Utilities Impelling Energy Transition Via Decarbonization, Renewables Capex

Q1 2021 hedge fund letters, conferences and more

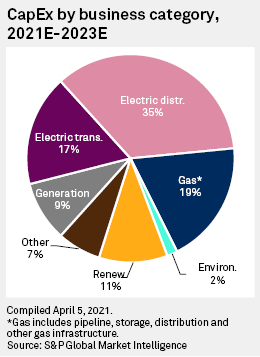

According to a new S&P Global Market Intelligence analysis, renewable energy expansion at U.S. utilities on track to eclipse prior years. The renewable energy outlook from our analysis of a sample of 47 publicly traded electric, multi- and gas utilities, demonstrates strong commitment to infrastructure spending over the next several years.

Key highlights from the new analysis include:

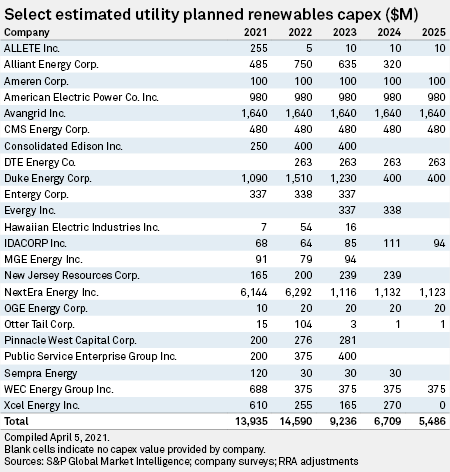

- Projected renewable energy investments are forecast to reach $13.94 billion in 2021, then rise approximately 5% in 2022 to $14.59 billion.

- Renewable energy investment opportunities in the U.S. are expected to expand for the foreseeable future. State and federal regulatory jurisdictions in the U.S. generally provide supportive pathways to recover investment in renewable generation, whereas new fossil generation development appears to be an increasingly risky endeavor, especially for utilities that seek stability and more regulatory support.

- The increasingly unfavorable outlook for the expansion of natural gas transmission and generation assets going forward, alongside a more defined opportunity in low-carbon energy, has caused diversified enterprises to firmly pivot into regulated utility investments including renewable generation.

Two company perspectives on the renewables and the low-carbon energy transition

Alliant Energy

Alliant Energy Corporation (NASDAQ:LNT) is pursuing what it calls a "cleaner energy strategy" through its Clean Energy Blueprint. Alliant has through 2020 driven down its carbon dioxide emissions by 42% from 2005 levels, via retirement of 1.1 GW of coal generation capacity thus far, according to the company's most recent investor presentation. Alliant plans to retire or fuel-switch an additional 1.3 GW of coal power by 2024, with the goal to reduce the company's overall carbon dioxide emissions by nearly 70% from 2005 levels.

Integral to its transition blueprint, Alliant has committed to a considerable increase in the contribution of renewable energy to its generation portfolio, and plans investment of nearly $2.2 billion through 2024 in renewable projects in support of its Iowa and Wisconsin utilities, Interstate Power and Light Co. and Wisconsin Power and Light Co., or IPL and WPL, respectively. Renewable spending represents 37% of the company's total capex budget of $5.9 billion planned for the four years 2021 through 2024.

CMS Energy

CMS Energy Corporation (NYSE:CMS) has planned a considerable transformation of its operations over the ensuing two decades, through retirement of its coal power plants and the replacement of the majority of its generation infrastructure with renewable sources.

Carbon emissions by 2040 are to be reduced by 90% across the company's operations, compared with 2005 levels, at company-owned power generation and its natural gas infrastructure. CMS also aims to attain by 2040 net-zero carbon emissions in-regard to its generation and purchased power, and by 2030 regarding its gas transportation and distributions resources, through emission offsets.