From Stanphyl Capital’s May 2019 letter to investors.

For May 2019 the fund was up approximately 14.4% net of all fees and expenses. By way of comparison, the S&P 500 was down approximately 6.4% while the Russell 2000 was down approximately 7.8%. Year-to-date 2019 the fund is up approximately 32.5% while the S&P 500 is up approximately 10.7% and the Russell 2000 is up approximately 9.3%. Since inception on June 1, 2011 the fund is up approximately 117.9% net while the S&P 500 is up approximately 142.1% and the Russell 2000 is up approximately 93.0%. Since inception the fund has compounded at approximately 10.2% net annually vs 11.7% for the S&P 500 and 8.6% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends.) As always, investors will receive the fund’s exact performance figures from its outside administrator within a week or two and please note that individual partners’ returns will vary in accordance with their high-water marks.

Yes, Tesla’s stock price finally seems to be collapsing in a manner commensurate with “reality” and we’ll get to that in a moment, but first please indulge my desire to bloviate on the macro…

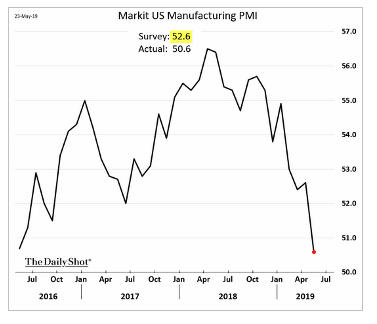

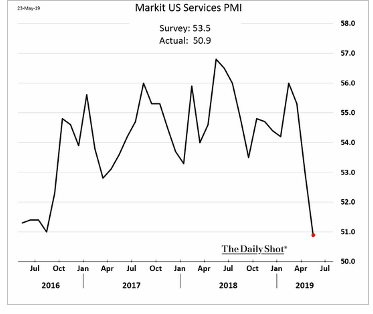

I continue to believe we’re in a bear market. The U.S. economic slowdown is in its early stages…

…and rail traffic (a terrific real-time economic indicator) is a disaster. Meanwhile global manufacturing and trade are an evolving disaster while U.S. loan demand is at the lowest level since the financial crisis. Although these problems are exacerbated by Trump’s tariffs, they’re not caused by them; rather, the Fed’s balance sheet contraction, lack of European QE and drastic reduction in Japanese QE combined with record levels of debt are allowing the deflation of the economic and asset bubbles those money-printing policies created. And as for the “Fed put” on which many bulls rely, we’re a long way from QE4; in fact the Fed is still removing approximately $50 billion a month from its balance sheet and will continue doing so through September. Meanwhile, real short-term U.S. interest rates are positive for the first time in over a decade and there will be a long time-lag before there’s any economic effect from the possible rate cuts the market anticipates for later this year.

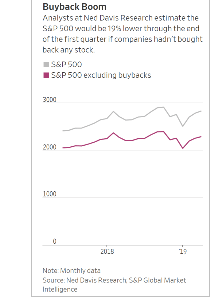

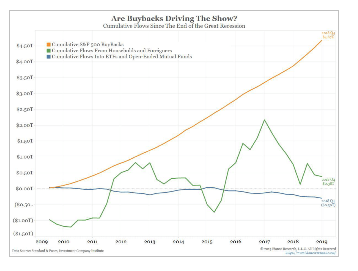

As for U.S. stocks, below are a couple of fascinating charts on corporate stock buybacks, showing how much of the S&P 500’s rise can be attributed to them. Remember that corporations tend to buy back their stock at the highs when everything’s great, then stop buying to “conserve cash” when the economy slows and they go into “cash conservation mode.” So when a recession hits and the largest buyers in recent times disappear, look out below!

Seeking the most overvalued of all stock indices, we thus remain short the Russell 2000 (IWM), which has a trailing twelve-month GAAP PE ratio of around 36 and 35% of its constituents losing money.

Elsewhere in the fund’s short positions…

We remain short stock and call options in Tesla, Inc. (TSLA), which I consider to be the biggest single stock bubble in this whole bubble market. The core points of our Tesla short thesis are:

-

Tesla has no electric vehicle “moat” of any kind; i.e., nothing meaningfully proprietary in terms of design or technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

-

Tesla is now a “busted growth story”; demand for its existing models has peaked and it will have to raise billions of dollars to produce new ones.

