IceCap Asset Management commentary for the month of May 2021, titled, “Californication.”

Q1 2021 hedge fund letters, conferences and more

If You Want These Kind Of Dreams, It's Californication.

Dionysus was quite the party animal. The infamous Greek god would simply arrive with a kegger, and then the party started. His free flowing drinks, tricks, and stories hypnotized his friends and carried them off into a carefree world of indulgence and gratification.

Years later, a California-based rock band the Red Hot Chilli Peppers also took upon the free-flowing attributes of Dionysus. The band immortalized the Greek god in their lyrics, concerts, and social gatherings.

One of their best tributes to Dionysus is “Californication”. The hit song perfectly encapsulates the spirit of the Greek god, as if he was living in modern-day Hollywood. Today, no matter where you gather, many social influences were born in Hollywood basements.

Meanwhile, David Duchovny's character, Hank Moody, has also been deeply influenced by Dionysus. The hit TV series “Californication” also feasted on the absurdity of experimenting, experiencing, and rolling life into the nth degree at levels that would have made even Dionysus blush. This Los Angeles-based story allowed audiences the opportunity to see life inside the machine that influences so many of today’s global social and entertainment drivers.

Still, it gets better.

Today, Dionysus and Californication have also spilled over into the world of financial and economic markets.

Yet, instead of Dionysus, the Red Hot Chilli Peppers and Hank Moody leading the charge into irrational gratifications, we have the European Central Bank, the US Federal Reserve, and other central banks leading the charge towards unlimited financial pleasures.

Yes, apparently the world’s monetary elite are living vicariously as Hank Moody, on the edge of the world in all of civilization, all while wallowing in Dionysus’ sweet wines.

After all, how else can you describe the financial and monetary world created by these central bank party animals?

Over the years, the central banks have slowly added a few pick-me-ups to the economic punch bowl. Yet the concoction has only yielded unflattering party results.

But then the pandemic struck the world with the force of Zeus’ lightening bolt, providing the central banks and their fiscal frat house friends the opportunity to raise the party all the way up to level 11.

Financial prudence and good governance be damned.

Investors everywhere have been seduced by the Dionysus-like stimulus provided by our central banks and governments. Yet, while the financial party escalates into the late hours, most investors are seemingly completely unaware of any inhibitions.

In Hank Moody’s Californication, in the end his best friend Charlie, managed to “out- Hank” Hank. And THAT was a feat.

And as the world progresses through these monetary parties, we completely expect the central banks to also attempt to out-Hank each other.

Financial Indulgence.

In other words, investors should fully expect central banks and governments trying to outdo each other by cranking up monetary and fiscal polices to even more absurd levels.

Eventually the party will end, it always does.

Yet, until that hour arrives, seemingly every investor, government, corporation, household and central bank will continue along these paths of financial indulgence.

Let’s get this party started!

Like all great parties, they have to start somewhere.

And usually within that somewhere lies the spirit of Dionysus, providing the atmosphere and limitless abilities to unshackle your inner-constrained self.

Within the investment world, Dionysus clearly has a permanent seat at the US Federal Reserve. And it was nearly 40 years ago he decided to slowly sow the seeds for an eventual financial party, unlike anyone in the world had ever experienced.

Initially, he subtly encouraged the world’s most important central bank to provide more party favours whenever it seemed like the party was hitting a lull.

Whether knowingly or unknowingly, other members of the Federal Reserve easily and quickly obliged. And obliged they did.

