From the onset Tellurian Inc (NYMARKET:TELL) tactic has been delaying a FID (final investment decision) as late as possible taking cash deposits from the investors without having the financial capacity to construct a such project.

Q4 2021 hedge fund letters, conferences and more

Tellurian IR's Promise

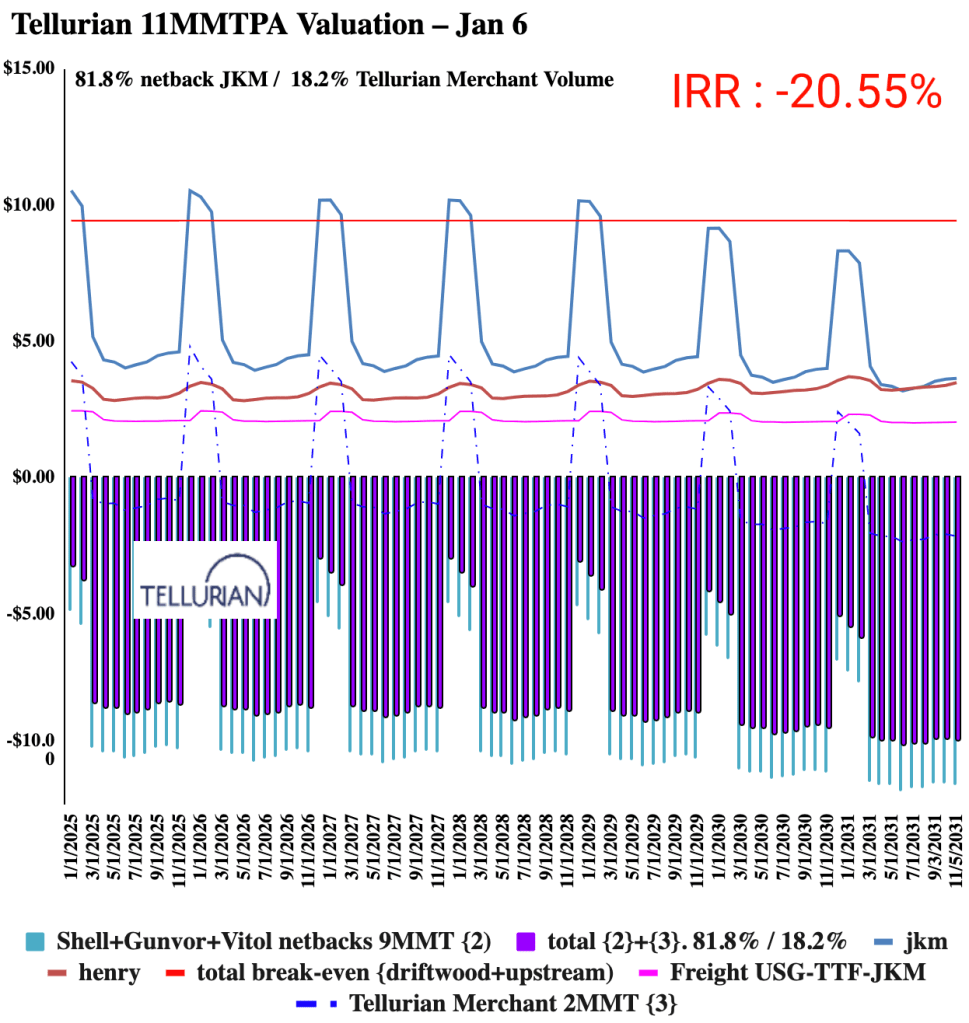

For example, Tellurian IR has promised to deliver lng cargoes baked at a $3.5/mmbtu FOB U.S Gulf to the investors but completely omitting the upstream segment cost.

Tellurian IR’s presentations have inflated their project cash-flows sometimes by a factor of 17X.

In parallel, the suits have executed a $201.3M bonus shares plan off-balance sheets diluting the company and have never stopped plundering the company. What a way to administer a “LNG start-up”.

What are the probabilistic odds of tendering a positive FID at Driftwood ?

