The COP26 summit is just over a month out, and Pre-COP Milan just wrapped up. According to recent research from the global financial services provider, Apex Group, US PE funds and their investors that haven’t already started to take action to report and wrangle their carbon footprints need to get a move on – and fast – if they want to remain competitive in the wake of COP26, including Pre-COP, and the growing push for climate-first business goals.

Q2 2021 hedge fund letters, conferences and more

But how will regulations, both in the US and from global task forces like COP26, affect the expectations put on funds? What are investors looking for? How can funds make sure they’re reporting what’s expected – and preparing for even more?

Report Highlights

The survey of over 350 PE executives found that US funds’ carbon reporting majorly lags behind those in other parts of the world – something that will almost certainly come to hurt them as investors look for more climate-conscious funds and COP26 increases awareness of the need to take more actionable steps towards net zero. Specific US highlights include:

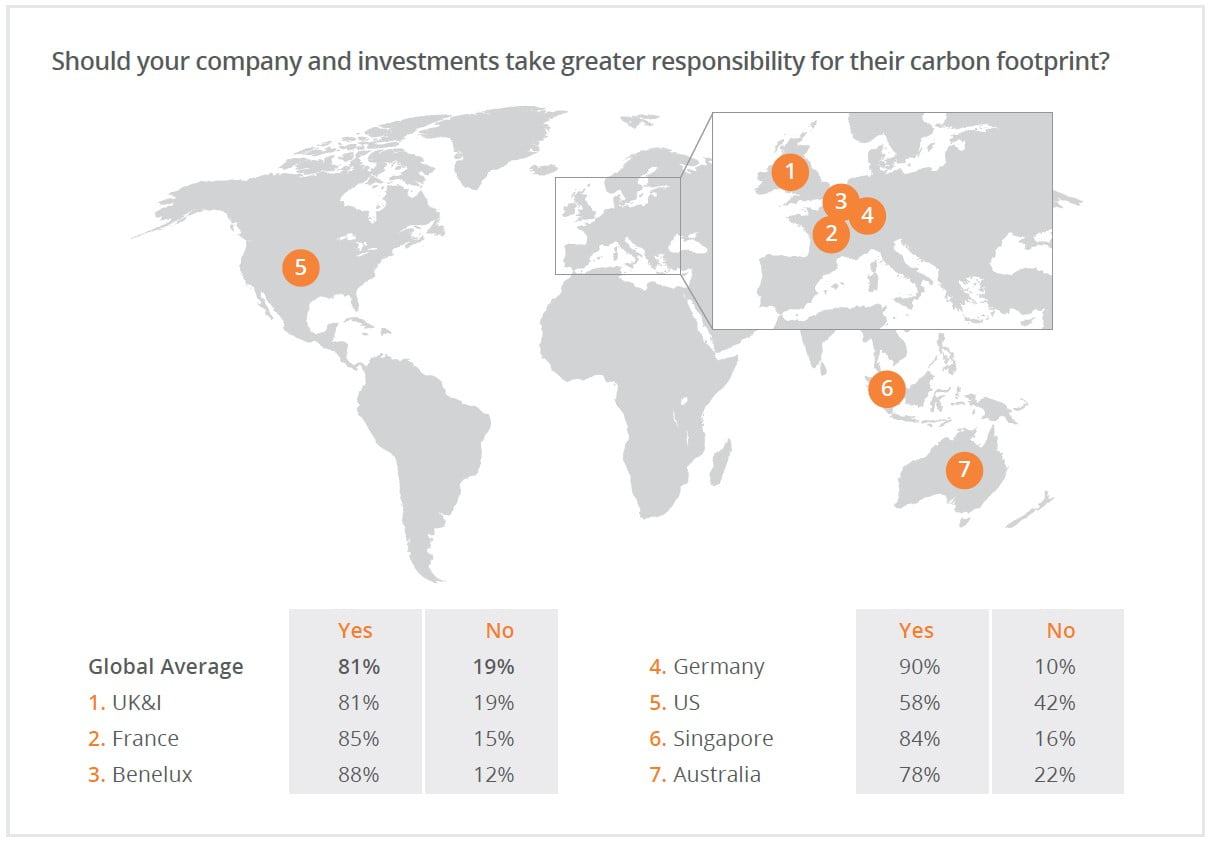

- Only 58 percent of US respondents think that their funds and portfolio companies should take greater responsibility for their carbon footprint. For comparison, over 80 percent of UK & Ireland, France, Benelux, and Germany respondents agreed on this need.

