Written by Jae Jun follow me on Facebook Twitter

To get this kind of information and other exclusive articles before regular readers, get on the VIP Mailing List today.

What You Will Learn

- 2017 Performance of our free value stock screens

- What is working and what isn’t

- Is value investing out of favor?

- What’s happening to the free screens going forward

2017 ended with a blast and 2018 looks to be continuing the trend.

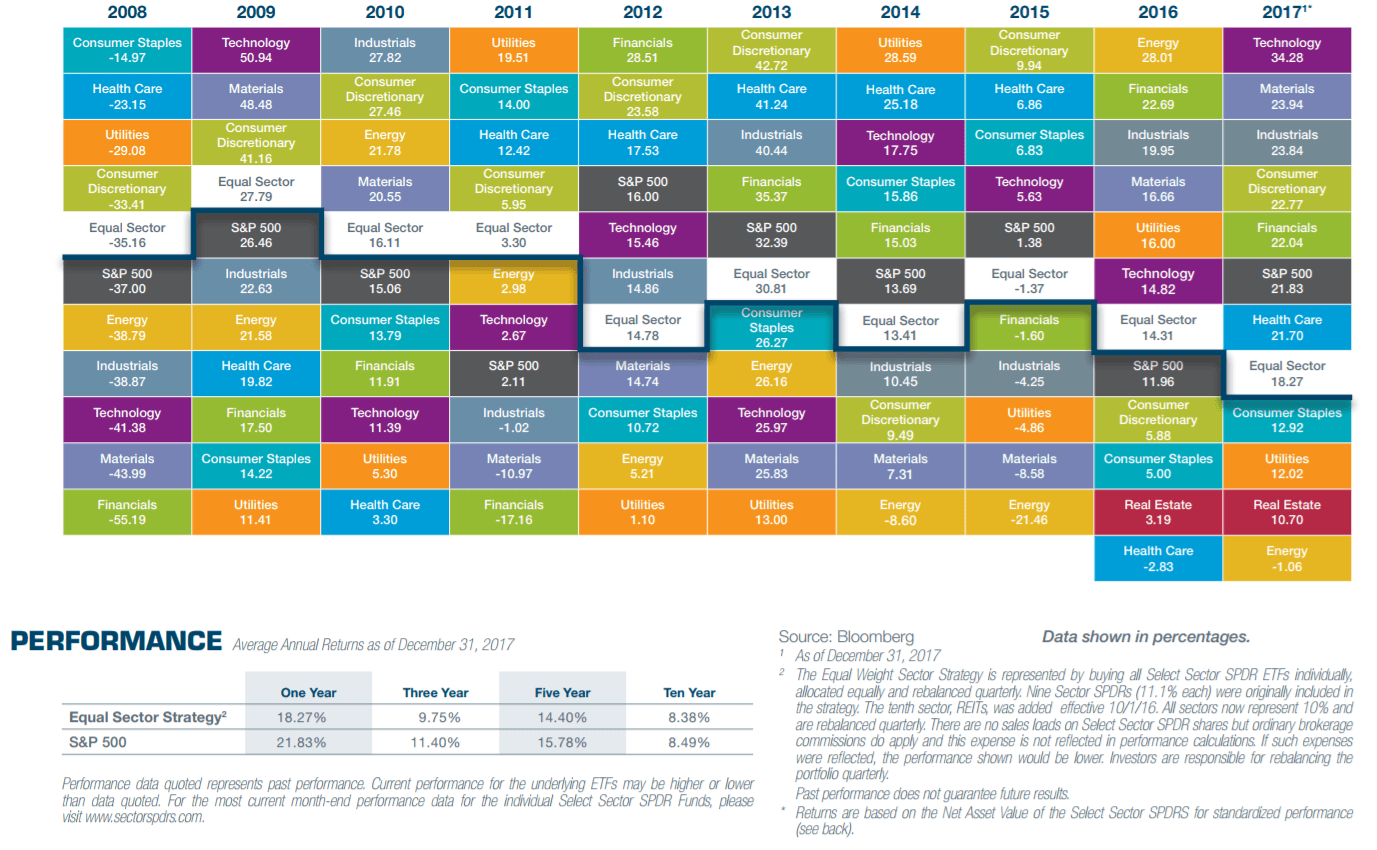

Here’s how 2017 ended across the various sectors.

