In his Daily Market Notes report to investors, while commenting on wage inflation, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

Wage Inflation Could Trigger Correction

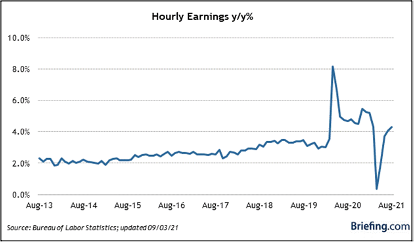

Wage inflation, in particular, is at the top of a list of things that could trigger a stock market correction of 10% or more. Wage increases are a source of major concern of corporate CFOs, who regard them as the biggest risk to future profit margins. While commodity inflation ebbs and flows, wage and services inflation are considerably more permanent – and we just saw strong evidence of this in last Friday’s employment release.

According to the Society for Human Resource Management, “Already, inflation has resulted in a nearly 2 percent pay cut from June 2020 to June 2021, despite modest gains in hourly wages, according to the U.S. Bureau of Labor Statistics.

Workers aren’t going to stand for negative wage growth and therefore it should be expected that further pay increases and cost of living adjustments will be expected going forward. These two forces might be self-correcting in the months ahead, but they matter now because both can impact corporate profits.

At present, third quarter guidance is bullish, with estimated earnings growth for the S&P 500 to be 29.8% but Q4 might be where some evidence of margin pressure starts to cut into profits, forcing companies raise prices of goods and services.

Good News Buried In The Small Print

Despite the lowball jobs total on Friday, plenty of good news is buried in the small print, like massive revisions to the previous two months. With over two million jobs created in June and July, you can be sure that the initial August estimates will be revised upward in coming months. After all, how can the Labor Department possibly count all jobs added in August just two days after the close of the month?

In addition, Hurricane Ida may have suppressed reporting of August payroll data. There are some more clues in the ADP reported last Wednesday, which counted 374,000 private payroll jobs created in August, far more than the Friday totals. ADP reported 201,000 jobs created in leisure and hospitality in August, despite the Delta variant, while the Labor Department showed no job gains in leisure and hospitality. In fact, they said bars and restaurants lost 42,000 payroll jobs in August and retailers lost 29,000 jobs!

Labor Shortage In Every Industry

Cutting through all these numbers, the obvious truth – up and down the pay ladder – is that there is an acute labor shortage in every industry now. Anyone who wants work can find a job.

In the wake of the apparently disappointing August payroll report, the Fed will have plenty of reasons to delay tapering QE at their next Federal Open Market Committee (FOMC) statement on September 22. One indication of that fact is that Treasury bond yields “spiked” after the Friday payroll report was released.

The FOMC may also cite the Covid-19 Delta variant as an excuse to “kick the can down the road” and defer any tapering announcement until December. They can also cite the fact that the economy has been unable to replace the 5.3 million jobs lost since the pandemic commenced.

However, the hawks on the FOMC are alarmed over higher inflation and they know the Fed cannot fight market rates forever. As a result, the upcoming September FOMC statement will be closely scrutinized.

In Print

Despite the digitization of nearly everything, the printed book is showing remarkable staying power. In the United States in 2020, just 23% of consumers purchased an ebook while 45% purchased a printed book. In Germany the figures were 10% and 58% respectively, according to data compiled by Statista.