Kerrisdale Capital sent a letter today to C3.ai Inc (NYSE:AI)’s signing audit partner and the head of the U.S. audit & assurance practice at Deloitte & Touche LLP regarding serious accounting and disclosure issues they have identified in C3.ai‘s SEC public financial statements.

C3’s fiscal year ends on April 30, and Kerrisdale have asked Deloitte to review their letter in anticipation of its upcoming work conducting the company’s year-end audit. In the letter, they discuss:

Q1 2023 hedge fund letters, conferences and more

- The highly conspicuous growth in unbilled receivables to levels we’ve never before seen in software companies

- Opaque, confusing and highly concerning disclosures and financials related to the company’s related party and very large customer, Baker Hughes

- Efforts to inflate gross profit margins by reclassifying costs of revenue as research and development expenses

- Classification of significant revenue as subscription revenue that in actuality is services- or consulting-oriented revenue

- Significant turnover in chief financial officers, and the appointment of successively less qualified CFOs over time

Kerrisdale hopes that their letter will bring to light various highly misleading accounting methodologies that they believe the company utilizes in order to inflate revenue and certain profit metrics, and to conceal deterioration in its underlying business.

Kerrisdale's Letter To C3.ai's Auditor

Joseph R. Prast

Partner, Audit & Assurance, Deloitte & Touche LLP

555 Mission Street, Suite 1400

San Francisco, CA 94105

Dipti S. Gulati

Chair and CEO of U.S. Audit & Assurance, Deloitte & Touche LLP

30 Rockefeller Plaza

New York, NY 10112

CC:

Audit Committee, C3.ai Inc.

Michael G. McCaffery, Chair

Richard C. Levin

Lisa A. Davis

Securities & Exchange Commission

Gary Gensler, Chair of the U.S. Securities and Exchange Commission

Paul Munter, Chief Accountant, Office of the Chief Accountant

Dear Mr. Prast and Ms. Gulati,

My name is Sahm Adrangi and I am the Chief Investment Officer of Kerrisdale Capital Management. I am writing to bring to your attention serious accounting and disclosure issues at your client C3.ai, Inc., a publicly listed technology company based in Redwood City, CA.

I believe these allegations deserve the immediate attention of Deloitte & Touche LLP, as well as the Securities and Exchange Commission. You will soon begin preparing the audited financial statements of C3.ai for the fiscal year ending April 30, 2023. Please examine the contents of this letter as you engage in your review, to ensure that the company cannot use fraudulent accounting conventions to mislead investors and damage the integrity of the public markets.

In our opinion, C3.ai has utilized highly aggressive accounting to inflate its income statement metrics in order to meet sell-side analyst estimates for revenue and certain profit metrics, and to conceal significant deterioration in its underlying operations. In this letter, we discuss:

- The highly conspicuous growth in unbilled receivables to levels we’ve never before seen in software companies

- Opaque, confusing and highly concerning disclosures and financials related to the company’s related party and very large customer, Baker Hughes

- Efforts to inflate gross profit margins by reclassifying costs of revenue as research and development expenses

- Classification of significant revenue as subscription revenue that in actuality is services- or consulting-oriented revenue

- Significant turnover in chief financial officers, and the appointment of successively less qualified CFOs over time

Please note that Kerrisdale is short shares of C3.ai and we provide a link to full disclosures at the end of this letter. While we may be short shares of the company, the American public markets have no place for deceitful accounting, and financial statements need to reflect underlying business fundamentals, instead of being used as a tool to fool market participants by painting a false portrait of a company’s profit and loss.

Days Sales Outstanding and Unbilled Receivables

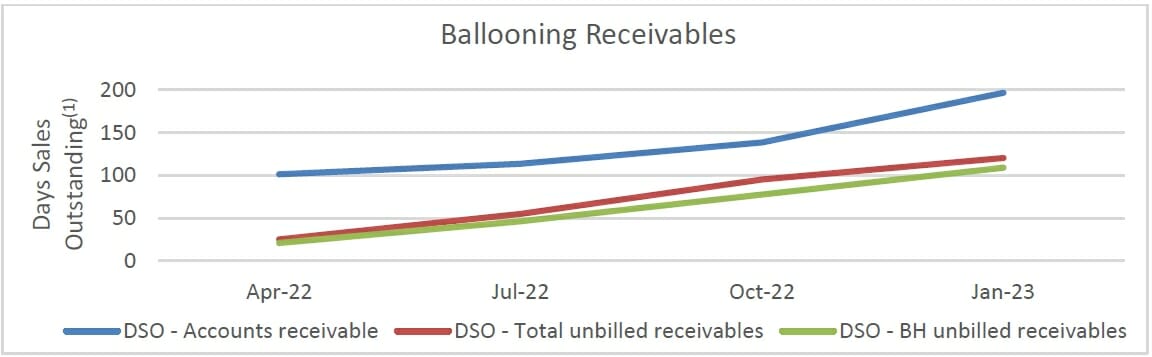

Over the past year, the company’s accounts receivable have ballooned, with total accounts receivable more than doubling while quarterly revenue has declined. This has led to a cumulative negative cash flow statement entry of -$76m owing to changes in accounts receivable over the past four quarters. (Over the past five quarters, that figure is an even more negative -$117m.)

Given C3.ai generated last-twelve-months revenue of just $267m, this cash flow discrepancy due to growing receivables accounted for over a quarter of revenue, a material sum. Days sales outstanding (DSO) has ballooned to 197 days1, a level unheard of among software companies, which C3.ai claims to be.

