Bill Ackman’s Pershing Square Holdings, Ltd. released its Annual Investor Update Presentation. The presentation includes a performance review, an update of the fund’s portfolio and an organizational update.

Current Portfolio Update

Automatic Data Processing (“ADP”)

ADP is a high quality, simple, predictable, free-cash-flow generative business

- ADP participates in an attractive industry with robust secular growth

- Recent developments have confirmed elements of our investment thesis

- U.S. tax reform will drive a ~13-15% increase in earnings

- ADP has a significant opportunity to create long-term shareholder value

- Rising interest rates will increase ADP’s profits on its $24bn float balance over time

- As a result of our proxy campaign, ADP’s management committed to improved growth and accelerated margin performance

- We remain actively engaged at ADP; achieving ADP’s structural potential will drive substantial shareholder value

- Employer Services’ growth can increase from ~2-4% to ~7%+, while operating margins should increase from ~19% today to 35% or greater

- Implies ~$10 of EPS by FY 2022, >50% increase relative to the status quo

- ADP’s stock has increased 18%(1) from our average cost, but remains undervalued and does not reflect the significant opportunity for improvement

- Pro-forma for tax reform, ADP trades at ~24x ADP’s FY June 2019 EPS guidance, slightly below the valuation when we initiated the position

ADP: Share Price Performance Since Inception

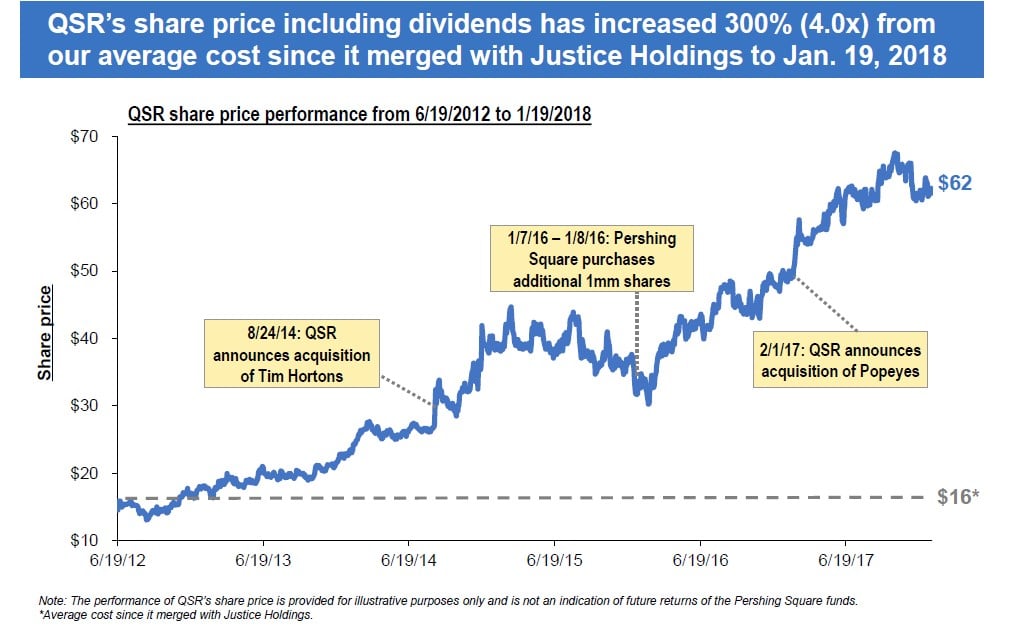

Restaurant Brands International (“QSR”)

QSR remains an attractive investment opportunity despite significant share price appreciation in 2017

Continued Strong Business Performance

- Net unit growth of 6% at Burger King and 4% at Tim Hortons

- Margin enhancement from continued efficiencies and Popeyes integration

- Increased EBITDA margins ~250bps at Burger King and >1,000bps at Popeyes

- Same-store-sales growth at Burger King (+3%) more than offset flat results at Tim Hortons

Cheap Relative to Intrinsic Value and Peers

- Trades at ~21x our estimate of 2018 free cash flow per share

- Peers(1) trade at an average of ~25x 2018 free cash flow per share based on analyst estimates

