Third Point Reinsurance investor presentation for the month of March 2018.

Check out our H2 hedge fund letters here.

Our Company

- Specialty property & casualty reinsurer based in Bermuda

- A- (Excellent) financial strength rating from A.M. Best Company

- Began operations in January 2012 and completed IPO in August 2013

- Investment portfolio managed by Third Point LLC

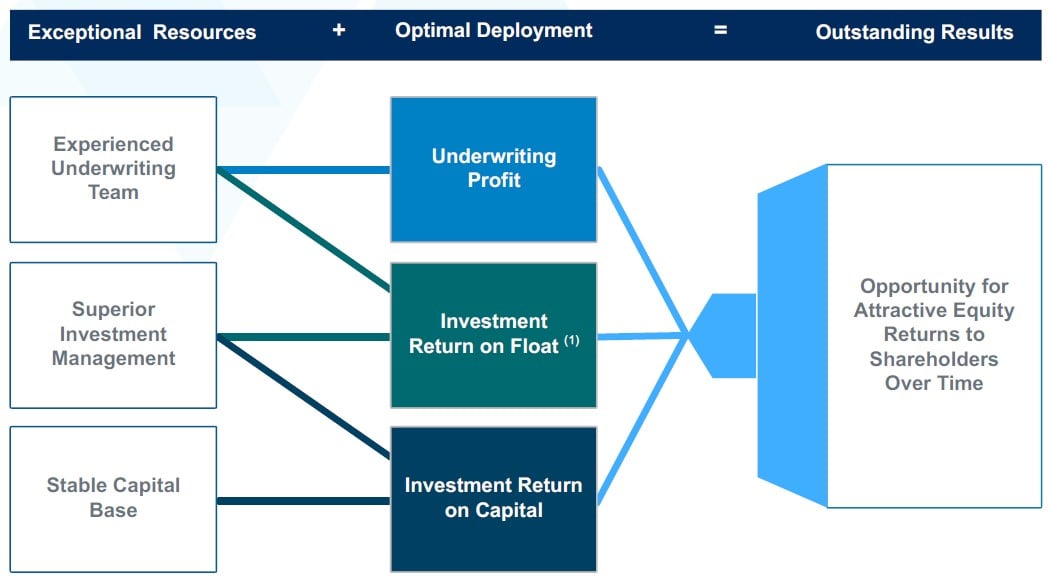

- Total return business model

- Flexible and opportunistic reinsurance underwriting

- Superior investment management

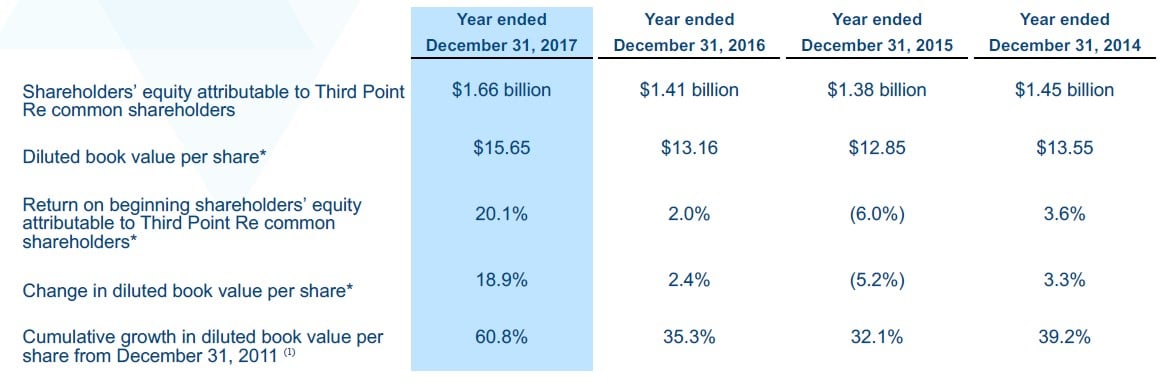

Key Metrics

Total Return Business Model Designed To Deliver Superior Returns

Experienced Senior Management Team

- Strong business relationships

- Expertise in writing all lines of property, casualty & specialty reinsurance

- Track record of capitalizing on market opportunities and producing strong underwriting results

