Article by Investment Masters Class

If we were asked to come up with 5 or 10 names of the world’s greatest stock market investors, most of us could do it easily and many of us would probably include one or more of the following – Buffett, Munger, Graham, Templeton, Lynch, Fisher, Steinhardt et, al. But picking bond market gurus is a much more difficult task, however. Bill Gross and Jeff Gundlach are two names that come to mind for me, and to be honest, I can’t think of many others.

Gross and Gundlach's ability to unravel the economic landscape has allowed their portfolios to beat their bond market benchmarks time and time again, and fund inflows have followed. But relative to the great stock market investors, their returns have been rather pedestrian. That's in no way to say they're inferior investors, they're just fishing in a different pond.

Most of those people we consider the investment greats have made their money, not in bonds or 60:40 stock/bond allocations, but through owning stocks. If anything, they've shunned bonds.

"On the whole we are allergic to bonds.” Walter Schloss

"Gentlemen who prefer bonds don't know what they're missing." Peter Lynch

In recent years, I can't recall one Investment Master recommending government bonds as an investment. It's fair to say that most have been outright dismissive....

"If I had a choice between holding a US Treasury bond or a hot burning coal in my hand, I would choose the coal. At least that way I would only lose my hand." Paul Tudor Jones

“With interest rates being historically low right now I would not want to invest in bonds. Also a bond is a contract and you can’t do anything with that.” Ted Weschler

“I believe the risk lies in the risk-free rate.” Sir Michael Hintze

“It absolutely baffles me who buys a 30 year bond. I just don't understand it. And, they sell a lot of them so clearly, there's somebody out there buying them." Warren Buffett

"It is very strange situation to have the Fed say our goal is 2% inflation and people buy Treasury bills at 1.5% and have to pay tax on it. The government has announced to you it doesn’t pay to save. You will have nothing in the way of purchasing power. To me it has just been absurd to see pension funds [in 2013 and future years] saying we ought to have 30% in bonds.” Charlie Munger

“Almost anybody who trades risk assets has felt the impact of low rate policies. If there is a bubble, it is probably in the price of sovereign debt globally.” Jon Pollock

"Long-term government bonds are ridiculous at current yields. They are not safe havens. Investors who have experienced the price run-up in the bond market but who have not marked down their forward expected portfolio rate of return are making, in our view, a possibly fatal mistake.” Paul Singer

There are a few good reasons that the Investment Masters haven't been advocating bonds; they're expensive, the return profile is asymmetric, there's no upside participation, prices have been manipulated, and a bout of unexpected inflation would mean some seriously permanent capital losses. Furthermore, over the long term bond returns have significantly lagged equities, and that's not likely to change in the future.

Let's consider some of those..

Bonds are Expensive

Buffett advocates a approach to buying bonds; that is, viewing bond investments with a businessman’s perspective. What does the return profile look like? What is an equivalent PE ratio? How long would it take to double your money? On this basis, and relative to equities, bonds have looked horribly expensive.

“The ten-year bond is selling at 40 times earnings. And it's not going to grow. And if you can buy some business that earns high returns on equity and has even got mild growth prospects, you know, at much lower multiple earnings, you are going to do better than buying ten-year bonds at 2.30 or 30-year bonds at three, or something of the sort." Warren Buffett

“A bond that pays you 2% is selling at 50X earnings and the earnings can’t go up. And the Government has told you we would like to take that 2% away from you by decreasing the value of money. That is to absurd to own something like that. To make that a voluntary choice in the last ten years against owning assets has struck me as absolutely foolish." Warren Buffett

No Upside Participation

When you hold a bond you get paid a coupon and hopefully receive your face value at maturity. You don't get more coupons if the government or the company issuing the bond does well. Unlike owning a stock, there is no upside optionality. That's why it's called 'fixed' income. The coupon, maturity date and repayment of par are all fixed.

