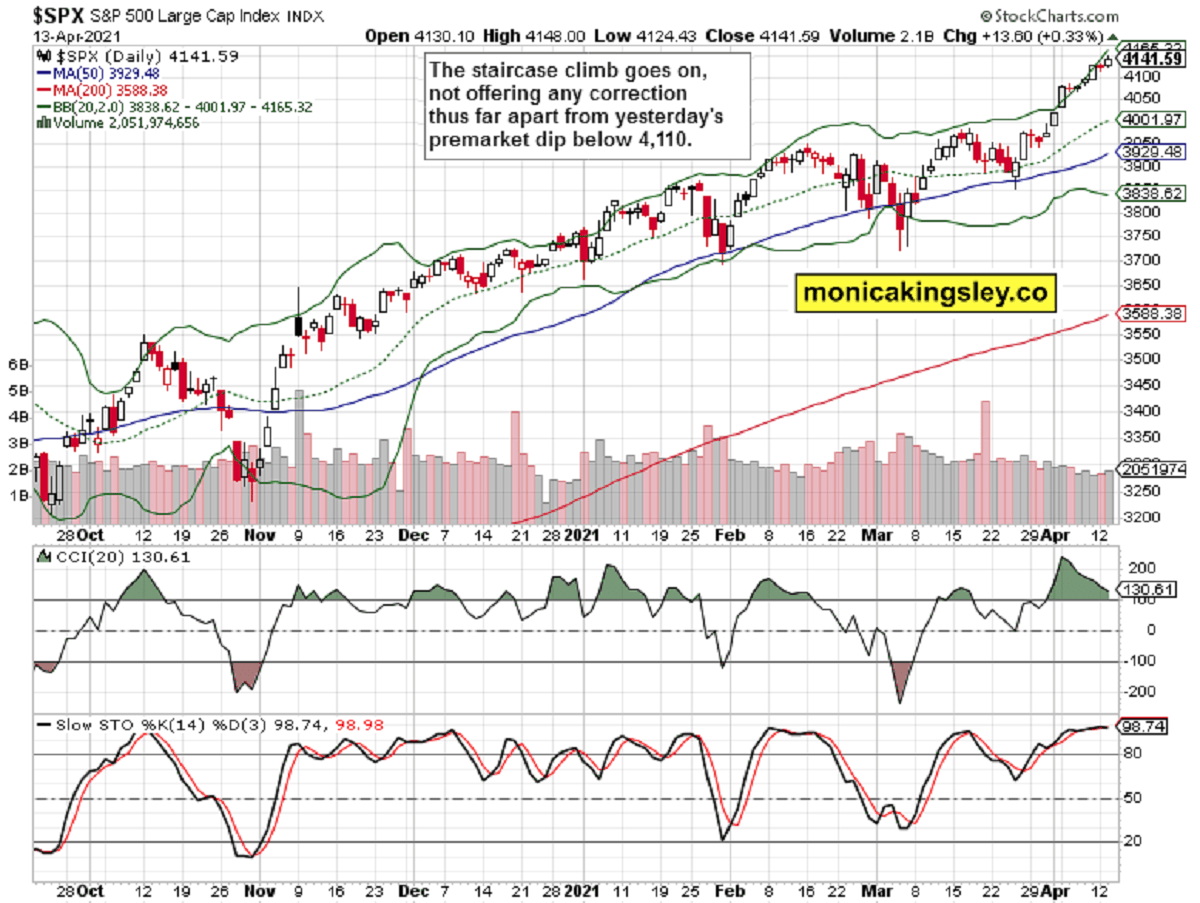

S&P 500 went up yet again yesterday, and the corporate credit markets‘ non-confirmation quite resolved itself. While the same can‘t be said about smallcaps or emerging markets in the least, S&P 500 doesn‘t care, and keeps up the staircase rally without real corrections to speak of.

Q1 2021 hedge fund letters, conferences and more

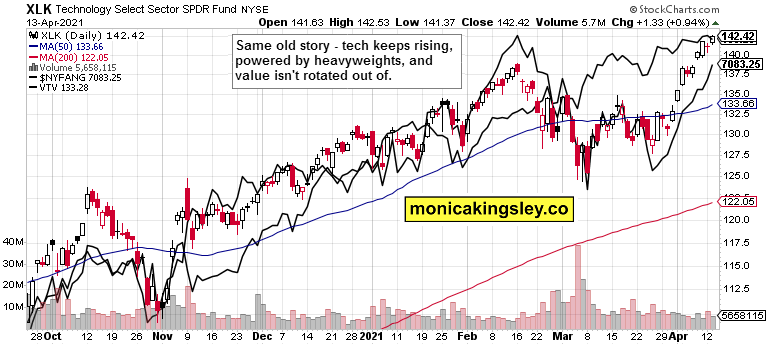

Not even intraday ones, unless you count the sharp and brief premarket one yesterday before the CPI figures came out. That‘s the result of the sea of liquidity in practice, and the avalanche of stimuli. The 1.50% yield scare on 10-year Treasuries is long forgotten, and technology welcomes every stabilization, every retreat from even quite higher levels, and value stocks barely budge. No real rotation to speak of and see here, move along.

