 was subpar.

Interestingly, 2019 has thus far been a case-study in how fickle and how short-term Mr. Market’s emotions can be. When I say our portfolio had a subpar year, I’m of course referring to the share price performance of our companies. However, the business fundamentals of the companies we own stakes in are doing very well, and indeed are much more valuable now than they were a year ago. Eventually, share prices catch up with fundamentals, and 2019 so far has been an example of how quickly this realignment can occur. Our portfolio finished the first quarter of 2019 up 18.03% net of fees.

I’ve talked for years about how even large cap stocks can get mispriced. Apple is now 30% higher than it was when I sent my last investor note just three months ago. Despite no real fundamental changes, the market is now valuing that business at a whopping $200 billion more than it was just 12 weeks ago. I outlined my thoughts on Apple’s valuation in the last investor note in January, saying that at the-then stock price of $156, the company was trading at around 12.5 times free cash flow, excluding the excess cash. The company returned $86 billion to shareholders in the previous year, which meant that the stock was carrying a total yield of 11.5% (buybacks plus dividends). Despite its 30% rise since then, it still remains very attractively priced considering how great the business is and how strong the ecosystem and the brand are.

We added significantly to our Apple position in early January when the stock fell to yearly lows after announcing that it was cutting expectations for the upcoming quarter. The reaction in the stock price at that time, and its subsequent 40% rise since then is a great example of how extreme sentiment can be and how far stock prices can wander away from the intrinsic value of the underlying business. There are plenty of opportunities to buy undervalued stocks of even the most followed companies in the world at certain times.

Other large caps in our portfolio have seen similar swings, including two of our largest holdings: Facebook and Tencent, which have seen their shares rise by 40% and 50% respectively from their late 2018 lows less than six months ago.

The fund added to all three stocks in late December when sentiment seemed to be significantly negative. At the end of the first quarter, Apple, Facebook, and Tencent represented 30%, 22%, and 14% of the fund’s net assets. The fund owned smaller positions in 8 other stocks, collectively representing 24% of the fund’s assets. I will discuss these positions in more detail if/when they become a more meaningful part of the portfolio over time. The remaining 9% of the fund was in cash at quarter-end.

I’ve written about all three of our major holdings in detail in the past and I’ve also discussed why sometimes even the largest stocks can become significantly undervalued. Here are two recent writings that outline my thoughts on the investment case for each of them:

- Apple, Tencent, and General Market Commentary

I intend to continue hunting for value, both in small-caps, large-caps, and everything in between. Thankfully, we need not know more than most market participants in order to have an edge in the stock market. Our edge is not in knowing more than the market, it’s in behaving more rational.

Performance History

Saber Capital Management, LLC is the General Partner to our partnership, Saber Investment Fund, LP. The fund has been operating with the General Partner’s capital since January 1st, 2014, and the fund began managing outside capital in August of 2018. Prior to 2018, Saber Capital managed all of its outside capital using separate accounts. This fund was the only fund that Saber Capital has ever managed outside of the separate accounts. The fund had slightly different levels of portfolio concentration at certain times, but the investment approach and security selection were consistent with the way Saber has managed all of its assets under management since 2014.