- Less than half of US respondents currently measure the footprints of their firms, suppliers or investments.

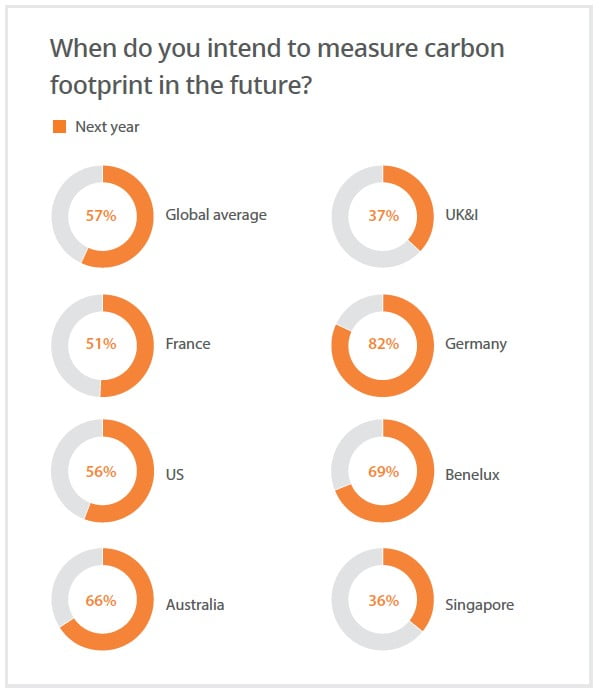

- On a more positive note, 56 percent of US respondents said they plan to measure carbon footprints in the next year – and over half have a process in motion already to be carbon neutral.

What Is Private Equity Doing In The Fight Against Climate Change?

There is little doubt that climate change is a ‘hot’ topic of discussion the world over. Young activists, NGOs and politicians have all played their part in ensuring the issue is firmly on the media agenda and at the forefront of people’s minds. Among politicians, the ratification of the Paris Agreement has made it a focal point for many governments, all pledging to play their part in keeping the mean global temperature to below 1.5ºC above pre-industrial levels.

It is becoming increasingly clear however, that more needs to be done to meet those targets, with plenty of evidence to support that. A recent report by the BBC shows that the number of days where temperatures have exceeded 50ºC (122ºF) has doubled since 1980, with the knock-on effect of that being felt in many places. US President Joe Biden, commenting on the wildfires that rocked California this summer, said it was clear those were “being supercharged by climate change”. A shocking scientific study suggests that even the Amazon rainforest is now a net contributor to warming the planet. As scientists from the independent research group Climate Action Tracker concluded: “The gap between where we want to be and where we are currently is huge.”

The financial sector has a key role in addressing these Environmental, Social and Governance (ESG) issues – not just by looking inward at its own carbon footprint, but in terms of where it directs capital flows. Pressure to invest more sustainably, into businesses which support people and planet, has been mounting for several years, and regulators are taking steps to ramp up that pressure further.

The first stage of the European Union’s Sustainable Finance Disclosure Regulation (SFDR) was introduced in March (2021), with the aim of improving disclosures among fund managers on the adverse impacts of investment decisions and on sustainability features of financial products, while stamping out so-called ‘greenwashing’ of ESG funds. A further step is to be introduced by the EU next year – the SFDR’s Regulatory Technical Standards – which will require asset managers investing in the region to produce far more comprehensive reports, with quantitative ESG metrics around their investments. It will include carbon emission data points. Regulators in the US and the UK are also now looking to push through similar rules.

But are these regulatory measures and societal pressures having an impact? Is the financial sector facing up to its responsibilities and ‘putting its money where its mouth is’ when it comes to climate change? We commissioned some global research to find out just that.

Market Research: How Is The Private Equity Market Responding?

Apex’s research, caried out by an independent research consulta ncy in September 2021, involved questioning decision-makers responsible for ESG policies and in vestments at Private Equity firms across the UK & Ireland (UK&I), France, Germany, Benelux ( Belgium, The Netherlands and Luxembourg), the US, Singapore and Australia on their approach to climate change and also how they are quantifying and reducing their emissions.

Among the 358 Private Equity leaders who took part, an overwhel ming majority globally (90%) agreed that climate change is an urgent issue for the world. Those most vocal on this were participants from Germany, where 98 percent agreed, compared to 78 percent among those based in Australia.