What you’ll see is that over the past 10 years, no sector is at the top of the list 2 years in a row. Some come close, but sectors are constantly in and out of favor.

While the markets had another banner year, the free value screeners did not keep pace.

Of the 15 screener ideas offered, a portfolio of 20 stocks purchased at the start of the year and held for one year performed as follows.

By the year end, only the Negative Enterprise Value Screen and the NNWC screen outpaced the market.

However, a few tiny stocks really pushed the performance over the top here.

If you look at the performance of Negative Enterprise Value at the end of Q2, it was at 0.88% vs the SPY 9.34%. NNWC was even worse at -6.43%.

But Negative Enterprise Value stocks ended the year: 27.6%.

NNWC went from -6.4% to finish 25.11%.

Talk about drawdown and recovery. Still, that’s not the type of portfolio that I am interested in anymore. My goal is to limit downside. The less you lose, the more gunpowder you have to continue the effects of compounding.

Results To Date

You can view the full results directly on our Free Value Investing Stock Screener page and go through each screen yourself.

Value Investing Out of Favor?

What’s clear in the results is that none of the value strategies have beaten the market as of late.

Compare the S&P and Russell 2000’s 3Yr and 5Yr CAGR and you’ll see that most of the screens have underperformed.

Even the value investing standard of the Magic Formula has fallen to rock bottom levels.

What does this mean?

Value stocks are definitely out of favor. Like the first image above, there’s a time where value stocks are at the top, and when they are at the bottom.

Unless those value stocks has additional strong catalysts, outside of just being cheap, value stocks haven’t done much.

David Einhorn is also feeling the pinch.

Given the performance of certain stocks, we wonder if the market has adopted an alternative paradigm for calculating equity value,” he wrote. “What if equity value has nothing to do with current or future profits and instead is derived from a company’s ability to be disruptive, to provide social change, or to advance new beneficial technologies, even when doing so results in current and future economic loss?

…

The market remains very challenging for value investing strategies, as growth stocks have continued to outperform value stocks. The persistence of this dynamic leads to questions regarding whether value investing is a viable strategy – David Einhorn

Past Performance is Definitely NOT an Indicator of Future Performance

When testing this and that to look up new strategies, it’s easy to let the computer do the work and think that it will continue going forward.

To simulate a passive portfolio, I like to run tests over a 1 year period. It keeps the fees to a minimum and turnover low. Entering sell and buy orders at the end and beginning of the year for 20 stocks is harder than it seems.

But, I’ve been having a change of heart to this. More on this in a later post when I review the OSV Action Score portfolio results.

This again brings me back to the sector rotation performance.

Technology won in 2017, but which sector will reign in 2018?

Who knows.

Value investing was down in 2017. Will it come back in 2018?

This is an easier question to answer. Value investing does well when the stock market tide isn’t as high.

Unless the market gets spooked by something, I wouldn’t be surprised to see tech and growth strategies continue to yield outsized gains.

Underperforming Strategies

These screeners were created and published around 7 years ago and it’s time to kill a few. Being free and having limited time, it is in dire need of a big redo.

Don’t be surprised when the following screens are killed or put on ice until the environment favors that particular screen strategy again.

- Negative Enterprise Value: It did the best in 2017, but has lost money.

- Insider Buys: Tracking stocks that insiders buy should be doing well, but not this version.

- NNWC Increasing: Although these companies are expanding their liquid asset base, it hasn’t been an indicator of stock returns.

- Low Expectations: Stocks surrounded with pessimism should have rebounded strongly, but this screen has produced low expectations.

The following are also on the chopping block. So close to getting cut.

- NNWC: Not many stocks worth investing will show up anymore. Nearly an extinct breed. Performance won’t be realistic until there is a bigger universe of NNWC stocks.

- Magic Formula: Hate to do it to Greenblatt, but it’s underperformed 6 of the past 7 years.

- FCF Cow: I love to FCF, but the market loves earnings more. Needs an upgrade to see if it will pick back up.

Let’s see how 2018 fares and if upgrades are made to the screen, you’ll hear about it and be able to read the methodology on each of the free stock screens.

This post was first published at old school value.