Dubai | 3rd August 2023 – Knight Frank, the leading global real estate consultancy, unveils its Dubai Office Market Review – Summer 2023 highlighting the robust demand for commercial office space. The report reveals that in the first half of 2023, the Dubai office market experienced an unprecedented spike, with demand reaching a remarkable 580,000 sqft. This represents a 23% increase compared to the same period last year.

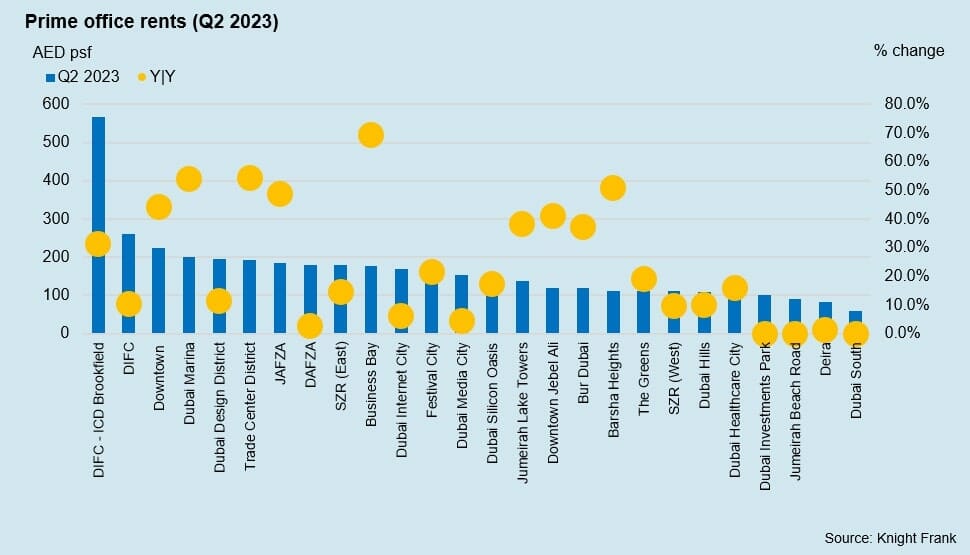

The report showcases the strong performance of average office lease rates, with the DIFC remaining the city’s star performing location, driven by market leading Brookfield Place, where rents remain well above the wider DIFC average of around AED 260 per square foot, according to Knight Frank. Demand for best-in-class work environments against a severe shortage of prime Grade A space has been a key driver behind the continued outperformance of the DIFC.

The 1 million square foot Brookfield Place is the among the world’s 20 largest LEED Platinum rated buildings and was also the first building in the Middle East to achieve a Platinum Wired Score rating, a process that Knight Frank undertook for the tower’s owners.

Elsewhere, Business Bay, the Trade Center District, and Dubai Marina have experienced the most significant uplifts in office rents in the last 12-months, registering increases of 69%, 54%, and 54%, respectively.

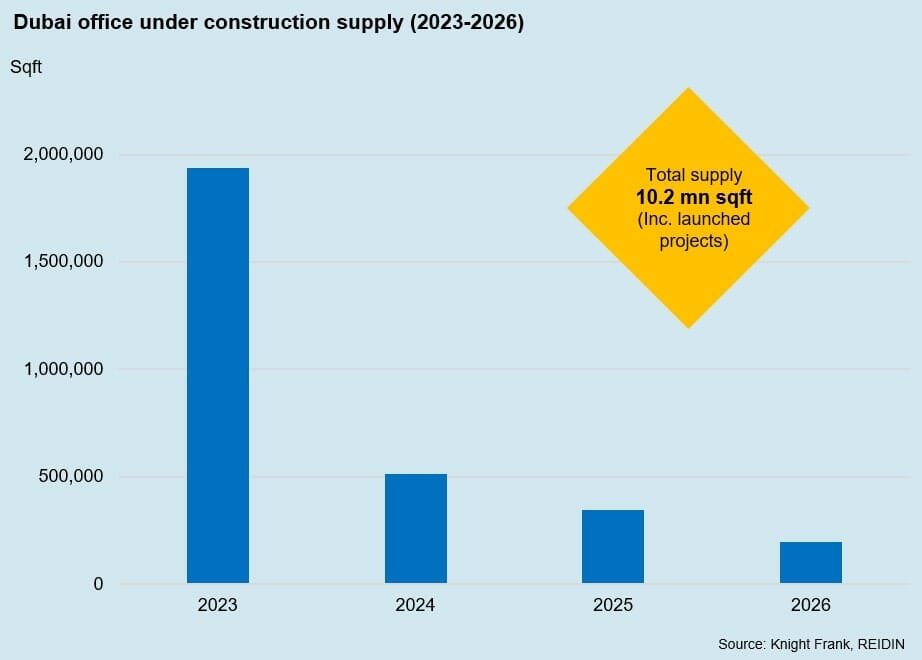

Faisal Durrani, Partner – Head of Middle East Research, explained:“Dubai’s office market continues to experience a severe shortage of supply, with just three million square feet of space due to be completed between now and 2026, the vast majority of which is already spoken for. This is against a backdrop of 580,000 square feet of requirements.