“Bonds offer no growth in intrinsic-worth opportunities comparable to equity securities. A bond indenture makes two primary promises: to make generally fixed semi-annual interest payments and to redeem the bond at par value on maturity date. If there is no upside, it makes no sense to us whatsoever to expose our clients to risk on the downside.” Frank Martin

"Whereas companies routinely reward their shareholders with higher dividends, no company in the history of finance, going back as far as the Medicis, has rewarded its bondholders by raising the interest rate on a bond." Peter Lynch

“In fixed income.. returns are limited and the manager's greatest contribution comes through the avoidance of loss. Because the upside is truly "fixed," the only variability is on the downside, and avoiding it holds the key. Thus, distinguishing yourself as a bond investor isn’t a matter of which paying bonds you hold, but largely of whether you're able to exclude bonds that don't pay. According to Graham and Dodd, this emphasis on exclusion makes fixed income investing a 'negative art.'" Howard Marks

"In stocks you've got the company's growth on your side. You're a partner in a prosperous and expanding business. In bonds, your nothing more than the nearest source of spare change. When you lend money to someone, the best you can hope for is to get it back, plus interest." Peter Lynch

Asymmetry of Bond Yields

When interest rates on bonds are plumbing record lows, close to zero or in some cases negative, it's difficult to imagine them falling much further. However, should yields rise to a level more consistent with history and economic theory [eg Taylor rule], bond prices could fall a lot. The lower the coupon the more downside there is from interest rates rises. If you have to sell before maturity, you could be wearing a large loss. This is the exact opposite type of asymmetry the Investment Masters seek; limited upside, big downside.

“When the [Treasury] yield is below 2.50%, it doesn't take much of either an inflation scare or something else—but it would most likely be an inflation scare—to make rates rise. And as they rise from such low levels, the mathematics are just brutal, and you can get your clock cleaned by going long Treasuries or high-grade bonds.” Michael Lewitt

“How in the world could we be talking about rates never going up when in fact rates have bottomed?…In the investment world when you hear ‘never,’ as in rates are ‘never’ going up, it’s probably about to happen.” Jeff Gundlach

"It would only take a 100 basis point rise in Treasury bond yields to trigger the worst price decline in bonds since the 1981 bond market crash." Ray Dalio

"An investor in fixed income today is beginning a compounding stream with the curve at the mid-1% level on cash to under 3% at 30 years. A rising interest environment will penalise the owner of long-dated debt with price declines, the longer the maturity the more severe the decline. A sustained increase in rates will help by allowing for re-investment at higher yields, but an expectation of returns much above initial yields would be asking for a lot." Christopher Bloomstran

"The Federal Reserve was founded in 1913. This is the first time in 102 years that the central bank bought bonds, and that we've had zero interest rates, and we've had them for five or six years. So do you think this is the worst economic period looking at these numbers we've been in in the last 102 years? To me it's incredible." Stanley Druckenmiller

US10yr Bond Yield Vs S&P500 Earnings Yield [Source Bloomberg]

Permanent Capital Loss

Successful investing requires avoiding the permanent loss of capital. This means not only avoiding absolute capital losses but also the loss of purchasing power inflicted by inflation.

“I define risk as the chance of permanent capital loss adjusted for inflation." Bruce Berkowitz

"What we care about is avoiding the permanent loss of capital and, increasingly relevant today, the permanent loss of purchasing power.” David Iben

“The goal of investing is to protect and increase your portfolio in inflation-adjusted dollars over time.” David Dreman

"There is no real safety without preserving purchasing power.” Sir John Templeton

"The riskiness of an investment is .. measured by the probability — the reasoned probability — of that investment causing its owner a loss of purchasing power over his contemplated holding period." Warren Buffett

Ordinarily, one hundred dollars today will buy you more than $100 in ten years as inflation raises the cost of goods over time. Historically bonds have compensated investors for inflation, providing a real return of a few percent [see chart below]. In recent years, real returns have shrunk and in some instances turned negative.

“In our opinion, the only thing that is guaranteed with a bond that has a lower interest rate than the rate of inflation is impoverishment. Generating negative real returns goes against the very concept of investment. With each passing year, the holders of this asset class have their capital slowly crumble. From our perspective, the certainty of capital loss in purchasing power is the very definition of risk.” Francois Rochon

For the first time in history, some government and corporate bond yields have ventured below zero. Holding these bonds to maturity guarantees a permanent loss of capital even before inflation. Little wonder, the Investment Masters have steered well clear of buying bonds.

US10Year Yield less Inflation [Source Bloomberg]

Inflation Risks

As we know, investors are prone to focus on the rear-view mirror. Prominent in most investor's rear view mirror has been the financial crisis, where the collapse in aggregate demand raised the prospects of deflation. The subsequent recovery has been characterised by low inflation which has conditioned investors to expect more of the same; extrapolating the last 10 years. But the future could be very different.