Such were my recent observations:

(…) No denying that the stock market is in a strong uptrend, but it got a bit too stretched vs. its 50-day moving average – a consolidation in short order would be a healthy move, but the CPI readings above expectations don‘t favor one today.

Talking gold prospects early yesterday:

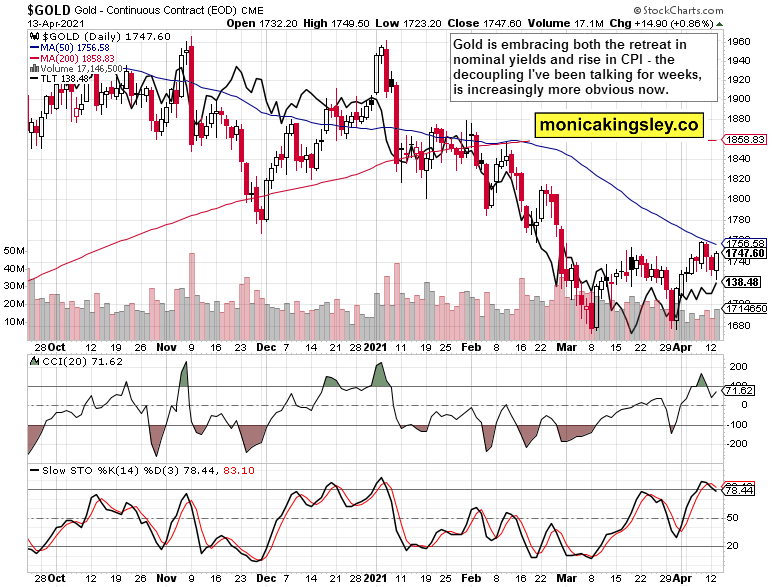

(…) And that‘s probably what gold is sensing as it grew weak yesterday. The rising yields aren‘t yet at levels causing issue for the S&P 500, but the commodities‘ consolidation coupled with nominal yields about to rise, has been sending gold down yesterday – and miners confirmed that weakness by leading lower. This would likely be a daily occurence only unless and until copper gives in and slides – that‘s because of the inflation expectations having stabilized for now, but Treasury yields not really retreating. Yes, gold misses inflation uptick that would bring real rates down a little again – and is getting one in today‘s CPI as we speak.

CPI inflation is hitting in the moment, and its pressure would get worse in the coming readings. Yet the market isn‘t alarmed now as evidenced by the inflation expectations not running hot – the Fed quite successfully sold the transitory story, it seems. Unless you look at lumber, steel or similar, of course. None of the commodities have really corrected, and the copper performance bodes well for the precious metals too.

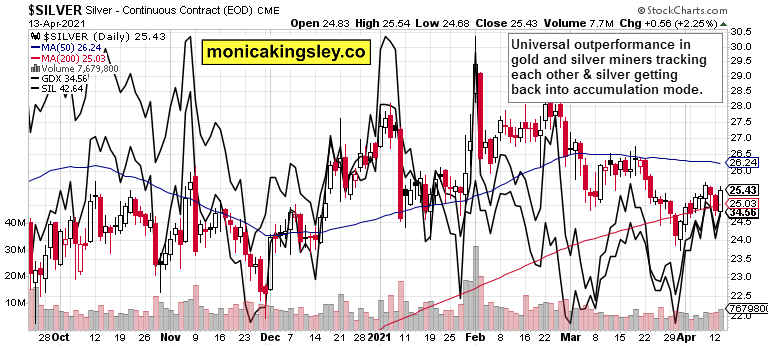

The stalwart performance in the miners goes on after a daily pause as gold gathers strength and silver outperformed yesterday. Silver miners and gold juniors are pulling ahead reliably as well, not just gold seniors.The run on $1,760 awaits.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

S&P 500 is no longer trading above the upper border of Bollinger Bands, the price action remains bullish, and volume is ever so slowly picking up (sending weak early signs thereof), but the bulls better watch out for a catalyst forcing a down day once in a while again.