-

Tesla is losing a ton of money with a terrible balance sheet while suddenly confronting massive competition in every aspect of its business

-

Elon Musk is extremely untrustworthy.

Early in May $TSLA did an ugly convertible debt and equity deal to plug a hole in a very leaky bucket, netting approximately $2.3 billion which—on the back of my envelope—means it will still be completely out of cash by year-end, and thus will have raise more money in Q3 with its back against the wall on terms that are even uglier. In fact, fewer than three weeks after the financing, one of Tesla’s lead sell-side analysts held a conference call and generally agreed with me.

Why all this ugliness? Well, in April Tesla reported a disastrous Q1, with a GAAP loss of $702 million (over $900 million excluding regulatory credit sales) and just 63,000 vehicles delivered, down 30% sequentially from Q4 of 2018. Model 3 sales were down 17% despite the initial, backlog-filling sales into Europe and China, while sales of the much higher-margin S&X were down an astounding 52%, and this all happened despite massive price cuts on every model as the quarter progressed.

Of course this didn’t stop Tesla’s Q1 earnings press release from blatantly lying about Q2 guidance, claiming it will sell 90-100,000 cars when in fact it’s likely to fall far short of that figure– my current best guess (subject to revision during June) is for around 78,000 deliveries at much lower ASPs than Q1’s. Although this would be more cars than were sold in Q1, that will be due only to massive price slashing and thus will come with no incremental profit; thus, excluding one-time items Q2’s loss will be roughly as bad as Q1’s, with the only wild card being how much deferred Autopilot revenue Tesla recognizes (which could reduce that loss on a non-cash basis).

To put these quarterly delivery numbers in perspective, Tesla is valued similarly to Ford and yet Ford sells approximately 1,500,000 vehicles per quarter. Does anyone really care if in Q2 Ford delivers 1,485,000 cars or 1,515,000? In other words, at this point a 15,000-unit quarterly variance for Tesla should be considered meaningless. The party’s over, folks. With no profitable growth, massive ongoing losses and tens of billions of dollars in debt and purchase obligations, the equity in Tesla will prove worthless, either quickly or—following a series of increasingly ugly capital raises—slowly.

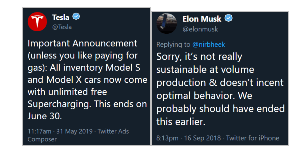

Here’s a “Twitter nutshell” of how desperate Tesla now is to generate money-losing revenue: its offer today of “unlimited free Supercharging” vs. Musk’s tweet last September when the program was “ended forever”:

And for those of you looking for a resumption of growth from Tesla’s (supposedly) upcoming Model Y, by the time it’s available in late 2020/early2021 (if Tesla is still in business), it will face superior competition from the much nicer Audi Q4 e-tron, BMW iX3, Mercedes EQC and Volvo XC40, while less expensive and available now are the excellent new all-electric Hyundai Kona and Kia Niro, extremely well reviewed small crossovers with an EPA range of 258 miles for the Hyundai and 238 miles for the Kia, at prices of under $30,000 inclusive of the $7500 U.S. tax credit.

Meanwhile, Tesla has the most executive departures (and semi-departures!) I’ve ever seen from any company, a dubious achievement that continues in full-force– here’s the astounding full list. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both). Could the business (if not the stock price) be saved in its present form if he left? Nope, it’s too late. Even if Musk steps down in favor of someone who knows what he’s doing, emerging competitive factors (outlined in great detail below) and Tesla’s balance sheet make the company too late to “fix” without major financial and operational restructuring.

In May Consumer Reports completely eviscerated the safety of Tesla’s so-called “Autopilot” system while its annual auto reliability survey ranks Tesla 27th out of 28 brands. Meanwhile the number of lawsuits of all types against Tesla continues to escalate– there are now over 600!