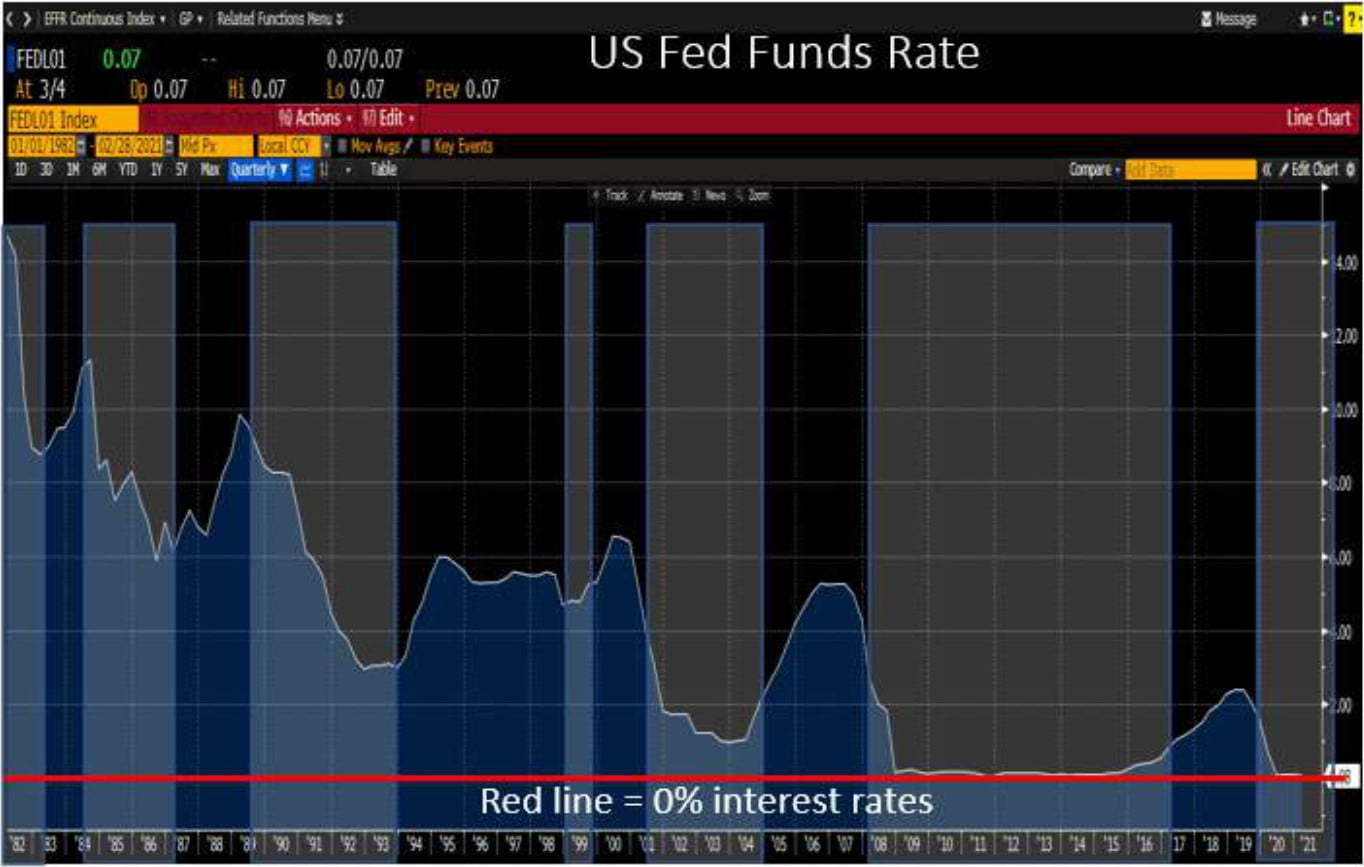

Chart next column details all the times Dionysus and his mates at the US Federal Reserve recognized the financial party was dying and they needed to juice it up a bit.

During the 1980s, the party almost ended several times. Yet, the recession, the Plaza Accord and the ‘87 crash gave Dionysus and the Fed plenty of reasons to cut interest rates to keep the party going.

Next came the 1990s and the Savings and Loan crisis, followed by the Asian currency crisis and the Russian Ruble crisis, which ignited the Long Term Capital Management (LTCM) crisis.

Zzzzzzurich.

