According to the latest U.S. bank M&A projections report from S&P Global Market Intelligence, bank M&A activity should continue to heat up and could soon exceed pre-pandemic levels as institutions seek scale to combat the challenging earnings environment.

Q2 2021 hedge fund letters, conferences and more

Quote from Nathan Stovall, principal analyst at S&P Global Market Intelligence

“Banks are feeling greater pressure to merge due to the challenging earnings environment and dramatic changes in customer behavior during the pandemic. Deals offer the opportunity to gain scale, which in turn allows banks to cut costs and use some of those savings to invest in technology to meet growing demands for more convenient services. More banks could pursue to sales as they see some of their strong peers decide to partner with other institutions.”

Bank M&A Activity Increase In The Q2

After a slow start to 2021, the pace of bank deals increased notably in the second quarter as easing credit concerns brought many buyers back into the fray. Potential sellers, meanwhile, continue to face earnings headwinds as excess liquidity and low interest rates pressured net interest margins. The fundamental revenue pressures, growing comfort from buyers and desire to achieve scale to invest in technology and reduce costs should support a further rebound in bank M&A activity and lead to the highest aggregate deal value recorded since the global financial crisis.

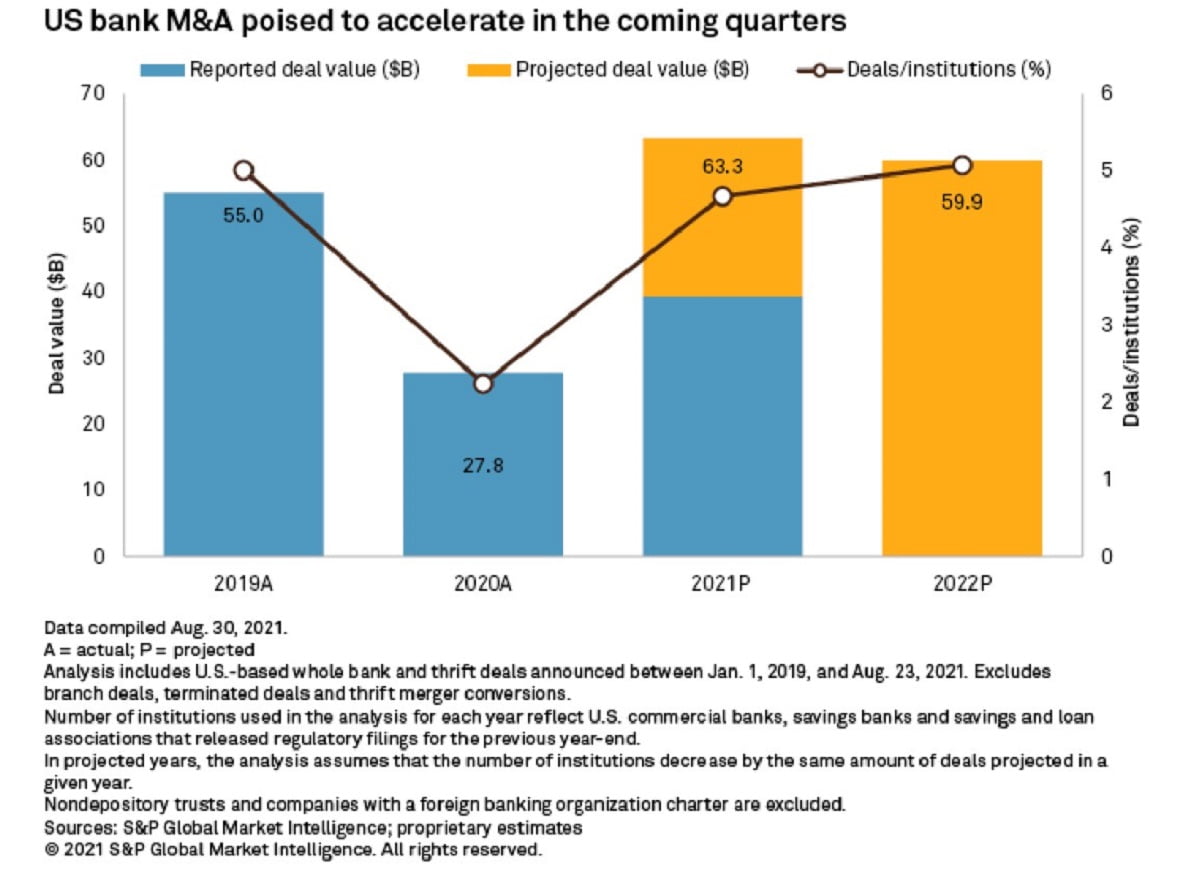

We expect 229 deals to occur this year, with 135 transactions surfacing in the second half of 2021 and 70 deals in the fourth quarter alone. That projected level of banks selling in 2021 would equate to nearly 4.7% of U.S.-based banking institutions, representing the percentage of the industry consolidating. Such a pace of consolidation would be slightly below the level witnessed in 2019 but roughly on par with activity seen in 2018.