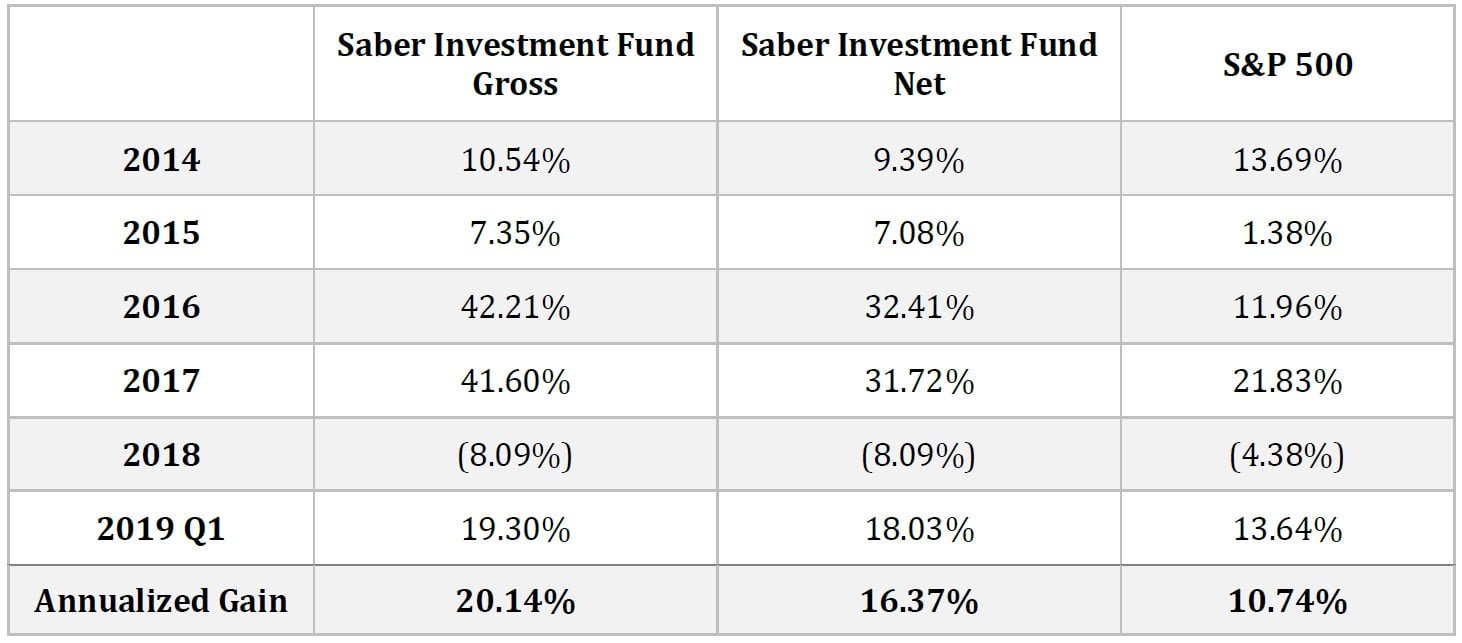

Below is a summary of Saber Investment Fund’s actual results going back to inception, which was the beginning of 2014. The gross returns are the fund’s actual returns, and the net returns are the results a full fee-paying limited partner would have achieved if they invested in the fund at inception (see the Spicer Jeffries performance examination report for more performance details):

Despite a mediocre 2018, the fund’s long-term results have been satisfactory thus far. Saber’s number one goal as an investment firm is to provide great results for our current investors, not to become the largest fund. I certainly have a desire to grow our firm, but my focus is firmly on improving my craft in an effort to achieve great results over time. I define a great result as one that meaningfully exceeds the S&P 500 over rolling five-year periods. Some years, like 2018, will underperform the market, but over the long-run, I need to be able to beat the market by a comfortable margin, net of fees and net of taxes, for your investment in Saber Investment Fund to make sense for you. This applies to me personally as well, as my wife and I are limited partners in the fund as well and have virtually all of our net worth invested alongside you. Our opportunity cost as investors in the fund is the return we could achieve without any real expense by investing in a Vanguard S&P 500 index fund. That is my main competitor, and it is a difficult one to beat. And it will prove to be even more difficult as the years go on and as – I’m thinking optimistically here – our fund grows larger.

Investor Communication

Regarding communication, you will receive quarterly statements via email directly from the third party administrator (Liccar & Company), a “fund fact” sheet from me with performance data and more information on our portfolio, as well as both a mid-year and a year-end investor letter that will outline more of my thoughts on our specific investments. You will also receive occasional updates in between those two semi-annual letters when I have something I’d like to convey. In addition, I expect to continue writing relatively often on my blog/website at www.sabercapitalmgt.com.

Many of you are familiar with my blog called Base Hit Investing. This blog will soon be merged into my firm’s website at www.sabercapitalmgt.com. I have subscribed each of your emails to this site so that you’ll receive an email notification when I post an updated note to this site. Again, these updates will be the same kind of writing I’ve been posting for years at Base Hit Investing; they will now just live under the firm’s website.

