For weekend reading, while commenting on investing in America’s new electric power grid, Louis Navellier offers the following commentary:

Q3 2021 hedge fund letters, conferences and more

Electricity Demand To Double If We Shift All Transport To Electric

This past weekend, MarketWatch ran an article titled “Tesla’s Musk Says U.S. Electric Production Needs to Double to Power Transition to EV Vehicles” (October 3, 2021).

At CodeCon, a conference held at the Waldorf Astoria in Beverly Hills, Musk said, “If we shift all transport to electric, then electricity demand approximately doubles… this is going to create a lot of challenges with the grid.” The article laid out some key facts that are compelling, like: “Today, there are about 276 million cars, trucks, buses and motorcycles on U.S. roads. About 1% of them are all-electric.”

So far, most of the attention in green transportation is paid towards companies manufacturing EV vehicles and to battery manufacturers, but there is little attention paid to how transforming the transportation industry from internal combustion engines to electricity will stress the existing electric grid.

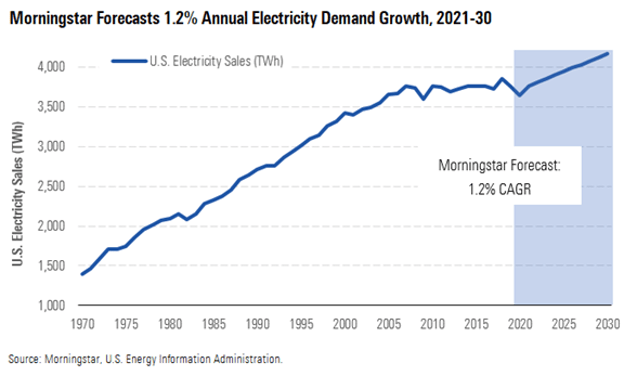

If EV proponents get their way – starting with 50% of all new sales in the U.S. being all-electric by 2030 – the number of all-electric vehicles will be roughly 15% of vehicles on the road, implying it will take the better part of a generation to convert the majority of gas and diesel-powered vehicles to electric power.

The U.S. consumes roughly 19 million barrels of oil per day. That’s seven billion barrels per year. About 40% or 50% of these barrels are used to power cars, according to BP’s annual energy report. Considering the massive changeover required, the idea that renewables will generate the majority of America’s electric power by 2035, as the Biden administration states, is just fanciful thinking.

The Energy Crisis

The current energy crisis was brought on by President Biden and the green lobby, which have failed miserably to manage the transition to renewables in an intelligent way. A year ago, the U.S. was energy independent, but recently Biden was on the phone with OPEC begging them to increase production because of all the curbs being placed on the domestic oil and gas industry. No wonder CEOs of U.S. energy producers are bristling as crude oil prices continue to climb to seven-year highs.

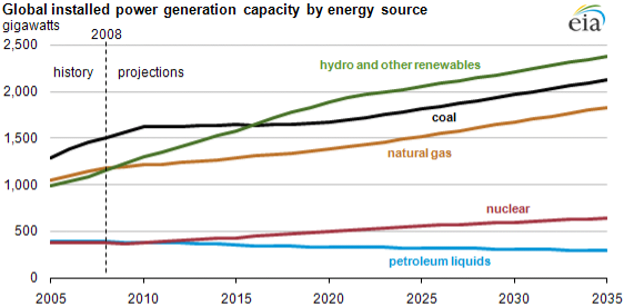

The Energy Information Agency (EIA) reported in July that electricity demand is growing faster than renewables, driving strong demand for fossil fuels. “Renewable power is growing impressively in many parts of the world, but it still isn’t where it needs to be to put us on a path to reaching net-zero emissions by mid-century,” said Keisuke Sadamori, IEA’s Director of Energy Markets and Security. “As economies rebound, we’ve seen a surge in electricity generation from fossil fuels. To shift to a sustainable trajectory, we need to massively step-up investment in clean energy – especially renewables and energy efficiency.”

The electrification of America by renewables is a generational task, where the largest utility companies will still be the primary providers of power to homes and businesses, requiring expansion of green power plants and distribution networks. To this end, the market might warm back up to the utility sector following a sharp pullback during the month of September against a backdrop of rising bond yields.