In a post last year titled 'The Buffett Series - Thinking About Bonds' I recommended reading the chapter 'The Last Hurrah for Bonds' in the excellent book, 'The Davis Dynasty'. Investment Master, Shelby Davis was an outspoken critic of bond investments in the 1940's. Here's an extract ...

"[Shelby Davis] became an anti-bond maverick. The recent past had told people bonds were attractive and safe, but the present was telling Davis they were ugly and dangerous. Interest rates were fast approaching what economist John Maynard Keynes called the "balm and sweet simplicity of no percent." Keynes was exaggerating, but not by much - the yield on long-term Treasuries hit bottom-2.03 percent in April 1946. Buyers would have to wait 25 years to double their money, and, to Davis, this was pathetic compounding. He saw the threat in the "sea of money on which the U.S. Treasury has floated this costliest of wars." With the government deep in hock and forced to borrow another $70 billion to cover its latest shortfall, he was certain lenders soon would demand higher rates, not lower. The most reliable inflation gauge, the consumer price index, rose sharply in 1946."

What followed was a 34-year bear market in bonds that lasted from the Truman era to the Reagan years. The 2 to 3 percent bond yields in the late 1940's expanded to 15 percent in the early 1980's and, as yields rose, bond prices fell and bond investors lost money. The same government bond that sold for $101 in 1946 was worth only $17 in 1981! After three decades, loyal bondholders who had held their bonds lost 83 cents on every dollar they'd invested. Ignoring the scene in the rear-view mirror, Davis focused his attention on navigating the future.

The biggest dupes in the triple swindle were fat cats and institutions (pension funds, insurance companies, and their ilk). These sophisticated types who could afford bonds might have seen the folly in owning government paper in the late 1940's, but most didn't. Fanciful arguments tranquilized the bond bulls. They believed that because bonds were profitable in the past decade, they’d be profitable in the next. They convinced themselves that the Fed could keep interest rates from rising, indefinitely. A government that controlled the price of pork chops, it was widely assumed, could also control the price of money."

And Davis was right ...

“An individual in a 50% bracket who put money into T-bills or government bonds after World War 2 and kept re-investing in these instruments to 1996, lost the major part of his or her capital.” David Dreman

Sound familiar? Since the Financial Crisis, investors have allocated significantly more funds into bonds than stocks. Only now are investors awakening to the risks of rising inflation.

"What is the worst investment against inflation? Bonds. The objective of governments who are overly indebted will be to devalue bonds so that their burden can be reduced. Yet, what are investors doing these days? They are aggressively buying bonds and moving away from equities. They rant against debt but continue to buy government notes or leave cash in the bank at 1% interest."

What is the best hedge against inflation? Owning companies with unique products that have high pricing power. If I were a German investor in 1945, I would have wanted to own Porsche, Beck’s, Hugo Boss, Bayer, Braun, and Nivea. The value of the German currency could have gone to zero, but if the brands were solid, you still could have realized a profit in any currency. Our job is to select solid companies that can withstand inflation and other economic risks." Francois Rochon, 2010

Prices are being Manipulated

The global central banks have become the price setter in the bond market. Having taken short rates to zero, for the first time in history, the global central banks sought to lower the long end of the curve by buying bonds. The endgame was to force investors into riskier assets, [e.g. junk bonds, equities, real estate], create a wealth effect, and stimulate the economy. This may very well be the biggest 'peg' in financial history.

"While we are aware that debt markets can persist at zero or even modestly negative rates for a period of time, we believe it is best to make capital allocation decisions on the basis that fixed income securities will eventually trade where a fixed income investor would own them rather than where governments and fixed income traders will push them." Larry Robbins

Historic Underperformance

Earlier this century, only bonds were deemed a safe investment; equities were considered too speculative. As a result, bond yields were lower than the yields on common stocks.

"After the great market decline of 1929 to 1932, all common stocks were widely regarded as speculative by nature. A leading authority stated flatly that only bonds could be bought for investment." Benjamin Graham

This changed after the 1930's when it dawned on investors that stocks offered more upside than bonds, as the retained earnings after dividend payments could compound within the company...

"To report what Edgar Lawrence Smith discovered, I will quote a legendary thinker - John Maynard Keynes, who in 1925 reviewed the book, thereby putting it on the map. In his review, Keynes described 'perhaps Mr. Smith's most important point ... and certainly his most novel point. Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back in the business. Thus there is an element of compound interest (Keynes' italics) operating in favor of a sound industrial investment.

