New research has revealed the banks and brokers that have been hit with the biggest financial penalties and the most commonly fined offences – with one bank racking up $82bn in fines.

Q2 2021 hedge fund letters, conferences and more

The study by BrokerChooser analysed fines imposed upon companies in the financial services sector from 2000 to the present day to reveal the most heavily fined banks and financial offences.

Table of Contents

Show

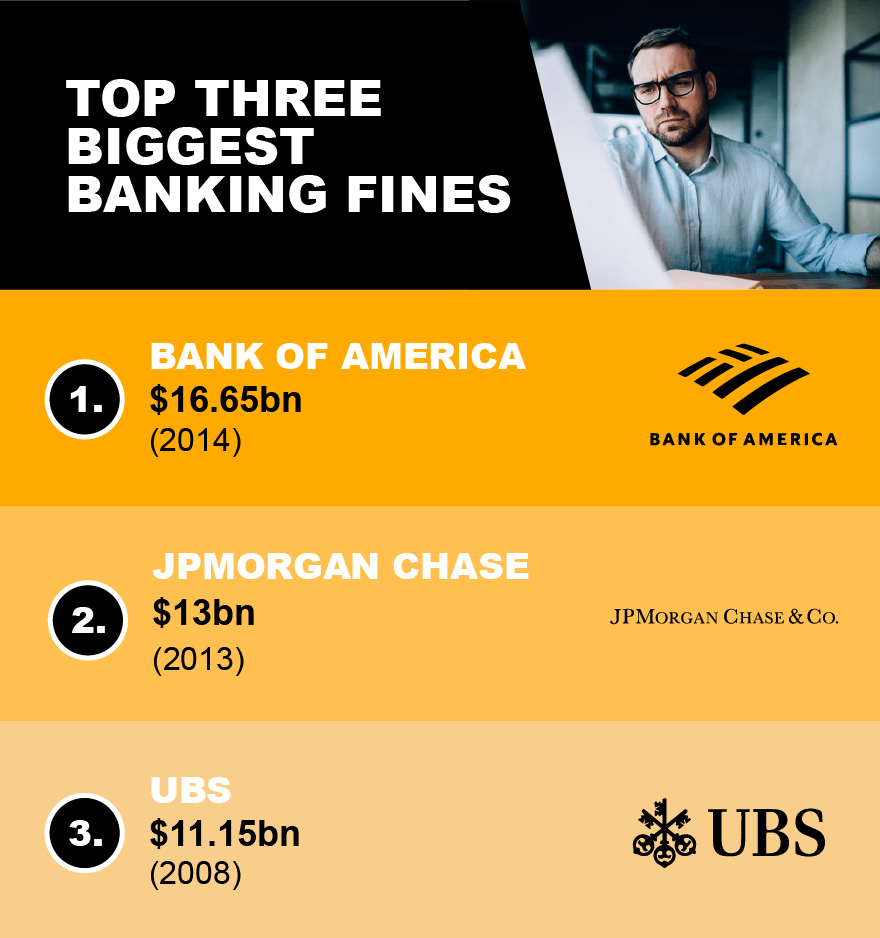

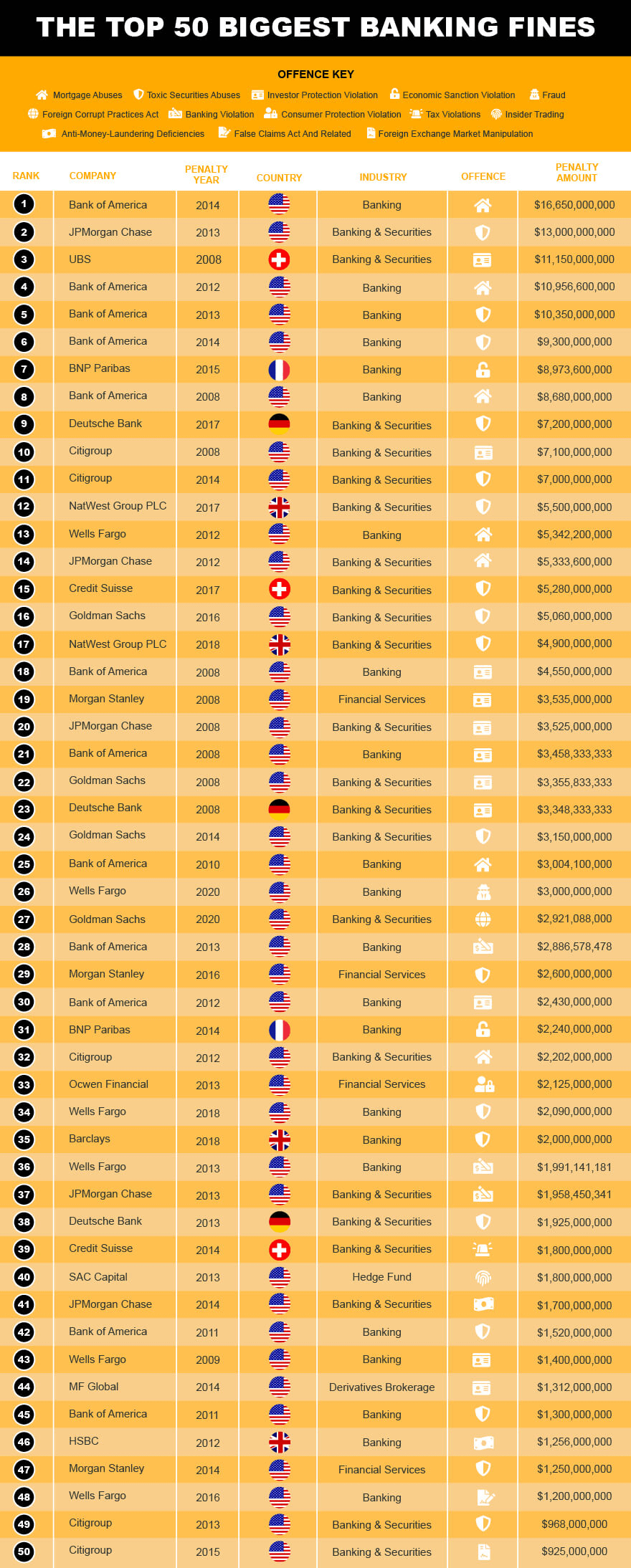

Top Three Biggest Banking Fines

| Rank | Bank | Fine | Year |

| 1 | Bank of America | $16.65bn | 2013 |

| 2 | JPMorgan Chase | $13bn | 2014 |

| 3 | UBS | $11.15bn | 2008 |

- Coming in first, The Bank of America actually accounts for half of the top ten biggest fines of all time, but by far the biggest was the one that they incurred in 2014, for knowingly selling toxic mortgages to investors, a big contributor to the financial crisis of the late 2000s.

- Another of the big US banks, JPMorgan Chase takes second place, with JPMorgan Chase being forced to pay $13bn in 2013 for toxic securities abuses in the time of the financial crisis.

- Swiss investment bank UBS comes in third place after being fined $11.15bn for investor protection violation offences in 2008.