- Significant business-building experience

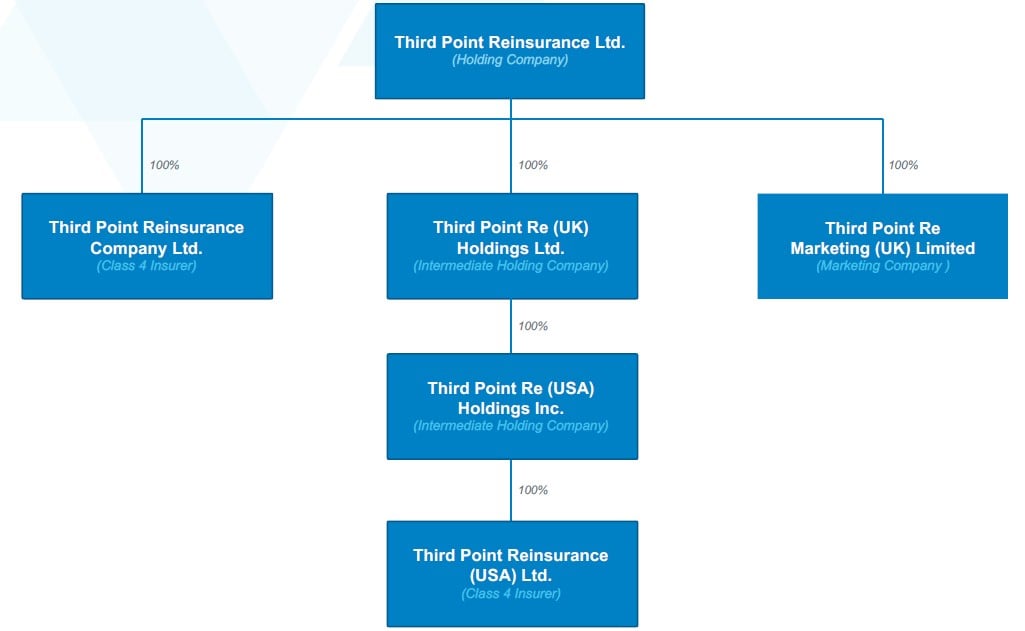

Organizational Structure - Key Entities

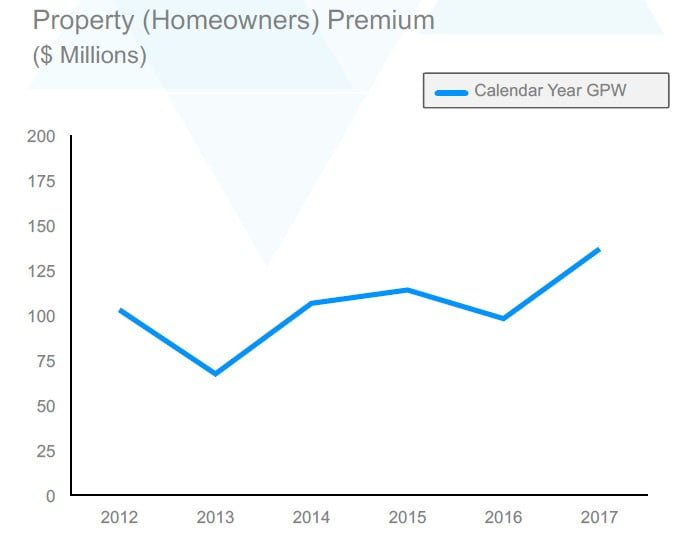

Evolution Of Our Portfolio

- Portfolio of primarily Florida carriers built from past relationships. The portfolio now also includes a Northeast carrier

- Identified Assignment of Benefits (AOB) issue in Florida early, but did not fully price for it

- Attempted to adjust ceding commission, but the market did not follow us until recent cat events

- Renewed two contracts in Q4-17 at significantly improved pricing

- Market conditions vary widely by state, segment and carrier

- The portfolio has performed reasonably well, though not as well as originally expected (due to underperformance of one large contract)

