Watermark Consulting research finds wealth management firms that lead in Customer Experience financially outperform those that lag by a more than 7-to-1 margin in shareholder return

Q3 2021 hedge fund letters, conferences and more

The Pivotal Role Of Customer Experience In Wealth Management Marketplace

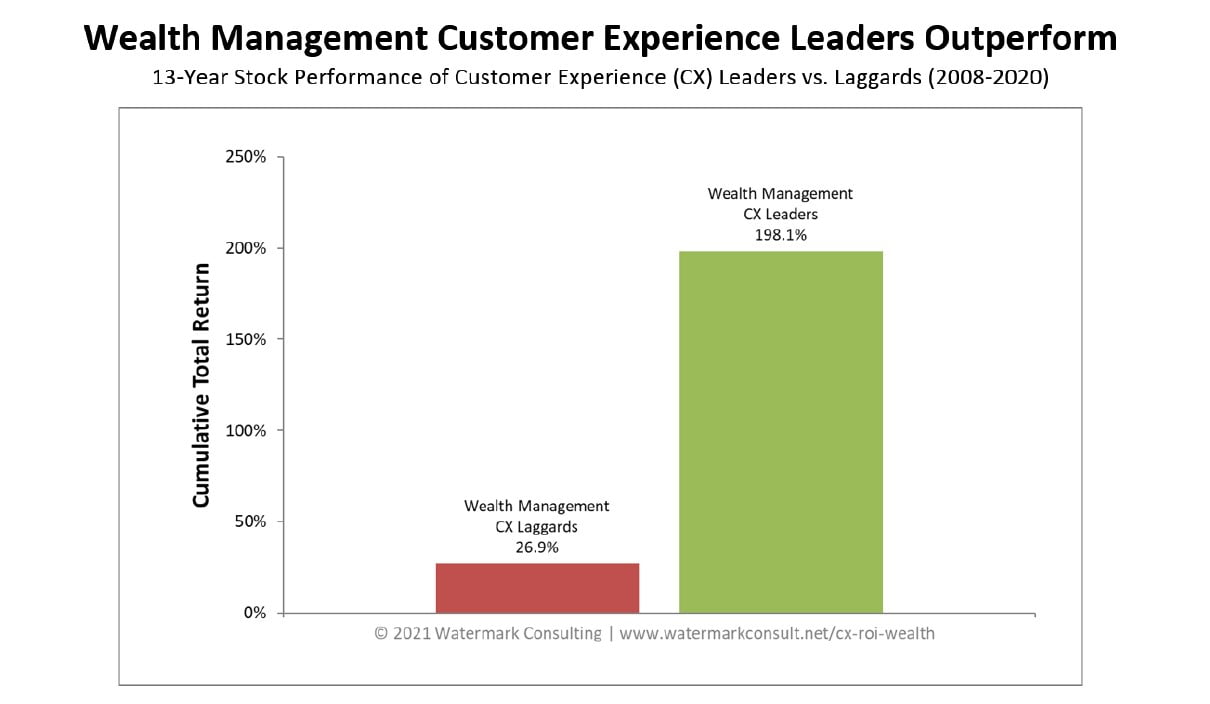

HARTFORD, Conn. [Oct. 25, 2021] – A new study reveals the significant payoff (and penalties) associated with the quality of customer experience in today’s wealth management marketplace. Admired brands with strong consumer feedback ratings enjoyed an average total shareholder return that was more than 170 points higher than firms with weaker ratings.

The data comes from new research conducted by customer experience advisory firm Watermark Consulting, which analyzed shareholder returns for wealth managers that inspire client raves versus rage. The findings reveal something that Main Street and Wall Street can agree on: A great wealth management customer experience helps build business value, while a poor one erodes it.

“Over the long-term, wealth management firms with a positive client experience are seeing shareholder returns that are on average 7.4 times greater than their less customer-centric competitors,” remarked Jon Picoult, founder of Watermark Consulting. “That disparity in financial returns has nearly doubled over the past few years, widening the performance chasm between firms that lead in customer experience versus those that lag.”

The study was conducted as part of research for Picoult’s new book, From Impressed to Obsessed: 12 Principles for Turning Customers and Employees into Lifelong Fans (McGraw-Hill, Nov. 2), in which he explores the science-based strategies that CX-leading firms (including wealth managers) use to engineer outstanding, loyalty-enhancing experiences.

With 13 years of data analyzed, the Watermark study vividly illustrates the vital role customer experience plays in wealth managers’ success.

Paying The Price For Subjecting Investors To Indignities

“Many wealth management firms excel in frustrating their clients, whether it’s from inferior needs analysis and onboarding, unintelligible disclosures and documents, hidden fees and conflicts of interest, or just plain poor live and digital services,” Picoult noted. “Our study reveals that wealth managers eventually pay a price for subjecting investors to such indignities.”

Conversely, wealth managers that consistently impress customers reap rewards – through increased loyalty, greater wallet share, stronger word-of-mouth and a more competitive cost structure.

Picoult stressed that customer loyalty doesn’t arise by accident: “The businesses that do this well do it with great intentionality – relying on proven techniques to infuse their customer experience with simplicity, advocacy, emotional resonance, and other appealing qualities.”

Many wealth managers are reluctant to invest in a better client experience, questioning its ROI. Picoult views this study as a much-needed wake-up call: “The payoff from a great wealth management client experience is far from intangible. It is material and real. And if wealth managers should be struggling with any question, it’s not ‘What’s the case for customer experience?’ but rather, ‘What’s the cost if we do nothing?’”

For complete results and a discussion of Watermark’s Wealth Management Customer Experience ROI Study, please view this white paper.

About Watermark Consulting

Watermark Consulting is a customer experience advisory firm that helps companies impress their customers and inspire their employees. Watermark has worked with some of the world’s foremost brands, helping organizations capitalize on the power of loyalty in both the marketplace and the workplace. Learn more about Watermark’s consulting services, educational workshops or conference keynotes at www.watermarkconsult.net.