“Record-breaking 2020 Sustainable Finance issuance levels continue to be built upon by companies and government bodies around the world. We’re seeing a resurgent Green Bonds market powered by the Technology, Consumer Staples and Industrials sectors with focus on issuance earmarked for Sustainable and Social purposes, robust equity capital raising and lending. The global capital markets have been remarkably resilient this year and the growing presence of sustainable businesses, innovative structures and use of proceeds will be a hallmark of 2020,” comments Matt Toole, Director of Deals Intelligence, Refinitiv.

Q3 2020 hedge fund letters, conferences and more

Download the full Sustainable Finance Review. Highlights below.

Refinitiv Deals Intelligence | 20Q3 Sustainable Finance Bonds Review

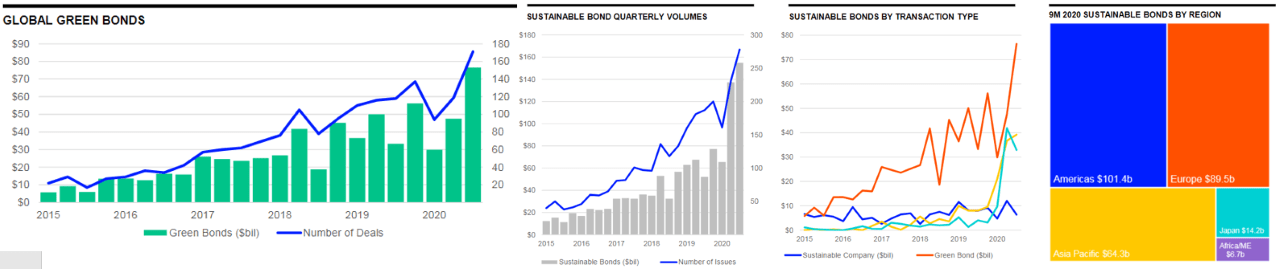

All-Time Record: Sustainable Finance Bonds Total US$357.5bn, 96% Increase YoY; 101% Increase in Volume YoY

Highlights - Debt Capital Markets

- Sustainable Finance bonds totalled US$154.8 billion during the third quarter of 2020, up 13% compared to the second quarter of 2020 and more than double the proceeds registered during the third quarter of 2019.

- 20Q3 marks the highest quarterly total, by proceeds and number of issues, since our records began in 2015

- All-time record: Sustainable Finance bonds totalled US$357.5 billion during the first nine months of 2020, up 96% YoY.

- Green bond issuance accelerated during the third quarter, reaching an all-time record of US$76.5 billion from 171 issues.

- US$84.5 billion worth of Social bonds were recorded globally during the first nine months of 2020, nearly 8x the total raised YoY

- Social bond issuance accounts for almost one-quarter of the sustainable bond market during 2020, compared to 6% YoY

- Sustainability bond issuance reached US$97.0 billion during the first nine months of 2020, more than triple YoY

- The number of Sustainability bonds increased 101% compared to a year ago.

- Corporate issuers accounted for 49% of Sustainable Finance bonds during the first nine months of 2020, while Agency and Sovereign issuers accounted for 51% of overall activity, the highest percentage since sustainable records began in 2015.

- 2020 Largest regional market for Sustainable Finance bonds: Europe 48%, Americas 28%, Asia Pacific 18% market share

- Top spot for sustainable bond underwriting: HSBC with 6.3% market share, an increase of 0.8 market share points compared to a year ago followed up JP Morgan and Citi

Syndicated Loans

- Sustainable lending totalled US$114.5 billion during the first nine months of 2020, a 1% increase YoY, while third quarter sustainable lending activities totalled US$30.1 billion, a 21% decline compared to 20Q2 and the slowest quarter for the sustainable category since 18Q3

- European borrowers accounted for 60% of overall sustainable lending during the first nine months of 2020, led by facilities for Italy’s Enel SpA, Denmark’s AP Moller-Maersk and Germany’s Traton SE and Siemens Gas & Power.

- Sumitomo Mitsui Financial Group took the top spot for sustainable syndicated lending during the first nine months of 2020, with 5.8% market share, an increase of 2.6 market share points, followed by BNP Paribas 5.4%, and Mizuho Financial Group and Mitsubishi UFJ Financial Group, each with 4.8%.