- We are opportunistically targeting carrier deals with good historical results

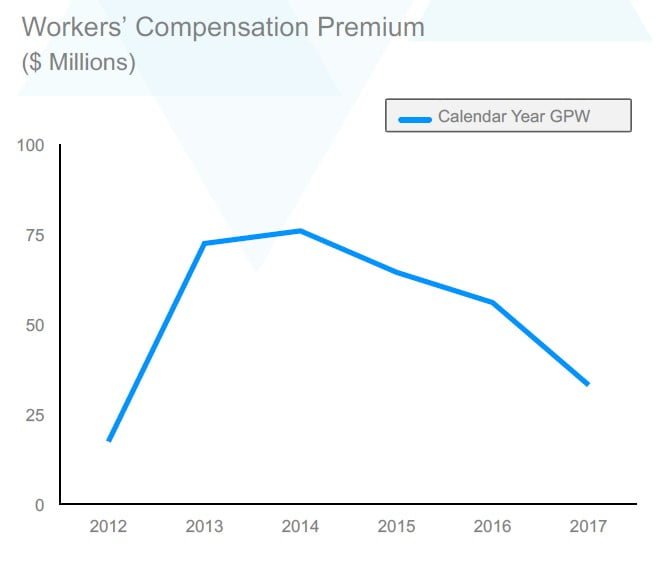

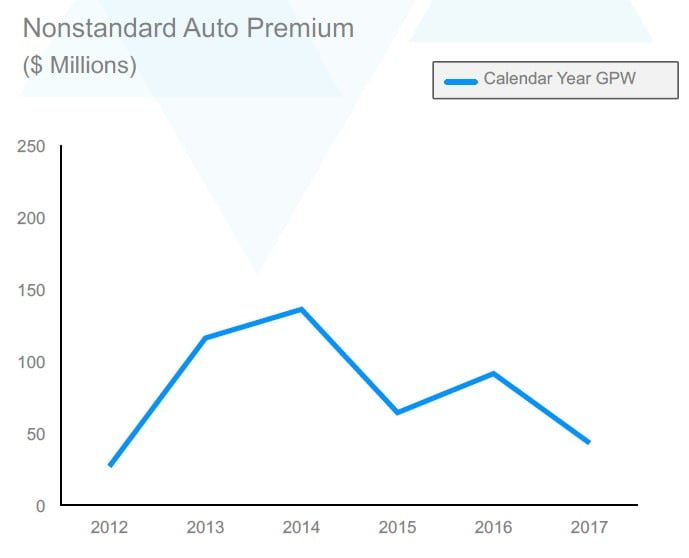

- Portfolio of MGA-driven nonstandard auto business built from past relationships

- Re-oriented our approach to focus on best-in-class carriers/MGAs with the size and differentiation to navigate difficult market conditions

- Hard market conditions have improved results considerably in 2017

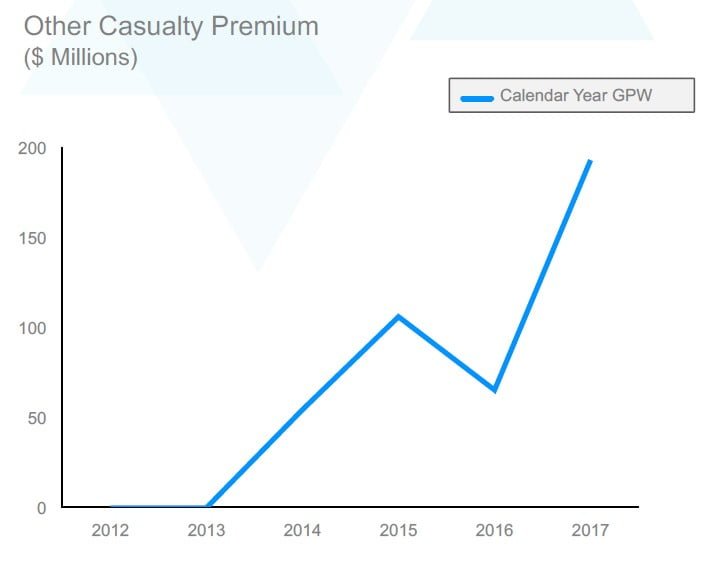

- Portfolio is dominated by broad casualty retrocession deals.