"It was that simple. It wasn't even news. People certainly knew that companies were not paying out 100% of their earnings. But investors hadn't thought through the implications of the point. Here, though, was this guy Smith saying, "Why do stocks typically outperform bonds? A major reason is that businesses retain earnings, with these going on to generate still more earnings--and dividends, too." Warren Buffett

“In the 1920s, a brilliant and important book by Edgar Smith, Common Stocks for Long-Term Investment, became a prime market influence. It was still popular in the fall of 1929, but most people read it too late. Mr. Smith advocated the benefit to corporate growth of the application of retained earnings and depreciation. Thus capital appreciates. The book may have been influential in changing accepted multiples of 10 x earnings to higher multiples of 20 to 30 x earnings." Roy Neuberger

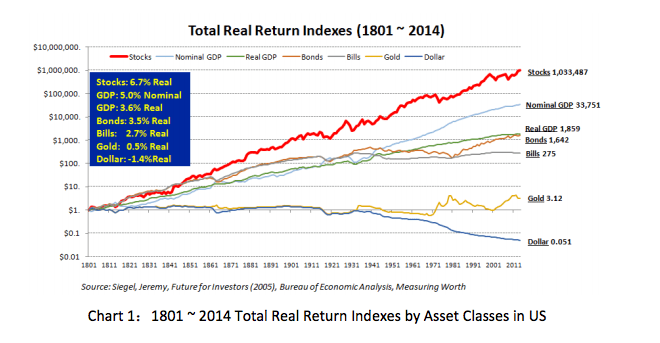

And outperform they did. Analysis by Professor Siegel of the Wharton School of Business highlights returns on several major classes of financial assets, including stocks and bonds, in the US during the past two hundred years. The figures are staggering. Long term bonds significantly under-performed stocks.

Source: Li Lu's Lecture 'The Prospect of Value Investing in China'

"Here is the result: 1 US dollar in stocks, after discounting for inflation, experienced an appreciation of 1 million times the original value over the past 200 years! Its value today would be 1.03MN US dollars. Even the remainder of this number is bigger than the return on every other class of assets. What are the reasons behind such an astonishing performance? The answer lies in the power of compounding. The average annualized rate of return for stocks, discounting inflation, is only 6.7%. No wonder Einstein called compound interest the eighth wonder of the world." Li Lu

David Dreman's excellent book 'Contrarian Investment Strategies' contains a chapter titled 'An Investment for All Seasons' which states; "I will make clear, the crucial but little known fact that stocks are not a risky investment, if you hold them for a number of years... stocks also keep their value better than almost any other investment through hyperinflation and most other crises."

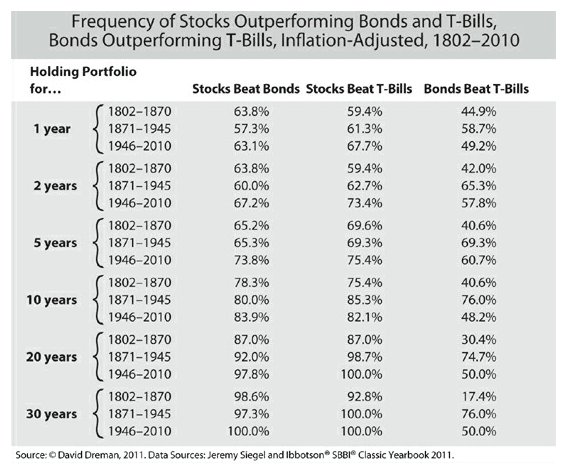

Source:Masterinvestor

Dreman noted .. "Stocks outperformed T-bills 73% of the time for all five year periods between 1802 and 1996, 81% for ten year periods, 95% and 97% respectively for 20- and 30- year periods. The results after the war are better yet. For any five year period stocks outdistanced T-bills 82% of the time, and for any 20-year or 30-year period 100% of the time. The comparison with long bonds are nearly identical." David Dreman

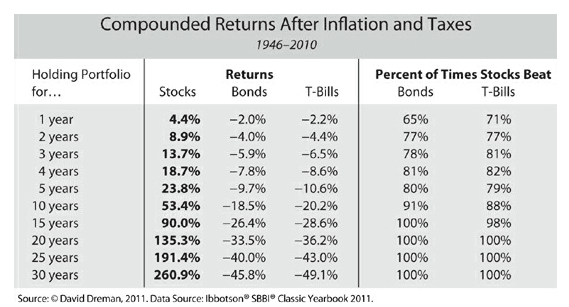

Source: Masterinvestor

Mr Dreman concludes.. "the probability that the investor holding stocks will double her capital every 10 years after inflation, quadruple every 20, combined with 100% odd that she will outperform T-bills or government bonds in 20 years, can hardly be called risky. Conversely, the supposedly 'risk-free' assets actually display a large and increasing element of risk over time."