These growing receivables are, in large part, the result of the dramatic growth in “unbilled receivables”. Unbilled receivables have grown from less than $10m in each quarter prior to April 2022 to $88m in the most recent quarter. This growth in unbilled receivables, in turn, is primarily due to the growth in unbilled receivables from one customer – Baker Hughes.

A metric that was previously unreported, unbilled receivables from Baker Hughes has grown from $17m in the quarter ending April 30, 2022 to $80m in the most recent quarter, and now accounts for 91% of the total unbilled receivables figure.

Below we show a chart demonstrating the growth in DSO for total accounts receivable, total unbilled receivables and total Baker Hughes unbilled receivables.

What exactly is going on? In the last four quarters, C3.ai has apparently recognized $80m of receivables (from a related party shareholder, no less) in an amount that is equivalent to almost 30% of total company-wide revenue during that same period, for which it has not even invoiced.

It appears to us that C3.ai is booking fictional revenue in order to meet consensus analyst estimates and cover up the fact that, in reality, its products are unable to get traction with customers and its business is failing. With the company unable to invoice 30% of its reported revenue, which just so happens to come from a related party, how exactly are you as its auditor signing off on these financial statements?

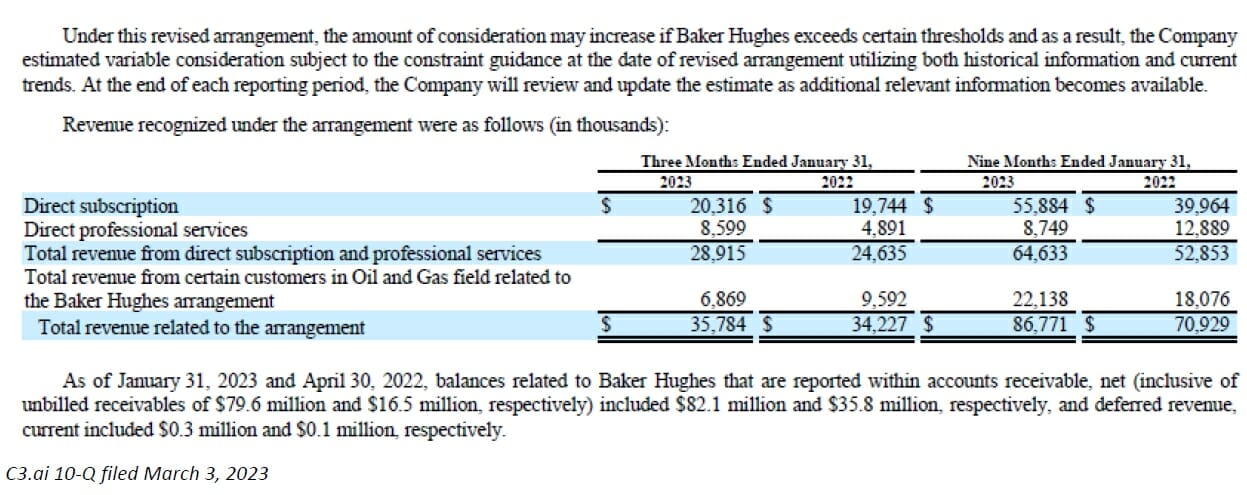

Conspicuously, while unbilled receivables from Baker Hughes have ballooned, actual revenue from Baker Hughes has been stagnant. In the most recent quarter, “revenue related to the arrangement” – whatever that’s supposed to mean – increased to $35.8m from $34.2m in the year prior.

Thus, unbilled receivables from Baker Hughes have increased 5x since being first reported, yet actual revenue is growing at a low single digit rate? To reiterate, we believe the company is using highly aggressive accounting in order to meet sell-side analyst estimates, and both its internal accounting staff and external accounting firms signing off on this charade are complicit. Below, we paste the relevant section of the most recent quarterly report, to put the discrepancies in broad daylight.

More Problems with the Baker Hughes Relationship

More broadly, accounting red flags abound with the Baker Hughes relationship. Disclosures in the company’s SEC filings are generally unintelligible, and the accounting surrounding C3’s financial reporting as it relates to the Baker Hughes business is unlike anything we’ve seen before.

All we can tell is that revenue and profit are being booked to boost income statement figures, the requisite amount of cash is not coming to the company, and an array of convoluted accounting representations are being used to justify why this is all okay.

To begin with, the Baker Hughes subscription revenue is being recognized at 99%+ gross margins, according to footnotes in its income statement – for instance, in the most recent 10Q, C3.ai reported $56m of related party subscription revenue over the past nine months, yet zero related party subscription cost of revenue. (Baker Hughes is the only related party that the company discloses selling to, so presumably all related party sales are associated with Baker Hughes).

Why does C3.ai want to inflate its gross margin? We believe it does so because it regularly pretends to be a software-as-a-service company instead of the services-intensive consulting business that we believe it really is.

Software companies trade at much higher valuation multiples than consulting businesses, and we believe that the Baker Hughes 100%-gross-margins gimmick is one of numerous tricks management has adopted to prop up its stock price – successfully.

We might add, since the market is valuing shares of C3 at a $5bn+ fully diluted market capitalization despite poor financial and business metrics, including -$150m negative cash flow from operations on $267m of revenue over the past twelve months, a year-over-year decline In quarterly revenue, and an inability to grow customer count over the past two quarters.

Read the full letter here by Kerrisdale Capital Management.