So here is Tesla’s competition in cars (note: these links are regularly updated)…

THE NEW ALL-ELECTRIC JAGUAR IPACE

Jaguar XJ sedan to be replaced by an electric version in 2020

Audi e-tron electric SUV is available now

Audi e-tron Sportback comes late 2019

AUDI E-TRON GT FIRST DRIVE: LOOK OUT, TESLA (available 2020)

Audi’s Q4 e-tron previews entry-level EV for 2021

Porsche Electric Taycan Launches Late 2019

Porsche Taycan Cross Turismo to launch in 2020 after Taycan Sedan

The next generation of the Porsche Macan will be electric

VW Names 2020 Fully Electric Hatchback ID 3, starts taking deposits in Europe

VW Group to launch 70 pure electric cars over the next decade

Mercedes EQC Electric SUV Available Mid-to-Late 2019

Mercedes to launch more than 10 all-electric models by 2022

258-Mile Hyundai Kona electric is available now for under $40,000

239-Mile Kia Niro EV is Available Now For Under $40,000

Kia Soul (available mid-2019) EV’s Range Jumps to 243 Miles

Kia Europe to have six pure electric models by 2022

Chevrolet Bolt Offers 238 Miles On A Single Charge

GM is transforming Cadillac into an electric brand

Nissan LEAF e+ with 226-mile range is available now

Nissan Leaf-based SUV coming in 2020

The 2020 Volvo Polestar 2 Is Priced to Beat Tesla’s Best-Selling Model 3

Volvo XC40 full-electric variant to debut later this year

BMW iX3 electric crossover goes on sale in 2020

New BMW i4: Tesla-rivalling coupe seen winter testing

BMW to have 25 electrified models by 2025

Ford’s Mustang-inspired electric performance SUV arrives in 2020 with >300-mile range

Ford Accelerates Its Electric-Vehicle Push With $500 Million Stake in Rivian

Rivian (electric pick-up truck maker) Announces $700M Investment Round Led By Amazon

Peugeot 208 to electrify Europe’s small-car market

Toyota, Mazda, Denso create company to roll out electric cars beginning 2019

Toyota to market over 10 battery EV models in early 2020s

New Renault Zoe to feature 400km range

Renault aims to remain EV leader in Europe

Infiniti will go mostly electric by 2021

DS 3 Crossback will give PSA’s upscale brand an electric boost

ALL-ELECTRIC MINI COOPER COMING IN 2019

Smart Will Electrify Its Entire Line-up By 2020

SEAT will launch 6 electric and hybrid models and develop a new platform for electric vehicles

Opel sees electric Corsa as key EV entry

Opel/Vauxhall will launch electric SUV and van in 2020

2019 Skoda e-Citigo confirmed as brand’s first all-electric model

Skoda planning range of hot all-electric eRS models

New Citroen C4 Cactus to be first electrified Citroen in 2020

MG E-Motion confirms new EV sports car on the way by 2020

Fiat Chrysler bets on electrification for Alfa, Jeep and Maserati

Rolls-Royce is preparing electric Phantom for 2022

Honda will offer full-EV or hybrid tech on every European model by 2025

Bentley mulls electric car to help reduce carbon footprint

Subaru to introduce all-electric vehicles by 2021

Korando will lead SsangYong’s push into electrification

Dyson electric car: new patents show mould-breaking design

Lucid Motors closes $1 billion deal with Saudi Arabia to fund electric car production

Borgward BXi7 Electric SUV Flies Under The Radar

Detroit Electric promises 3 cars in 3 years

Two new electric cars from Mahindra in India by 2019; Global Tesla rival e-car soon

Saab asset owner NEVS plans electric car production

EV startup Canoo will only sell cars on a subscription basis

And in China…

VW, China spearhead $300 billion global drive to electrify cars

Audi Q2L e-tron debuts at Auto Shanghai

Audi China to roll out 12 locally-produced models in total by 2022

BYD launches EV535, all-electric SUV

BYD Song MAX BEV version with 500km range to hit market in 2019

2019 BYD Yuan EV360 goes on sale with prices starting RMB89,900 after subsidy

Daimler & BYD launch new DENZA electric vehicle for the Chinese market

BAIC and Daimler to Build $1.9 Billion China Plant

BAIC brings EX5 Electric SUV to market

BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

Daimler to Start EQC Electric SUV Production in China in 2019

Daimler and BMW to cooperate on affordable electric car in China

BMW will develop and produce electric Mini in China

GM China raises new-energy vehicle target to 20 models through 2023

Buick Rolls Out First Electric Car for China

Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

Toyota unveils first electric SUVs at Shanghai motor show

Nio’s ES8 Electric Crossover debuts with half the Tesla Model X’s price tag

536 HP Nio ES6 Midsize Electric SUV Launches With 317-Mile Range (at 1/2 the price of Tesla X)

This is NIO’s Tesla Model 3 and Polestar 2 rival

GAC NIO unveils new NEV offshoot dubbed HYCAN

GAC NE to roll out 12 new models for Aion series, including solar-powered models

Ford ramps up electric vehicle push in China

Jaguar Land Rover’s Chinese arm invests £800m in EV production

SAIC building factory in China for EVs from Roewe and MG

Renault and Brilliance Automotive to build 3 new electric light commercial vehicles for China

