In his Daily Market Notes report to investors, while commenting on the surge in household income, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

Surge In Household Income

The Commerce Department recently announced that household income surged 21.1% in March, due largely to the federal stimulus checks that were sent out. This was the largest monthly surge in household income ever recorded – ever since records commenced in 1959. The personal savings rate surged to 27.6% in March, up from 13.9% in February. These are massive numbers, unprecedented in history.

The Institute of Supply Management (ISM) manufacturing index hit a 37-year high in March, so it was expected to cool off in April, and it did, declining to 60.7 in April from an over-heated 64.7 in March. Any reading over 50 signals an expansion, so manufacturing activity remains healthy. The new orders component declined to 64.3 in April, down from an incredible 68 in March. The production component slipped to 62.5 in April, down from a stunning 68.1 in March. The best news was that the backlog component rose to 68.2 in April, up from 67.5 in March, boosted by supply chain bottlenecks that have plagued the auto industry. I expect manufacturing to stay strong due to strong demand and order backlogs.

The Wall Street Journal reported last week that the automotive industry is moving away from “just in time” delivery, due to acute plastic and semiconductor shortages. The disruptions in the global supply chain are forcing the automotive industry to use suppliers closer to their plants, especially regarding the heavy batteries that are used in hybrid and electric vehicles (EV).

Battery Pack Production At Tesla's Plant Hits A Glitch

Battery pack production at the new Tesla plant in Berlin hit a “glitch” and caused the opening of this crucial manufacturing plant for Tesla to be postponed several months, until at least January 2022. But frankly, this is just one of many delays associated with battery production that is expected to slow down the transition to EVs due to shortages of cobalt, neodymium, and other rare earth materials. The Financial Times recently reported that cobalt prices have risen 40% so far this year, so do not be surprised if more auto manufacturers follow Tesla’s Shanghai plant and make lower-priced, lower-range EVs without cobalt.

The most shocking EV news last week was that Stellantis (formerly Chrysler Fiat & France’s PSA before merger) announced it will no longer need to buy Tesla CO2 credits. Tesla reported $2.365 billion in regulatory credits and posted earnings of $1.407 billion since 2019. So now, without Stellantis’ CO2 credits, Tesla’s future earnings are in doubt – unless it boosts its manufacturing efficiency.

Rate Rise Sinks In

Even as the 10-year yield has been trading between 1.5% and 1.6%, there has been a newfound reality check these past couple of weeks, namely, it is sinking in that interest rates may start to rise again following the current pause. It is thought that the Fed will have to start a conversation about tapering its amount of quantitative easing (currently $120 billon per month), in the face of $5.7 trillion in current and proposed government spending by the Biden administration that will further fuel GDP expansion in 2021.

All this money pouring into the banking system and the economy comes at a time when the economy is rebounding at a strong clip. This scenario carries the risk of seeing bond yields pop higher, which could trigger a move in the 10-year Treasury that would likely weigh on investor sentiment – which has become accustomed to ultra-low interest rates “forever.” However, until that upward rate move happens, the path of least resistance for stocks is higher, as was the case last week following the jobs report.

Dollar Declines

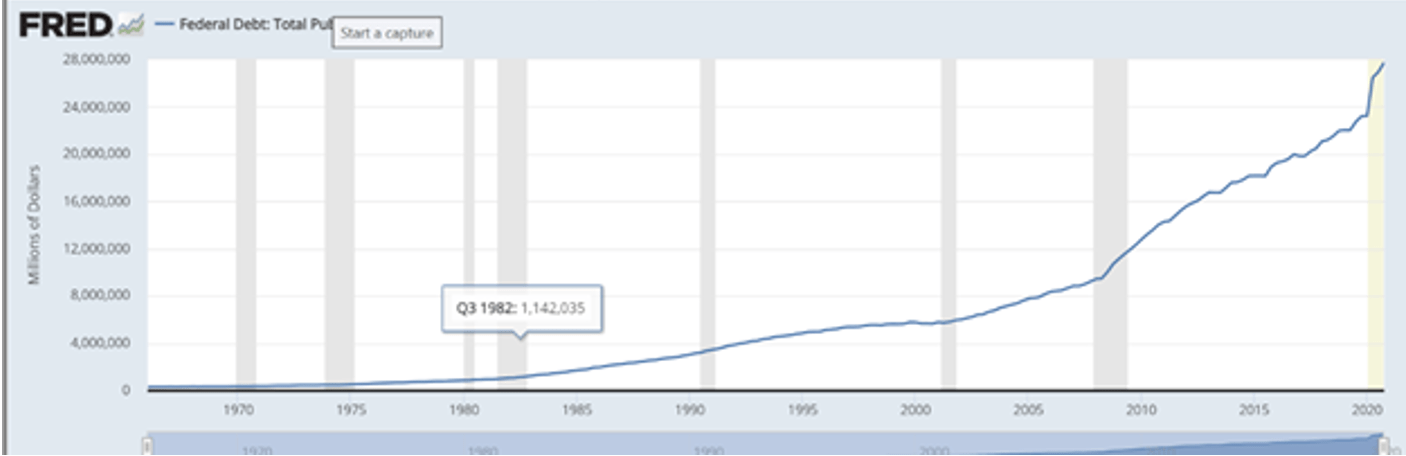

One factor contributing to the recent decline of the dollar, is the parabolic growth in the nation’s debt, currently sitting at roughly $28 trillion (chart, below). Moody’s Analytics, in reports on the Jobs Plan and Families Plan – to be paid for by increased taxes on corporations and wealthy households – has estimated a shortfall of $848 billion over 10 years for the Jobs Plan and $218 billion shortfall on the Families Plan. That’s over $1 trillion short.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The bond market will have a chance to vote up or down soon, as this week will bring a burst of debt supply, with the U.S. Treasury auctioning $58 billion in three-year notes on Tuesday, $41 billion of 10-year notes on Wednesday, and $27 billion of 30-year bonds on Thursday. How the dollar trades against this heavy new issuance will carry some psychological weight for both the bond and stock markets.

With surging GDP growth, spiking commodity prices, and soaring debt loads, the dollar is at a technical inflection point. The Federal Reserve has the power to step in to buy dollars to support the price. Such an action by a central bank in the forex market is seen as a way to stabilize or increase the competitiveness of that nation’s economy, but it also sends a negative message – that the Fed is buying dollars to offset fears of debt-related devaluation. I’m not sure the Fed has a persuasive-enough spin doctor for that scenario.

As a result of this set of circumstances, the best yields available to most investors are found in high-quality multinational stocks that pay more than 30-year Treasury bonds, currently yielding 2.28%.

I think the Nasdaq Composite will trade to its March 2021 lows by the end of the second quarter as interest rates rise in the U.S. Bull market corrections to a rising 200-day moving average are healthy and we are overdue for one. Many technology stocks ran up into their good earnings reports and then sold off, which feels like a “tired tape” to me – to use some trading terminology.

Due to rising interest rates, similar to what we saw in 2018, we should see volatility with an upside bias in the stock market by the end of 2021. The problem in 2018 was that the Fed was pushing long-term rates higher. These days, the bond market is pushing them instead, which should bring a more benign outcome.