Not one to worry, once again Dionysus and the interest rate revelers slashed rates all to ensure the music kept playing.

Towards the end of 1999, the Federal Reserve was quite pleased with itself.

After all, the Tech Bubble was in full swing and with $Billions being thrown at unprofitable companies simply because they had a website, the party of the century was sure to continue for millenniums to come.

Of course, the Tech Crash followed by the Housing Crash was again a nothing-burger for the Federal Reserve. Both crises were exponentially larger than the previous party crashers, and both created the biggest financial hangovers ever to be felt by mankind.

But no worries, Dionysus had a plan—cut interest rates all the way down to 0%, and then to really pick up the mood, throw in some quantitative easing, money printing, and bailouts, just to be sure. That would certainly keep the party humming into eternity.

But then came the pandemic with the MOAB of financial crises.

This time, however, the party was knocked out cold, and on the verge of never waking up.

Yet, what seemed like a serious situation was once again another opportunity for Dionysus to turn up the music as loud as possible, serve as many personality boosters that existed and ensure all of the party animals came to enjoy themselves.

And came they did.

While Dionysus was running the parties at the Federal Reserve, the Red Hot Chilli Peppers were clearly breathing life into the staid European Central Bank.

Yes, while the rest of the world was bopping and weaving to the tunes from the big guy, the ECB themselves had started their own little party.

Between rescuing the Irish, the Portuguese, the Spanish, the Italians, and even dudes in Dionysus’ homeland, the ECB became quite good at keeping their party going.

Meanwhile, the ultimate chilled party animal Hank Moody was also rather busy having a good time. While Dionysus and the Red Hot Chilli Peppers are THE life of the parties, Hank Moody kinda enjoys himself in the background.

Yes, while others were appreciating the stamina and imaginations of the US Federal Reserve, and the European Central Bank, Hank Moody revelled with the lower tiers of the central bank world.

London, Ottawa, Sydney, Copenhagen, Stockholm, and even the sleepy banker town of Zzzzzurich began appreciating the financial fun to be had—simply by living carefree.

Yet, like every party circuit, the challenge is trying to determine exactly who is throwing the best party.

Truth be told, since the Americans run the largest economy with the largest stock and bond markets, and with the largest media markets, Dionysus and the Federal Reserve attract all of the attention, both good and bad.

Perspective.

It is also true the Federal Reserve has twisted and distorted its financial and banking system to levels never before seen or even imagined.

And because of these monetary extremes, calls for the USD to crash have become loud and boisterous into the late nights:

Admittedly, this is a sensational and spectacular headline.

However, it is also false.

One of the single, biggest errors investors (and yes, even by the veterans such as Mr. Roach) make is viewing the investment world through a singular lens and perspective.

Yes, by itself the US monetary and fiscal positions are not particularly pleasant. But we’ll show you how other countries and economies are in even worse shape.