Honda launches new all-electric Everus VE-1 for ~$25,000 in China

Honda to roll out over 20 electric models in China by 2025

Geely all-new BEV sedan Jihe A starts at RMB150,000

Geely unveils GE11 compact BEV

New Geely Emgrand GSe crossover has EV range up to 400km

Geely launches new electric car brand ‘Geometry’

Changan New Energy to launch three NEV platforms by 2020

Mazda and Changan Auto join hands on electric vehicles

Xpeng Motors G3 Electric SUV Launches in China

Xpeng Motors premiers the P7 intelligent electric coupe

WM Motors/Weltmeister EX5 Electric SUV Launched On The Chinese Car Market

Chery Breaks Ground on $240M EV Factory in China

Chery’s second EV plant open in Dezhou

Seres launches production SF5 sleek 684HP electric crossover with 300 miles of range

Byton M-Byte electric SUV tackles cold-weather testing, nears production

DearCC Launches ENOVATE Electric SUV

Guangzhou Auto To Launch Four New Electric Cars By 2020

Great Wall Launches New EV Brand (ORA) In China

Singulato iS6 Electric SUV Debuts With 249-Mile Range

Singulato, BAIC partner to promote smart new energy vehicles

Hongqi launches E-HS3 BEV SUV with AWD option, 390km range and 0-100kh/h in 5.9 seconds

FAW (Hongqi) to roll out 15 electric models by 2025

JAC Motors releases new product planning, including many NEVs

Seat to make purely electric cars with JAC VW in China

ICONIQ to build electric cars in Zhaoqing with total investment of RMB 16 billion

Quianu Motor aims to grab share of US electric vehicle market

Hozon Kicks Off Mass Production With All-Electric Neta N01

EV maker Bordrin skips flash, keeps real-car focus

Aiways U5 long-range electric SUV

All-electric NEVS 9-3 sedans (nee Saab) being built in China

Youxia Motors raises $1.25 billion to start 2019 EV production

CHJ Automotive buys Lifan for shortcut to EV production

Infiniti to launch Chinese-built EV in 2022

Zotye Auto to roll out 10 plus NEV models by 2020

Wanxiang Gets China Electric Vehicle Permit to Make Karma Cars

Qoros Auto’s new owner plans to be an EV power

JMC (Jianling Motor Corp.) Starts New EV Brand In China

Thunder Power Chinese EV manufacturer clinches deal with Belgian investment fund

Leapmotor raises RMB2.5 billion for Series A round to build electric cars

Continental, Didi sign deal on developing EVs for China

Here’s Tesla’s competition in autonomous driving…

Consumer Reports finds Tesla’s Navigate on Autopilot is far less competent than a human driver

Navigant Ranks Tesla Last Among Automakers & Suppliers for Automated Driving

Tesla has a self-driving strategy other companies abandoned years ago

Waymo and Lyft partner to scale self-driving robotaxi service in Phoenix

Jaguar and Waymo announce an electric, fully autonomous car

Nissan-Renault alliance to tie up with Waymo on self-driving cars

Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

Ford and VW Discuss Autonomous Car Team-Up at a $4 Billion Valuation

Volkswagen Group and Aurora Innovation Announce Strategic Collaboration On Self-Driving Cars

VW taps Baidu’s Apollo platform to develop self-driving cars in China

An Overview of Audi Piloted Driving

Daimler, BMW deepen cooperation with self-driving venture

Mercedes plans advanced self-driving tech for next S class

Daimler’s heavy trucks start self-driving some of the way

Volvo, Nvidia expand autonomous driving collaboration

Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

Intel’s Mobileye has 2 million cars (VW, BMW & Nissan) on roads building HD maps

Nissan and Mobileye to generate, share, and utilize vision data for crowdsourced mapping

Magna joins the BMW Group, Intel and Mobileye platform as an Integrator for AVs

Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

Volvo, Baidu to co-develop EVs with Level 4 autonomy for China

BYD partners with Huawei for autonomous driving

Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks

Byton cooperating with Aurora on autonomous vehicles

ZF autonomous EV venture names first customer

Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

Groupe PSA’s safe and intuitive autonomous car tested by the general public

Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

Self-driving startup Momenta ready to launch fully automated driving solution in Q3 2019