Aggregate deal values could stand out even more as we expect regional banks to represent a higher percentage of all targets than seen in years past. Banks with between $10 billion and $50 billion in assets have already made up a far higher concentration of sellers this year — nearly 4% of all targets compared to just over 1% between 2017 and 2020 — as more institutions have sought scale to improve efficiency and allow investment in technology to keep up with shifting customer preferences to digital channels.

Through Aug. 23, 14 deals with values over $500 million had already surfaced in 2021 — the highest number since the global financial crisis.

We believe regional banks will continue to make up a larger proportion of sellers when compared to prior years as they seek scale to keep up with the technology investments made by the nation's largest banks. As more sizable banks pursue sales, aggregate deal values could exceed $63 billion in 2021, which would represent the highest mark since the global financial crisis. We expect the trend to continue in 2022 and project that aggregate deal value could near $60 billion.

Largest Bank Deals

A number of sellers, including among the regional ranks, have noted that the scale offered through transactions was attractive. Investors Bancorp Inc (NASDAQ:ISBC) agreed to sell to Citizens Financial Group Inc. for $3.65 billion in late July, representing the third largest bank deal announced in 2021. A few months earlier on the company's first-quarter earnings call, Investors President Domenick Cama said there was compelling reason to pursue deals simply because being bigger allows institutions to become more diversified and allocate more funds to investments in technology.

Buyers are looking for scale as well. M&T Bank Corporation (NYSE:MTB), the acquirer in the largest deal announced this year — the planned $7.60 billion purchase of People's United Financial Inc. — said the transaction would allow it to leverage past technology and infrastructure investments across a broader base. M&T Chairman and CEO René Jones said on a conference call to discuss the deal that M&T invested to become faster and more nimble and expects to export those enhancements to the People's franchise without additional investments.

The PNC Financial Services Group Inc (NYSE:PNC) made a similar case when touting its $11.57 billion purchase of BBVA USA, announced in November. PNC Chairman and CEO Bill Demchak said on the deal call that the company would onboard virtually everything that BBVA does onto its platform, automate many of the risk and control functions at the institution, and effectively take the total cost "down to nothing."d

Combating The Pressure On Margins

Buyers also want scale to combat the pressure on margins due to persistently low rates and trillions of dollars of excess liquidity. Meanwhile, digital adoption has accelerated considerably due to the pandemic. Against that backdrop and a low-rate environment where deposits are worth less, many banks are operating with elevated cost structure associated with their branches and deals offer the opportunity to right-size their physical distribution networks quickly. While most banks have worked to trim their branch networks on their own, deals offer the opportunity to take advantage of potential overlap with seller's branches and close branches without taking as great of a risk of losing business.

Many buyers have plenty of capital and firepower through their stocks to pursue deals as well. Would-be acquirers trade at higher multiples than their smaller counterparts, giving them a healthy currency to pursue transactions.

Still, there is some concern that regulatory scrutiny over bank M&A could grow, particularly larger transactions, due to President Joe Biden's executive order encouraging a "revitalization of merger oversight." Some deal advisers expect the deal approval to slow but still believe that transactions will get done.

However, some bankers, including ones that had previously announced sizable acquisitions, have said they expect the order to result in considerably more scrutiny.

"A larger deal in today's environment would get much more political scrutiny and noise than we did with the BBVA deal. And that weighs on us," said PNC CEO Demchak on the company's second-quarter earnings call when asked about the executive order.

As the ultimate impact remains unknown, buyers could look to move before any official regulatory changes are made. Any would-be buyer no longer looks at acquisitions like the prospect of trying to catch a falling knife either. Few loans have gone bad because myriad government relief efforts have served as an effective bridge over the pandemic-led downturn. We expect that strong credit performance should hold through the remainder of 2021, giving buyers greater confidence in pursuing acquisitions.

It seems that the potential tailwinds for further M&A activity far outweigh headwinds, setting the stage for a considerable pickup in deal announcements.

Join us Sept. 8 for a discussion on the changing drivers and considerations for successful mergers and acquisitions in the industry post-pandemic, featuring leading bank M&A advisors who have been active dealmakers in the last few years. Click here to register for the webinar.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Article by S&P Global Market Intelligence