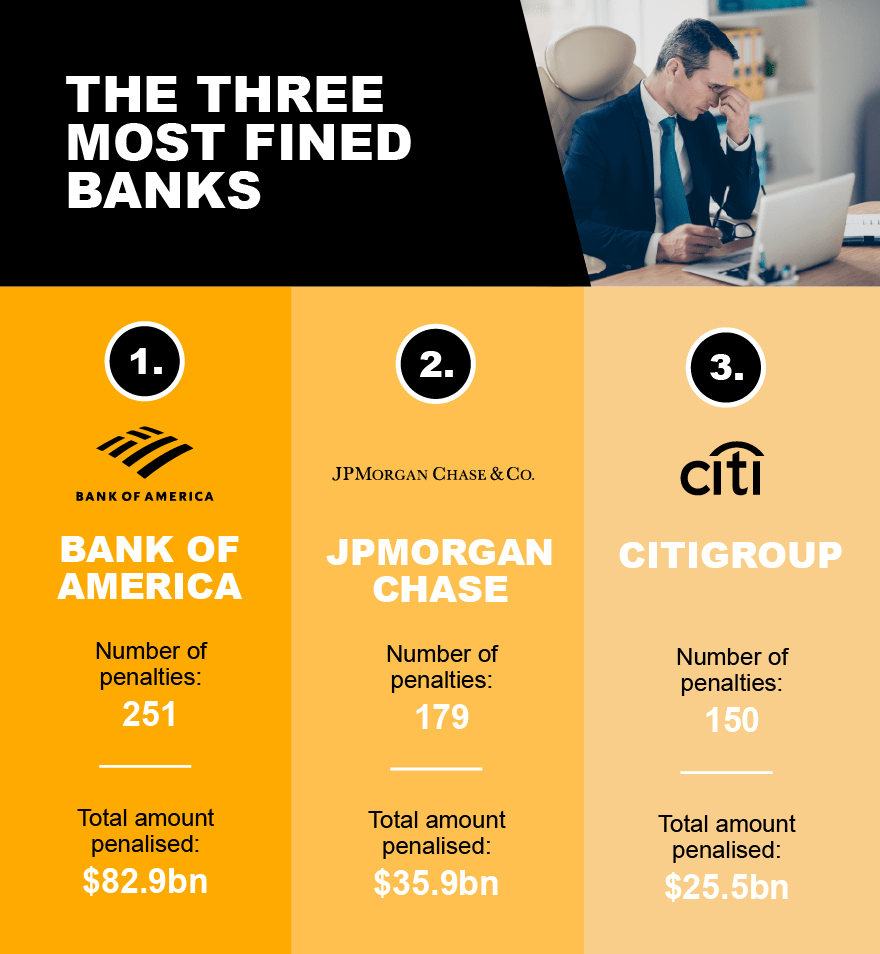

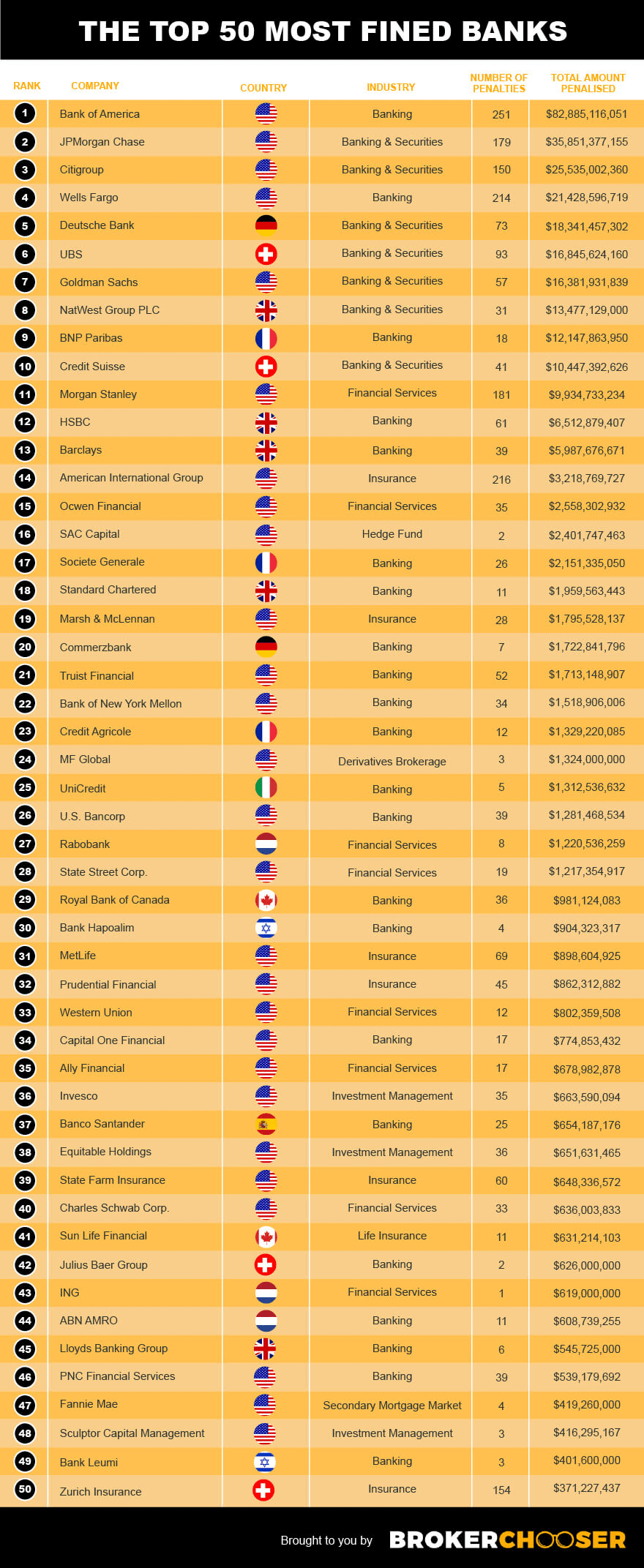

The Three Most Fines Banks

| Rank | Bank | No. of Penalties | Total Amount Penalised |

| 1 | Bank of America | 251 | $82.9bn |

| 2 | JPMorgan Chase | 179 | $35.9bn |

| 3 | Citigroup | 150 | $25.5bn |

- In first place again, The Bank of America is the most heavily fined bank clocking up a total of over $82bn across 251 different fines over the past 20 years.