JD.com Delivers on Self-Driving Electric Trucks

NAVYA Unveils First Fully Autonomous Taxi

Fujitsu and HERE to partner on advanced mobility services and autonomous driving

Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

First Look Inside Zoox’s Autonomous Taxi

Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s Tesla’s competition in car batteries…

LG Chem targets electric car battery sales of $6.3 billion in 2020

LG Chem to build $1.8 bln EV battery plant in China

Samsung SDI Unveils Innovative Battery Products at 2018 Detroit Motor Show

SK Innovation to boost EV battery production capacity more than tenfold by 2022

New Toshiba EV Battery Allows 320km Charge in 6 Minutes

Daimler starts building electric car batteries in Tuscaloosa – one of 8 battery factories

Panasonic Opens New Automotive Lithium-Ion Battery Factory in Dalian, China

Panasonic forms battery partnership with Toyota

CATL’s Chinese battery factory will be bigger than Tesla’s Gigafactory

CATL to set up battery cell manufacturing in Germany

BYD to quadruple car battery output with lithium site plants

GM inaugurates battery assembly plant in Shanghai

Volkswagen building battery cell plant in Germany

VW Wants to One-Up Tesla With a Next-Generation Battery

Honda Partners on General Motors’ Next Gen Battery Development

Energy Absolute Plots Asian Project Rivaling Musk’s Gigafactory

France’s Saft plans production of next-gen lithium ion batteries from 2020

Northvolt making ground on Gigafactory in Sweden

FREYR AS to build a 32 GWh battery facility in Norway

Chinese Battery Maker to Open Factory Next to Swedish EV Plant

Sokon aims to be global provider of battery, electric motor, electric control systems

BMW Group invests 200 million euros in Battery Cell Competence Centre

BMW Brilliance Automotive opens battery factory in Shenyang

BMW announces partnership with solid-state battery company

Toyota promises auto battery ‘game-changer’

Hyundai Motor developing solid-state EV batteries

Wanxiang is playing to win, even if it takes generations

UK provides millions to help build more electric vehicle batteries

Rimac is going to mass produce batteries and electric motors for OEMs

Elon Musk Has A New Battery Rival (Romeo Power) Packed With His Ex-Employees

Evergrande acquires Cenat battery production

Bracing for EV shift, NGK Spark Plug ignites all solid-state battery quest

ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

Here’s Tesla’s competition in storage batteries…

Panasonic

LG

AES + Siemens (Fluence)

ABB

Saft

EnerSys

sonnenBatterie (acquired by Shell)

Sharp

Kreisel

Leclanche

UET

ENGIE

Bluestorage

Clean Energy Storage Inc.

Younicos

Powin Energy

Powervault

Schmid

Ecoult

Natron Energy

And here’s Tesla’s competition in charging networks…

EVgo Installing First 350 kW Ultra Fast Public Charging Station In The US

Tritium’s First 350-kW DC Fast Chargers Coming To U.S.

Porsche plans network of 500 fast chargers for U.S.

ChargePoint To Equip Mercedes Dealerships With 150kw Charging Stations For EQC

Recargo Ultrafast West Coast Charging

GM and Bechtel plan to build thousands of electric car charging stations across the US

BMW, Daimler, Ford, VW, Audi & Porsche form IONITY European 350kw Charging Network

E.ON to have 10,000 150KW TO 350KW EV charging points across Europe by 2020

Enel kicks off the E-VIA FLEX-E project for the installation of European ultra-fast charging stations

Europe’s Allego “Ultra E” ultra-fast charging network now operational

Allego & Fortum Launch MEGA-E High Power Charging network for Europe’s Metropolitan areas

ChargePoint Secures $240 Million in Additional Funding; $500 million raised in total

UK’s Podpoint installing 150kW EV rapid chargers this year; 350kW by 2020

UK National Grid plans 350kW EV charge point network

BP Chargemaster’s 150kW UK network to allow 30min electric car charging at 50 sites this year

Fastned building 150kw-350kw chargers in Europe

Deutsche Telekom to build electric car charging network in Germany

ABB powers e-mobility with launch of first 150-350 kW high power charger

Shell buys European electric vehicle charging pioneer NewMotion

Total planning EV charging points at its French stations

VW Is Setting Up Electric Car Charging Stations in China

Yet despite all that deep-pocketed competition, perhaps you want to buy shares of Tesla because you believe in its management team. Really???