- We also write a few transaction liability and professional lines reinsurance treaties

- Pricing on renewals improved based on both reinsurance terms and underlying pricing

- Portfolio is primarily quota share contracts of Lloyds entities

- Have seen an increase in inquiries following recent cat events

- Expect this line to grow in 2018

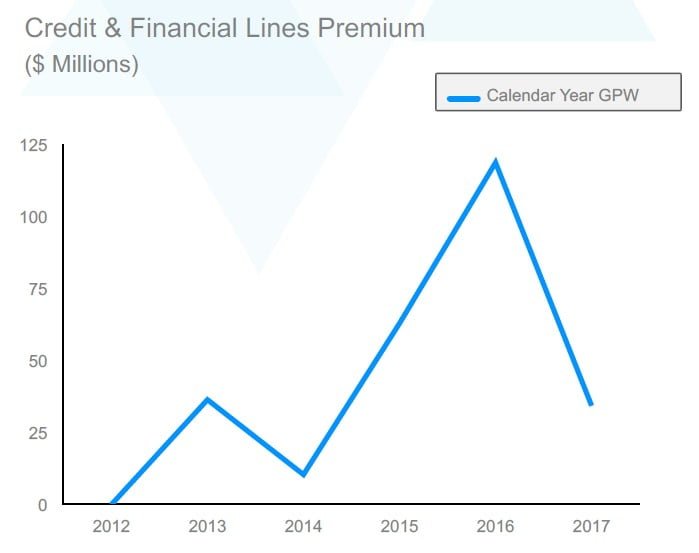

- Portfolio includes political risk, trade credit, structured credit, surety, title, residual value and mortgage

- We believe pricing and terms & conditions of mortgage risk have held up well due to rapidly increasing demand

- Traditional credit and political risk insurance is highly competitive. We favor market leads with the capacity and expertise to transact in less commoditized areas

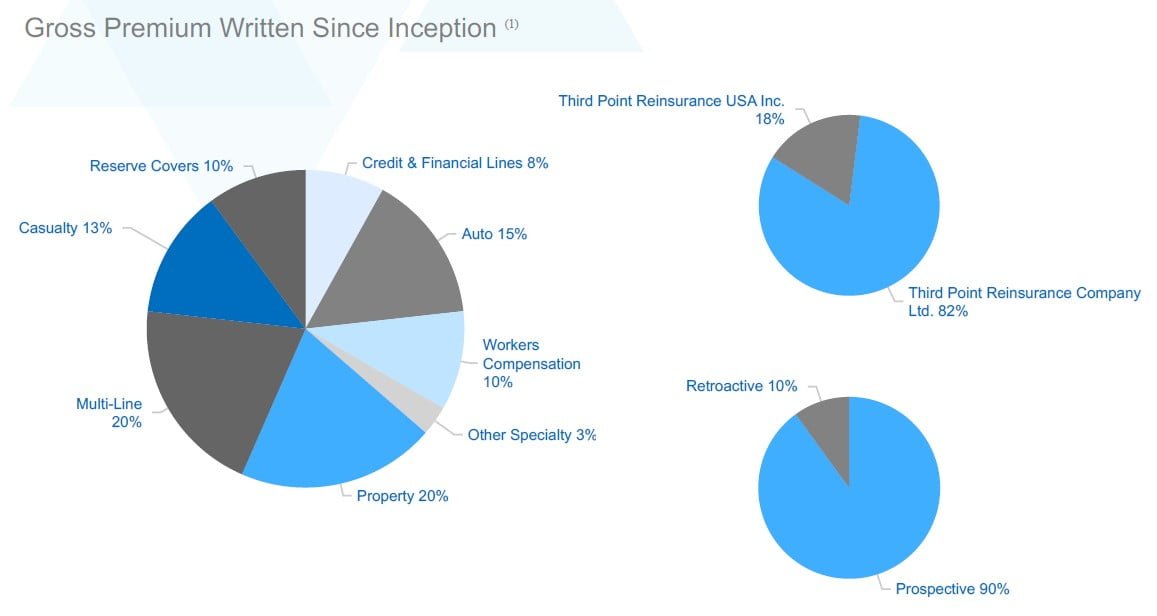

Diversified Premium Base

See the full PDF below.