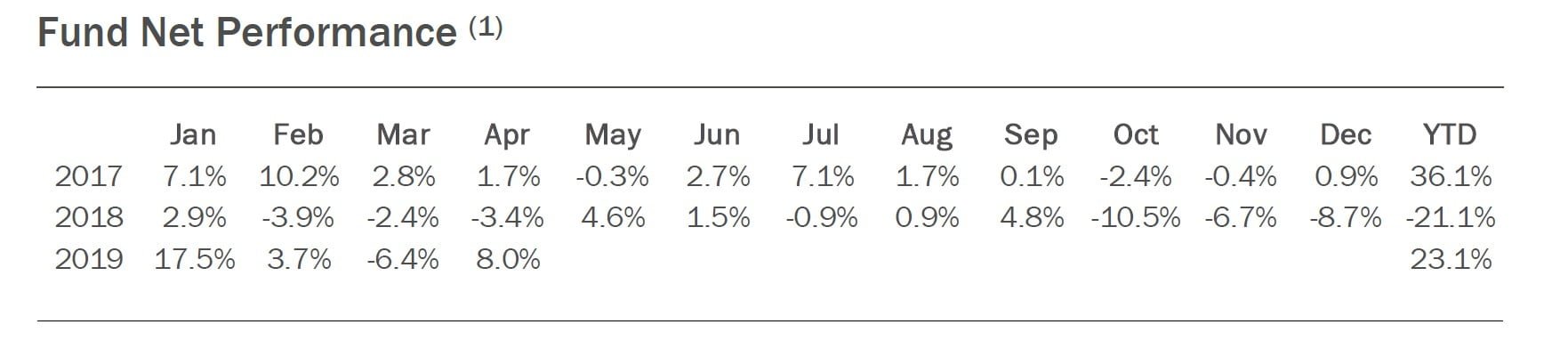

McIntyre Partnerships tear sheet for the month ended April 30, 2019.

Fund Description

McIntyre Partnerships is a concentrated, 130/30 fund with a goal of significant outperformance over the market cycle. The fund focuses on event driven, non-cyclical GARP, and distressed investments, with an emphasis on high-quality, predictable business models. We believe a concentrated portfolio of five-to-ten thoroughly researched investments provides the best risk/reward returns over the economic cycle. AUM and management fees are capped.

Q1 hedge fund letters, conference, scoops etc

Portfolio Manager Biography

Chris McIntyre has eleven years of investment experience across several funds: MAK Capital, Cobalt Capital, MDR Capital, and FNY Securities. Most recently he was a Managing Director at MAK Capital, a value focused equity and credit fund, where he managed investments in consumer, telecom, and special situations. Chris is a CFA charterholder. He is a University of Virginia graduate with degrees in Economics and Government.

Fund Terms and Service Providers

- Subscriptions: $1,000,000 minimum, monthly

- Founders Class: 1.5% management fee, 20% incentive fee Drops to 1% and 15% at $50MM AUM

- Class A Fees: 1.5% management fee, 20% incentive fee

- Hurdle: 5% hard

- High Water Mark: Yes

- Redemptions: 25% per quarter over four quarters No initial lock up

- Auditor: Spicer Jefferies LLP

- Administrator: NAV Consulting

- Prime Broker: BTIG/Pershing (Bank of New York)

- Legal Counsel: Cole-Frieman & Mallon LLP

This article first appeared on ValueWalk Premium