Elon Musk Settles SEC Fraud Charges

Elon Musk, June 2009: “Tesla will cross over into profitability next month”

Tesla SEC Correspondence Shows A Pattern Of Inaccurate, Incomplete & Misleading Disclosures

Tesla: Check Your Full Self-Driving Snake Oil Expiration Date

As Musk Hyped and Happy-Talked Investors, Tesla Kept Quiet About a Year-Long SEC Probe

The Truth Is Catching Up With Tesla

With Misleading Messages And Customer NDAs, Tesla Performs Stealth Recall

Who You Gonna Believe? Elon Musk’s Words Or Your Own Lying Eyes?

How Tesla and Elon Musk Exaggerated Safety Claims About Autopilot and Cars

When Is Enough Enough With Elon Musk?

Musk Talked Merger With SolarCity CEO Before Tesla Stock Sale

Tesla Continues To Mislead Consumers

Tesla Misses The Point With Fortune Autopilot Story

Tesla Timeline Shows Musk’s Morality Is Highly Convenient

Tesla Scares Customers With Worthless NDAs, The Daily Kanban Talks To Lawyers

Tesla: Contrary To The Official Story, Elon Musk Is Selling To Keep Cash

Tesla: O, What A Tangled Web We Weave When First We Practice To Deceive

I Put 20 Refundable Deposits On The Tesla Model 3

Tesla: A Failure To Communicate

Elon Musk Appears To Have Misled Investors On Tesla’s Most Recent Conference Call

Understanding Tesla’s Potemkin Swap Station

Tesla’s Amazing Powerwall Reservations

So in summary, Tesla is losing a massive amount of money even before it faces a huge onslaught of competition (and things will only get worse once it does), while its market cap nearly equals that of Ford and is around 70% of GM’s despite selling fewer than 300,000 cars a year while Ford and GM make billions of dollars selling 6 million and 8.4 million vehicles respectively. Thus this cash-burning Musk vanity project is worth vastly less than its nearly $45 billion enterprise value and—thanks to roughly $34 billion in debt, purchase and lease obligations—may eventually be worth “zero.”

Elsewhere among our short positions…

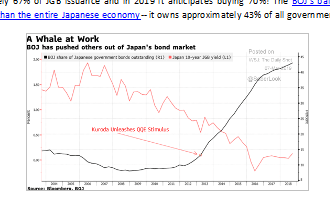

We continue (since late 2012) to hold a short position in the Japanese yen via the Proshares UltraShort Yen ETF (ticker: YCS) as Japan (despite having substantially tapered its QE) continues to print over 3% of its monetary base per year after nearly quadrupling that base since early 2013. In 2018 the BOJ bought approximately 67% of JGB issuance and in 2019 it anticipates buying 70%! The BOJ’s balance sheet is now larger than the entire Japanese economy— it owns approximately 43% of all government debt…

…and nearly 78% (!) of the country’s ETFs by market value.

Just the interest on Japan’s debt consumes 8.9% of its 2019 budget despite the fact that it pays a blended rate of less than 1%. What happens when Japan gets the 2% inflation it’s looking for and those rates average, say, 3%? Interest on the debt alone would consume nearly 27% of the budget and Japan would have to default! But on the way to that 3% rate the BOJ will try to cap those rates by printing increasingly larger amounts of money to buy more of that debt, thereby sending the yen into its death spiral.

When we first entered this position USD/JPY was around 79; it’s currently in the 108s and long-term I think it’s headed a lot higher—ultimately back to the 250s of the 1980s or perhaps even the 300s of the ‘70s before a default and reset occur.