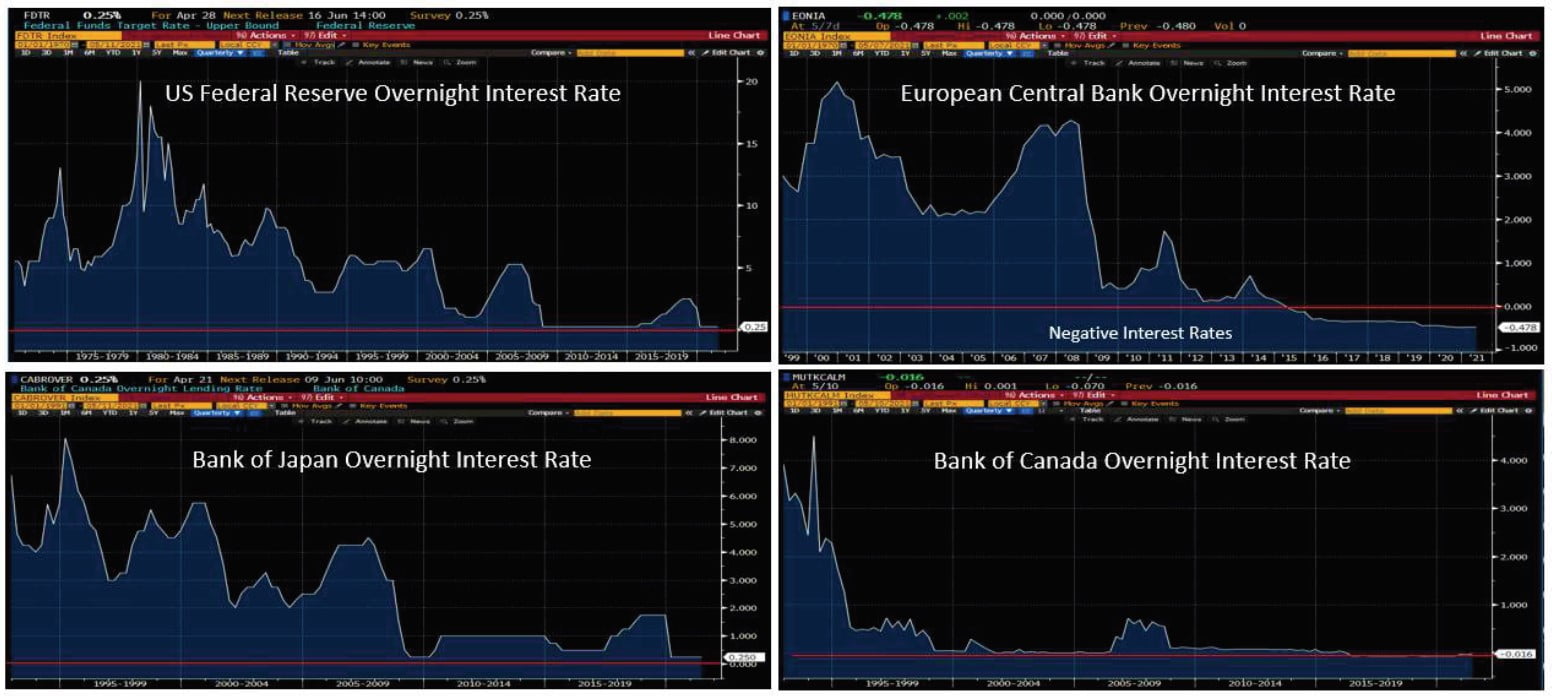

Charts below provide clarity and perspective as to the real monetary and financial threats to the world’s financial structures.

Sure enough, you’ll see how the US Federal Reserve has now run out of interest rates to cut. Put another way, after 40 years of extending the party with interest rate cuts, the US Federal Reserve has astoundingly run out of interest rates. Yes, even if they wanted to, the Americans have no more interest rates left to cut. The cupboard is dry.

But the cupboards are also bare for the Canadians, the British, the Australians, and the Kiwis. They too have cut rates all the way down to 0%.

And for an even more dire comparison for the financial world - the Europeans, the Japanese, the Danes and the Swiss have cut interest rates to negative %.

The other metric used by USD Bears, measures the ultimate monetary party trick - quantitative easing (or money printing as somewhat erroneously referred to by some).

By this measure, the Americans certainly have gone on a monetary bender. Charts on page 7 show how America's money printing machine has produced enough stimulus equivalent to 33% of their total economy (GDP).

To put this in perspective, consider that during the darkest days of the 2008-09 Housing Crisis, the Americans increased this metric from near 0% to only 5% of GDP.

So, yes - with the current number equal to 33%, the Americans are definitely on the road to financial exuberance.

Looking at the American’s financial position in this light, then one should conclude that the American empire is indeed at the cusp of becoming known as an historic era similar to that once enjoyed by the British, the French, the Spanish and the Romans.

Note the past tense.

All Major Central Banks Have Cut Overnight Rates To 0 Or Negative %.

Read the full article here by Ice Cap Asset Management