No market crash, no recession due to money printing and budget deficit, S&P 500 might go to 5,000 points in 2030 but Index Fund investors might not be happy.

S&P 500 To Hit 5,000 Points In 2030, Index Fund Investors Might Be Unhappy

Q2 hedge fund letters, conference, scoops etc

Transcript

Good day fellow investors. Welcome to the stock market news with a long term fundamental twist. Free extremely important pieces of information over the last few weeks were the increased U.S. budget deficits. The Fed getting ready to lower rates over the next month and doing getting ready to do whatever it takes to stabilize economic growth and to keep the economy growing no matter what happens. And the ECB doing the same by saying that they will print money buy assets do whatever it takes to push up the economy and prevent a recession which changes the normal historical things where you have had a boom and bust in the economy and then the bed dies.

The good survives and grows. So financial engineering to the max. And we have to see how will that affect our investments.

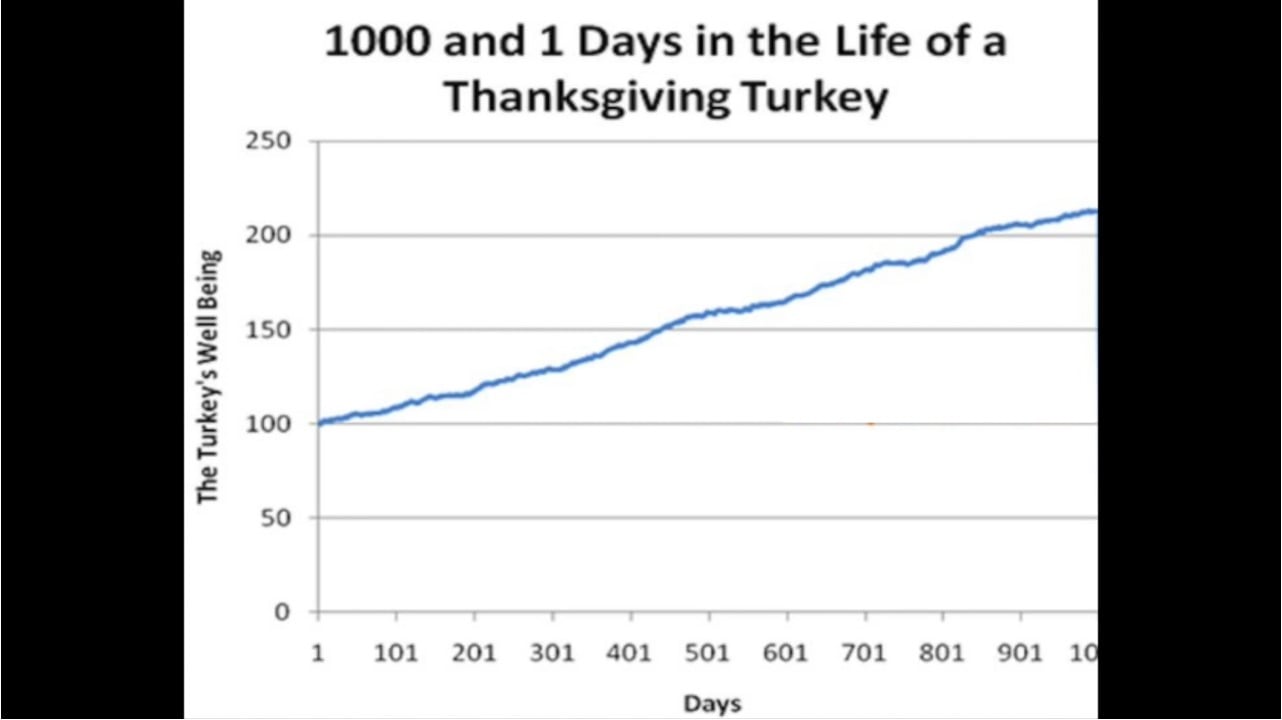

The key is not to be the turkey. The turkey story is very nice.

The turkey is born and every day it gets more and more food. It's happy the turkey's well-being constantly grows. The Turkey thinks there is absolutely no risk because The Bachelor is feeding him more and more and happiness goes on as we have similarly with the current situation in monetary policy. There is more and more money. Interest rates keep going down. Everybody's happy. Everybody's buying new houses new cars and travelling around the world.

Everything looks great. However there is one problem. Governments think they can spend money and not care for deficits. The central bank has will do whatever it takes to keep things going well by printing more money. And we all feel like turkeys there is only one minor issue at some point in time. The butter that's feeding the Turkey decides to prepare it for tense Thanksgiving. Similarly the money printing game ends because it gets out of control. It's the problems escalate. And this has happened a thousand times in history. And then currencies implode. The same happens to the turkey before Thanksgiving.

Now the key for investors is not to be the turkey. You don't want to see your portfolio end up like the turkey ends up before Thanksgiving. And the key here is to simply position yourselves to take advantage of what might happen of what will likely happen. And we've discussed this also with Daley and his monetary policy free projections and I just want to give you a little tips on what you can do and why you should do that with your portfolio on the content.

So just quickly we'll discuss the deficits what's going on why it is important lower interest rates and money printing. How will that affect things how to invest. Just be like the government have debt but have smart that good debt. The S&P 500 might go to 5,000 points in 2030 but index fund investors will not be happy what to do by value like Buffett did in the last 50 years. So on U.S. budget deficits this is probably the most important piece of information over the last two weeks U.S. budget gap ballooned to seven hundred thirty nine billion despite tariff revenue. So if we look at the Congressional Budget Office and their projections for budget deficits we can see that the budget deficit will be larger than one trillion per year in the next one two years. This means that the US total public debt will continue to grow at extremely fast rates. And if we check it over the past 30 40 years it has increased 22 times. Consequently the S&P 500 has increased twenty eight times. Very interesting correlation. So from my point of view of spending more than what you make can only last for a while sooner or later the budget will come. Now what will happen.

Usually the currency is debased which makes it very easy to pay off the debt.

Currencies are worthless and then the news cycle the new economy starts. When will that happen. Nobody knows. But what we can do is position ourselves now to protect ourselves in case that happens but still get the good return in case that doesn't happen. Also we have monetary policy central banks the Fed the ECB doing whatever it takes to help the governments to help those in debt to keep the economy growing because everything is based on that debts are skyrocketing. And therefore central banks say well we'll just print money and fuel that debt bubble into oblivion until they lose control inflation comes. And then there will be trouble.