With no supply relief in sight and economic growth being sustained – indeed the national non-oil PMI reading for June stood at 56.9, marking two-and-a-half of business expansion – the only way rents are likely to continue trending is upwards. Still, while occupiers may be getting a relatively ‘good deal’ compared to historic rates, the shortage of options is likely to be even more frustrating.”

Noteworthy developments include One Za’abeel Tower, Uptown Tower, DP World and Landmark Group’s new Headquarters building, Gate Avenue Link Bridge, 6 Falak, TECOM’s Innovation Hub Phase 2, and Al Wasl Tower. These projects aim to meet the escalating demand for cutting-edge offices, further solidifying Dubai’s position as a leading global business hub.

Grade A Focus

The market trend of occupiers gravitating towards new Grade A developments has continued to intensify throughout the first half of the year. National and international occupiers are actively seeking efficiently managed, ESG accredited, and well-maintained offices. Older, more secondary office stock, however, almost irrespective of location face challenges in returning to pre-Covid lease rates due to a lack of demand for older offices.

Durrani added: “Occupiers are clear on the link between high-quality offices and staff attraction and retention, which is likely to continue hampering the prospect of strong performance for older office buildings in the city. The bigger question lies in how landlords respond to the unwavering focus on well-managed, modern office buildings. ESG accreditations serve as the cherry on top and while there is demonstrable evidence of rental premia for green buildings around the world, the sustainability imperative is manifesting itself in different ways in the Middle East”.

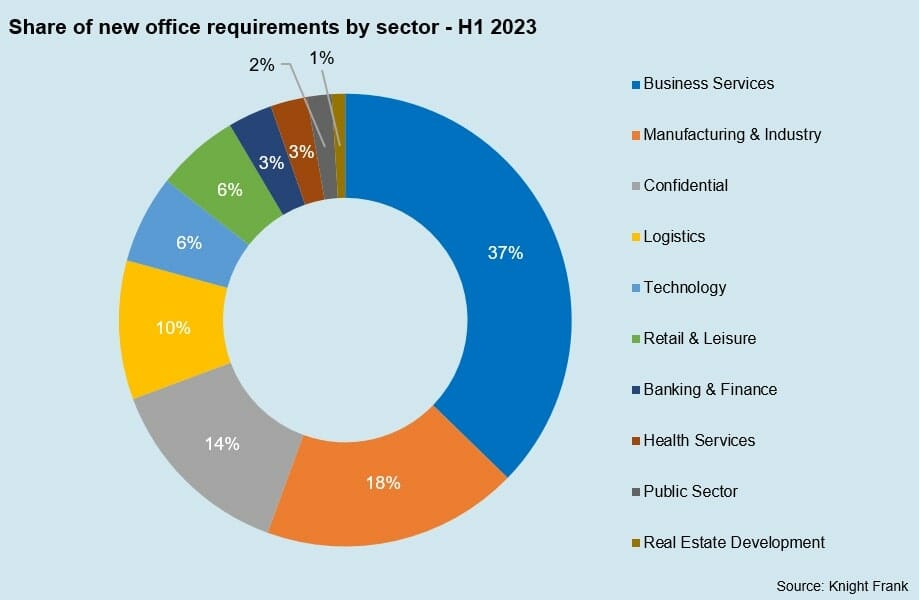

Knight Frank also points to the varied nature of office demand that is helping to sustain the rental growth rates being recorded.

Adam Wynne, Associate Partner – Occupier/Landlord Strategy & Solutions Dubai, commented: “We have seen an uplift in the amount of business services setting up in the Emirate. Dubai is perceived as a strategic location – businesses can strengthen their presence in an emerging market, which has a stable economy and affordable office rents (in comparison to other global hubs). It allows their work force to work multiple time zones from one office, enabling access to both Western and Eastern colleagues and clients.”