When it comes to accountability, four-fifths globally (81%) said their company and their portfolio companies should be taking greater responsibility for their carbon footprint. Respondents from Germany again proved to be most vocal (90%), significantly higher than their US counterparts, where only 58 percent agreed on the need.

Despite that strong recognition that the alternative investment class needs to take more responsibility, less than half of all Private Equity firms curre ntly measure their own carbon footprint (44%), or that of their suppliers (48%), and only 50 percent measure the carbon footprint of their investments.

The research however, showed some significant geographical variations. Those based in Germany (69%) and the Benelux countries (52%) are most likely to already be measuring their carbon emissions, with those in France (23%) and the US (38%) the least. German firms are also most likely to measure the carbon footprint of their suppliers (71%), almost double that of UK&I Private Equity firms (37%). However, UK&I Private Equity funds are most likely to measure the carbon footprint of their investments (58%), whilst those in Singapore the least (32%).

Making Strides With Carbon Footprints

Encouragingly, there is a greater commitment to measurement in the future, perhaps prompted by the knowledge that tighter regulations are coming. Over half (57%) of respondents globally said they intend to measure carbon footprints next year. That commitment is particularly high among German firms (82%), compared to those at the other end of the scale, in Singapore and the UK&I, which appear to be more reticent to commit to this.

Interestingly, BlackRock, announced recently that it is asking its portfolio companies to disclose their plans to achieve net-zero emissions, and is now threatening to sell its shares in the worst polluters. It’s Chief Executive, Larry Fink, in a letter to CEOs, wrote: “No issue ranks higher than climate change on our clients’ lists of priorities.”

Positive On Carbon Neutrality

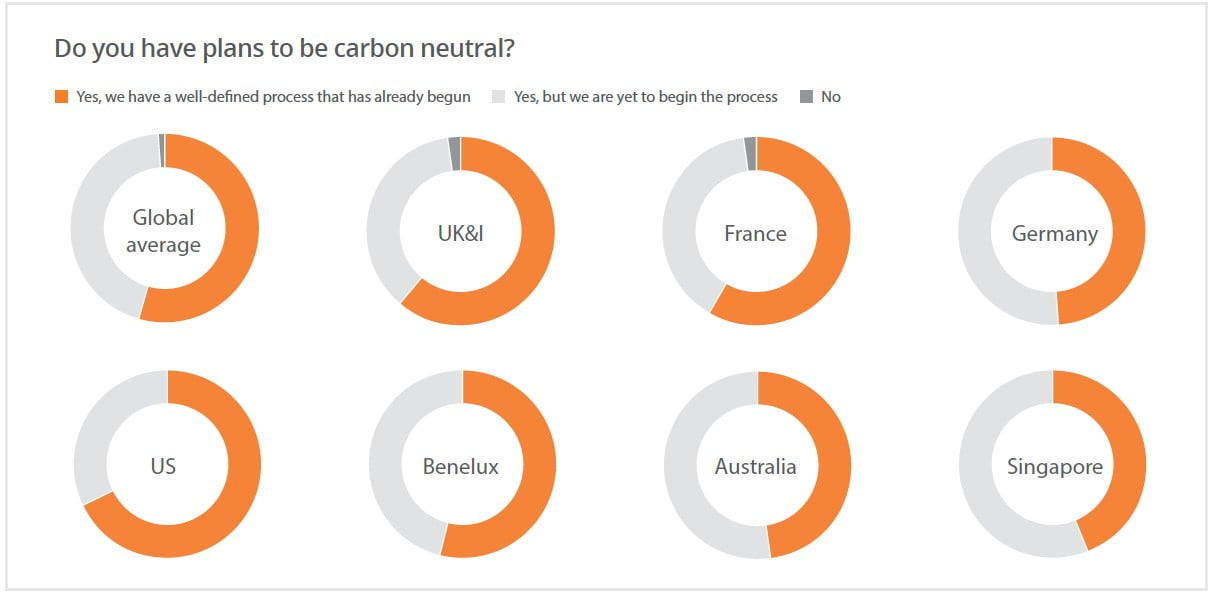

On a further positive note, carbon neutrality is seen as an ach ievable goal by nearly all the ESG decision-makers who took part in our research. Over half (55%) said they already have a welldefined process in place to be carbon neutral – with those in th e US leading the charge (68%) – and 44 percent globally saying they have aspirations to achieve carbon neutrality, but don’t have those plans underway quite yet.