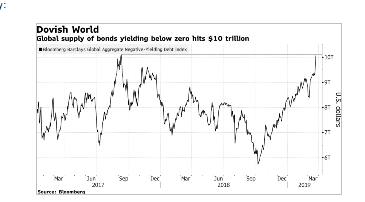

We continue to hold a short position in the Vanguard Total International Bond ETF (ticker: BNDX), comprised of dollar-hedged non-US investment grade debt (over 80% government) with a ridiculously low “SEC yield” of 0.77% at an average effective maturity of 9.5 years. As I’ve written since putting on this position in July 2016, I believe this ETF is a great way to short what may be the biggest asset bubble in history, as with Eurozone inflation now printing 1.7% annually these are long-term bonds with significantly negative real yields. In mid-December the ECB halted quantitative easing, thereby removing the biggest source of support for those bonds’ bubble prices. Currently the net borrow cost for BNDX provides us with a positive rebate of nearly 2% a year (more than covering the yield we pay out) and as I see around 5% potential downside to this position (vs. our basis, plus the cost of carry) vs. at least 20% (unlevered) upside, I think it’s a terrific place to sit and wait for the inevitable denouement of this insanity:

We also have relatively small short positions in Netflix (NFLX) due to its egregious valuation within the context of increasing cash burn and competition (particularly from Disney), Square (SQ) due to its egregious valuation and a stock-dumping CEO who so effusively praises (and enables) Elon Musk that I suspect he’s equally untrustworthy, Carvana (CVNA) due to a laughable business model with escalating losses and a founder with a sketchy past who’s dumping stock every two days and Wayfair, an egregiously bad on-line furniture business with yet another stock-dumping CEO.

And now for the fund’s long positions…

We continue to own Aviat Networks, Inc. (ticker: AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in May reported a lousy Q3 for FY 2019 (with revenue down 13% year-over-year), but guided to a very strong Q4 (ending June 30th) with revenue and income up substantially year-over-year. For all of FY 2019 the company cut guidance to $246-$251 million of revenue (a $4 million reduction from previous guidance) and non-GAAP EBITDA of $11-$12 million (a $1 million reduction), and because of its approximately $330 million of U.S. NOLs, $10 million of U.S. tax credit carryforwards, $214 million in foreign NOLs and $2 million of foreign tax credit carryforwards, Aviat’s income will be tax-free for many years; thus, GAAP EBITDA less capex essentially equals “earnings.” So if the non-GAAP number will be $11.5 million and we take out $1.7 million in stock comp and $6 million in capex we get $3.8 million in earnings multiplied by, say, 14 = approximately $53 million; if we then add in approximately $29 million of expected year-end net cash and divide by 5.4 million shares we get an earning-based valuation of around $15/share. However, the real play here is as a buyout candidate; Aviat’s closest pure-play competitor, Ceragon (CRNT) sells at an EV of approximately 0.6x revenue, which for AVNW (based on the low end of 2019 guidance) would be 0.6 x $246 million =$148 million + $29 million net cash = $177 million. If we value Aviat’s massive NOLs at a modest $10 million (due to change-in-control diminution in their value), the company would be worth $187 million divided by 5.4 million shares = just under $35/share.

I added a bit in May to our position in Westell Technologies Inc. (WSTL), which this month reported a terrible FY 2019 Q4, with revenue down 12.5% year-over-year and a drop in gross margin from 45.5% to 37.6% and negative free cash flow of around $1.4 million. About the only good news here is that the company ended the quarter with $25.5 million in cash and no debt, and (as gleaned from the conference call) normalized FCF burn at Q4’s revenue level is “only” around $900,000. Westell now sells at an enterprise value of only around 0.06x (i.e., 6% of) revenue, so on that metric it’s clearly dirt cheap but the business needs to stabilize and grow. On the conference call management was confident that later this year there should be enough revenue growth to cut quarterly burn to around $500,000 but “break-even” now sounds like more of a “next year” possibility. Westell also suffers from a dual share class with voting control held by descendants of the founder; however, management has often stated that the controlling family is open to merging the two share classes, and the company is so cheap on an EV-to-revenue basis that if management can’t start generating meaningful profits it seems primed for a strategic buyer to acquire it. An acquisition price of just 0.8x run-rate revenue (on an EV basis) would be around $3.70/share.

We continue to own the PowerShares DB Agriculture ETF (ticker: DBA), although I halved the position in early May when trade deal talks stalled and new tariffs on China went into effect, as part of my rationale for owning this was an imminent trade deal. The other reason we own it though hasn’t changed, and in fact has strengthened as prices continue to decline: agricultural products remain the most beaten-down sector I can find that isn’t a “buggy whip” (something on the way to obsolescence) or cyclical from a demand standpoint. If a trade deal with China is made the implications for U.S. ag products would be huge, and meanwhile the position recovered a bit in late May due to disastrous weather in the farm belt.

Thanks and regards,