Investment Market

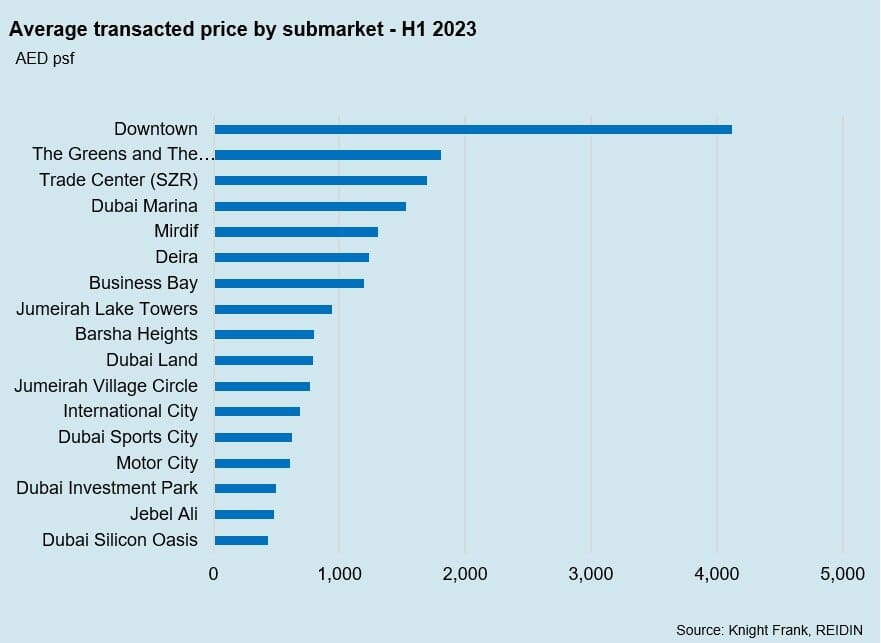

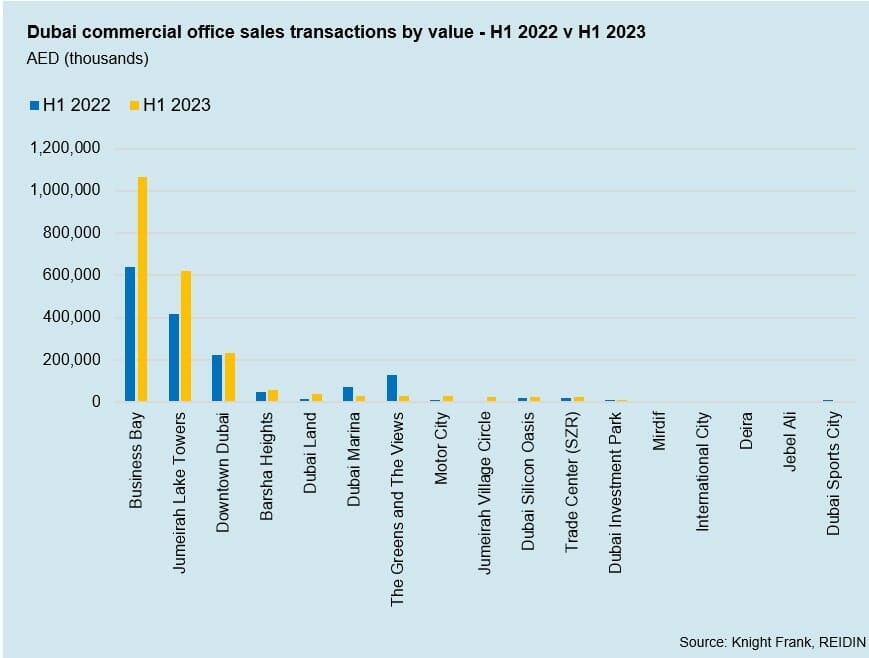

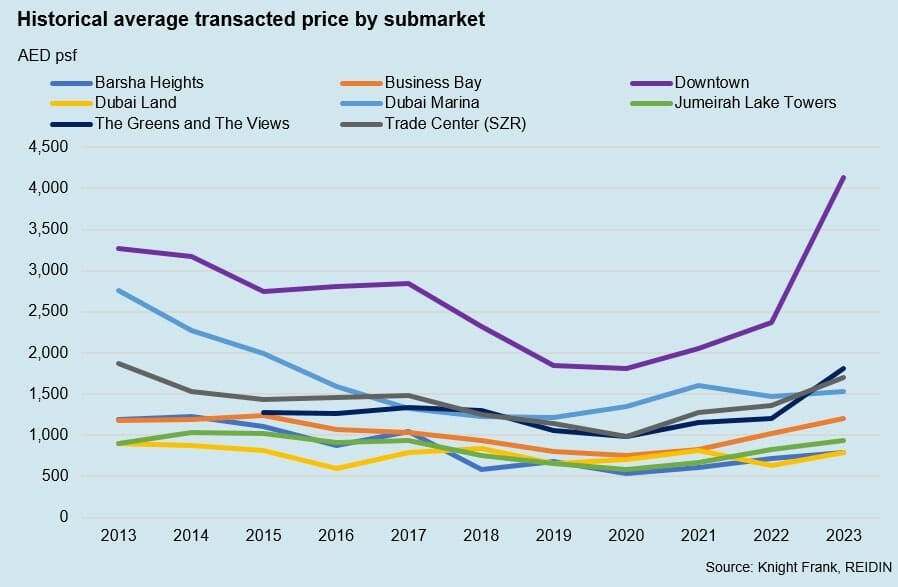

The investment market in Dubai has also experienced significant growth during the first six months of this year, with a 35% increase in transaction volumes compared to the same period last year, amounting to AED 2.2 billion. Business Bay and Jumeirah Lake Towers have emerged as key contributors to office sales, with notable transactions such as the AED 22.5 million sale of 4,187 square foot and the AED 19 million sale of 6,559 square feet in Business Bay driving the average transacted price up by 18% to AED 1,060 psf.

About Knight Frank:

For over 125 years, Knight Frank has continued to expand its impressive global footprint to now include 487 offices, in over 53 territories, employing more than 20,000 real estate professionals and is the leading independent global property consultancy.