- QSR trades at a discount to peers despite higher long-term growth potential

- Free option on future value-creating acquisitions

QSR: Share Price Performance Since Inception

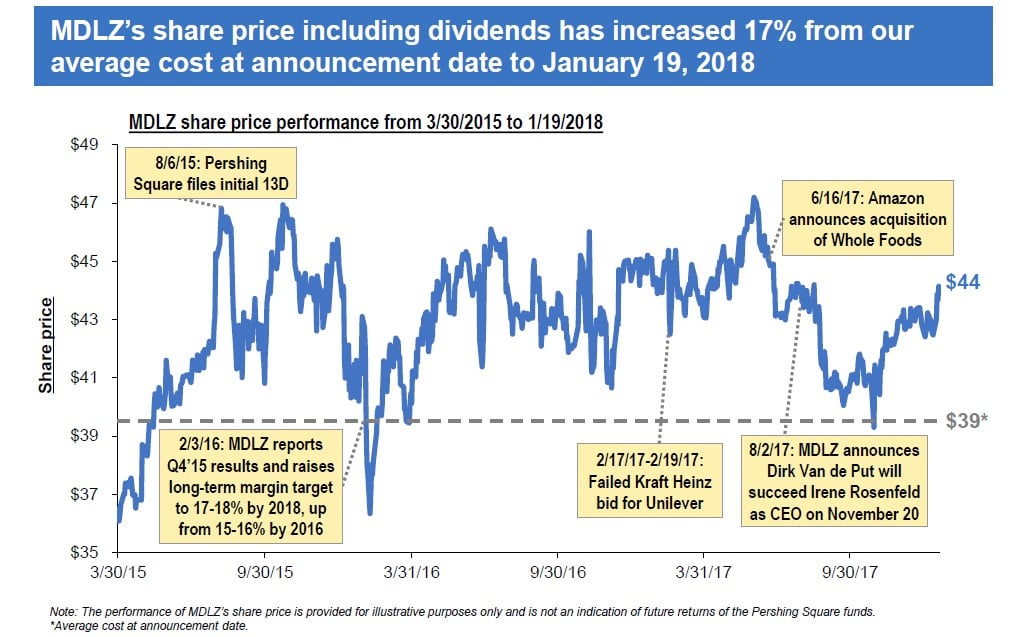

Mondelez International (“MDLZ”)

We believe there are clear catalysts for an upward revaluation of MDLZ as key investor concerns that emerged last year are addressed

- Today, MDLZ trades at 18x our estimate of 2018 earnings per share

- Slight discount to S&P 500 despite high business quality, secular growth potential, and substantial margin improvement opportunity

- ~15% discount to both peer valuations and historical average multiple

- Undervaluation driven by concerns around the U.S. grocery landscape, MDLZ’s growth potential, and the recent CEO transition

- We expect continued acceleration in revenue growth and clarity on the new CEO’s strategy will cause MDLZ’s gap to intrinsic value to close

- Only 25% of sales in the U.S., with ~40% in emerging markets and ~85% in snacks

- Improved quality of organic growth with higher contribution from volume growth

- EMs macro, FX, and product rationalization have turned from headwinds to tailwinds

- No need for new CEO to “rebase” earnings given strength of manufacturing base and supply chain; healthy levels of A&P investment; and remaining margin opportunity

- Compelling upside from re-rating combined with double-digit EPS growth

MDLZ: Share Price Performance Since Inception

Howard Hughes Corporation (“HHC”)

HHC continues to create value across its portfolio of core trophy real estate assets

- Strong condo sales at HHC’s 60-acre Ward Village coastal development in Hawaii with 93% of its existing condo inventory sold or under contract

- Seaport District on track for grand opening in Summer 2018

- Signed long-term lease with ESPN for 19K SF to broadcast its daily shows

- HHC’s Summerlin master planned community (“MPC”) in Las Vegas will have its fifth straight year with over $100M in land sales

- Increase in land sales at both Bridgeland and Woodlands MPCs in Houston

- Announced that Bank of America will serve as the lead anchor tenant for a new 51-story, Class A downtown office building in Chicago

- HHC has 37M SF of remaining vertical development entitlements at its existing MPCs alone, which is nearly 10x the amount of development that HHC has executed since 2011

PSH sold its common stock in HHC (but retained its HHC total return swaps) to address potential FIRPTA issues at PSH

HHC: Share Price Performance Since Inception

..............

Fannie and Freddie are trading near our average cost despite significant positive developments since our initial investment

We believe that any proposal for housing finance reform must satisfy the following conditions in order to succeed

Simplicity to ensure broad support and minimize systemic risk

Appealing investment proposition to raise new private capital, including visibility into long-term earnings power

Fair treatment of current investors in Fannie and Freddie in order for new capital to be raised

While momentum for reform is stronger now than at any time since the conservatorship began, several key points of debate remain

Feasibility and desirability of creating new competitors

Appropriate capital levels, rates of return, and degree of regulation

Treatment of various classes of securities in Fannie and Freddie

If housing finance reform is successful, we believe Fannie and Freddie will be worth multiples of their current share prices

...........

See the full PDF below.