Excerpt from Third Point Re’s investor presentation for the month of September 2018, discussing their “market-leading investment management.”

Q2 hedge fund letters, conference, scoops etc

Market-Leading Investment Management By Third Point LLC

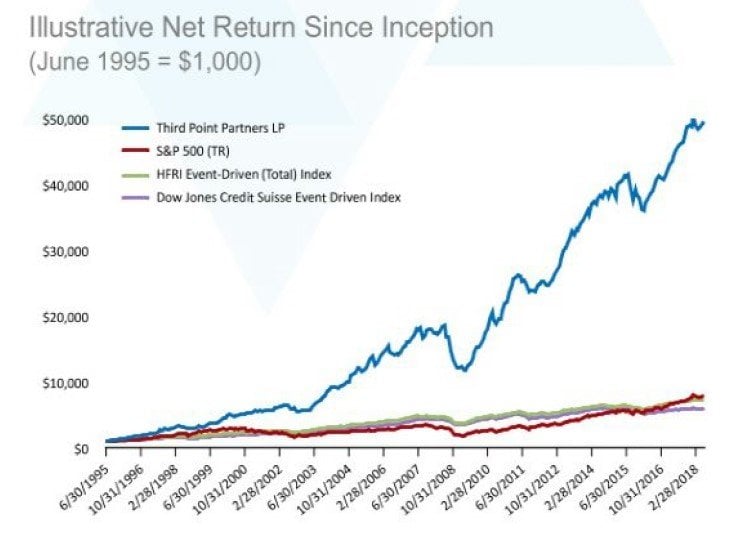

- Third Point LLC owned and led by Daniel S. Loeb

- 18.4% net annualized returns for Third Point Partners LP since inception in 1995

- 10.0% net annualized return on TPRE managed account since inception (Jan. 1, 2012)

Investment Returns Profile

Relationship With Third Point LLC

Limited Partnership Agreement

- Exclusive relationship through 2021, followed by successive 3-year terms on renewal

- Investments are managed on substantially the same basis as the main Third Point LLC hedge funds

- We pay a 1.5% (exposure adjusted) management fee and 20% performance allocation. The performance allocation is subject to a standard high water mark

Risk Management

- Restrictions on leverage, position concentrations and illiquid, private investments

- Key man and performance termination provisions

- Allowed to dwersnfy portfolio to address concerns of AM. Best or regulator

Liquidity

- Weekly redemption rights to pay claims and expenses as well as manage required capital

- Portfolio concentrated in large cap Iong equity positions

- No material changes in liquidity by moving to fund structure

Third Point LLC Portfolto Risk Management

- Portfolio diversification across industries, geographies, asset classes and strategies

- Highly liquid portfolio - investment manager can dynamically shift exposures depending on macro/market developments

- Security selection with extensive diligence process

- Approach includes index and macro hedging and tail risk protection

- Institutional platform with robust investment and operational risk management procedures