Google Finance has finally hammered the last nail into the coffin.

Say goodbye to the perfectly good finance page, and say hello to the new trendy page that does less and takes 3x more clicks to show less.

We all knew this was coming as Google has a habit of discontinuing perfectly well run apps.

I used Google mainly to:

- look up quick quotes

- chart multiple stocks

- check what the market was doing

- read news associated with some stocks I was tracking

Looks like more things to do on OSV

Many people used the Google portfolio, but I've included the link to our google sheets version that is still working. Hopefully they don't kill the GoogleFinance function from Google Sheets completely. Now that would be a disaster.

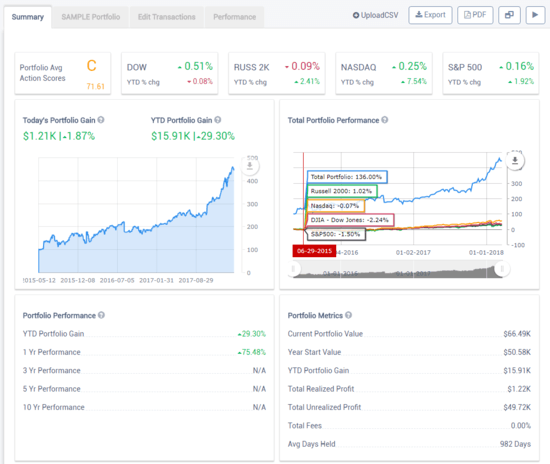

For a much better portfolio, you should also use the OSV portfolio function to accurately track your stocks and performance.

Old School Value Articles You May Have Missed

- The Best Free Stock Portfolio Tracking Spreadsheet using Google Drive

- Google Finance Portfolio Discontinued. Our Alternative Portfolio.

- Free Stock News Aggregator Google Spreadsheet

What We're Reading in the Media

Here's a motivational photo to get your Wednesday started.

If the photo is squashed for you, click the link below the photo to see the full size.

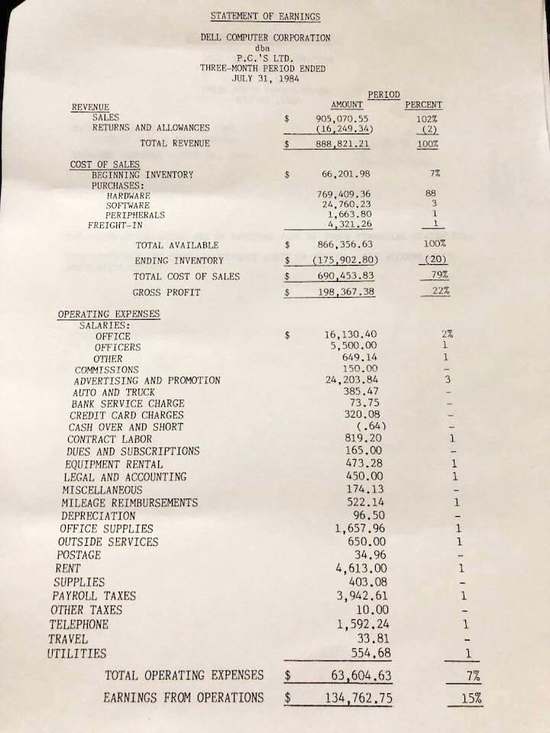

This is Michael Dell's first financial statement for Dell when it doing business as P.C.'s LTD.

It's a quarterly income statement showing

- Total revenue of $888K

- 22% gross margins

- He paid himself $1,833 a month

- Only spent 2.7% of revenue on ads

- Obviously traveled in first class by spending $33.81 on travel

- Telephone bill is one of the top expenses. Must have cold called everyone.

- 15% operating margins

Like any start up, it was a lean and mean operation which Dell used to take over market share to become one of the biggest computer brands in the world.

A lesson for any entrepreneur on how to run a business.

Mr. Buffett on the Stock Market The most celebrated of investors says stocks can't possibly meet the public's expectations. As for the Internet? He notes how few people got rich from two other transforming industries, auto and aviation.

A 1999 Fortune article by Buffett and Carol Loomis discussing the market hype and expectations of "investors". A year later, the dot com bust rears its ugly head and Buffett is proven right. And the only tool he uses is common sense and basic valuation.

Ultimately, an investment is judged on what price you pay. There are two ways to profit in the stock market.

1. Buy low and sell high.

2. Buy high and sell higher.

#1 is the typical value investing approach. #2 is the Buffett and Munger approach of buying fair valued or buying at a premium expecting it to become a behemoth.

In any case, an article definitely work re-reading again.

Other reading links:

- The SEC Says Elizabeth Holmes' Fraud Was Worse Than Anyone Thought

- Skenderbeg - Hedge Funds Produce Higher Risk-Adjusted Returns

What is Old School Value?

Old School Value is a suite of value investing tools designed to fatten your portfolio by identifying what stocks to buy and sell.

It is a stock grader, value screener, and valuation tools for the busy investor designed to help you pick stocks 4x faster.

Check out the live preview of AMZN, MSFT, BAC, AAPL and FB.