No ordinary business can increase its dividend payments for 25+ consecutive years.

It takes a high quality company with a shareholder friendly management to accomplish this feat. But a long dividend streak alone doesn’t indicate a good investment moving forward….

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

In fact, we are projecting the 3 companies below to actually deliver negative returns over the next 5 years - even though they've been increasing their dividends for 25+ consecutive years.

That's because each is significantly overvalued. These companies' growth and dividend prospects just do not make up for their poor valuations.

Key Metrics

Overview & Current Events

Lancaster Colony has been making food products since 1969 after shifting away from housewares. The move has afforded LANC some meaningful growth in the past five decades and the stock sports a $3.4B market cap today as a result. LANC makes various meal accessories like croutons and bread products in frozen and non-frozen categories.

The company’s recent Q2 report was a tough one as sales fell 2.2%, with both its Retail and Foodservice businesses seeing lower revenue. Margins fell markedly as well as gross profit plummeted 10% off of a record Q2 number last year. LANC has been experiencing some pain from a slowdown in restaurant traffic and as a result, its Foodservice business has been weak. Cost saving measures haven’t been enough to salvage margins so this year looks tough for LANC.

Growth on a Per-Share Basis

LANC’s EPS growth has been spotty at best as its revenue tends to ebb and flow, beholden to restaurant traffic trends. It recovered nicely from the Great Recession but the cut to 2008 earnings was very steep indeed. In addition, YoY declines in EPS are common and thus, the multiple that should be assigned to LANC should reflect that risk going forward.

We are forecasting 2.9% EPS growth annually going forward, comprised of low single digit sales and flat margins; LANC does not buy back stock. LANC’s average revenue growth has been and should remain in the low single digits but keep in mind the risk going forward; there will be years where it dips and other years where it may rise at faster rates. Organic growth has been a problem for LANC of late but it does complete sizable acquisitions on a fairly regular cadence. We are forecasting 4% dividend growth annually for the next five years as LANC continues its impressive streak of payouts to shareholders; the payout should approach $3 per share during the next five years.

Valuation Analysis

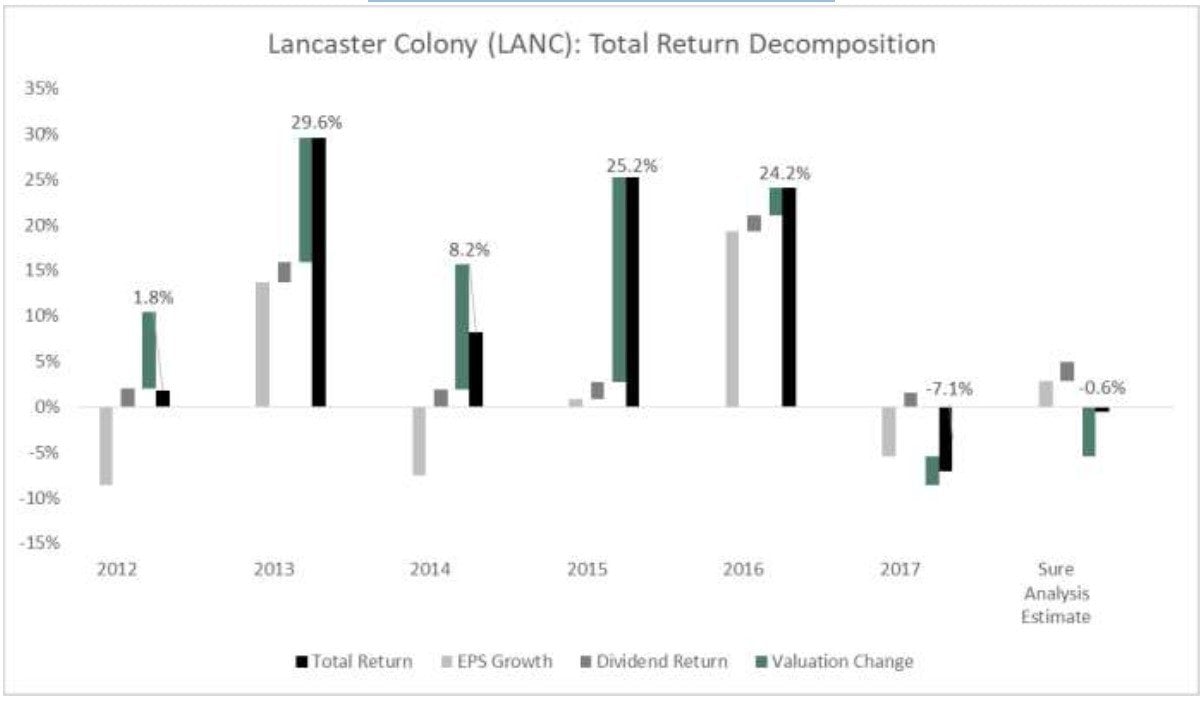

LANC’s PE has been highly volatile in this time frame but of late, investors have assigned it enormous multiples. Last year’s average was in excess of 30 and even after a substantial pullback, the stock is still valued at 26.9 times earnings. We are forecasting a 5.5% headwind to total returns over the next five years as the PE should come back in line with historical norms around 20; LANC looks significantly overvalued today despite the pullback we’ve already seen.

Due to a forecast decline in the valuation and thus, the stock price, we are expecting the yield to climb back to more normalized levels as well at 2.7%. LANC’s dividend yield was nearly cut in half from 2009 to 2017 due to a huge rally in the stock but that situation should be rectified by a declining multiple and rising payout per share.

Safety, Quality, Competitive Advantage, & Recession Resiliency

LANC’s quality metrics are outstanding as it is a very conservatively financed company. It hasn’t had any debt to speak of since 2009 apart from trade payables, which amount to about 20% of its total assets. We expect this will continue as LANC finances its acquisitions through cash.

Gross margins should remain roughly flat as pressure from rising freight costs is combated by pricing increases and cost saving measures. Margins have risen over time for LANC but the outlook is murkier than it has been in the past. LANC’s payout ratio will likely rise gradually over time to 55% of earnings as dividend growth outpaces slow earnings growth. Given LANC’s Dividend King status, we know the payout is important to management; it’s dividend is very safe.

LANC’s competitive advantage is in its leadership position within the niche categories in which it competes. LANC goes after accessory categories like bread, dressings and croutons where competition tends to be lighter. It also has strong distribution partnerships with companies like Wal-Mart and McLane Company, a major distributor to restaurants across the country. LANC’s recession performance track record is spotty because it is reliant upon restaurant traffic, something that suffers mightily during times of economic stress, as we saw with its trough 2008 EPS number.

Final Thoughts & Recommendation

We expect LANC to provide shareholders with total annualized returns of -0.6% over the next five years. This will be comprised of 2.9% EPS growth, the 2% current yield and a 5.5% headwind from the valuation reset. LANC is therefore very unattractive here as it is well in excess of fair value and the yield is low. Investors seeking income should wait for a better price with a higher yield and those seeking growth or value should simply look elsewhere.

Total Return Breakdown by Year

Article by Josh Arnold, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.