The 1987 Stock market crash or the 2008 stock market crash were rare occasions. It is hard to time the market and know when to buy, will it crash 10%, 15% or 40%. Better just be an investor.

Waiting For A Stock Market Crash Has A Huge Opportunity Cost

Q1 hedge fund letters, conference, scoops etc

Transcript

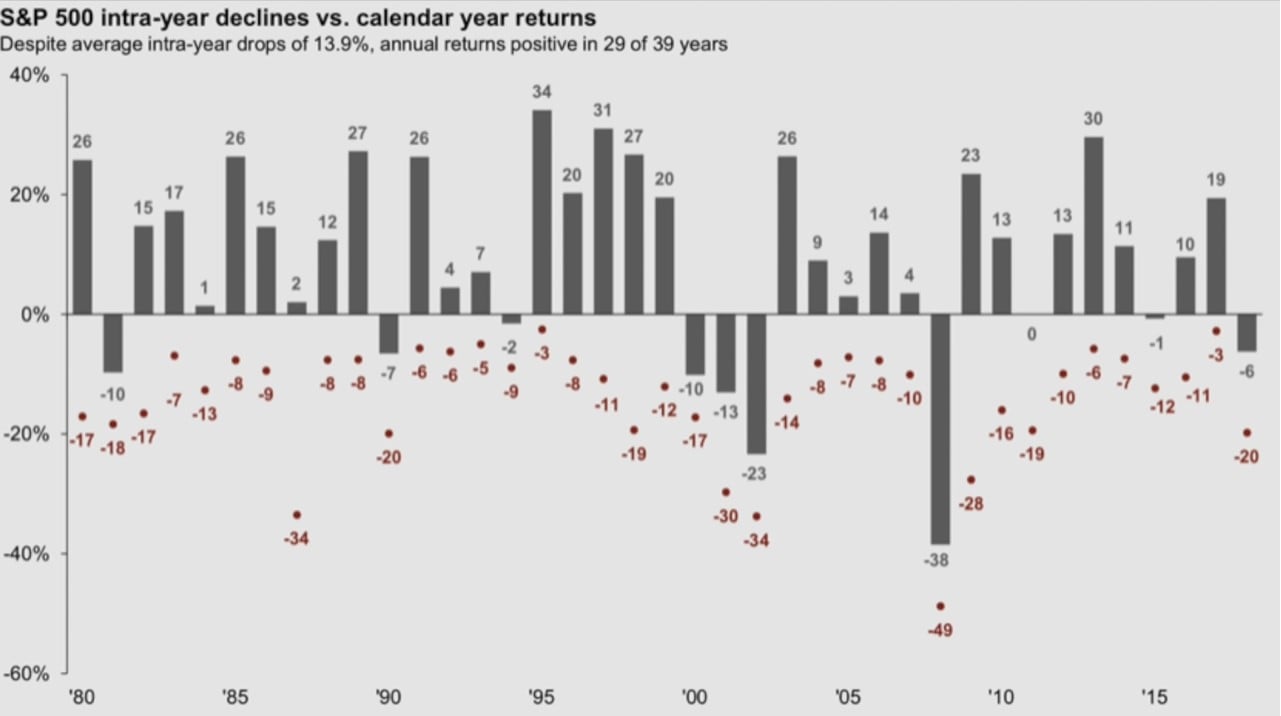

Good day fellow investors. I read many comments about stock market crashes and how you're waiting for a stock market crash. I thank you for the comments and leave always a comment. Always I'm always happy to read it but I might not disagree on the waiting for a stock market crash because I think that over the very long term it doesn't maximize your investment returns. And in this video I'm going to explain why I think so and why a strategy of being a little bit more aggressive not Waiting does not timing the market. But having time in the market I believe will lead to higher long term investing returns. Let's start. So I don't like timing the market because you are timing the market and you are assuming that you can forecast where will stock prices go that you can forecast what will the economy do and that you can forecast what the Fed will do with interest rates and everything that comes along with that. Warren Buffett always says I can do it. I cannot forecast what will happen with the economy what will happen with the Fed. What will happen with stock prices. So why would we think we could do it. So that's one and then timing the market has also proven in the past not as a good strategy because you never know what will happen what will happen next. Which leads to speculation greed trying to outperform not on investing but on speculating which is a very very tough thing to do. If we just look at the draw downs of the S&P 500 over the last 35 forty nine years you can see that OK if there is always volatility but there are only a few really really deep drawdowns so.

Intra year drawdown was 34 percent in 1987 20 percent in the 1990s but then a lot of just small declines up to 11 percent then two big dumb declines in the 2000s the dot-com bubble then a huge decline for the great financial crash and then the last one was 20 percent recently but you can see that it's very difficult to pick. OK. When am I going to buy. If we look at from this perspective many that were expecting bigger crashes 20 30 40 50 percent as we have seen in 2009 2001. They missed out on huge opportunities to buy and they missed out on huge opportunities to get the amazing returns that many of us got over the last nine 10 years.

Now I am relatively fully invested now. I have been a little invested at the beginning of the year because I did great in 2018 the biggest largest position I had got acquired. So that was the only reason I also made the video why I had a lot of cash then I wanted to finish my research go on with my research and now I'm pretty well positioned in my portfolio. If I checked my portfolio that I started in May 2018 where I started with 10000 I add 1000 monthly I am not now a few thousand up on something off of about 25000 invested. So that's very very good. And that's the key that shows okay even if the markets are expensive you can always find the value here and there that will give you a good investing returns. And I'm going to further argue that's better to be invested because let's say that you make 15 percent for free here's your total cumulative return after free years is 52 percent. Even if there is a decline of 40 percent yes you are down to down 9 percent from your initial perspective but add a few dividends add something and you will break even. But as we have seen in the drawdowns 40 percent declines are really really rare and. If you don't invest if you're waiting for those you might miss on a much much bigger opportunities. If you do 15 percent over 7 years then whatever crash might happen whatever might happen it doesn't affect you because whatever happens you are still positive. And then again if we look at the draw downs of the S&P 500 over the very long term you can see those declines. Those dips as very very small points in time. So it's against evolves. It again involves huge timing skills that very few have to buy re really those dips and then again something to help your case. And if you're saying that we can't time the market what we can do it's very simple. You invest based on the return from the business when you are happy with the return from the business. That's it. I'm currently researching reads. Here is just the initial table of what I'm doing.