Arquitos Capital Management commentary for the first quarter ended March 31, 2021.

Q1 2021 hedge fund letters, conferences and more

"Reason can only speak. It is love which sings." - Joseph de Maistre

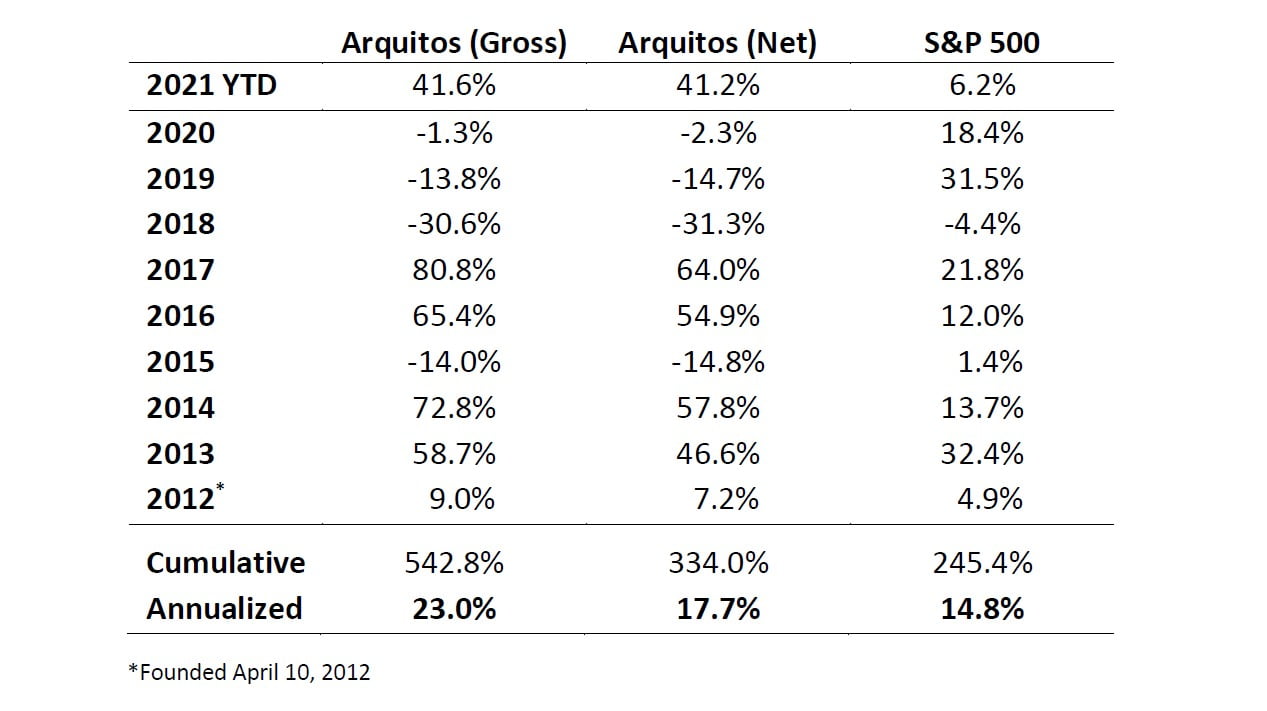

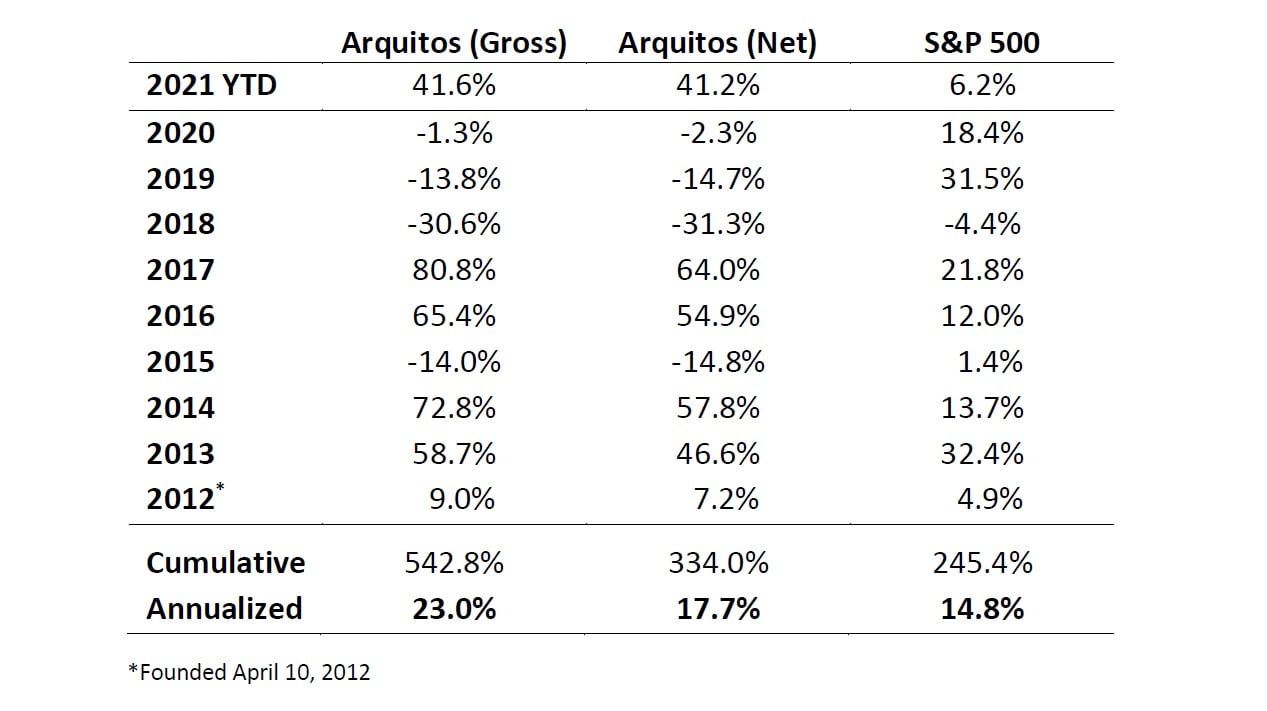

Arquitos Performance Compared to the S&P 500

Dear Partner:

Arquitos returned 41.2% net of fees in the first quarter of 2021. The fund is up approximately 81% over the last six months.

Our positions in Nam Tai Property (NYSE:NTP), Enterprise Diversified (OTCMKTS:SYTE), and ALJ Regional Holdings (NASDAQ:ALJJ) were the primary drivers of performance during the first quarter.

Nam Tai Property

I wrote about NTP in last quarter’s letter as a special situation with a hard catalyst. The story I laid out in the letter materialized and shares rose from $5.85 on December 31 to $12.33 at quarter end. An activist investor had sued NTP to reverse a private placement from last fall orchestrated by the company’s controlling shareholder. At the trial earlier this year, the court reversed the private placement and found that the controlling shareholder had initiated it in order to thwart the activist’s calls for a special meeting.

The court also set the date for a special meeting for April 26. The activist is nearly certain to win. However, a wrinkle in the situation occurred that may allow us to take a second bite at the trade. The controlling shareholder appealed the court’s decision, and the court granted a stay. The special meeting is now postponed.

To make things even more fun, most of the proceeds from the private placement have been caught up in a separate scandal. The proceeds from the now-reversed private placement will likely need to be returned to the controlling shareholder at some point. However, the court found that the logistics for that return should occur after the special meeting and those logistics should be decided by the new board.

NTP reported in their annual report that most of the private placement proceeds, approximately $150 million of the $170 million total, were invested through Credit Suisse into a supply chain management fund. This fund, almost certainly Greensill, was sold to clients by Credit Suisse as a sort of cash-equivalent vehicle. It was anything but. Credit Suisse is now liquidating that investment and it may be years until the investors in the vehicles receive a full recovery; and there is a possibility that they will realize a material loss. NTP has said they have received half of their investment back. When I spoke to NTP’s management, they told me that they do not yet know the timing for the return of their investment but that they expect a full recovery. The company’s commentary to me about why they chose to invest in Greensill was unconvincing.