- As was the case with one-off fines, JPMorgan Chase takes second place behind Bank of America, although by some distance, with fines totalling $35.9bn.

- Coming in third, the Citigroup investment bank and financial services corporation has been fined over $25bn across 150 different fines, with the biggest of these being $7.1bn.

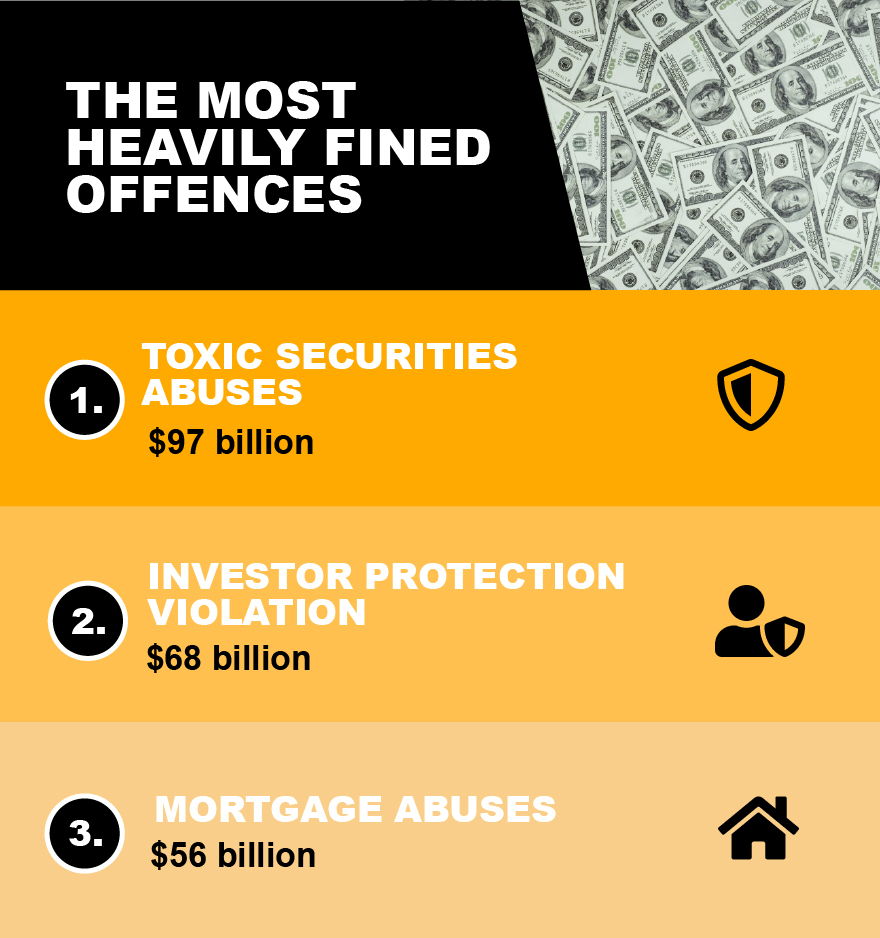

The Most Heavily Fined Offences

| Rank | Offence | Total Fined for Offence |

| 1 | Toxic Securities Abuses | $97bn |

| 2 | Investor Protection Violation | $68bn |

| 3 | Mortgage Abuses | $56bn |

- The offence that saw the heaviest penalties overall, racking up $97bn in fines, was ‘toxic securities abuses’ which refers to the sale of investments that are either difficult or actually impossible to sell on, due to demand for them collapsing.

- In second place, there were over 1,400 fines that added up to over $68 billion for breaches of the Investor Protection Act.

- In third place, 83 fines were handed out for offences within the mortgage sector. They added up to over $56 billion, meaning that each fine was worth an average of over $680 million.

To view the full research, including the top 50 biggest banking offences and top 50 most fined banks, please click here.