Residential market declines amid supply surge, office market faces oversupply challenges, retail market competes with increasing pressure, and hotel occupancy falters despite spike in tourist arrivals.

DOHA l 7th August 2023: Knight Frank, the leading global real estate consultancy, has unveiled its Qatar Real Estate Market Review for Spring-Summer 2023, providing an in-depth analysis of the current state of the real estate market across the residential and commercial sectors.

Residential Market

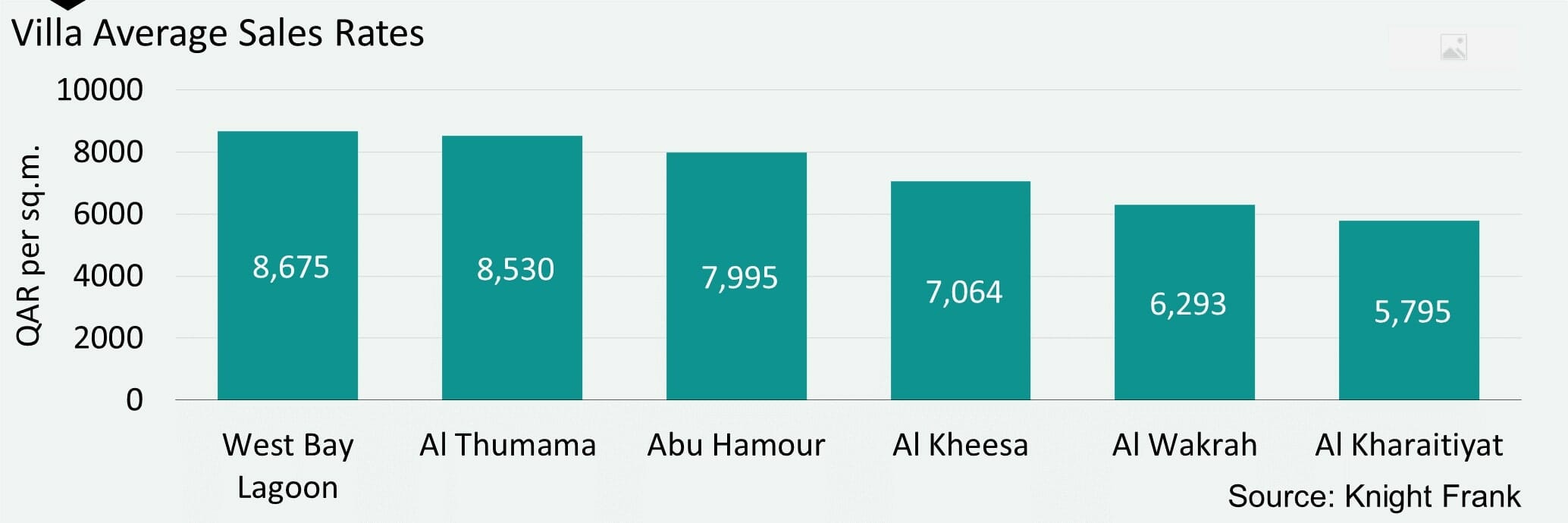

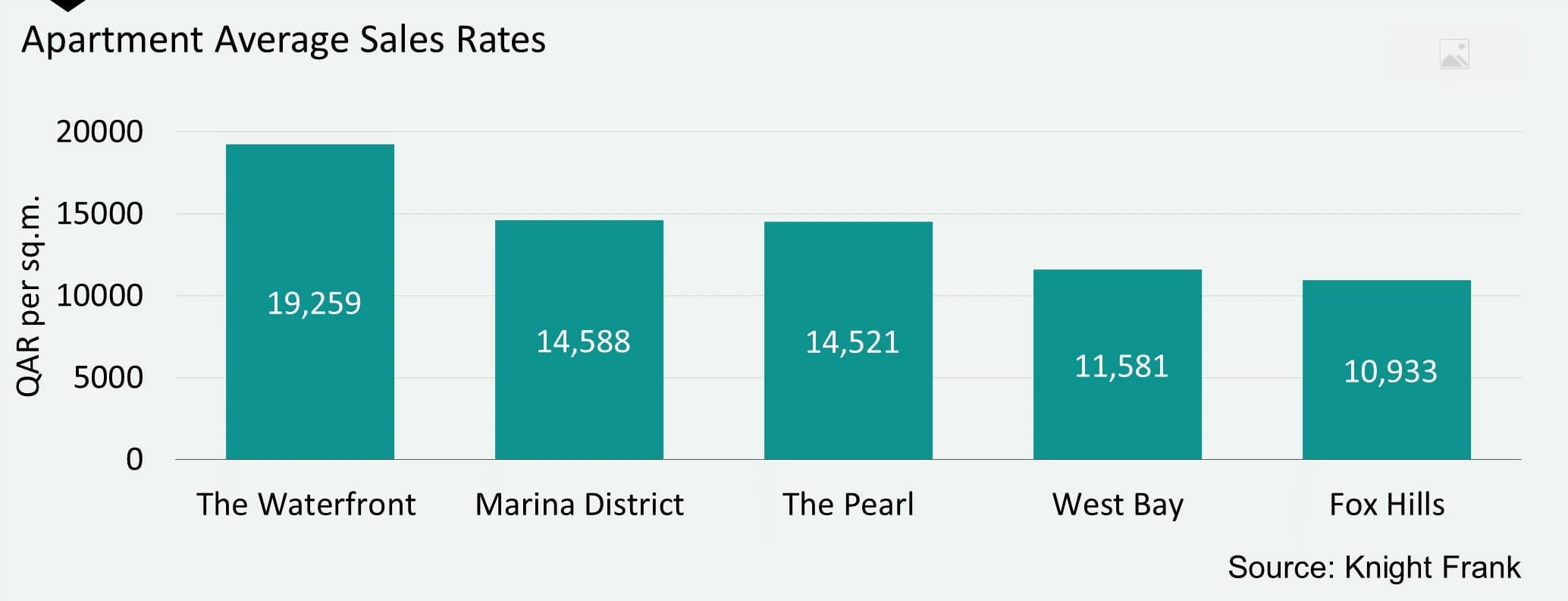

The housing market in Qatar faces challenges as a fall in demand for residential properties is coupled with a rise in supply following the construction boom linked to the FIFA World Cup 2022.

Faisal Durrani, Partner, Head of Research, Middle East and North Africa, explained: “The supply-demand imbalance, rising interest rates, and affordability challenges are contributing to a shrinking mortgage market and impacting the volume of home sales, while also undermining residential values. Indeed, the total number of residential sales transactions has fallen by 36% over the last 12-months. Simultaneously, the total value of residential transactions has declined by 24%”.

Knight Frank notes that Doha and Al Rayyan municipalities recorded the highest volume of residential transactions during the second quarter.

