I recently wrote an article for Sure Dividend entitled “Consider Equity REITs for Your Next Investment“. In that article, I listed nine equity REITs for dividend investors to consider in light of the drubbing that REIT valuations have recently taken due to fear of rising interest rates and to capitalize on the pass-through provision for REIT income included in the new tax legislation. Both of these topics are covered in some detail in the previous article. This article provides a more complete investment thesis for Sabra Healthcare REIT (SBRA), one of the nine REITs highlighted in the previous article.

[REITs]ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Sabra Healthcare REIT

Sabra invests in skilled nursing facilities (SNFs), senior housing, hospitals, and other healthcare facilities owning 728 properties in 45 states. The company’s enterprise value is $6.1B so Sabra is relatively small compared to Ventas (VTR) or Welltower (WELL). As it stands today, Sabra’s revenue mix is 65% skilled nursing, 25% senior housing, 8% hospital (and other), and 2% interest and other income.

Sabra is often compared to Omega Healthcare (OHI) because of the concentration of skilled nursing facilities in both. Sabra, however, is a bit different and has an aggressive plan to further differentiate itself. When Sabra was spun off from Sun Healthcare Group in 2011, it was essentially 100% dependent on a single operator of its properties, Genesis (GEN). Today, Genesis only makes up 8% of revenues for Sabra and Sabra plans for that to go to zero by early in 2019. As Sabra transitions away from Genesis, the majority of the proceeds from the sale of Genesis operated properties are being reinvested in senior housing properties. So, not only is Sabra transitioning away from Genesis as an operator, they are lowering their concentration in skilled nursing facilities.

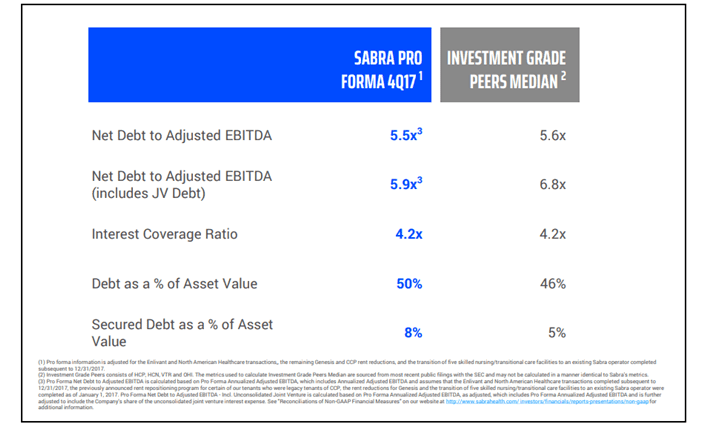

Sabra has also been working aggressively to secure an investment grade credit rating since 2011 and they received that from Fitch in 2017 with a BBB- rating. Sabra isn’t resting on their new rating and continues to build a fortress balance sheet. Today, 87.2% of Sabra’s long term debt has a blended fixed rate of 4.0% and nearly all is unsecured. Sabra has roughly $350M in current liquidity. As you would expect for an investment grade equity, Sabra’s debt metrics are very solid as shown in the chart below.

Source: Sabra Investor Website

These metrics represent a very solid balance sheet showing a reasonable overall debt load and more than sufficient earnings to cover interest payments.

Sabra Healthcare REIT’s Recent Financial Performance

Sabra’s recent financial performance has been very good despite the drubbing the REIT has taken in the market over the last several months. The chart below shows Sabra’s normalized AFFO/share, dividend distributions per share, and the revenue concentration of Genesis and skilled nursing.

Source: Sabra Investor Website

The take away from the chart above are that AFFO is showing healthy growth as is Sabra’s dividend distribution and that the AFFO easily covers the dividend distribution. Because REITs have very high depreciation write-offs which are tax accounting entries not affecting cash flow, the usual metrics of earnings per share (EPS) and price earnings ratios (P/E) are not meaningful for REIT financial reporting. The accepted metric for REIT financial reporting is FFO (funds from operations) and AFFO (adjusted funds from operations) which are cash flow metrics. The dividend payout ratio for 2017 was 76% and the ratio for 2018 is expected to be similar. For a REIT, anything less than 90% payout ratio is acceptable and less than 80% is considered good.

Compared to its peers, Sabra has been performing well but this has gone unrecognized by investors. The chart below shows a comparison of FFO multiples (share price/FFO) dividend yield, premium/discount to net asset value (NAV), and portfolio composition.

Source: Sabra Investor Website

The charts show that Sabra is on sale with a price/FFO below 7, sports a very high dividend yield, and is selling at a discount to NAV. Clearly Sabra has not seen much love from the market. Reader’s should note here that the last week was very volatile for stocks and REITs in particular. Because of that volatility, some of the relative comparisons in the above chart between Sabra and its peers may have changed a bit. None-the-less, the conclusion that Sabra has been selling at a cheap valuation still holds.

Sabra Investment Thesis

With the general market currently experiencing a mild correction and REIT valuations suffering further from fear of rising interest rates, why would I be considering an investment in Sabra at this time?

For the last six months, Sabra has been pummeled by the market’s fear of rising interest rates and fears concerning the possible demise of Genesis. Sabra has fallen roughly 23% in that time. While the market has pushed REIT valuations down due to fears of rising rates, history tells us that REITs generally do well during periods of slowly rising rates and some REITs will even beat the big market indexes under these conditions.

With roughly 87% of Sabra’s debt at a long term fixed rate of 4.04%, rising interest rates are unlikely to have much if any effect on Sabra’s current balance sheet. Sabra recently achieved an investment grade credit rating giving the company access to lower future financing costs. Sabra has taken steps to mitigate and eventually eliminate the risk of having Genesis as an operator.

Long term, Sabra is in a growth business. We are all getting older fast and as we age, we tend to consume more healthcare including hospitals, skilled nursing facility care, and senior housing. Approximately 10,000 baby boomers reach retirement age every day, 7 days a week, 365 days a year in the US. As the baby boom generation ages, we will cause a major shift in demographics in the US as well as other developed countries. The number of people over the age of 85 today in the US is about 8 million. In thirty years, that number is forecasted to grow to 20 million, a 2.5 fold increase. The chart below shows the forecast of our changing age demographics.

The growth in older American’s will provide a steadily growing demand for Sabra’s facilities and that growth will last for at least 30 years.

In addition to the increasing demand for Sabra’s properties, the recent tax legislation included a 20% deduction for pass-through income from partnerships, MLPs, and REITs. This makes Sabra’s current 10.5% dividend yield all that much more enticing. For a more complete discussion of the impact of rising rates on REIT financial performance as well as a more detail on the new pass-through provision, readers should see my earlier article “Consider Equity REITs for Your Next Investment“.

In Conclusion

Sabra is a well established and well run healthcare REIT with a history of steady and conservative growth. With an investment grade credit rating, a strategy in place to eliminate the Genesis operator risk, ongoing efforts to reduce the current concentration in skilled nursing, Sabra management is making the right moves for the future.

Recent investor jitters over rising interest rates has pushed Sabra’s stock price into deep bargain territory and its dividend yield up to 10.5%. The partnership and REIT pass-through income provision in the recently passed tax legislation will shield 20% of Sabra’s dividend from Federal income taxes. An investment in Sabra at its current valuation should reward investors very well in future years.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Dirk S. Leach, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.