I’ve always loved to write. The learning process is advanced through four main activities: reading, listening, speaking, and writing. Knowledge accumulation and comprehension can be focused on any one of those four, and I try to involve all four into my day-to-day work flow, but I strongly believe that writing is – for me – one of the most valuable ways to improve my understanding of a particular subject, which makes it an important pillar of my investment process.

Fund Service Providers

Saber’s internal operations team will be growing in the coming years, as I expect a few new faces to help me with the day-to-day business (“non-investing”) tasks that have to get done, but in addition, the fund’s third party service providers handle many of these types of tasks and have thus far done an excellent job.

Liccar & Co. will likely provide most of the investor communication that does not come from me directly. Spicer Jeffries performs the annual audit, and I can provide this report to any partner who is interested, but Liccar will provide most of the updates that will most interest you (the value of your investment in the fund).

Liccar does the fund’s administration work, which includes onboarding new investors, handling associated paperwork, bookkeeping, and quarterly investor statements. Liccar calculates the fund’s net asset value each month, and also sends the investor statements that provide each partner’s capital account value each quarter. Maureen Murphy is Director of Fund Administration at Liccar. She has done an excellent job for me and the partnership, and she is always available to answer questions you might have regarding your investment in the fund, including helping you add money to the fund, make a withdrawal, or other related matters. She can be reached at [email protected], or +1-312-922-6600 ext. 104.

Liccar also does the fund’s tax work, and so each spring you will receive a K-1 directly from Liccar. Partners who invested in the fund during 2018 have received a draft of the K-1, which should be finalized shortly. I apologize that this was not completed in time to meet the April 15th deadline for personal tax filings. This is the fund’s first tax return with new investors, which creates some modest one-time setup issues that took some extra time, and there was also some one-time complexity due to this being the first tax year under the new tax law. Going forward, I expect the fund’s tax return to be completed by early March, and I expect to have the K-1’s out to you a few weeks prior to Tax Day.

Transition from Separate Accounts to a Fund

I thought it would be helpful to recap my motivation for making the switch to a fund structure. I’ve conveyed these thoughts to each of you for the most part, but I wanted to share some notes I sent to separate account clients earlier this year as a summary for why I made this decision. I started Saber Capital Management nearly six years ago as a business to manage capital through separate accounts. Since then, the business has grown to the point where it now makes sense to manage money inside of a partnership structure.

There are pros and cons to the separate account approach, but generally speaking, from the standpoint of the investment manager, it is a low cost way to manage money, especially when the business is just starting out. Separate accounts don’t require auditors, partnership tax returns, or third party administrators. However, the lower overhead does come with two drawbacks, one which is somewhat minor and one which is significant.

So, I made the decision to change to a fund structure for these two reasons:

First, it is simpler to manage money in one vehicle than in many different separate accounts. At the end of 2018, Saber Capital was managing over 80 different client accounts, and while the technology allows me to fairly easily manage these accounts using one strategy, it is still logistically easier to manage capital in one vehicle, especially given the fact that the third-party administrator and accounting firm handles much of the back office work such as onboarding new investors, calculating the fund’s net asset value, distributing the quarterly statements, helping coordinate the audit each year, and preparing financial statements.

The second reason is really the main reason for my decision to transition from separate accounts to a fund structure: taxes. We were all paying higher taxes inside of separate accounts than we would have been had we been using the same exact investment strategy inside of a partnership. Saber manages $24 million currently, and at this level the benefit of lower costs using separate accounts has been far more than offset by higher taxes.

Your Tax Benefit

The new tax law changed the rules regarding the deductibility of management fees. So, within a fund, the client doesn't pay tax on the gross return, he or she will pay tax on the net return. In a separate account, the client will pay tax on the gross return. This can have a meaningful tax drag.

Let’s look at a simplified example. Assume someone is a high-income earner whose marginal tax rate, including state income tax, is around 43%. Let’s also assume this client has invested $250,000 in a separate account and pays an annual performance fee of 20% of the account’s profits. Now, let’s further assume that the account shows a gain of 20% one year (a $50,000 gain). In this case, the performance fee would equal $10,000 (20% of the $50,000 gain).

In a separate account, the client can no longer deduct the $10,000 fee. In a fund structure, the performance fee is technically not a fee, but an allocation from the LP's account to the GP's account, and that allocation is not taxable to the LP. The bottom line is the client would save over $4,000 in this particular year. Obviously, for larger accounts the savings could be multiples of this amount.