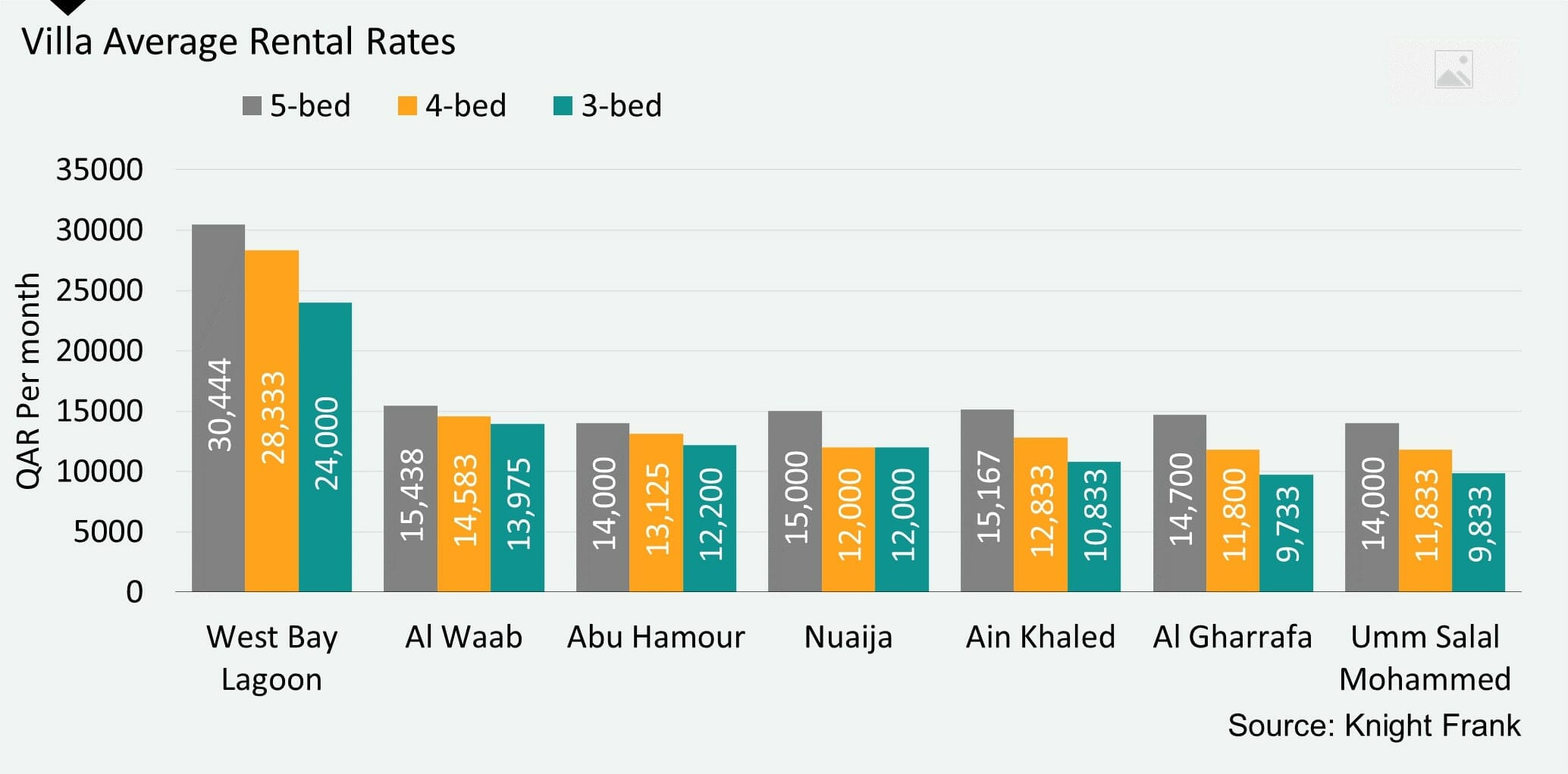

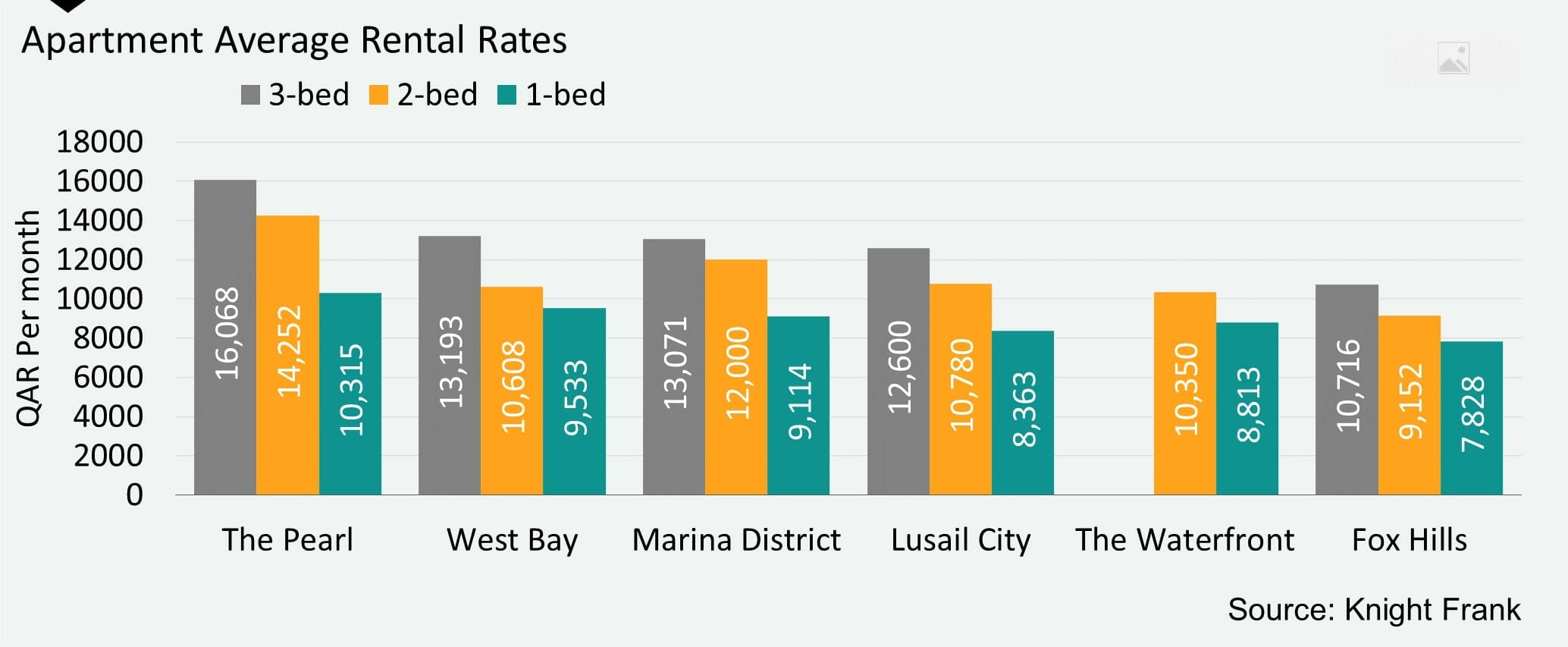

With rents dropping in majority of the districts, Lusail’s Waterfront and Fox Hills districts experienced the highest quarterly depreciation of 23% and 18%, respectively, in the average quoted rents for apartments.

Durrani continued, “The sharp decline in rents will undoubtedly put landlords under pressure to remain competitive, particularly as our 2023 Destination Qatar report shows that Qatari high net worth individuals most prefer Lusail for a residential acquisition, with an average budget of US$ 1.8 million. Among the HNWI we spoke to, 71% already own a home in Lusail. Additionally, Lusail Marina and Lusail Waterfront were identified as the two most favoured locations for residential real estate acquisition”.

Moving on to rental yields, during Q2 2023, the gross single-let rental yield for residential properties in Qatar averaged 6%. Apartments had a higher yield of 6.4%, while villas yielded slightly lower at 4%.