Mr Dreman is not alone. The Investment Masters recognise this ...

"The S&P outperformed inflation, Treasury bills, and corporate bonds in every decade except the ‘70’s, and it outperformed Treasury bonds – supposedly the safest of all investments – in all four decades.” Sir John Templeton

"Stocks outperformed bonds, as Edgar Lawrence Smith, Irving Fisher, and John Maynard Keynes noted as far back as the twenties." David Dreman

"Practical experience demonstrates that stocks provide superior returns over reasonably long holding periods." David Swenson

"In spite of crashes, depressions, wars, recessions, ten different presidential administrations, and numerous changes in skirt lengths [for 60 years until 1987], stocks in general have paid off fifteen times as well as corporate bonds, and well over thirty times better than Treasury bills" Peter Lynch

"In the very long term, equities represent the best investment class." Francois Rochon

"Stocks have historically outperformed over moderate to longer periods by a significant amount." Ed Thorp

And that's likely to continue in the future..

"In the long run, a portfolio of well-chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won't outperform the money left under the mattress." Peter Lynch

"The unconventional, but inescapable, conclusion to be drawn from the past fifty years is that it has been far safer to invest in a diversified collection of American businesses than to invest in securities – Treasuries, for example – whose values have been tied to American currency. That was also true in the preceding half-century, a period including the Great Depression and two world wars. Investors should heed this history. To one degree or another it is almost certain to be repeated during the next century." Warren Buffett

Notwithstanding, there may be occasions where it makes sense to invest in bonds.

"... though the value equation has usually shown equities to be cheaper than bonds, that result is not inevitable: When bonds are calculated to be the more attractive investment, they should be bought." Warren Buffett

The last time was back in the 1980's when bond yields peaked at 15% plus.

“We remember vividly 35 years ago staring at long-term impeccable bonds trading at 15% to 17% yields, thinking; “Why bother trading, hedging and knocking ourselves out? Why not just liquidate the whole portfolio and own these things and go on vacation for 10 years?” Paul Singer

“Anyone with a sense of contrarian mentality had to look at interest rates in the early 1980’s as presenting a potentially great opportunity. You knew the Fed would have to ease as soon as business started to run into trouble. In addition, we had already seen an important topping in the rate of inflation.” Michael Steinhardt

"In 1981 the public should have seen Volcker's jacking up of short-term rates to 21 percent as a very positive move, which would bring down long-term inflation and push up bond and stock prices." Stanley Druckenmiller

"When I purchased long-term zero-coupon bonds in the early 1980's at market yields in excess of 13%, I welcomed the prospect of outsized volatility because I felt it would eventually work in my favour." Frank Martin

That's not the case today..

“It is possible that there could be a time where a wise investor could be all in treasuries. It is virtually impossible for me to see when. I guess I could imagine it, but I haven’t seen it. Long-term treasuries are a losing battle over the long pull.” Charlie Munger, 2018

Warren Buffett once again espoused his thoughts in his most recent letter ...

"I want to quickly acknowledge that in any upcoming day, week or even year, stocks will be riskier – far riskier – than short-term U.S. bonds. As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.

It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals – to measure their investment “risk” by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk."

So let's wrap it up.. over the very long term, stocks have outperformed bonds by a significant margin. As an investor's holding period lengthens, the chances of a portfolio of quality businesses [low debt, good management, pricing power, etc.] purchased at reasonable prices outperforming a bond portfolio rises. Notwithstanding, if you require funds in the short term, or you can't stomach a large decline in the quoted prices of your portfolio of stocks, you probably shouldn't be investing in the stock market. With rates as close to zero as they've been in decades, today's bond market looks like a bubble to me. It's little wonder the world's greatest investors continue to favour quality businesses over bonds. Wouldn't you?

Further Reading:

David Dreman, 'Contrarian Investment Strategies' - Chapter 13/14 'An Investment for All Seasons'/'What is Risk?'

Peter Lynch, 'One up on Wall Street' - Chapter 3 'Is this Gambling or What'