Quite simply, if Musk is right, and he probably is, then a case for accelerating sales and earnings growth can be made for the utility sector, as gas stations close – or convert to charging stations with coffee bars while customers wait 20 minutes for a full charge. It’s going to be a new growth phase for the nation’s utility sector and one that might make investible sense for what should be robust future dividend growth.

XLU's Performance

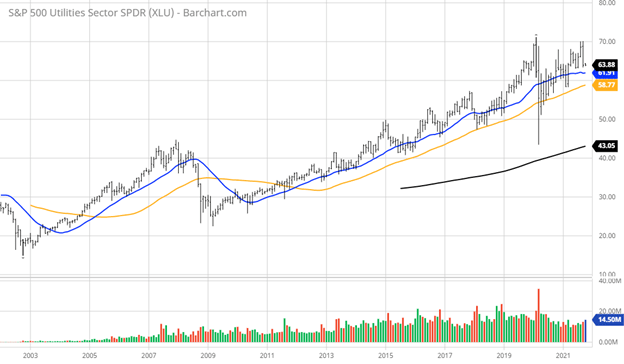

Currently, the Utilities Select Sector SPDR ETF (XLU) pays a dividend yield of 3.12% as of its closing price of $63.88 last Friday, down from its near all-time high of $70.07 on September 1. History would indicate that investors dump utilities when rates rise, but that also assumes the transportation industry isn’t going through a gigantic transformational change, requiring massive new electrical output.

XLU has grown its dividend payout by 36% from 2012 to 2020, which is modest for what is a steady but stodgy industry and market sector. Here is the nearly-10-year track record (2021 data is incomplete):

However, if the sector is about to experience a long runway of faster growth, the current selling pressure could test the $57-$59 area (if the 10-year Treasury challenges 2.0%) creating a place to give XLU a look.

Federal Government Spending

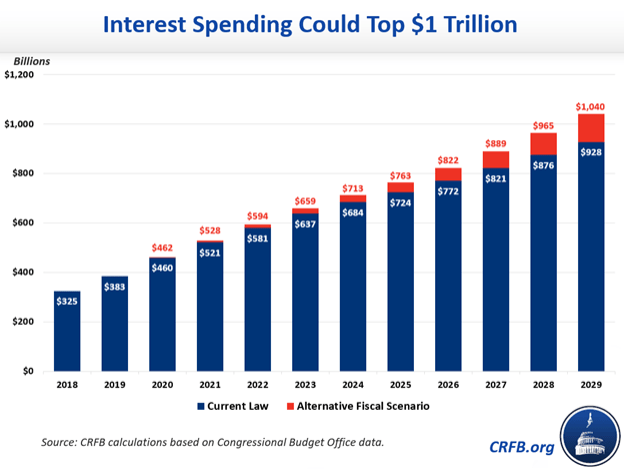

It is hard to imagine the Fed letting Treasury yields get too elevated before they would go on a bond-buying binge to tamp down rates. Here’s why. The Congressional Budget Office (CBO) states that, “The federal government spends more on interest than on science/space/technology, transportation and education combined. This cost will worsen dramatically if interest rates rise. Each one percent rise in the interest rate would increase FY 2021 interest spending by roughly $225 billion at today’s debt levels. The U.S. national debt stands at $28.8 trillion as of October 1, 2021.”

How this federal spending and debt service gets settled is a moving target of unknown factors. It seems that no career politician wants to address reducing the debt or ask Fed Chair Powell what higher rates mean to carrying this debt load. The Fed alone has exploded its balance sheet to $8.4 trillion from $3.7 trillion in the past two years, so interest rate manipulation is probably in store if yields rise much further.

What is known is that the power grid has to grow rapidly to manage the future surge in electrical demand. This argues for the nation’s utilities as sound investments, the timing of which may depend on when bond yields plateau. That might sound futuristic now, but in a couple of years, it might look rather savvy.

Navellier & Associates does own Tesla (TSLA), for one client, per client request, in managed accounts.