Equity Capital Markets

- All-time record: ECM activity for sustainable companies totalled US$9.7 billion during the first nine months of 2020, a 38% increase YoY

- All-time quarterly record: 20Q3 sustainable equity issuance totalled US$5.6 billion, a more than three-fold increase compared to 20Q2

- Overall ECM activity during first nine months of 2020: the Americas accounted for (77%), Asia Pacific (12%) and Europe (11%).

- BofA Securities, Morgan Stanley and JP Morgan topped the list of bookrunners for sustainable equity offerings during the first nine months, each with more than 15% market share.

Mergers & Acquisitions

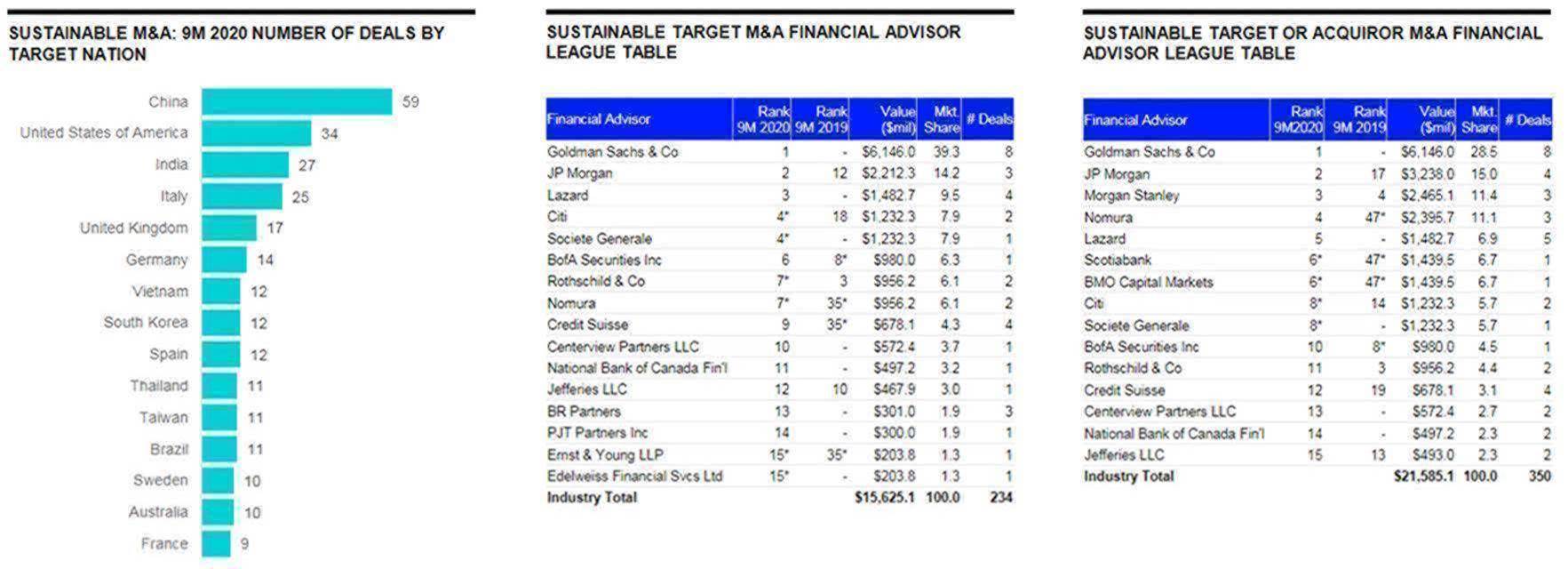

- Two-year high: M&A activity involving sustainable companies totalled US$21.6 billion during the first nine months of 2020, a 7% increase YoY.

- 350 sustainable deals were announced during the first nine months of 2020, a 3% increase compared YoY

- By number of deals: China (17%), United States (10%), India (8%) and Italy (7%).

- By deal value: Asia Pacific (40%), Europe (39%), and Americas (20%).

- Goldman Sachs leads the advisory league tables advising on 8 deals valued at US$6.1 billion.

Sources: Data/charts: “Refinitiv” and commentary: “Matt Toole, Director of Deals Intelligence, Refinitiv”

Learn more about Refinitiv Capital Markets Insights, Equity Capital Markets, Debt Capital Markets and Deals Intelligence.