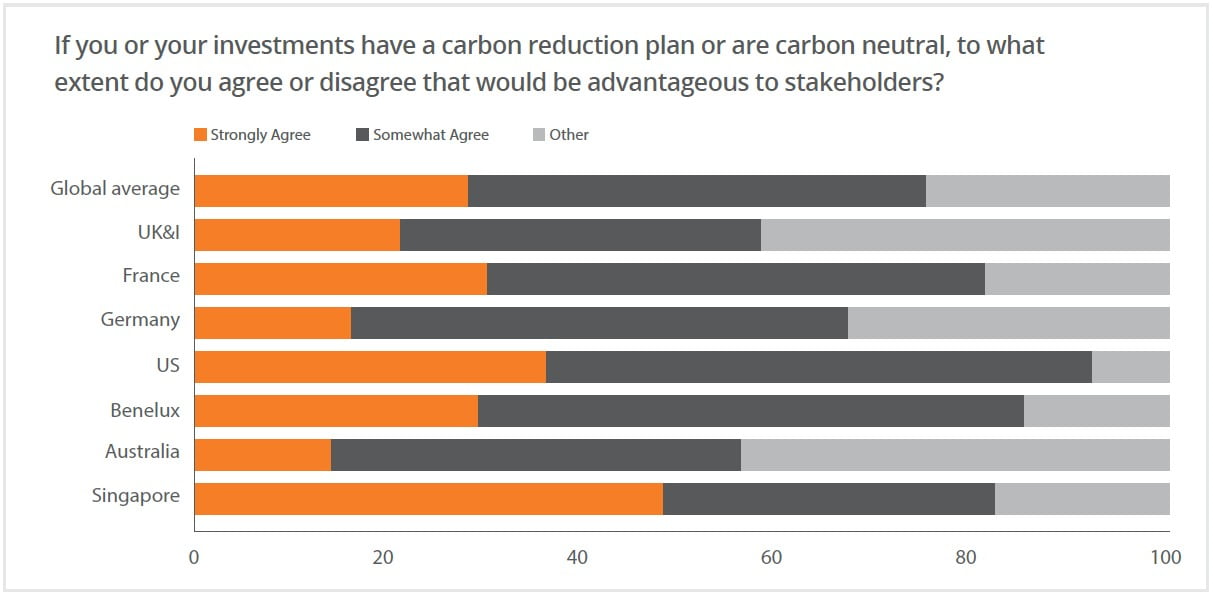

When it comes to the impact on corporate reputations, three qua rters agreed or strongly agreed (75%) that a carbon reduction plan is seen as ‘advantageous’ by key stakeholders, like their employees and clients. That figure was particularly high among U S (92%), Benelux (85%) and Singapore respondents (82%). Only 7% overall believe that a car bon reduction plan is not seen as important or beneficial among stakeholders that matter.