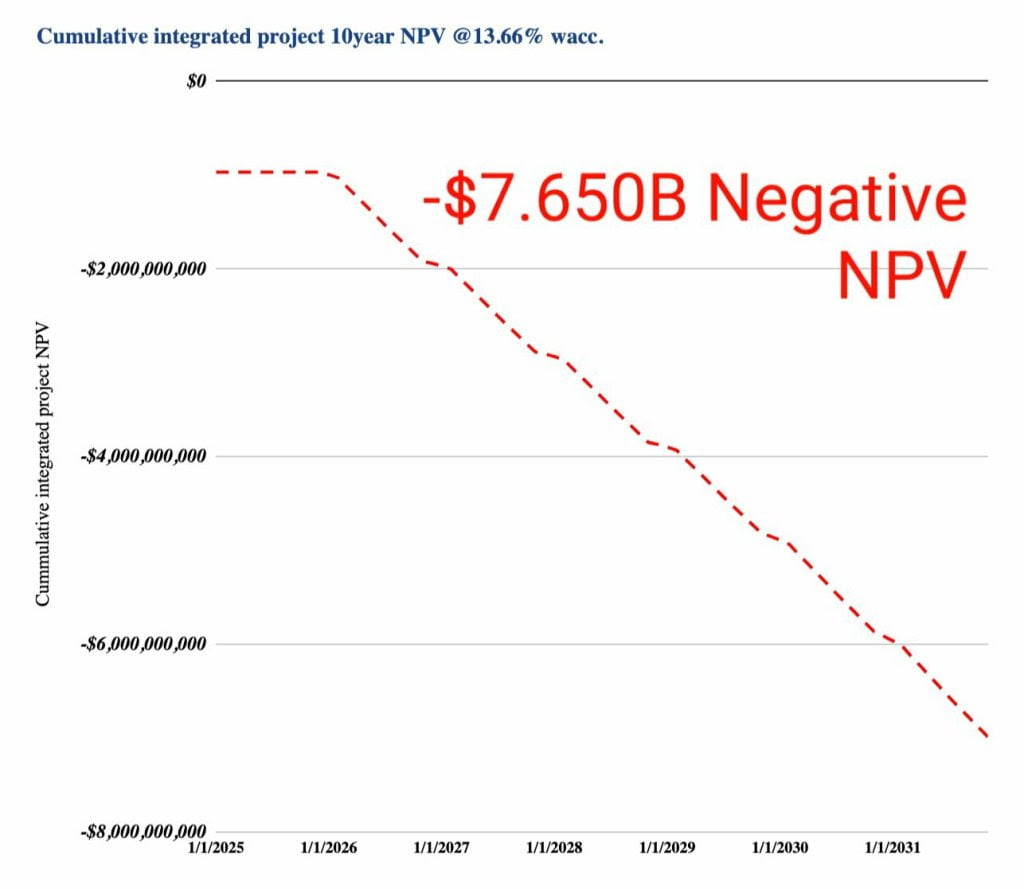

Driftwood hasn’t the adequate gas supply (by cash, equity gap or production) to cover the Netbacks SP&A.

We know that: a) The gas supply and/or a positive IRR (internal rate of return) and b) financing are condition precedents to declare a FID.

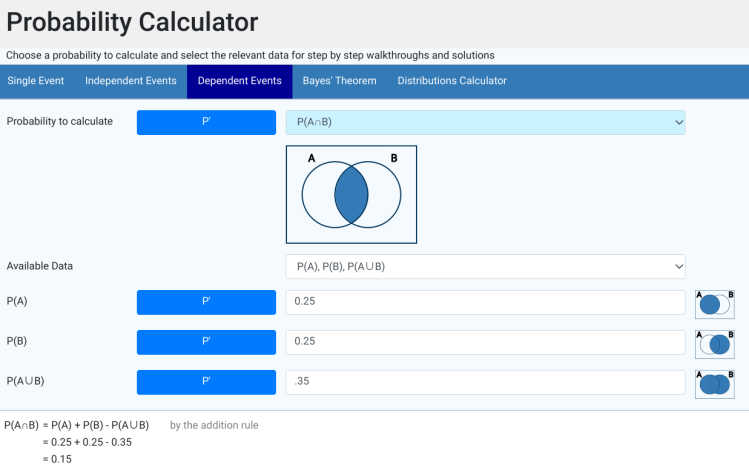

https://www.statskingdom.com/probability-calculator.html

We assign a .25 probability to both p(a) and p(b). P(A U B) we choose .35.

If a and b are two dependent events, the probability for Tellurian to declare a commercial FID on Driftwood is 15%.

The project is not moving forward: in reality the odds of a non final investment decision (FID) for Driftwood are 85%.

Now for a select group of insiders to profit the probability of getting paid given a NO FID in 2022 is 100%.

As Souki and his gang are becoming millionaires, you get poorer and poorer. What you get is an asymmetry.

Dividing The Bonus

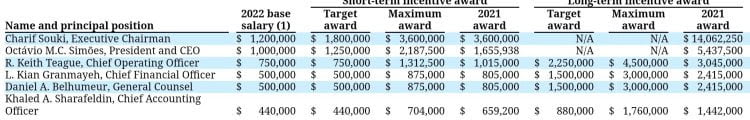

At Tellurian we are so big that we divide the bonus into two categories.

Lebanese Lance Granmayeh gets 500K +805K ST-award+ 2.4M “long-term award”

King Souki is targeting a 1.2M salary, a 3.6M “short-term 2021 award plus 14M long-term award.