The tax drag is made worse in the event that the account is fully invested, and a small amount of securities have to be sold in order to satisfy the performance fee. In a fund, no securities need to be sold, and thus no tax liability is incurred when fully invested. The performance allocation is simply shifted from the LP to the GP, making it a much more tax efficient transaction for both parties.

In my opinion, it no longer makes sense from a tax perspective to manage money inside of separate accounts, especially for higher income earning individuals.

My Tax Benefit

It should be made clear that while the tax savings are not trivial for you as the investors, they are even more significant for my firm as the general partner, and thus for me personally as the investment manager. In separate accounts, Saber’s performance fees flow through to me as earned income and are therefore taxed at ordinary income tax rates. But in a partnership, the performance fees are technically called a “performance allocation”, and depending on the length of the investment holding, these gains are often taxed at capital gains tax rates. The difference in tax rates is meaningful. The highest tax rate for ordinary income is currently 37%, compared to the capital gains rate of 23.8% (this includes the ACA’s 3.8% Medicare surtax). So, when Saber’s portfolio has a strong year, the higher tax rate on the performance fee means a significantly higher tax bill for me.

The higher taxes associated with managing separate accounts were not significant when I started Saber Capital, especially considering the costs associated with running a fund. But at Saber’s current level of assets, the benefit of lower costs using separate accounts has been far more than offset by much higher taxes.

The tax benefits on my end were the largest factor in my decision to make this transition, but after careful consideration, I do think it’s a win-win for everyone (I wouldn’t have made the decision had I thought it would be even a slight net-negative for investors).

Fee Structure

To further that last point, I strongly believe the fee structure that the fund will use is significantly more attractive for investors.

As mentioned above, the fee structure for our fund is modeled after the partnership that Warren Buffett ran in the 1950’s, prior to taking over Berkshire Hathaway. Investors in our fund will pay:

- No management fee

- A performance allocation of 25% of the profits over a 6% compounding hurdle

This is a very attractive fee structure for investors. Basically, you pay nothing for performance under 6%, and you only pay significant fees if there is significant performance (for example, I earn nothing for 6% returns, 1% for 10% returns, 2% for 14% returns, etc…). But importantly, I also have to recoup losses as well as any amount below 6% per year hurdle rate.

Compounding Hurdle Rate

I think this last point is critical, as many funds use a hurdle rate, but very few funds have a hurdle rate that actually compounds. What this fee structure means is that your capital must earn 6% per year (compounded) from the most recent yearly high water mark before any performance compensation is paid. So not only do losses need to be recouped before fees begin accruing, but any deficit under 6% annualized returns have to be recouped as well. The high water mark is compounding at 6% per year.

For example, if you start with $100,000 on January 1st, your capital account must reach $106,000 by December 31st before any fees are earned. If the account ends the year at $110,000, there will be a $1,000 performance fee earned (25% of the balance over $106,000). This is straightforward.

However, instead of a gain in that first year, let’s assume the account dropped 10% to $90,000. Since the account didn’t end the year over $106,000 (the 6% hurdle), there is no fee. But in addition, the account needs to recoup not only the $10,000 loss, but now needs to exceed $112,360 (6% over $106,000). Let’s assume in that second year, the account goes from $90,000 to $110,000, a 22% gain for the year. There would be no performance fee earned for the second straight year because the account was still below the $112,360 threshold. In the third year, this hurdle compounds another 6% to $119,102, and so on.

So, to summarize, the fee structure is very simple: your money must be growing at 6% per year from the previous high water mark for me to collect any compensation. Investors keep 100% of the profits up to 6%, and the profits over 6% get split: 75% to the limited partners; 25% to my firm as the general partner.

Summary

I’m excited to have Saber Investment Fund open to outside investors, and I want to thank you for the trust you’ve placed in me as your investment manager. Many of you have been invested with me for a number of years, and it has been a real privilege to manage your capital. Please reach out to me with any questions on anything in this letter, or anything at all.

Your Partner,

John Huber

Managing Member

Saber Capital Management, LLC

This article first appeared on ValueWalk Premium