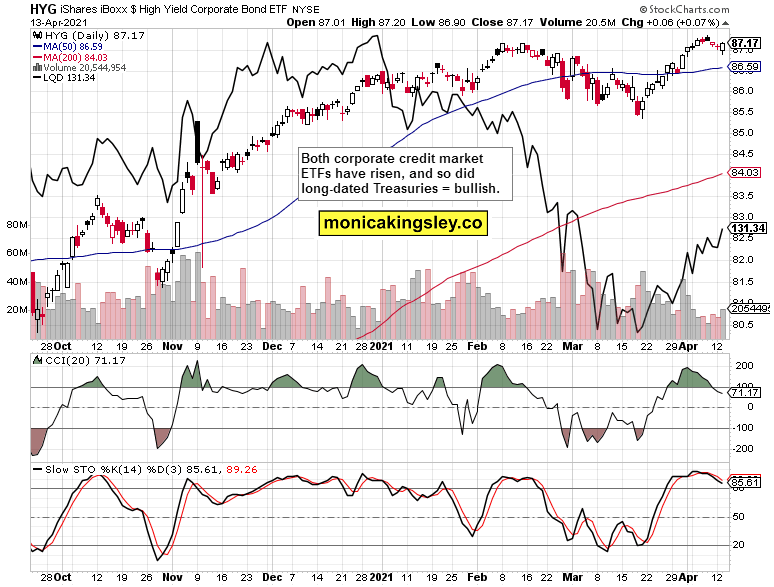

Credit Markets

Both high yield corporate bonds (HYG ETF) and the investment grade ones (LQD ETF) turned around yesterday, and so did long-dated Treasuries – and that supports the bullish spirits in stocks. It was indeed right to view the prior non-confirmation as not too pressing at the moment.

Technology and Value

Tech (XLK ETF) rose strongly yesterday, and so did the kingmaker $NYFANG (lower black line) and Tesla that I called out yesterday. But value stocks didn‘t sell off – a powerful testament to the TINA trades driving no real rotations to speak of as nothing gets really sold off just on its own.

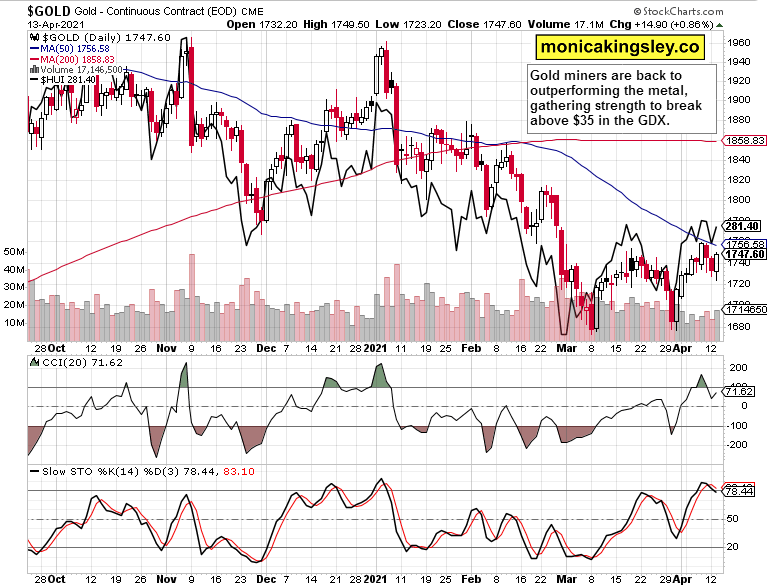

Gold and Miners

Gold isn‘t in a decline mode anymore, and appears picking up strength so as to take on the $1,760s. Volume is returning, and the current reprieve in rising yields is welcome.

Miners returned to the limelight, and it‘s my view they would lead gold by breaking above their recent highs convincingly, as the tide in the metals has turned. Time and desirably a catalyst of such move, is all that is needed. Geopolitics (to the short-term rescue) or more unavoidable inflation data bringing down real rates, that‘s I am looking for next.

Silver and Miners

See the gold and silver miners trading in lockstep, remember gold juniors as well, and you get this bullish picture where the whole precious metals sector is slowly coming back to the limelight. In case of silver, the return in volume is boding well for the days ahead – all without the classic signs of bearish isolated silver outperformance.

Summary

S&P 500 and the still elusive consolidation – the Fed speakers won‘t likely trigger one today, but bulls, watch out for some daily downside with little to no warning in your plans, after all.

Gold and miners‘ paths are aligned, and nominal yields trajectory is boding well for the days ahead when patience is still needed before the nearest resistances in both assets are taken out with conviction.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.