BIG keith TEAGUE goes for 750K plus his $1M award and his $3M 2021 long term award.

https://ir.stockpr.com/tellurianinc/sec-filings-email/content/0001104659-22-001897/tm221671d1_8k.htm

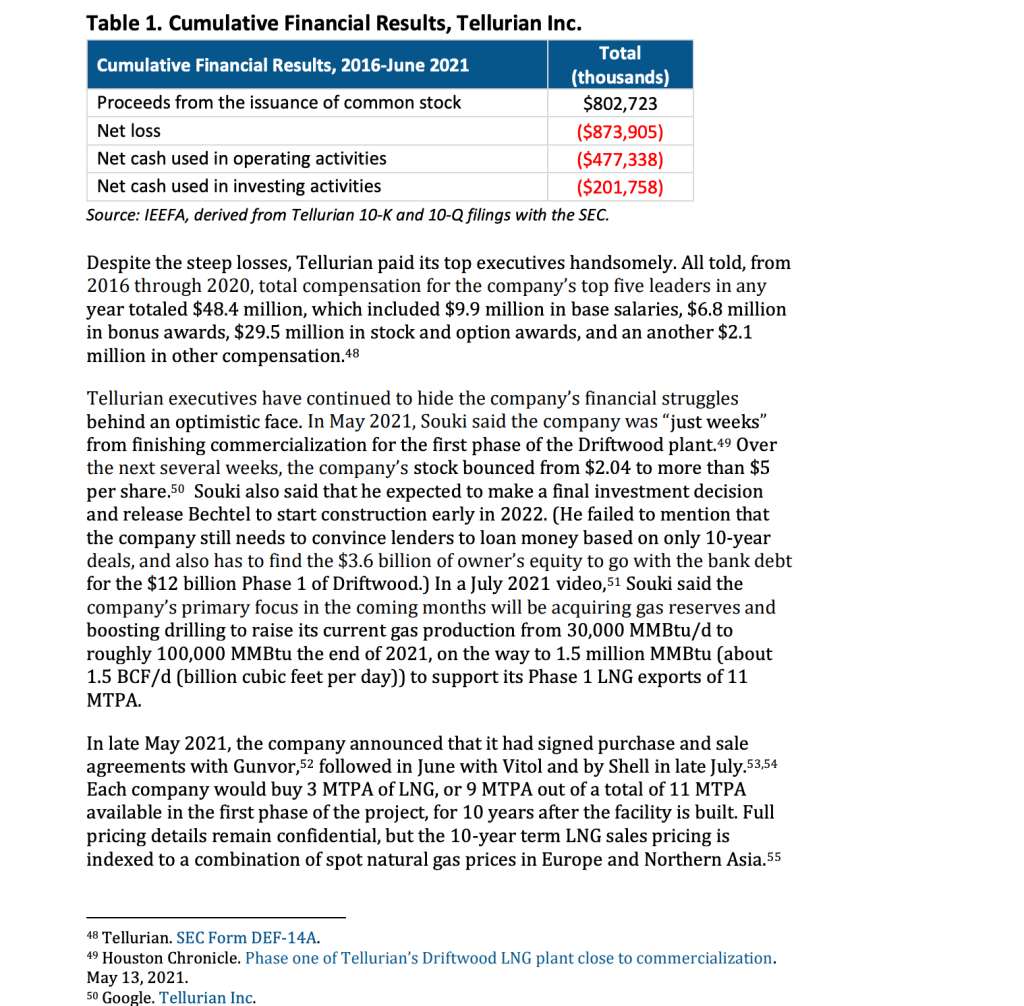

$905M is the amount of money raised in stocks as of December 2021 ( and the company wants $200M more of it ). This is the same company that has invested $50-75M in FID (at a cost basis) and owns a mere $80-95M of gas acreage as assets. Where did the money go?

Source: ieefa.org

Driftwood LNG is truly a loss-center for the investors while the execs take it to the BANK. Like Enron in the end, everyone knew or had suspicion it was a fraud in Houston.

Because the project doesn’t move forward inevitably there is a reset down the road and what the executives are really concerned about first is their seat costs, and secondly a $200M bonus plan that cannot materialize when the FID is canceled.

What the suits signal next is that Tellurian will move some of the $200M pile directly into the payroll:

“On January 6, 2022, the Compensation Committee of the Board approved, effective as of January 1, 2022, increases in the base salaries of Mr. Simões (from $725,000), Mr. Teague (from $580,000), Mr. Granmayeh (from $460,000), Mr. Belhumeur (from $460,000) and Mr. Sharafeldin (from $412,000), in each case in exchange for the applicable named executive officer agreeing to the aforementioned amendments to his existing equity-based award agreements”. - Tellurian SEC Form 8K 6/1/2022

Tellurian is the quintessential example of a LNG retail fraud: Its brain-master knows that he can take the money without having to return it back.

At the college we will teach Tellurian inc in the manual books like we teach Enron Corp.

Every participant with a piece of the action in the scheme, NYSE AMEX, the drive-by medias, Tellurian IR, Renee C. Pirrong have all some serious soul searching to do.

The fun is just beginning.

Article by The Driftwood 22 DISCLOSURE Project

Disclaimer

The author may have short position in stock.