New and interesting information is coming out daily, but the bottom line is that this new scandal is a continuation of many troubling decisions by NTP’s management. Of course, this is why there was an opportunity to buy into the company at an attractive valuation in the first place. The decisions of NTP’s management are what led to the shares becoming so undervalued and are what attracted the activist to the situation.

We have significantly decreased our position in NTP since the end of Q1 and will be looking for opportunities to get more heavily involved again at a lower price.

MMA Capital

We also had news from one of our other major positions, MMA Capital (NASDAQ:MMAC), that came out after the end of the quarter. MMAC was caught up in the major winter storms that occurred in Texas, and they announced that they may see losses of up to $4 per share. This caused shares to drop from $22.81 at the end of the first quarter to the $17 range. Our portfolio allocation for MMAC was down to less than 17% at the end of Q1.

We are continuing to hold our shares. Adjusted book value is around $39. Even with a $4 hit, which is likely overstated, the discount between the share price and NAV is massive. The Texas situation was a one-time black mark on the company and involved a lot of bad luck on timing. MMAC’s management has a long history of acting ethically and in the interests of shareholders, and I am confident that they will continue to do so. After all, they are all major shareholders themselves.

I expect more guidance on their capital allocation strategy going forward, as well as details on what they will do to close the discount to NAV.

Conclusion

It has been an interesting quarter, and I expect even more market-moving news to come in the portfolio over the next few months. Given the current market environment, I am continuing to be much more nimble when compared to the past few years. I am also seeing several new event-driven opportunities, so the make-up of the portfolio could change quickly.

Thank you again for your continued support. I look forward to giving you another update shortly. In the meantime, I would love to have you join us virtually at Enterprise Diversified’s annual meeting on May 27. Please visit enterprisediversified.com for more information.

Best regards,

Steven L. Kiel