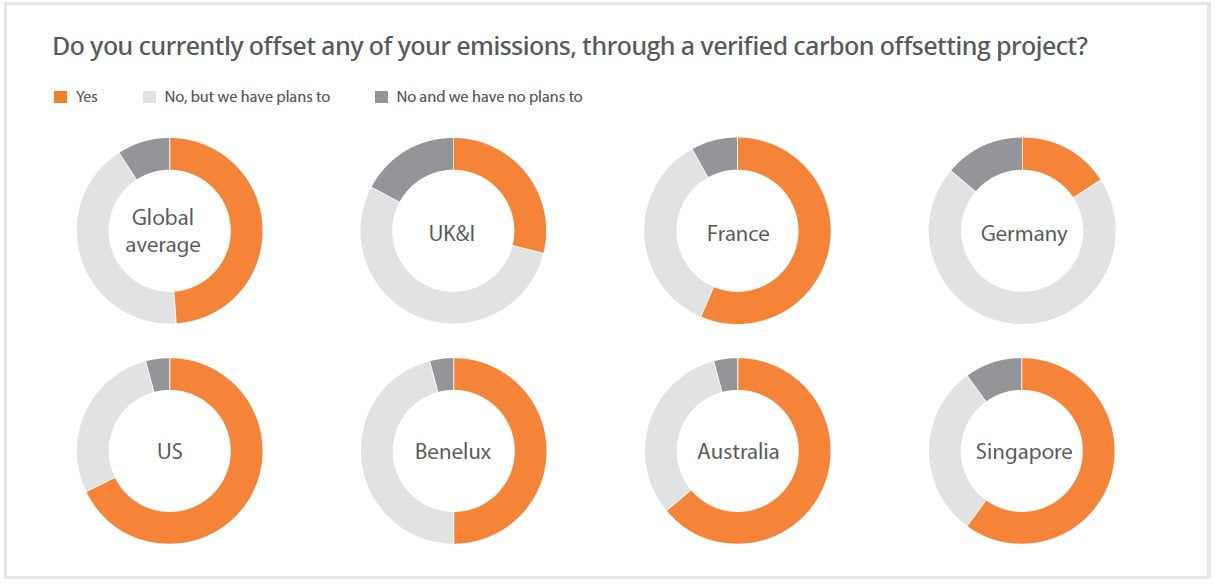

The research revealed that nearly half (49%) of Private Equity firms currently offset their emissions through a verified carbon offsetting project, with a fu rther 42 percent planning to do so in the future. Existing commitments to that is strongest in the US, Australia and Singapore; UK&I firms remain the most sceptical with 17 percent said they don’t offset their emissions and have no plans to do so.

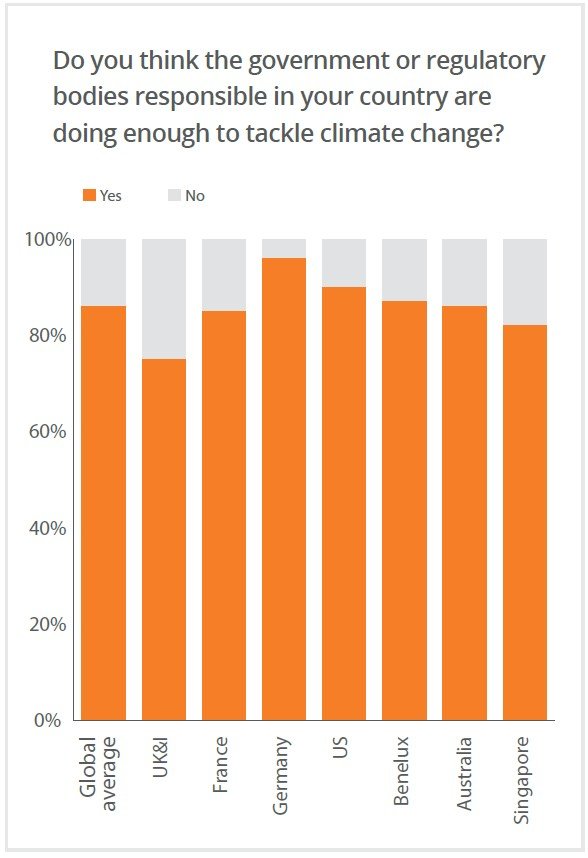

While the research focused primarily on understanding how Private Equity firms around the world are performing in terms of addressing their own carbon footprints, and that of their investments, it also asked for their views on how well climate change is being tackle from a wider perspective. The majority (86%) said they think their government or relevant local regulatory bodies are doing enough to tackle climate change. Respondents from the UK&I were most critical, with a quarter saying more needs to be done in their countries.

These findings perhaps highlight that there is a disconnect between the views of those within the financial sector and the opinions around climate change in other circles. Many scientists argue that not enough is being done, with analysis carried out by Climate Action Tacker, highlighting that only one country, Gambia, is currently taking enough action to meet the world’s aspiration of limiting global heating to 1.5C above pre-industrial levels.

Andy Pitts-Tucker, Managing Director, Apex ESG Ratings & Advisory, commenting on the findings, said: “Private Equity firms, along with the investment community, have a pivotal role in addressing climate change, not just from a moral perspective, but also from an economic one, ensuring sustainability is at the centre of any investment strategies.

“Recognition of that obligation is widespread among firms worldw ide, which is encouraging, but there appears to be a significant gap between that acknowledgmen t and their commitments to bringing about change. Less than half are measuring their own carbon footprints, and only half are measuring that of their portfolio companies.

“All firms should also remember that if they put a neutrality pl an in place, they must commit to it, and one of the first steps in the process is to conduct a carbon footprint assessment. Those who prioritise marketing over action in their carbon neutrality effo rts will increase their exposure to accusations of greenwashing.

“Having accurate and meaningful data to track and monitor ESG p erformance levels is central to creating an action plan that ensures Private Equity firms can pl ay their part in building a more sustainable future.”