Office Market

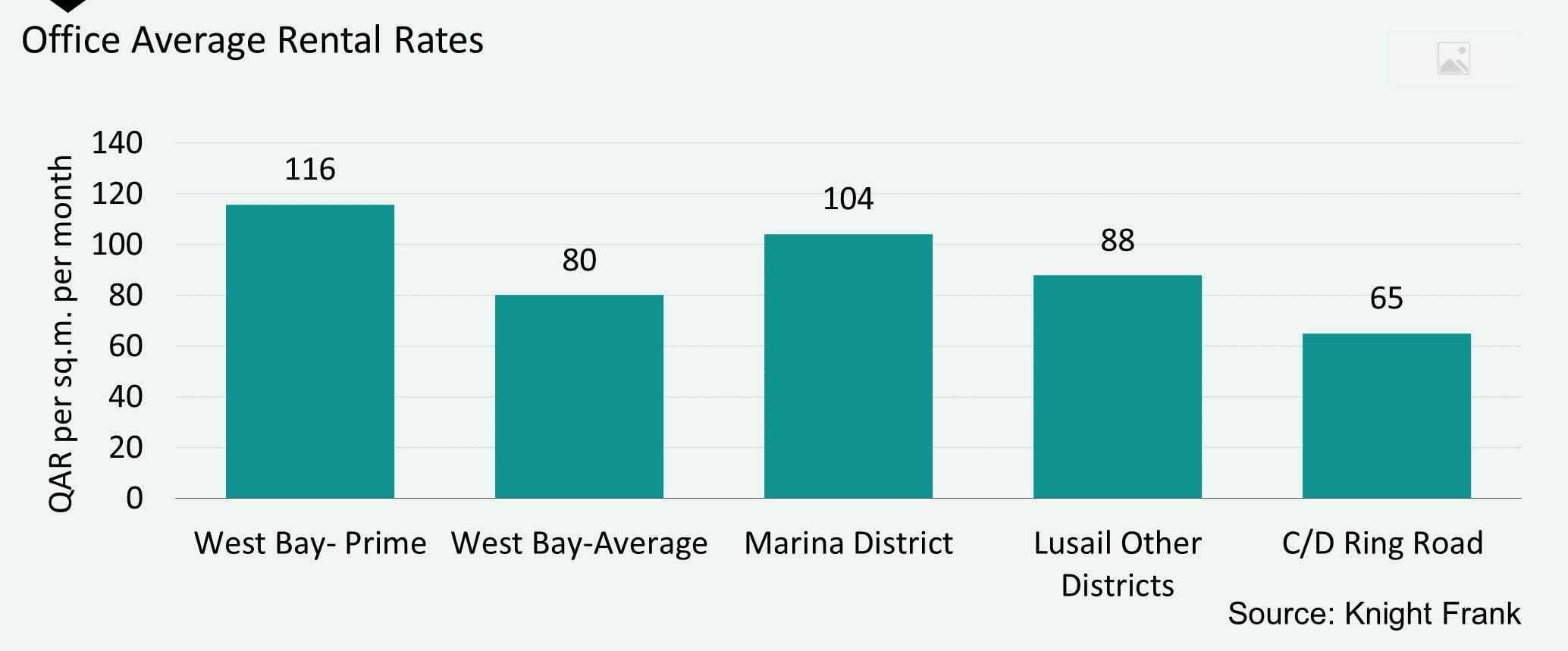

Knight Frank highlights challenges in the office market too, which is experiencing a widespread drop in average rental rates.

Adam Stewart, Partner, Head of Qatar, highlighted: “Despite strong demand from the public sector and oil and gas industries, the Qatari office market’s biggest challenge is an oversupply of office space, which is undermining rents, leaving occupiers firmly in the driving seat”.

Notably, the public sector is driving most of the activity in Qatar, particularly in Lusail, says Knight Frank. A recent example of a substantial lease is Qatari Diar’s 6,200 sqm lease at The Qatar Financial Centre Authority’s (QFCA) Lusail Boulevard.

Stewart added: “With a concerted effort by authorities to relocate public sector entities to Lusail, we expect leasing activity in Lusail to continue rising”.

Hospitality Sector

Following the successful hosting of the 2022 FIFA World Cup, the tourism sector in Qatar continues to show promising growth, with a significant increase of 206% in visitor numbers reaching 1.77 million during the first five months of 2023, compared to the same period last year, Knight Frank says, highlighting data from STR.

Turab Saleem, Partner, Head of Hospitality, Tourism and Leisure Advisory – MENA, concluded: “Despite increased visitor arrivals, average occupancy fell from 58% to 53% over the year’s first six months, highlighting that both rising hotel stock, combined with the supply overhang from the World Cup is remaining ahead of demand”.

About Knight Frank

With a legacy of over 125 years, Knight Frank has proudly established itself as the go-to independent global property consultancy, encompassing an extensive network of 487 offices across more than 53 territories. Our team of 20,000+ real estate professionals is known for their profound industry knowledge and dedication to delivering exceptional results.