Horizon Kinetics portfolio update for the first quarter ended March 31, 2018.

Q1 hedge fund letters, conference, scoops etc

An Overview

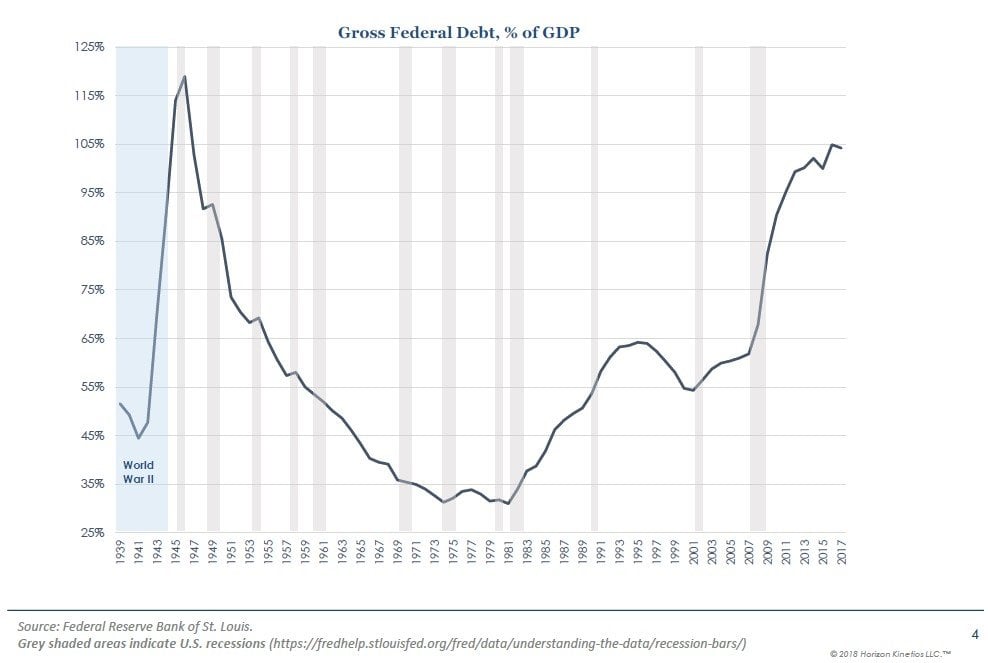

Part 1: Anatomy of Systemic Risk. Where are We, Briefly?

Part 2: The False Premise of Large Scale Passive Investing: The ‘Free-Ridering’ Phase of Indexation is Expiring

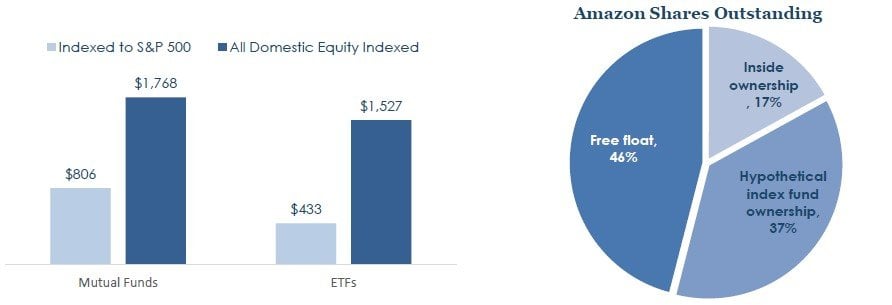

Part 3: Are Index Funds Part of Float?

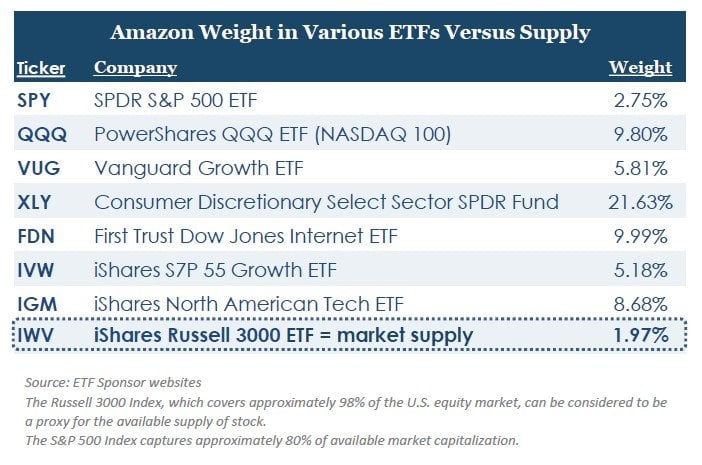

Part 4: What is the Amazon Index Weight? Bet You Don’t Know.

Part 5: Reprise: Portfolio Weightings in Inflation Beneficiary and Other Non-Correlated Securities

Where are we?

U.S. Stock Market Performance

Another Way to Think About Systemic Risk

An Illustration

World War II Ration Books

This set of World War II ration books, stamps and cloth ration book and token holder, with 24 months of stamps, was issued in 1942 to a nurse living in Adelphia, NJ. It may be purchased for $35 on Biblio.com.

That $35 today, converted to 1942 purchasing power after 75 years of inflation, would have been equivalent to $550 to that nurse, about a year’s worth of rent.

The average median rent in New Jersey in 1940, according to the U.S. Census Bureau was $36 per month. Manhattan, of course, was more expensive: although rents in the Lower East Side were less than $30 (a “pleasant” 4-room ground - floor Greenwich Village apartment with no heat went for $27), Washington Square Park rents were as high as $150 or more . Isn’t that always the way?

The False Premise of Large Scale “Passive” Investing

The concept of float was originally based on the presumption that any holder could, theoretically, offer to sell shares at any moment at which the price is sufficiently or enticingly high.

For an index fund, though, there is no such thing as an enticing price . There is only an efficient price —in fact, the price is always presumed to be efficient , and the index and ETF transaction rules are written that way.

If index funds today hold 37% of Amazon’s shares and the employees hold another 17%, the available float is only 46%, a minority of the market capitalization. We’ve begun to enter uncharted territory.

Another Simple Question

What is the Amazon Index Weight?

So, What Isthe Market Weight of Amazon?

Classical economic theory states 14 that demand declines as the 12 price increases .

But in the world of investing, demand actually increases in the short run as the price increases – because of everyone who wants to own the shares of what’s going up. The active managers might not provide the supply the indexes need.

In this example, there would be enough Amazon shares to supply the demand . But what if the active managers decided to sell less of Amazon than other holdings, or to make Amazon a larger position?

Article by Steven Bregman, Horizon Kinetics

See the full PDF below.